EXPIRED This article relates to an offer or promotion which has now expired.

Good news for those of you who hold the Maybank Horizon Visa Signature card (you may even be looking closely at it following our review of the card on Monday this week) – a new promotion has been announced boosting the miles earning rates on all the spending categories by an extra 1 mile per dollar.

Update 2nd August 2018: The promotion has now been extended to holders of the Maybank World Mastercard. “Maybank World Mastercard cardmembers now enjoy 5 air miles at participating merchants and 1.4 air miles for all other spend!” See here.

Labelled the ‘Triple One Campaign’ to celebrate Singapore National Day, the offer is valid from 1st August 2018 (today) to 30th September 2018, so you have 2 full months to take advantage.

You’ll need to spend at least S$1,000 on your card in both August and September to enjoy the enhanced rates throughout the promotional period, alternatively you can choose to participate for just one of the two months if you prefer (we clarified this with Maybank).

The bonus rates

| Category | Standard Rate | Bonus Rate |

| Dining Petrol Taxi fares |

3.2 | 4.2 |

| Overseas spend Air tickets Travel packages |

2.0 | 3.0 |

| All other spend | 0.4 | 1.4 |

While the headline rate is clearly in the dining, petrol and taxi fares spend category, it’s the increases for overseas spend and general (local) spending which are the standouts here for us – rising to 3.0 miles per dollar and 1.4 miles per dollar respectively.

Now that the Citi 8 mpd with Apple Pay has ended and the OCBC 4 mpd mobile payments offer comes to a premature end in the next few days, these enhanced rates from Maybank are up there with the best credit cards on the market right now (with the exception of the BOC Elite Miles card, but let’s face it – who actually has one of those yet? Processing will take at least 2-3 weeks from application date according to a BOC representative we spoke to).

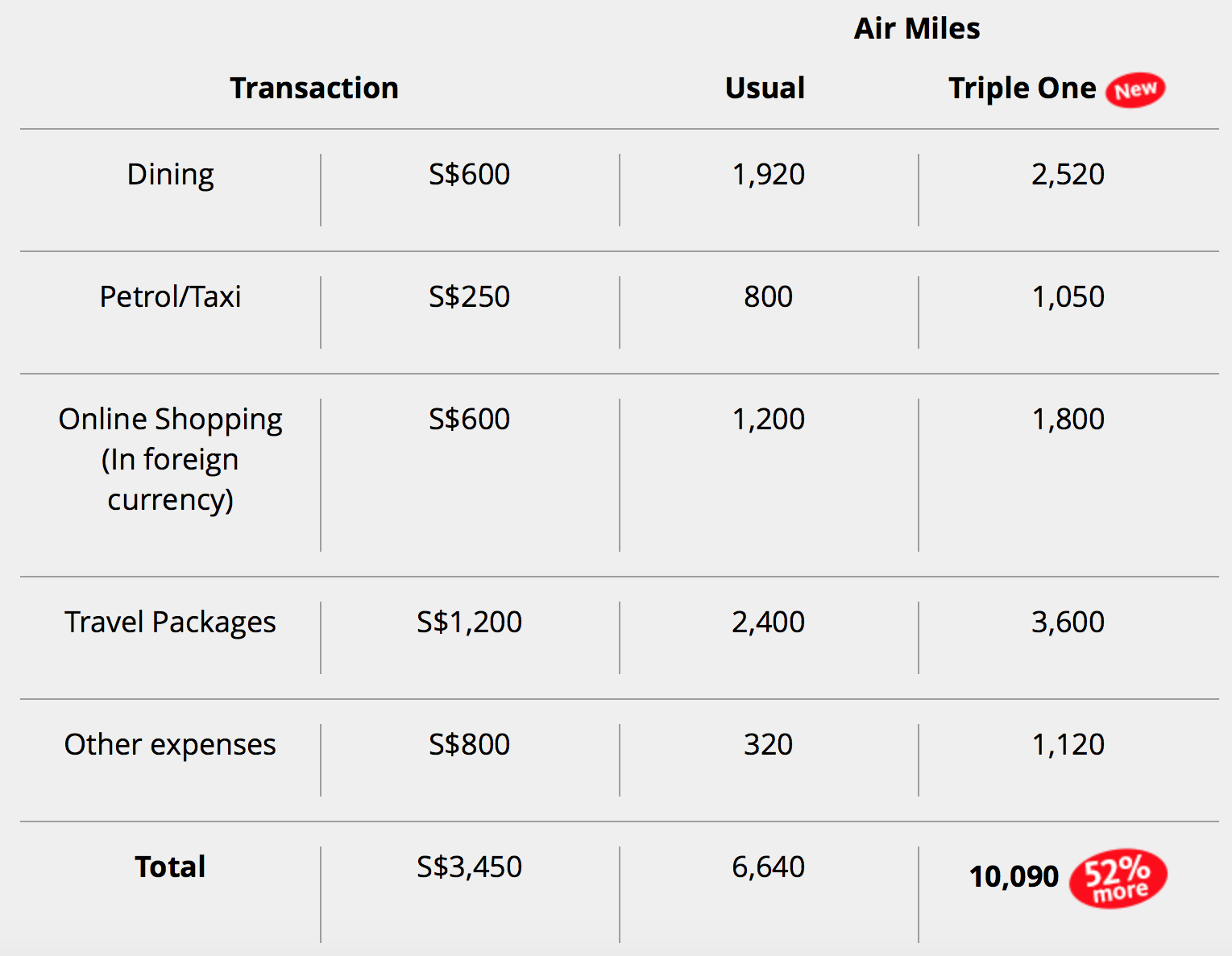

Here’s how Maybank break down the number of miles you can achieve in this promotion with an example:

Overseas spend

There’s more good news on the overseas spend front. Maybank are only charging a 2.5% foreign transaction fee, so at 3 miles per dollar on overseas spend that’s a very attractive cost per mile of just 0.91 cents. That’s only beaten by the bonus rate on the (still non-existent, in people’s wallets anyway) BOC Elite Miles card.

Effectively this is based on the additional amount you are paying using your credit card over and above using cash overseas obtained at money changer rates. For the full methodology on our cost per mile analysis, see our article from February.

Cost per mile on overseas credit card transactions by card

(Best to worst, August 2018)

| Card | Fee | Miles per $ | Cost per mile |

| BOC Elite Miles (bonus rate) |

2.5% | 5.0 | 0.54¢ |

| Maybank Horizon Visa (bonus rate) |

2.5% | 3.0 | 0.91¢ |

| BOC Elite Miles (standard rate) |

2.5% | 3.0 | 0.91¢ |

| Standard Chartered Visa Infinite | 3.5% | 3.0 | 1.22¢ |

| OCBC Voyage Visa | 2.8% | 2.3 | 1.31¢ |

| AMEX KrisFlyer Ascend | 2.5% | 2.0 | 1.36¢ |

| HSBC Visa Infinite | 2.5% | 2.0 | 1.36¢ |

| Maybank Horizon Visa (standard rate) |

2.5% | 2.0 | 1.36¢ |

| UOB PRVI Miles | 3.25% | 2.4 | 1.43¢ |

| Citi PremierMiles / Prestige | 2.8% | 2.0 | 1.50¢ |

| DBS Altitude Visa | 2.8% | 2.0 | 1.50¢ |

| DBS Altitude Amex | 3.0% | 2.0 | 1.60¢ |

As you can see that’s a very competitive cost per mile on overseas spend during this promotion, which again of course does depend on a minimum total spend of S$1,000+ on the card in each of the calendar months you wish to participate in (August and September if you want to maximise the offer).

If you’re using the Standard Chartered Visa Infinite card to earn 3.0 mpd overseas, previously one of the cheapest ways to ‘buy’ miles, each mile is costing you 34% more than with the Maybank Horizon Visa under this promotion. If you’re using the UOB PRVI Miles card it’s even worse – you’re spending 57% more per mile with that card.

Another benefit of the Maybank Horizon Visa is that unlike some cards, which require foreign currency transactions to be processed overseas to be eligible for the bonus rate, with this card any transaction posted in foreign currency is included.

That takes away the worry of whether an online shopping transaction for example will be eligible for the higher earning rate – provided it doesn’t post in SGD it will qualify.

The Mileslife equation shifts

In our full review of the Maybank Horizon Visa published on Monday we broke down some computations on whether you should be using this card to earn the enhanced rate on dining transactions at a restaurant which is also included in the Mileslife program. It’s a little complicated, as Mileslife transactions are not coded under the dining category meaning they will earn at the local general spend rate on this card.

It meant that outside the offer period you should be using your Maybank Horizon Visa to pay the restaurant directly at Mileslife 1 mile per dollar restaurants, you should be paying through Mileslife at 3 miles per dollar restaurants and for 2 miles per dollar restaurants it probably didn’t matter either way, depending what other general spending cards you hold.

With these new rates though the calculation is slightly different, again assuming you are meeting the S$1,000+ spending threshold in one or both of the calendar months to activate the enhanced promotional earning rates.

Remember the Maybank Horizon Visa card will earn 1.4 miles per dollar for Mileslife transactions during this promotional period.

In summary, at a Mileslife restaurant during this promotion:

- Offering 1 mile per dollar – use the Maybank Horizon Visa to pay the restaurant directly (4.2 mpd vs. 2.4 mpd)

- Offering 2 miles per dollar – use the Maybank Horizon Visa to pay the restaurant directly (4.2 mpd vs. 3.4 mpd)

- Offering 3 miles per dollar – pay through Mileslife (4.4 mpd vs. 4.2 mpd)

Terms and conditions

The bonus rates will apply provided you spend a minimum total of S$1,000 on this card either in the calendar months of August or September (to earn the bonus rates in each respective month), or both months (to earn the bonus rates throughout the promotional period).

For example if you spend $900 in August and $1,100 in September you will only earn the bonus rates for transactions in September. You must achieve a total spend of $1,000+ in both calendar months for all your transactions in both months to be eligible for the bonus.

Miles are awarded as bonus ‘TREATS Points’ (2.5 points = 1 mile) and will be awarded based on the transaction date. For details of how the ‘TREATS Points’ scheme works and their validity, see our card review.

The offer is capped at 10,000 bonus miles (25,000 bonus ‘TREATS Points’) per calendar month, so you’ll max out this particular promotion with $10,000 of total spending each month.

Remember also the combined cap on ‘regular’ bonus miles, which applies generally to the card (12,000 miles per month, or 30,000 ‘TREATS Points’) remains in force, so if your spending levels are high you may hit this threshold first. Your earning rate would then drop to 1.4 miles per dollar until this ‘Triple One’ offer was exhausted, then down to 0.4 miles per dollar after that.

For a breakdown of how the ‘regular’ monthly cap on bonus miles works for this card, click here to go straight to that section of our full review. If your monthly spend in the bonus categories on this card doesn’t exceed S$4,000 you don’t have to worry about any of this. Above that, take a look as it may affect you.

For a full list of the terms and conditions for this offer, click here.

Summary

The cessation of 8 miles per dollar and 4 miles per dollar on mobile payments / Apple Pay seems to be spurring a few cards to enhance their rates lately – notably the recent launch of the BOC Elite Miles card and now the enhanced rates on this card.

Both the 1.4 miles for local spend and 3.0 miles for foreign currency transactions are now up there with the best cards on the market during this 2-month promotion, notably excluding the BOC Elite Miles card though it may be a few weeks before any of us can get our hands on that.

Indeed until the BOC card arrives the Maybank Horizon Visa now represents the best cost per mile rate for foreign currency transactions during this promotion.

The 4.2 miles per dollar on dining transactions is a very attractive rate and if you already hold this card primarily to take advantage of that perk then you’ll no doubt make good use of the bonus in August and September. Be careful at Mileslife restaurants to do the maths on the earning rate before deciding which payment method to use as the calculation has shifted slightly during this promotion.

Do bear in mind the minimum S$1,000 spend in August and/or September using this card to be eligible for the bonus miles in each respective month (do both to get the bonus through the whole 2 month period).

Also remember the ‘regular’ bonus miles cap might come into play before the cap on this +1 mile promotion if you’re spending a large amount each month. For more than $4,000 spending in the bonus category – you need to have a think about it.

(Cover Photo: Erwin Soo)

Hi Andrew,

This is fantastic news for existing holders of the Maybank Horizom Visa Signature, and also a fabulous kicker to your ‘still warm’ review, giving even more ‘carrot’ to those thinking of applying for the card…

But.. Did Maybank say anything about potentially not ‘leaving behind’ existing holders of their Maybank World Mastercard? Of course they don’t have to, and the Maybank World Mastercard still has other perks that the Maybank Horizon Visa Signature does not have.. but it just seems that they could make another bunch of their customers (instead of just one group) happy too, and I know Maybank has several more cards in their stable and can’t/didn’t want to give this promo across the board, but it is just these two that are ‘closest’ to each other, and so handing out just ‘a little bit of a sweetener’ that even if not to overtake, but at least match, for the same period..? Maybe you can reach out to your contact at the bank..?

By the way, for the record, I’m now holding neither, but truth be told, I did send in my application a few days ago, so yes, even if not current holder, if approved, would have a kvested interest’ too.. 😇

Hi Ken,

I spoke to my people and the promotion has now been extended to the Maybank World Mastercard.

”Maybank World Mastercard cardmembers now enjoy 5 air miles at participating merchants and 1.4 air miles for all other spend!”

(I didn’t actually speak to anyone yet but maybe they read your post!)

Woohoo!

Shall provide P.O. Box no. for where existing World Card holders can send their Free-Beer Coupons to Ken?? 😬

I can only hope Maybank DID read my post and will further ‘reward me’ by expediting my application so that I can taking advantage of this promo ASAP! 😊

🍻

Sorry.. I forgot to add.. that little cpm table you did.. OMG, Andrew… that’s been printed, cut out, laminated and in my wallet.. and I don’t even have a photo of the wife in my wallet.. 🙇🏻♂️🙇🏻♂️🙇🏻♂️

Ken, I don’t know whether to feel flattered or feel sorry for your wife! Haha 😂

Hi Andrew,

Don’t worry about the wife.. I’m smarter than the average bear, you know.. I told her years ago that I don’t need to silly photo of her to remind me of how she looks like! 😉

Hi Andrew..

Re foreign charges.. aside from Overseas Transaction Fees.. do you know how and what forex rates are used? Do they differ from bank to bank or card type (Visa, MasterCard, American Express, JCB, Union Pay, etc).. or both..? Has anybody done this before.. on same day overseas, use different cards for same amount, just to see how different the end amounts turn out to be?

BTW.. LOVE the addition of “Recent Comments” window! 👏🏻😊

Thanks Ken, a few teething problems but I think we have it resolved now.

It’s an awesome article in favor of all the web users; they will get advantage from it I

am sure.