Back in November Citi launched a trial for selected credit card holders to try out its new PayAll facility. The deal was to earn your usual Citi ThankYou points or Citi Miles at the local rate when making rental payments to your landlord or tuition bills to education providers, for a nominal 1.2% processing fee.

That was rather promising as, if you were targeted and able to take advantage, you could effectively buy miles for as little as 0.8 cents each.

PayAll is now rolled out to everyone

The PayAll facility is now available to all Citi credit card holders in Singapore, through the mobile app.

Currently Citi has not added the facility to the online banking homepage, though this will likely follow in due course if that’s your preferred way to do things.

As before, recipients do not need to bank with Citi and will receive payment via normal bank transfer. Your credit card account will then be charged for the same amount, plus the processing fee. You earn miles on the base amount, but not the processing fee itself.

Currently PayAll remains limited to rental payments to your landlord in Singapore and educational payments to a school or tuition centre in Singapore, as it was in the November / December trial period.

In a New Year email, the CEO of Citi Singapore Han Kwee Juan stated:

“In the months ahead, you can look forward to instant currency account opening with easy access to foreign currencies when travelling and faster accumulation of miles and points through Citi PayAll on our app, allowing you to easily schedule big payments such as rent, education expenses, taxes and more on your credit cards.”

Han has since resigned to join DBS, but we’re sure he was being accurate about the plans for PayAll!

His statement suggests rental payments and education payments are only the beginning for this facility, with additional functions including tax payments (hopefully in time for the upcoming IRAS statement period) still to come.

Unlike during the targeted trial period, where the fee was a fixed amount tiered based on the total transaction amount, leading to a complex table of equivalent miles purchase rates for different cards and different transaction levels, the PayAll fee is now a simple rate.

That means you are now ‘buying’ miles at a fixed percentage rate regardless of the transaction amount, and the only difference in miles purchase rate arises from the credit card you use for the transaction (i.e. the specific card local earn rate).

What’s the rate?

This is where PayAll remains slightly complicated. If you were targeted back in November 2018 and took part in the trial, you now have a 1.5% rate for PayAll transactions.

For everyone else, it’s a 2.0% rate.

For example Eddie was targeted in the PayAll trial, with the excellent 1.2% fee meaning he could use his Citi Prestige card from 0.9 cents per mile during that period. Eddie now has an unlimited 1.5% fee for PayAll transactions across his Citi cards.

I was not targeted in the trial on the other hand, and my fee is 2.0%. This pattern also appears to be the case for other Citi customers.

Payments can be scheduled as one-off or recurring for up to 24 months.

Cost per mile

Here’s the cost per mile analysis for Citi PayAll, depending on whether you can use the facility at the 1.5% fee or 2.0% fee levels, based on the Citi credit card used.

| Card | Earn rate (mpd) |

Cost per mile | |

| 1.5% fee | 2.0% fee | ||

Citi ULTIMA |

1.6 | 0.94¢ | 1.25¢ |

Citi Prestige |

1.3 | 1.15¢ | 1.53¢ |

Citi PM Amex |

1.3 | 1.15¢ | 1.53¢ |

Citi PM Visa |

1.2 | 1.25¢ | 1.67¢ |

Citi Rewards |

0.4 | 3.75¢ | 5.00¢ |

As you can see the lucky Citi ULTIMA cardholders who were also targeted for the PayAll trial and therefore can use the facility with a 1.5% fee get the best deal here – the ability to buy miles for 0.94 cents each.

At the top end those on the 2.0% fee structure with the Citi PremierMiles Visa can buy miles at 1.67 cents each, still worth considering if you need them. Our upper limit to buy is 2 cents per mile.

As we mentioned when the targeted trial started in November, you can never make this work well with the Citi Rewards card and so should never consider using that card for PayAll transactions.

How do I know what rate I get?

Use the Citi mobile app to schedule a PayAll payment. It can be a one-off or recurring payment, and the recipient details don’t need to be accurate at this stage as you’re just looking for a quote.

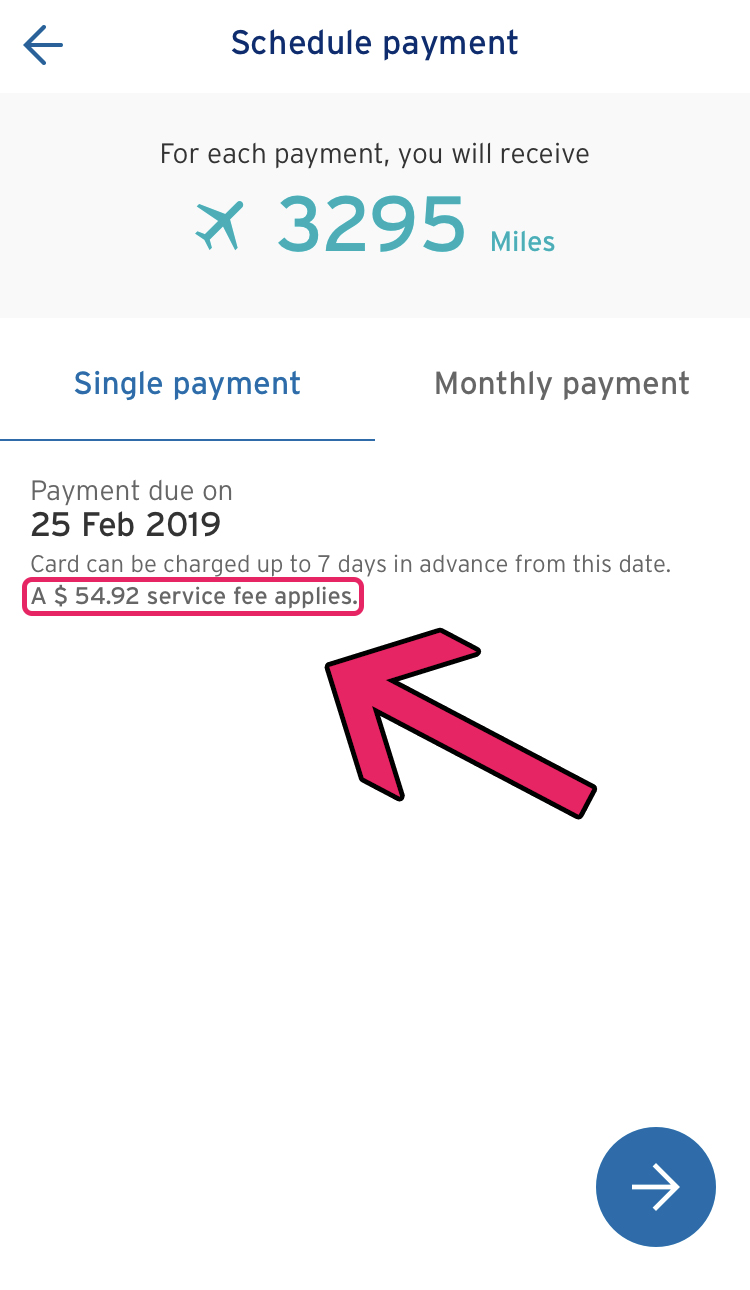

The app will display the applicable service fee for the transaction. In this example I am using my Citi PremierMiles Visa for a S$2,746 rental payment. This will accrue 3,295 miles (2,746 x 1.2), and the fee is S$54.92.

You can see that the fee is 2.0% of the transaction amount (54.92 / 2,746), and the cost per mile is 1.67 cents (54.92 / 3,295).

Here’s Eddie’s quote for a S$10,000 payment using the Citi Prestige card:

As you can see the service fee is 1.5% (150 / 10,000). He’s ‘buying’ at 1.15 cents per mile (32,500 ThankYou points convert to 13,000 miles).

Follow the same process to check what your rate is, though as we mentioned you should find if you were previously targeted for the trial it’s 1.5%, and if not it’s 2.0%.

Are PayAll transactions eligible for the Citi $8,888 promo?

Yes, Citi confirmed with Mainly Miles that PayAll is a valid transaction for meeting the spend criteria for the recent 38,888 miles for $8,888 spend in 2 months promotion for the Citi PremierMiles Visa.

If you have that card this gives you just over five weeks remaining to register and make the spend (though all eligible spend since 1st February 2019 is still counted for that promotion, even if you register for it on the last day).

It’s open to all Citi PremierMiles Visa cardholders whose credit card account was opened before 1st August 2018.

$8,888 is a large spend, however you could consider paying some of your rent in advance if your credit limit allows it, and your landlord agrees.

What if I already set up a recurring payment at 1.2%?

If you were targeted for the trial at the 1.2% rate and signed up for a recurring payment over a number of months at that agreed fee level, your recurring payments will continue to be made at that lower 1.2% rate until the end of the agreed period.

Any new one-off or recurring payments set up now however will be at 1.5% (or 2.0% if you weren’t part of the trial).

Citi has the most flexible points in Singapore

One of the great benefits of Citi Miles and Citi ThankYou points in Singapore is the wide range of transfer partners compared with other bank loyalty points.

You can transfer your points into 12 different frequent flyer programs and into IHG points. The minimum transfer quantity is 10,000 miles, and transfers then need to happen in 10,000-mile ‘blocks’.

| Remember Citi Miles / ThankYou points credit to the following programs: | ||

|

||

There are some more useful programs here than others, personally we tend to use Citi miles to transfer into BA Avios points (see our analysis of some good value uses of those in the Asia-Pacific region).

While Emirates isn’t a partner, you can consider transferring from Citi into Qantas Frequent Flyer for Emirates First and Business Class redemptions.

Summary

With the upcoming increase in charges from UOB for their PRVI Pay facility, which we revealed on Friday, meaning it will soon cost you an unattractive 2.1 cents per mile to generate KrisFlyer miles or Asia Miles through that facility, Citi PayAll is a promising alternative.

We look forward to additional payment options being rolled out, hopefully including income tax payments prior to the upcoming IRAS assessment notices, as some of these miles purchase rates compete nicely with other alternatives in that category.

The flexibility of Citi ThankYou points and Citi miles is key here, with miles crediting to a range of programs in addition to the usual KrisFlyer and Asia Miles options.

Will you be using Citi PayAll, and what rate did you get for the payments? Let us know in the comments section below.

(Cover Photo: MainlyMiles)

I was targeted for the trial and am getting 2% rates now, so I think that rule of thumb isn’t 100% accurate…

(Wish it were so, though!)

Same here!

Interesting. Did you ‘participate’ in the trial too, or were you just targeted and didn’t use it?

Good question…. (btw not sure why the reply link didnt appear below Andrew’s post but appears below all other posts….) i didnt sign up the first time round…. damn….

I did participate (have one recurring payment locked in for the year at low rates, thankfully) but still at 2% for app payment. Am sad!

Is there a need to submit tenancy agreement to show the rental amount?

No need for us. Eddie set up a rental payment already with no details requested. Same as during the trial.

I’ve had 2 months of rent set up, was notified of deduction, and then later notified that the transaction was unsuccessful.. frustrating.. spoke to Citi today and was told that the “systems have had enhancements done on 15 Feb” and that “it should now be ok”.. let’s see..

Highly frustrating. Citi is joint most useless bank in Singapore for customer service in my experience (joint with Standard Chartered). Their customer service and nonsensical response to the most simple questions never ceases to disappoint me.

After FOUR failed attempts (me n wife each once, over two consecutive months) at setting PayAll at 1.2%, and a couple of days ago being told on phone about ‘system enhancements’ on 15 Feb, I went into citi app to set it up all over again… and was offered 2%.. sigh…

I went down to CG and laid out my past two months of frustrations, and now tipping off with my being offered rate at 2%, after missing on $40k of Citi points, is simply not going down very well with me.. So, I’d like to find out..

1. If I set this up again.. how am I going to know for sure that it’s going to go thru this time around? or am I going to wind up having to scramble again for Cheque book?

2. What is Citi going to do about my four failed attempts and my lost points?

3. How did I go from being offered the facility at 1.2% to 2%?

Will update…

Still Happy tho.. 😬

Can I pay the “rental” to my friend, and he pay me back?

Provided they continue to ask for no evidence of a rental agreement – yes why not?

I only worry if my friend will kena tax from government or not….

@Jason.. I don’t wanna be a wet blanket, but you may want to go thru Citi PayAll’s Ts&Cs..

https://www.citibank.com.sg/CAF/assets/doc/ace/GENERAL_POLICY_CONDITIONS.pdf

..namely Point 9.1 (a few sub points there, I reckon), and then figure out yourself whether or not it’s worth it…

Hi Andrew, thank you very much for writing up a series of awesome articles. As I’ll relocate to Singapore soon and investigating the best credit card option there, your info is incredibly useful.

After knowing the general availability of PayAll, now I think Citi Prestige might be the card for me (I was originally looking at CardUp to pay my rent). That said, I’d appreciate it if you could give me some advice on which card I should choose. I obviously wanna accumulate mileage as much as possible from every single daily spending, I’m already a lifetime Star Alliance Gold member, my existing credit card gave me Priority Pass with unlimited entry, I rarely fine-dine, but love traveling with my wife, and my annual salary is $130k. With these specs, do you think Citi Prestige is the card to go, or do you think there’s any better options?