We kicked off our KrisFlyer College series with some basics in Part 1, then covered the waitlist process in Part 2. For this installment, it’s those dreaded taxes and fees associated with any KrisFlyer award booking.

How do you find out what you’ll pay, where they are highest, and how you can try and avoid them?

Part 3 – Taxes & Fees

Updated: 19th May 2019

In the third part of our KrisFlyer College series we delve deeper into one of the less popular parts of a KrisFlyer redemption – the taxes and fees you’ll have to pay in cash on top of the miles needed to secure your booking.

In this part you’ll learn about:

- Why your redemption is not not ‘free’.

- Calculating the taxes via singaporeair.com.

- Calculating the taxes via ITA Matrix.

- UK Air Passenger Duty (APD)

- Which routes charge the most and least.

- Avoiding high tax routings.

- Fuel surcharges on Star Alliance and partner airlines

It’s not “free” after all

So you’ve collected thousands of KrisFlyer miles through your regular credit card spending, apps like Grab, KrisPay and Chope, even when flying paid tickets on Singapore Airlines, SilkAir and Scoot, not to mention Star Alliance flights.

Now you come to redeem your “free” flight with KrisFlyer miles and you might be in for a nasty shock.

As we mentioned in Part 1, you’ll still be asked to part with some cash in addition to the miles due for your award ticket.

Can I pay the taxes and fees with KrisFlyer miles instead of cash?

Simple question, simple answer: No.

While some frequent flyer programs like Qantas do allow you to literally pay nothing but miles for a redemption by covering the cost of the flight and the taxes and fees with miles or points if you prefer, KrisFlyer does not permit this.

The exception is if rather than redeeming you pay for a cash ticket with KrisFlyer miles. It’s a poor value method which allows you to use your miles at a value of 1 cent each off any Singapore Airlines or SilkAir flight, definitely something you should not be doing and not to be confused with a redemption / award ticket.

In that case you can actually reduce the cash element of a booking to zero, but again please don’t consider this as it’s frankly a waste of your miles.

Find out how much you will pay

We showed a couple of examples in Part 1, highlighting some good news which is that Singapore Airlines does not levy fuel surcharges on award tickets on its own flights, and some bad news which is that some airlines (like Lufthansa) certainly do levy these surcharges, which SIA will pass on to you if you book using KrisFlyer miles. More on that later.

Now you know (from Part 1) that you can check the taxes and fees that will apply to your redemption flight by making a dummy booking using the Singapore Airlines website or mobile app.

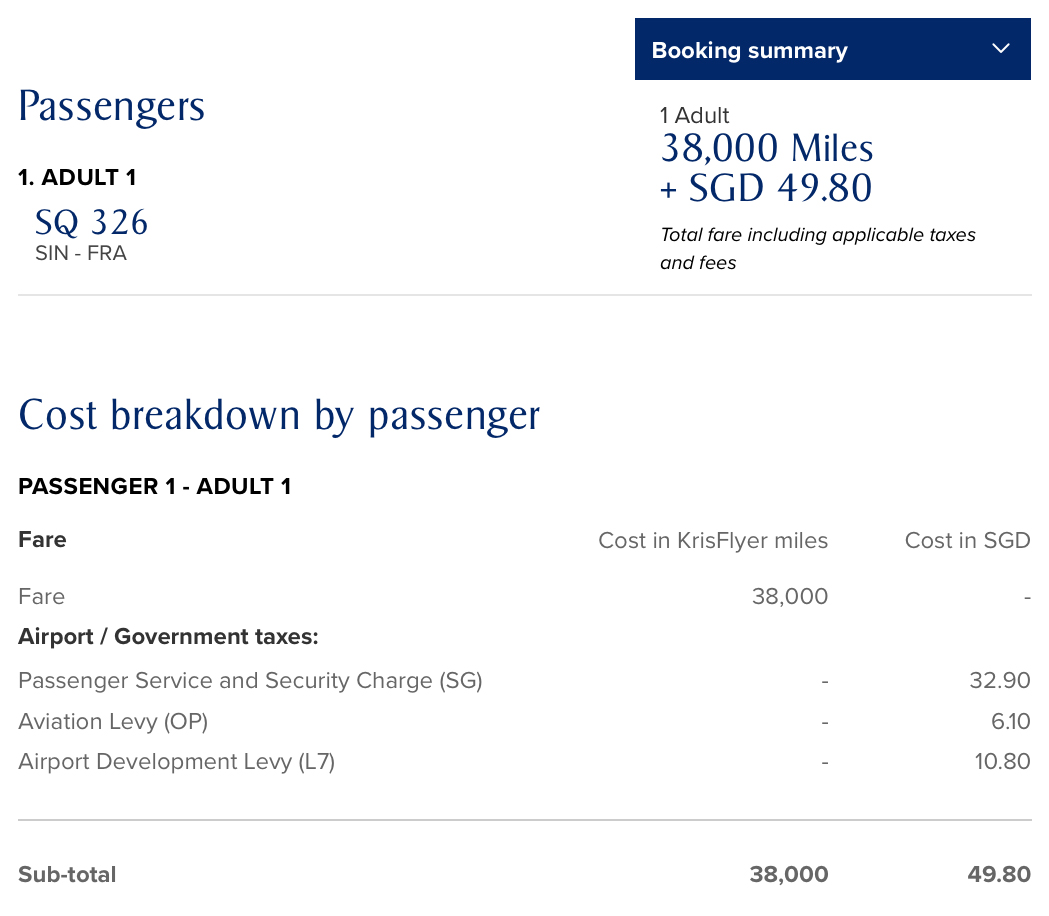

Clicking ‘More details’ provides a breakdown of the Airport/Government taxes.

That process can be a little tricky and time consuming though, so there is another way – using Google’s powerful ITA Matrix.

A little daunting at first, ITA Matrix is designed to show you the best cash fares on a route (with whole month view available), including filters such as airline and even individual flight number.

It takes a little getting used to but one major benefit, and the one we’re using here, is that once you have found a fare of interest you can see how it’s broken down in terms of the fare itself and the individual taxes and fees.

Effectively with Singapore Airlines flights your KrisFlyer miles are paying for the fare element, while you are paying for the taxes and fees in cash. Here’s how the ITA Matrix result appears for the same Singapore – Stockholm flight we looked at above.

For almost every route on the Singapore Airlines network this same principle applies. It is a much faster way to determine the taxes and fees payable (again, once you’ve become used to it) than making individual searches on the Singapore Airlines site.

Limitations of ITA Matrix

There are a few Singapore Airlines routes (we know, because as you’re about to find out we checked all of them) for which ITA Matrix does not accurately show what you’ll pay in taxes and fees for a KrisFlyer redemption ticket.

- To the USA (US International Arrival Tax is not levied on award bookings)

- From the USA (Passenger Facility Charge and International Departure Tax are not levied on award bookings).

- From India (India Goods And Service Tax, shown on ITA Matrix, is a percentage of the ticket cost and varies by cabin class, but is not levied on award bookings as no cash is paid towards the fare component).

- From The Maldives (SIA charges a flat fee of US$50, around S$68, in addition to the miles required for all KrisFlyer redemptions from Malé. This is around double the taxes and fees actually levied by the Maldives authorities, according to ITA Matrix). Let us know if you have any ideas on the reasons for this one!

- From The Philippines (Philippines Travel Tax, shown on ITA Matrix, is only imposed on Filipinos traveling abroad. It varies by cabin class and is paid over the counter at the airport, but will not apply to the majority of our readers and is not charged as part of your redemption booking.)

What currency will you pay in?

For one-way and return award bookings departing Singapore, you’ll pay the taxes and fees in Singapore Dollars. For one-way and return bookings originating overseas, you’ll pay in local currency of the departure point, for example Euros (EUR) for a booking starting in Frankfurt.

From some countries, taxes and fees are charged in US Dollars (e.g. departing Myanmar or Maldives).

When taxes and fees charged in foreign currency need to be converted into Singapore Dollars, for example the return sector of a Singapore – Dubai – Singapore redemption (taxes and fees departing Dubai are charged in AED), the Singapore Airlines booking engine applies the IATA Consolidated Exchange Rates conversion (updated daily), with the amount rounded to the nearest 10 cents.

ITA Matrix also uses the IATA exchange rates (as does GDS / Amadeus, etc.), so it will always be consistent.

Who charges more to premium passengers?

The majority of countries around the world don’t differentiate aviation taxes by class of travel, but there are a few on the Singapore Airlines network that do.

- France: The “Air Passenger Solidarity Tax” is 10 times higher for Business Class and First Class passengers (e.g. CDG-SIN S$69.10), than for those flying Economy and Premium Economy (e.g. CDG-SIN S$6.90).

- Hong Kong: The “Hong Kong Airport Construction Fee” is set at a higher rate for Business Class and First Class passengers.

- United Kingdom: A higher rate of “Air Passenger Duty” applies in any cabin other than Economy (i.e. Premium Economy and up).

The taxes in these examples only apply to departing passengers, however they can also impact itineraries starting in other countries where a transit stop (layover) or stopover is made in one of the listed countries.

For example, the taxes are lower if you redeem Economy Class from San Francisco to Singapore on SQ1 via Hong Kong than they are if you redeem Business Class on the same flight, because of the higher Hong Kong airport construction fee rate, which also applies to transit passengers.

UK Air Passenger Duty (APD)

We alluded to some bad news in Part 1 which was that government and airport charges when departing certain countries, especially in Europe, can be outrageously high.

Nowhere is this more prevalent than the United Kingdom, which has the highest taxes in the world for departing air passengers in the form of Air Passenger Duty (APD).

If you’re redeeming a flight on Singapore Airlines from the UK you’ll be hit with APD as part of your award ticket cost on all three of the routes the airline operates from there – London to Singapore, Manchester to Singapore and Manchester to Houston.

Rates are based on the distance from London to the capital city of the destination country. In all cases for Singapore Airlines flights from the UK that means paying the higher rate.

| Distance | Economy | Premium* |

| 0 – 2,000 miles | £13 (S$23) | £26 (S$46) |

| 2,001+ miles | £78 (S$137) | £172 (S$301) |

* Premium Economy, Business or First Class

Also note that APD rates are rising (they never go down) in the higher distance band from 1st April 2020, to £80 and £176 respectively for the cabin types.

If you spend less than 24 hours in the UK (a layover, not a stopover), you won’t be hit with APD when you depart. That’s provided of course you’re flying on a single ticket issued by the same airline. A new ticket out of the UK booked with another airline (or as a separate booking with the same airline) will attract APD.

Upgrades

If you pay to upgrade your Economy Class flight on Singapore Airlines from London or Manchester, you’ll attract the higher rate of APD. That’s included in any upgrade quote or amount you pay, you won’t be chased for it afterwards.

If you are upgraded by the airline from Economy Class to a higher class for free (this does happen, even on Singapore Airlines), you won’t have to pay the additional APD.

So if I fly Singapore – Manchester – Houston, I must pay APD?

No, provided you fly all the way from Singapore to Houston via Manchester on the same flight your fare will not attract APD in any travel class. Once you stopover in Manchester for 24 hours or more, game over. In Economy Class S$72.70 in taxes just became S$238.60.

Step up to Premium Economy or Business Class and it’s S$405.30. Ouch.

You should always avoid departing the United Kingdom on a KrisFlyer award ticket, due to these ridiculously high taxes. The UK government calls it ‘APD’, claims it’s to help the environment, then doesn’t ring-fence a single cent of it for environmental causes.

In other words it’s just tax – because they can.

What you’ll pay

Here are our tables analysing the taxes and fees applicable on every Singapore Airlines route when you make an award booking, by class of travel.

- Y – Economy

- W – Premium Economy

- J – Business

- F – First / Suites

For flights originating outside Singapore, amounts have been converted to Singapore dollars to make them directly comparable for our readers. This was done using the ITA Matrix currency option, which applies the IATA Consolidated Exchange Rate on the search date (14th May 2019 in this case).

These rates will therefore fluctuate slightly due to exchange rate variations as the rates are updated daily.

Departing Singapore

For Singapore Airlines flights departing Changi the amount of tax you’ll pay on top of your KrisFlyer miles rate for a redemption ticket is simple – currently set at S$49.80 for a one-way redemption regardless of your class of travel.

There are exceptions however, for flights to 19 cities on the network you’ll pay anywhere from a few dollars more (e.g. Bangkok) to over double that rate (e.g. Canberra).

Why? Well it’s because the country / airport of arrival imposes a tax or fee on arriving passengers. This is rare, but on the Singapore Airlines network it applies in:

- Australia – the Passenger Services Charge (International Arrival) and the Safety And Security Charge (Arrival).

- Myanmar – the Advance Passenger Information User Charge (International Arrivals).

- New Zealand – the Border Clearance Levy (International Arrival) and the Passenger Service Charge (International Arrival).

- Russia – the Terminal Use Charge (International Arrival).

- Thailand – the Advance Passenger Processing User Charge and the International Arrival Fee.

- United Arab Emirates – the International Advanced Passenger Information Fee (Arrivals).

- United States – the International Arrival Tax, Immigration User Fee, Customs User Fee and APHIS Passenger Fee.

Singapore Airlines therefore collect these additional taxes at the redemption booking stage in addition to your KrisFlyer miles, with the exception of the USA’s International Arrival Tax, which is not charged on award bookings by law as mentioned above.

Here are the itineraries ex-Singapore that will cost you more than the ‘standard’ S$49.80 in taxes and fees when you redeem a KrisFlyer award, by cabin class. If your destination is not listed, it’s simply S$49.80 (at the time of writing).

| Route | Y | W | J | F |

| SIN – ADL | $70.70 | N/A | $70.70 | N/A |

| SIN – AKL | $80.00 | |||

| SIN – BKK | $52.00 | N/A | $52.00 | N/A |

| SIN – BNE | $81.80 | N/A | ||

| SIN – CBR transit SYD |

$106.00 | |||

| SIN – CHC | $77.20 | N/A | ||

| SIN – DME | $64.30 | |||

| SIN – DXB | $51.70 | |||

| SIN – EWR | N/A | $72.70 | N/A | |

| SIN – IAH transit MAN |

$72.70 | N/A | ||

| SIN – IAH stopover MAN |

$238.60 | $405.30 | N/A | |

| SIN – JFK transit FRA |

$105.40 | |||

| SIN – JFK stopover FRA |

$202.40 | |||

| SIN – LAX | N/A | $72.70 | N/A | |

| SIN – LAX transit NRT |

$92.30 | |||

| SIN – LAX stopover NRT |

$117.60 | |||

| SIN – MEL | $69.80 | |||

| SIN – PER | $66.80 | N/A | $66.80 | N/A |

| SIN – RGN | $54.30 | |||

| SIN – SEA | $72.70 | N/A | ||

| SIN – SFO | N/A | $72.70 | N/A | |

| SIN – SFO transit HKG |

$100.50 | $104.00 | ||

| SIN – SFO stopover HKG |

$130.10 | $133.60 | ||

| SIN – SYD | $79.90 | |||

| SIN – WLG transit MEL |

$78.80 | N/A | $78.80 | N/A |

| SIN – WLG stopover MEL |

$180.80 | N/A | $180.80 | N/A |

Correct at 14th May 2019. Variation due to exchange rates will occur.

Europe → Singapore

We already spoke about the ludicrously high taxes for flights departing the UK, so it’s no surprise to see the highest levels in the table below for itineraries starting in Manchester and London.

Other European countries imposing high taxes are France (for Business and First Class) and Germany (for all passengers, though Dusseldorf rates are more reasonable).

| Route | Y | W | J | F |

| AMS – SIN | $39.20 | N/A | ||

| ARN – SIN transit DME |

$79.80 | N/A | ||

| ARN – SIN stopover DME |

$97.70 | N/A | ||

| BCN – SIN | $33.10 | N/A | ||

| CDG – SIN | $81.40 | $143.40 | ||

| CPH – SIN | $33.00 | |||

| DME – SIN | $25.00 | N/A | ||

| DUS – SIN | $98.80 | N/A | ||

| FCO – SIN | $63.90 | N/A | ||

| FRA – SIN | $129.40 | |||

| LHR – SIN | $221.30 | $388.10 | ||

| MAN – SIN | $175.10 | $341.90 | N/A | |

| MUC – SIN | $110.60 | N/A | ||

| MXP – SIN | $42.80 | N/A | ||

| ZRH – SIN | $47.00 | |||

Correct at 14th May 2019. Variation due to exchange rates will occur.

Note that while APD rates are common across UK airports, other taxes are lower when you depart from Manchester so if you must fly to Singapore from the UK you can save some money doing so from there, or of course by flying Economy Class.

USA → Singapore

Good news for those redeeming flights from the USA to Singapore, there are some very low taxes here. That’s because as we mentioned previously most of them are not charged on award bookings, the exception being the “US September 11th Security Fee”.

Set at just US$5.60, it means paying as little as S$7.70 on top of the miles required for some of the longest flights on the network (and in the world).

| Route | Y | W | J | F |

| EWR – SIN | N/A | $7.70 | N/A | |

| IAH – SIN transit MAN |

$72.70 | N/A | ||

| IAH – SIN stopover MAN |

$173.80 | $340.60 | N/A | |

| JFK – SIN transit FRA |

$55.00 | |||

| JFK – SIN stopover FRA |

$137.40 | |||

| LAX – SIN | $7.70 | |||

| LAX – SIN transit NRT |

$27.30 | |||

| LAX – SIN stopover NRT |

$52.70 | |||

| SEA – SIN | $7.70 | N/A | ||

| SFO – SIN | $7.70 | |||

| SFO – SIN transit HKG |

$19.90 | $35.60 | ||

| SFO – SIN stopover HKG |

$53.00 | $64.40 | ||

Correct at 14th May 2019. Variation due to exchange rates will occur.

Additional costs only come in when you transit another airport, either by choice or necessity, as you’ll then pick up some additional taxes charged by those countries and airport operators.

These don’t have a dramatic effect though, it’s stopovers (24h+) where you really need to start watching out for those taxes. Manchester is the obvious one to avoid (your stopover means you’ll now pay UK APD on the second flight), but also having a few days in Frankfurt on your way back from New York will cost each passenger a not insignificant $82.40 extra.

Remember this is on top of the US$100 (c.S$137) stopover cost for saver redemptions so as you can see if you pick the ‘wrong’ place to stopover the US$100 fee could become the least of your worries.

Learn more about the US$100 stopover ‘trick’ here.

Middle East / Africa → Singapore

No major taxes in this part of the world makes all four of these routings good value, especially given the cheaper redemption zone compared to say Europe.

| Route | Y | W | J | F |

| CPT – SIN | $45.20 | N/A | ||

| DXB – SIN | $44.70 | |||

| IST – SIN | $35.20 | N/A | $35.20 | N/A |

| JNB – SIN | $45.20 | N/A | ||

Correct at 14th May 2019. Variation due to exchange rates will occur.

Istanbul to Singapore for example will set you back only 49,000 KrisFlyer miles in Business Class + S$35.20, compared to 92,000 miles + S$388.10 from London.

South West Pacific – Singapore

While the Kiwis aren’t really into aviation taxation in a big way for departing passengers, unfortunately the Aussies are. Remember you got stung when you arrived? Well it’s about to happen when you leave too.

Thankfully it’s nothing on the scale of UK APD, but the Australia Passenger Movement Charge (PMC) isn’t insignificant and applies on top of fees added by individual airport operators for departing passengers.

| Route | Y | W | J | F |

| ADL – SIN | $85.60 | N/A | $85.60 | N/A |

| AKL – SIN | $29.40 | |||

| BNE – SIN | $89.40 | N/A | ||

| CBR – SIN | $113.60 | |||

| CHC – SIN | $27.70 | N/A | ||

| MEL – SIN | $81.70 | |||

| PER – SIN | $80.70 | N/A | $80.70 | N/A |

| SYD – SIN | $87.50 | |||

| SYD – SIN transit CBR |

$122.10 | |||

| WLG – SIN transit MEL |

$28.30 | N/A | $28.30 | N/A |

| WLG – SIN stopover MEL |

$136.20 | N/A | $136.20 | N/A |

Correct at 14th May 2019. Variation due to exchange rates will occur.

Notice how a stopover in Melbourne on your way back to Singapore from Wellington will cost you nearly S$110 more per person.

North Asia → Singapore

Low taxes are predominant in this region, especially departing China, though Japan and Hong Kong are slightly more expensive.

| Route | Y | W | J | F |

| CAN – SIN | $18.00 | N/A | $18.00 | N/A |

| FUK – SIN | $24.50 | N/A | $24.50 | N/A |

| HKG – SIN | $45.30 | $57.40 | ||

| HND – SIN | $45.60 | |||

| ICN – SIN | $32.60 | |||

| KIX – SIN | $50.20 | |||

| NGO – SIN | $44.30 | N/A | $44.30 | N/A |

| NRT – SIN | $44.90 | |||

| PEK – SIN | $18.00 | |||

| PVG – SIN | $18.00 | |||

| TPE – SIN | $22.10 | N/A | $22.10 | N/A |

Correct at 14th May 2019. Variation due to exchange rates will occur.

Speaking of Japan, if you’re touring around and then looking for a redemption home at the end of your trip you might want to arrange to finish your journey in Fukuoka. Why? Because it has by far the lowest departure taxes (less than half what you’ll pay departing Osaka, for example).

For an individual it’s unlikely to be a deal breaker, but for a family of four it starts to add up.

South East Asia → Singapore

Mostly low taxes applicable on redemptions from this region, with only Colombo, Dhaka and Male charging above average.

| Route | Y | W | J | F |

| AMD – SIN | $7.20 | N/A | $7.20 | N/A |

| BKK – SIN | $32.70 | N/A | $32.70 | N/A |

| BLR – SIN | $33.50 | N/A | $33.50 | N/A |

| BOM – SIN | $28.70 | |||

| BWN – SIN | $12.00 | N/A | $12.00 | |

| CCU – SIN | $36.30 | N/A | $36.30 | N/A |

| CGK – SIN | $21.90 | N/A | $21.90 | |

| CMB – SIN | $81.80 | N/A | $81.80 | N/A |

| DAC – SIN | $92.10 | N/A | $92.10 | N/A |

| DEL – SIN | $8.40 | |||

| DPS – SIN | $21.50 | N/A | $21.50 | N/A |

| HAN – SIN | $36.90 | N/A | $36.90 | N/A |

| KUL – SIN | $11.90 | N/A | $11.90 | N/A |

| MAA – SIN | $6.80 | N/A | $6.80 | N/A |

| MLE – SIN | $68.40 | N/A | $68.40 | N/A |

| MNL – SIN | $14.40 | N/A | $14.40 | |

| RGN – SIN | $31.80 | N/A | $31.80 | N/A |

| SGN – SIN | $30.10 | N/A | $30.10 | N/A |

| SUB – SIN | $20.00 | N/A | $20.00 | N/A |

Correct at 14th May 2019. Variation due to exchange rates will occur.

Fifth freedom routes

Because of their varied nature on the Singapore Airlines network, fifth freedom routes (between two countries neither of which the airline is based in) attract some of the lowest and some of the highest taxes and fees.

| Route | Y | W | J | F |

| ARN – DME | $72.60 | N/A | ||

| DME – ARN | $25.00 | N/A | ||

| FRA – JFK | $152.60 | |||

| HKG – SFO | $80.30 | $83.80 | ||

| IAH – MAN | $7.70 | |||

| JFK – FRA | $7.70 | |||

| LAX – NRT | $7.70 | |||

| MAN – IAH | $145.60 | $274.30 | N/A | |

| MEL – WLG | $110.90 | N/A | $110.90 | N/A |

| NRT – LAX | $67.80 | |||

| SFO – HKG | $7.70 | |||

| WLG – MEL | $48.40 | N/A | $48.40 | N/A |

Correct at 14th May 2019. Variation due to exchange rates will occur.

What this tells us

What can we learn from that analysis? Mainly, it’s that there are departure airports and countries best avoided if you want to pay as little tax as possible on top of your miles for a redemption ticket on Singapore Airlines.

Within each country there are even cheaper departure alternatives, like Manchester in the UK and Fukuoka in Japan.

The average tax charged across the above routes is S$68.10. That’s a bit meaningless, as it isn’t the applicable rate for any single route, however it should give you a good ‘benchmark’ to work from. On routes charging significantly less than that you’re getting a decent deal, on routes where it’s significantly more – try to look for alternative options.

Avoiding UK APD

Many of our readers want to visit the UK using their KrisFlyer miles. For one thing, Singapore to London is SIA’s longest non-stop A380 flight. There’s a ‘golden rule’ here:

Redeem Singapore Airlines into the UK, but don’t redeem Singapore Airlines out of the UK.

That of course is because with no inbound taxation, it will cost you S$49.80 per person in addition to your KrisFlyer miles in any class of travel to fly Singapore – London, but up to S$388.10 in the other direction.

Singapore Airlines flies a host routes from Europe to Singapore with much cheaper taxes and fees. In Business Class for example:

- Amsterdam – $39.20

- Copenhagen – $33.00

- Barcelona – $33.10

- Milan – $42.80

- Zurich – $47.00

In First Class you can pick up redemptions with the above tax rates from Copenhagen (2013 First, though this ends in October 2019) and Zurich (2017 Suites).

So how do you avoid APD? Well there’s actually no way to completely avoid it, but APD on short intra-Europe flights (anything up to 2,000 miles in fact) is much lower than we’re talking about on a flight to Singapore in Business Class.

One method is to take a short flight, preferably in Economy Class, to a country with low taxes (for example from London, fly easyJet or British Airways to Amsterdam, then fly SIA to Singapore in Business Class from there).

If you have any miles in a oneworld scheme, like Avios, you can even redeem on British Airways when doing this.

One useful option with Avios is the ‘Reward Flight Saver’, available on redemptions up to 2,000 miles (which is all you’ll need here to access those cheaper departure airports).

Note: You must have earned at least one Avios point in the last 12 months to be eligible for Reward Flight Saver redemptions.

Instead of paying the taxes and fees on top of your Avios redemption, BA allows you to pay a simple ‘flat fee’ instead (meaning some of those taxes like APD are covered in the Avios points element itself).

For example nipping across to Amsterdam before you take your Singapore Airlines redemption flight home will set you back as little as 4,000 Avios + £17.50 (around S$31), whether you fly BA from London’s Heathrow, Gatwick or City airports.

Total taxes on this flight, in the form of APD and passenger service charge, are actually £59.31, so not only is your 4,000 Avios offsetting the fare, it’s covering £41.81 (S$74) of taxes and fees.

As our regular readers will know, we don’t usually endorse using your miles or points for Economy Class redemptions, however this flight costs £89.31 per passenger with a checked bag (which is a fair comparison, as you get a checked bag on a Reward Flight Saver award), so you are getting 1.8p per mile (around 3.2 Singapore cents per mile) for this redemption.

Even if you don’t have Avios, flying in Europe is relatively cheap with easyJet for example offering a flight on the same date as the one above from London Luton to Amsterdam for £43 (S$75) including a 23kg checked bag.

Of course this avoidance strategy equally applies to other countries and airports where taxes and fees are high, such as in France and Germany, but the savings there may not outweigh the costs like they usually do when avoiding APD.

As always if you’re making an unprotected connection before your award booking, do build in suitable contingency time. An overnight stay at your final departure point is best.

Star Alliance and partner awards

If you are making a Star Alliance or partner airline redemption with your KrisFlyer miles, a fuel surcharge may be added if it is imposed by the operating airline. For example, Lufthansa award tickets booked through KrisFlyer attract a fuel surcharge.

Basically Singapore Airlines are passing on the charge to you, because they will have to pay it themselves.

Obviously we’re not going to create a table of taxes and fees on all the Star Alliance and SIA partner airlines, but take the following example of a flight from Singapore to Frankfurt.

As you can see the taxes and fees total S$49.80. If you take the same routing with Lufthansa however, aside from paying the slightly Star Alliance redemption rate for Economy Class on this route, you’ll be stung with a significant fuel and insurance surcharge.

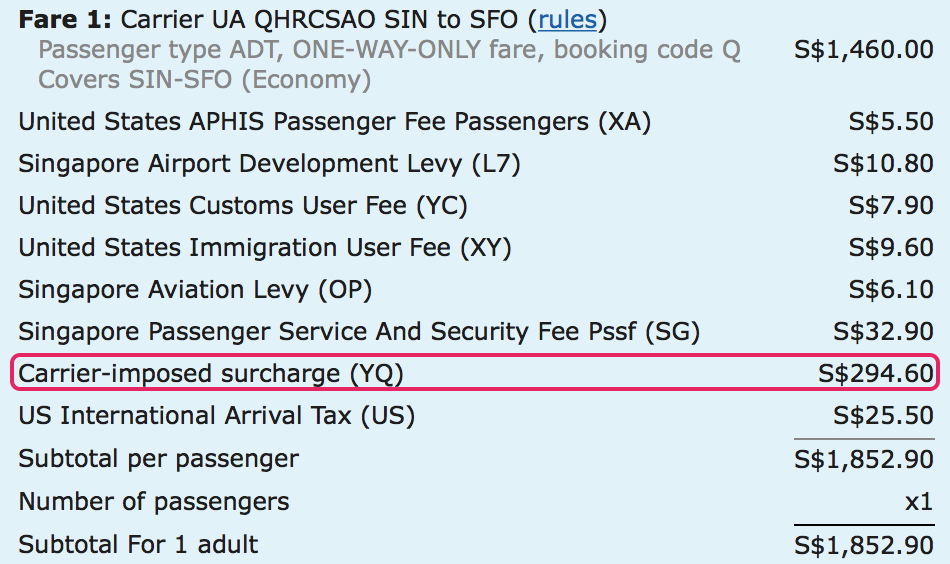

Note that YQ and YR are normally used to indicate a fuel surcharge or carrier-imposed fee, so if you see those codes in ITA Matrix or the cost breakdown, that’s what you’re paying.

It gets even more complicated though. While some Star Alliance and SIA partner airlines have high fuel surcharges, some are quite negligible, and some airlines don’t apply one to award bookings at all.

The problem in the latter case is that ITA Matrix will still show them, since it can’t differentiate between cash bookings and award bookings when showing the taxes and fees.

For example ITA Matrix will show you that a flight with United from Singapore to San Francisco will attract S$294.60 in fuel surcharges. If you buy a cash ticket on this flight, you will obviously have to pay this.

You would therefore expect to be charged it when you buy the same flight using KrisFlyer miles, but you won’t be.

Taxes and fees on this route are no different to those you pay flying Singapore Airlines. Why? Because United does not impose a fuel surcharge to KrisFlyer members on award bookings.

Which partner does what?

We’ve grouped Star Alliance and SIA partner airlines into three categories to help you predict the impact of fuel surcharges on your redemption booking.

Airlines that impose significant fuel surcharges on KrisFlyer award bookings

- Air Canada

- Air India

- Austrian Airlines

- LOT Polish

- Lufthansa

- Shenzhen Airlines

- South African Airways

- SWISS

- TAP Air Portugal

- Virgin Atlantic

Airlines that impose low or moderate fuel surcharges on KrisFlyer award bookings

- Adria Airlines

- Aegean Airlines

- Air China

- Air New Zealand

- ANA

- Asiana Airlines

- Brussels Airlines

- Croatia Airlines

- EgyptAir

- EVA Air

- Juneyao Airlines

- Thai Airways

- Turkish Airlines

- Vistara

Airlines that don’t impose any fuel surcharge on KrisFlyer award bookings (ITA Matrix results will not correspond to taxes charged)

- Alaska Airlines

- Avianca

- Copa Airlines

- Ethiopian Airlines

- Scandinavian Airlines

- United

- Virgin Australia

Summary

What have we learned in this part of the KrisFlyer college series?

- Whatever routing you choose for a KrisFlyer redemption, using your miles doesn’t make the ticket “free”. You’ll still have to pay the taxes and fees on top.

- SingaporeAir.com breaks down the taxes for you and tells you the total, but you have to search the route first to find the information.

- ITA Matrix is a nice alternative and is a much quicker way to calculate the taxes once you get used to using it, however there are a few routes and airlines this won’t work accurately for.

- Some countries charge more tax for premium cabins and some charge passengers when they arrive as well as when they depart.

- UK APD is the highest in the world. Fly Singapore Airlines into the UK, but don’t fly Singapore Airlines out of the UK if you can avoid it.

- Transits and stopovers usually significantly increase the taxes and fees you’ll pay on a redemption booking.

- Some Star Alliance and SIA partner airlines apply hefty fuel surcharges on award tickets which must also be paid in cash when making a redemption booking, but some are more reasonable and some waive them completely for KrisFlyer bookings.

Let us know your thoughts on taxes and fees in the comments section below. If you have any other hints or tips please do share them and we’ll consider adding them to the guide.

KrisFlyer College Series

Part 4: Upgrade with miles on SIA >>>

Thanks so much for this!

Another awesome write-up! Thanks for this, Andrew!

And.. just like Good Morning Vietnam, I’ll have to read this at least times more before I catch everything! 😄

🙏🏻🙏🏻🙏🏻

Excellent thank you ever so much

hi great post i want to ask,

it may be silly question,

example how if I booked reward J on bkk sin cgk, but I am not originating from bkk but my ticket is issued under bkk-cgk.

I fly from BKK to CGK not from BKK is that possible?

and also if condition like this :

i booked BDO-SIN-BKK but not take the bkk, just stop at sin, is that possible?

why i want to book like that, because it will reduce the tax, and i have access in SIN lounge like arrival lounge access.

so instead fly to bkk i just end my trip in singapore.

is that possible?

thans a lot!

Thank you so much!

Such a good read and easy to understand.