Here’s our review of the Standard Chartered Visa Infinite (SCVI) credit card issued in Singapore. It forms part of our series of credit card reviews, which are all summarised on our dedicated Credit Cards page.

Dollar amounts refer to SGD, and ‘miles’ refer to KrisFlyer miles, except where stated. This review was updated on 19th December 2019.

Key features

Annual fee: $588.50/yr

EIR/APR: 26.9%

Sign-up bonus: 35,000 miles

Local earn rate: 1.4 miles per $1*

Overseas earn rate: 3.0 miles per $1*

Foreign transaction fee: 3.5%

Minimum Age: 21

Minimum income: $150,000/yr**

* Minimum spending conditions apply, see below

** For Priority/Private Banking customers – $30,000/yr for Singapore Citizens or Permanent Residents, $60,000/yr for Employment Pass holders

Annual fee

Not one of the cheaper cards on the market – the SCVI will set you back $588.50 each year (including the first year), and it’s not optional.

Sign-up bonus

The current sign-up bonus for the SCVI card is 35,000 miles, worth around $665. No minimum spend applies; the bonus is credited on payment of the first year annual fee.

Renewal bonus

There is no official bonus for renewing your SCVI card when paying the annual fee for subsequent years, however we have both personally held the card since 2016 and have always been awarded 20,000 miles on renewal, worth around $380.

You may or may not receive the same bonus, so don’t bank on it.

Earning rates

Here’s where it gets a little complicated. The SCVI earns a guaranteed 1 mile for every $1 spent in either local or foreign currency. That’s automatically dreadful in Singapore credit card terms, but hang on…

Provided you spend at least $2,000 in any statement cycle (note – not calendar month), you’ll be entitled to an additional 0.4 miles per $1 spent locally and an additional 2 miles per $1 spent overseas, for all the spending you made (not just the amount over $2,000).

That means, provided you hit the $2,000 minimum spend each statement cycle on this card, the earning rate is actually:

- 1.4 miles per $1 spent locally (i.e. transacted in SGD), and

- 3.0 miles per $1 spent overseas (i.e. transacted in foreign currency)

Note that you are initially awarded 1 mile per $1 on all spending, then once the monthly statement is published the extra miles (0.4 locally or 2 overseas) are then added provided the $2,000 spending criteria was met.

| A note about Dynamic Currency Conversion (DCC)

Beware the ‘Dynamic Currency Conversion’ (DCC) offer you’ll often experience overseas when paying with your Visa or MasterCard. It’s very common when settling your overseas hotel bill, for example, to be offered to pay in SGD instead of local currency. This is a terrible idea, because: a) you’ll suffer financially, even after the credit card foreign exchange fee is accounted for. If you remember the SGD amount you were offered to pay, then pay in local currency instead, once the transaction appears on your credit card statement you’ll generally find they were scamming you, you’d have paid at least 2% more using DCC. b) you will earn credit card miles at the local spend rate if you accept DCC, because the transaction will take place in SGD, not the local currency. In other words, you’ll pay more, and lose miles. Always insist on paying in the local currency of the country you are in. |

Are KrisFlyer miles credited directly?

No, in fact rather than being credited miles directly you’ll accrue ‘rewards points’ both for your sign-up bonus and your regular spending on this card. These transfer to KrisFlyer miles at a 2.5:1 ratio (so the sign-up bonus is actually 87,500 reward points, for example, which you can then redeem for 35,000 miles).

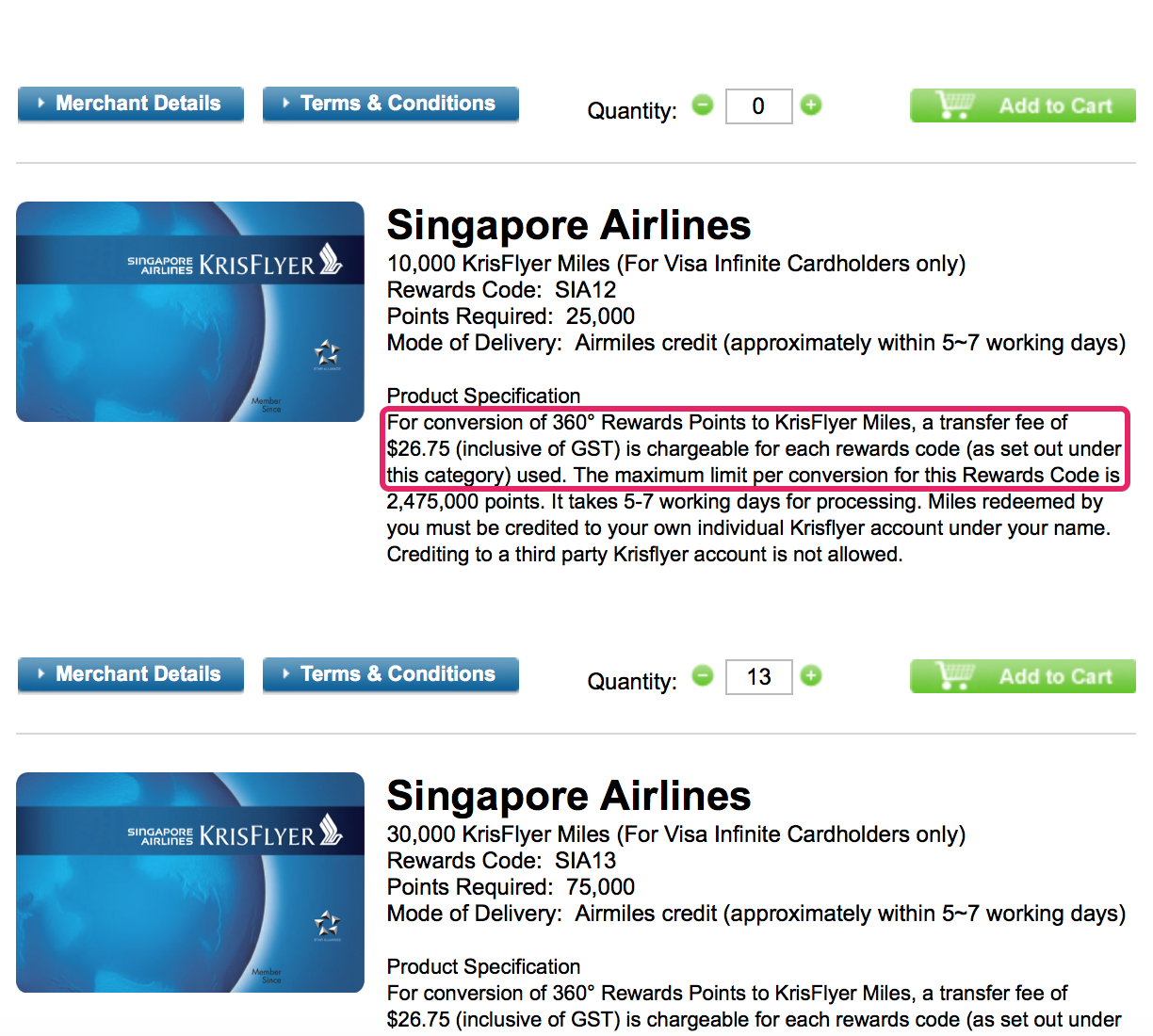

What is the transfer cost to KrisFlyer miles?

It’ll cost you $25+GST (i.e. $26.75) each time you transfer each ‘block’ of your points to KrisFlyer miles.

Is there a minimum transfer amount?

The minimum number of rewards points you can transfer into KrisFlyer is 2,500 (converting to 1,000 KrisFlyer miles). You can structure your points transfer in larger blocks instead, or add multiple smaller blocks but you should be aiming to accrue a decent rewards points balance before transferring as each rewards block code transferred attracts the $26.75 transfer fee.

Reward blocks available are:

- 2,500 points > 1,000 miles

- 25,000 points > 10,000 miles

- 75,000 points > 30,000 miles

- 125,000 points > 50,000 miles

- 250,000 points > 100,000 miles

You can add up to 99 of each ‘rewards block’ per transfer (e.g. 99 x 2,500 points blocks will give you 99,000 KrisFlyer miles).

Since you will attract the S$26.75 transfer fee charge for each of the blocks used, it’s better to add multiple numbers of the same block size. For example if you have accrued 325,000 points that should give you 130,000 miles.

Looking at the options you might think you’ll have to transfer 1 x 250,000 points block and 1 x 75,000 points block to do this, but that will result in you being charged the S$26.75 fee twice!

The better strategy in this example is to add 13 x 25,000 points blocks. This will mean only being charged the S$26.75 fee once, but you’ll still get 130,000 miles credited.

It’s a stupid system, but it’s just the way it works.

Remember the golden rule – if you combine more than one block size (‘rewards code’) in a rewards to points conversion you’ll be charged $26.75 for each one!

How long do miles take to credit to KrisFlyer?

The official line is “5-7 working days”. The last three times I converted, it took exactly a week the first two times, then about 3 working days the final time.

Not a great turnaround, there are faster cards out there when it comes to miles conversion and it won’t help you ‘jump’ on an available redemption, but it’s manageable if you’re organised.

Which loyalty schemes can I transfer into?

Standard Chartered also allows you to transfer miles into 11 other loyalty programmes, however do be aware the transfer ratios are not all identical (i.e. they are less generous) than a KrisFlyer transfer.

The other partners are as follows:

| Standard Chartered Airline Partner Conversion | ||

| FFP | Conversion Ratio | Minimum Points to Convert |

| 2.5:1 | 2,500 | |

| 2.5:1 | 2,500 | |

| 2.5:1 | 2,500 | |

| 3:1 | 3,000 | |

| 3:1 | 3,000 | |

| 3:1 | 3,000 | |

| 3.5:1 | 3,500 | |

| 3.5:1 | 3,500 | |

| 3.5:1 | 3,500 | |

| Standard Chartered Hotel Partner Conversion | ||

| Loyalty scheme | Conversion Ratio | Minimum Points to Convert |

| 2.5:1 | 2,500 | |

| 5:1 | 5,000 | |

Do your points expire?

No, your 360o Rewards Points never expire while your account remains in good standing, so you can keep your points at the Standard Chartered side as long as you need to before converting to KrisFlyer.

Once your miles are in KrisFlyer, they are valid for 3 years from the month of deposit.

Points top up

Standard Chartered also offers the option to top up your points to meet a higher redemption threshold – applicable to KrisFlyer miles only (not the other loyalty schemes). The cost is 0.8 cents per point, which equates to 2 cents per mile (since 2.5 points = 1 mile).

Apart from the relatively high cost (we value KrisFlyer miles at 1.9 cents each), the other consideration with this method is that you must have at least 30% of the desired points transfer total in order to pay to top up (though you likely won’t want to be paying to more than triple your balance at this purchase rate!).

Here’s an example:

In this case you are paying S$141.46 to top up by 17,682 points in order to meet the next redemption threshold. Our full article about this feature explains it in detail.

Pay your income tax

The SCVI is one of the few credit cards in Singapore allowing you to pay your income tax bill using your credit card and accrue the usual miles earning rate. While this facility is already available for any credit card through CardUp (see our article), the processing fee using the Standard Chartered method is 1.6%, compared to 2.6% with CardUp, so it’s therefore a much better deal to use the SCVI.

You have to set up the payment at least seven working days before your income tax due date, and of course you must have sufficient credit balance to cover the total.

For example:

- Annual Income Tax Bill: $5,000

- Standard Chartered 1.6% Fee: $80

- Total Payable: $5,080

- Miles Accrued: 7,112 (5,080 x 1.4)

- Cost per mile: 1.1 cents (we value KF miles at 1.9 cents each)

I’ve paid my personal income tax bill this way for the last two years, and it’s very straightforward. You simply send Standard Chartered your Notice of Assessment along with your bank account details using the online system, and they then transfer the balance you owe to IRAS to your personal bank account.

Your credit card will be charged with the same amount, plus the 1.6% processing fee (in the above example, you’d find $5,000 credited to your bank account, and a $5,080 charge applied to your credit card account).

Note that this does not compel you to then pay your income tax to IRAS in one lump sum if you don’t wish to. I personally use the credited funds to pay the credit card statement (usually the following month), and set up a GIRO to pay my income tax in interest-free instalments over the year as normal.

SC EasyBill

In August 2019 Standard Chartered launched EasyBill, a way for their credit card customers to earn the usual rewards points for outgoings not usually allowing credit card payments, like rental and education expenses.

A typical administrative fee of 2% is charged (though this can vary according to the terms and conditions), and certain accounts may not be eligible for the feature at all.

At a 2% fee, EasyBill allows you to ‘buy’ miles using your Standard Chartered Visa Infinite card for 1.43 cents each when making these payments, though you’ll want to channel your IRAS Income Tax payment through the existing facility at the 1.6% fee as outlined above for a 1.1 cents per mile cost.

Check out our article about SC EasyBill for full details.

Other benefits

There are a few other perks with the SCVI card, the key benefits which will be of most interest to our readers are:

- 15% cashback on all Grab rides globally, capped at $30 cashback per month, provided you have achieved a minimum spend on the card in the same calendar month of $900 (though you should be spending $2,000+ per statement cycle using this card to generate the enhanced miles earning rates). This perk switched from a (more generous) one with Uber prior to their withdrawal from the SE Asia market in 2018.

- For the big spenders, complimentary 4 hour yacht hire when you spend $75,000 on the card in 2018.*

- Priority Pass membership, with six free lounge visits per year, then US$27 per visit thereafter.

- Up to 25% Caltex fuel savings.

- Additional points, perks and discounts at The Fullerton Hotel and Ritz-Carlton Millenia in Singapore. These include spa and dining discounts.

- Hotel and resort discounts at selected Banyan Tree Hotels and Resorts, the new Andaz Singapore, selected YTL Hotels, and $100 off at theluxenomad.com if you spend over $700 on a single booking.

* Blackout period applies, and the rental is not available on eve of public holidays and on public holidays. Income tax payments and certain other transactions do not qualify towards the minimum spend.

Our summary

Not a card for everyone, due to the high income requirement, the hefty annual fee, and the $2,000 monthly minimum spend to generate the good local miles earning rate. The 35,000 welcome bonus miles, however, more than justifies your first year of card membership (as they have a value of around $660). Another way of looking at it is that for your $588.50 fee, you’re ‘buying’ KrisFlyer miles for 1.68 cents each.

This card particularly works for me due to the 15% Grab discount, capped at $30 each month (i.e. at $200 of Grab spend), because I commute to and from work using Grab anyway. That means I hit the $30 discount limit every month without fail, which nets me $360 in rebate per annum – a large chunk of the ongoing $588.50 annual fee.

That discount of course will not apply for everyone, so you’ll have to decide whether the higher miles earning rate (especially for foreign transactions at 3 miles per $1 spent, which is almost unbeatable), and the other card benefits, make the high fee work for you.

Our recommendations for credit cards and other similar products on this site do not constitute financial advice.

Hi,

Nice Review. Could you do a review on DBS Altitude, OCBC Titanium Rewards and Citi Rewards Card?

Thank you!

Thanks for the feedback, the OCBC Titanium Rewards review is now up, the others are on the “to do” list!

Does Cardup qualify for the minimum $2000 or it must be other type of transactions ? I like the income tax. Dbs version is 3% !!!

Yes I believe CardUp transactions are counted towards the minimum $2,000 monthly spend for this card (to unlock the 1.4/3.0 miles earning rates). Agreed that the income tax deal is one of the best ones out there currently – almost a no brainer especially as you can still pay your tax by GIRO if you prefer.

Hello

I have found quite a number of your articles to be instructive. I’m curious, as you rationalise that the fact that you max out the SGD 600 rebate via UBER makes the card worthwhile even after the first year. Now, that the arrangement with GRAB restricts the rebate to SGD 360 a year, has your position changed?

With my thanks and regards

B.V

Might be a dumb question but is the tax paid a qualifying spend for that calendar month? Or is it retail spending only?

Not a dumb question (no such thing!). It has been stated elsewhere that the Income Tax payment, which I assume you’re referring to here, counts towards your $2,000 spend a month to qualify for the higher earning rates.

It does not. You will need S$2,000+ spend on other eligible transactions in the same statement period to qualify for the higher earning rate even on the tax payment itself.

This was confirmed by phone with Standard Chartered in April this year. While the agent I spoke to could have been wrong, it’s a much safer strategy to clear the minimum spend requirement on other transactions in the same statement period if you’re counting on the 1.4mpd for your income tax payment.

Hope this helps and I will add this info to the review for clarity.

As you state that the 35K miles gift is a substantial component in offsetting the 588$ annual payment, and is given the first year, would this card be as attractive the second year onward, or would you then consider scrapping it (despite the high overseas earning rate) unless SC adds an annual renewal miles gift?

Hi, I wanted to know if there is any kind of upper limit to the amount of miles one can make via paying taxes through this card (in one lumpsum payment)? I tried checking with the company but only got a standard FAQ document in response…

I believe it will only be an issue of your available credit limit, as there is no publicised upper cap.

Hi, I wonder if insurance premiums are eligible to clock rewards points? I called the bank and was told if the premium was effected by the insurers on their end (applies to recurring premiums too), it’s considered a Qualifying transaction.

Hi – thanks for the informatively written reviews.

My single biggest annual spend is school fees 😭

Schools don’t allow cc payments. Can I use SCVI to do that at a 1.6% fee just like the taxes?

If not, which card do you recommend for it?

I personally have use this card for two consecutive years no waivable annual fee. And I would not recommend readers to take this card.

Simply the 3 miles for overseas spent is not KrisFlyer miles, and many other credit cards use this ‘miles’ in their front ads. Always read their conversion ratio to other airlines miles.

Their conversion ratio is 2.5 miles:1 KrisFlyer miles as Andrew has mentioned in this article. The pain parts (as actual customer) is what i wanted to comment about.

For 1$ you’ve spent overseas, the 3 miles is just 1.2 KrisFlyer miles; which make it the same as Citi PremierMiles with their 1:1 ratio.

Realistically, most of our card spending will be local, which only gives you 0.56 KrisFlyer miles per dollar.

I was on spending spree for a year, thinking I’m going to score high on miles, which only come to a full realisation when converting it back to KrisFlyer.

Couple that with the non-waivable 585$ annual fee, plus one of the most expensive annual fee for credit card in Singapore, I suggest stay away from this card.

I got 50K bonus when paying annual fee every year. So it’s ok for me to pay, particularly since I benefit from the IRAS facility (which allows the GIRO scheme ‘discount’) and the 50% dining discounts at Fullerton. And redeeming for J or F makes the 50K for $588 decent, not great but decent.

Your example calculation is not accurate. I really do get 3mpd (7.5points per $) forex spend and 1.4mpd (3.5 points per $) local spend. I just converted to KF at 2.5 points to a mile, last week.

SCB rewards come in points which are converted to miles for a fee (I paid $26.75 last week to convert into 210,000 KF miles from 525,000 points). I track my point awards regularly and I have to say that together with Citi, SCB probably has the best reward points tracking online as my spend usually shows up within 2 days. The bonus 1 point for local spend and 5 points for forex spend will always show up the next month (if you go above $2k spend per statement). Never failed so far.

Of course if you can’t benefit from the IRAS or dining privileges or if you’re not getting the 50K renewal bonus then perhaps this card is not for you. For me it’s an excellent forex general spend card and I gladly pay the annual fee knowing that I get back more than the fee in benefits.