EXPIRED This article relates to an offer or promotion which has now expired.

| Update 31st July 2019: The sign-up bonus has now been reduced to 60,000 miles for new applications between 1st August 2019 and 30th September 2019. See our article for details. |

All the talk lately has been about Standard Chartered’s upcoming ‘X card’. Not because there’s anything too special about it (there really isn’t), but because of the headline sign-up bonus, with a total 100,000 miles on offer when you meet the eligible spend on the card.

The waitlist is now closed and the X card is finally here, with the application link now available (being on the waitlist didn’t seem to matter!).

Everyone who signs up and meets the spend requirement is entitled to the sign-up bonus (this isn’t UOB!), but it is time-limited so if you’re eligible and want to take part – apply now.

The sign-up bonus is only applicable for card accounts approved by 31st August 2019, so if you’re interested in enough miles to fly SIA Business Class from Singapore to New York for S$696 – act fast.

Key features

The card is targeted at ‘millennials’, whatever they are (there is no agreed definition but being born between 1981 and 1996 seems to be the widely accepted criteria). That would make you 23 to 38 years of age, which puts Eddie and I in the target market.

We’ll have a full review of this card coming up soon, but for now the headline stats are as follows:

Annual fee: $695.50/yr

EIR/APR: 26.9%

Sign-up bonus: 100,000 miles*

Local earn rate: 1.2 miles per $1

Overseas earn rate: 2.0 miles per $1

Foreign transaction fee: 3.5%

Minimum Age: 21

Minimum income: S$80,000/yr**

* Minimum S$6k spend applies in first 60 days

** Priority/Private Banking customers: S$30,000/yr (Singaporean/PR) or S$60,000/yr (Foreigner)

Sign-up bonus

The sign-up offer for the Standard Chartered Visa Infinite X card is 100,000 miles if you spend S$6,000 in the first 60 days of card membership. It is subject to payment of the (non-waivable) annual fee of S$695.50.

The structure is as follows:

- 30,000 KrisFlyer miles “Upfront Gift Promotion”: for activating your card within 30 days and paying the annual fee of S$695.50, and provided your card is approved by 31st December 2019; and

- 70,000 KrisFlyer miles “Sign-up Gift Promotion”: for spending S$6,000 on eligible retail transactions in the first 60 days from card approval date, and provided your card is approved by 31st August 2019.

Firstly, bravo to Standard Chartered for not including the miles you would accrue anyway to meet the S$6,000 spend in the sign-up bonus calculation. More than one bank in Singapore plays this game, and of course we always see right through it.

Your total earning (including the sign-up bonus) during this promotion will be at least 107,200 miles, assuming local spend:

- Upfront bonus = 30,000 miles

- S$6,000 x 1.2 mpd = 7,200 miles

- Sign-up bonus = 70,000 miles

- Total earning = 107,200 miles

The cost per mile calculation is the annual fee divided by 100,000 miles (the bonus).

Cost per KrisFlyer mile

|

||

S$695.50 / 100,000 |

→ |

0.70¢ |

That’s a very competitive rate to acquire KrisFlyer miles, our upper threshold to buy is 1.9 cents each and we aim to achieve at least 2.4 cents per mile when we redeem.

A 1.9 cents per mile the 100,000-mile bonus is worth at least S$1,900 against future Singapore Airlines redemptions, and you’re getting it here for S$695.50, even if you value the rest of this card’s perks at nothing (which in fairness isn’t far off the truth!).

Earn rate equivalent

Looking at the calculation another way, you’re earning 107,200 miles for that S$6,000 spend (upfront gift + sign-up bonus + the base earn rate), assuming local spend, an effective earning rate of 17.9 miles per dollar. That’s unbeatable for this spend volume.

You’ll do slightly better than that with some foreign currency spend at the 2 mpd earn rate, and read later on about why you might want to do that.

You could break the calculation down further and say that since the first 30,000 miles require no spending at all, you are really only earning 77,200 miles for the S$6,000 in local spend (70,000 sign-up bonus + 7,200 regular earn rate).

That puts the effective earning rate at 12.9 miles per dollar, though we don’t think many people will be paying the annual fee and settling for the 30,000 miles ‘upfront gift’, as that would be a high cost of 2.32 cents per mile (S$695.50 / 30,000).

Who is eligible?

There are no exclusions in the terms and conditions document stating that existing customers, for example SCVI holders, will not be eligible for the upfront bonus and sign-up bonus.

All X card applicants who meet the criteria and have their card approved by 31st August 2019 should be eligible.

Deadline and timescale

The upfront gift of 30,000 KrisFlyer miles will be credited as Standard Chartered 360o Rewards Points within 30 days of card activation. You must have your card approved by 31st December 2019 to be eligible.

Provided you are approved for the card by 31st August 2019 and meet the eligible spend requirement, the 70,000 bonus KrisFlyer miles will be awarded (again as Standard Chartered 360o Rewards Points) by 30th November 2019. That’s around a month after the eligible spend period for those issued with the card in late August 2019.

If your card is approved earlier (e.g. 15th August 2019), the 70,000 miles bonus should come through earlier as well, theoretically around mid-November 2019 in that example.

Exclusions

The following spend categories do not count towards the S$6,000 minimum spend in the first 60 days of card membership to be eligible for the sign-up bonus, so make sure you either avoid them or disregard them in your calculations.

(a) Insurance premiums, including premiums for investment-linked policies, charged to the X Card;

(b) Bill payments (Examples of bill payment merchants include but are not limited to Telecommunications and utilities providers such as Starhub, Singtel and M1, Singapore Power);

(c) Any payment via AXS network;

(d) Any payment via SAM network;

(e) Any bill payment made using SC EasyBill programme;

(f) Payments to government agencies which include but is not limited to Land Transport Authority, Housing Development Board, Inland Revenue Authority of Singapore, Public Utilities Board, Immigration & Checkpoints Authority and the Ministry of Manpower;

(g) Income tax payments;

(h) Tax refunds credited to the X Card;

(i) EZ-Link cards transactions;

(j) CardUp transactions

(k) ipaymy transactions;

(l) RentHero transactions;

(m) Transit Link transactions;

(n) Any top-ups or payment of funds to any prepaid cards (with exception of EZ-Reload charged to your X Card) and any prepaid accounts, payment platforms, digital wallets including but not limited to Grab, Singtel, Dash, WorldRemit Singapore, YouTrip or any other accounts as the Bank may specific from time to time, including without limitation to the following accounts or any other accounts as we may specific from time to time;

(o) Any transactions pertaining to Merchant Category Codes 6211 (Security Brokers/Dealers), 7995 (Gambling/Lotto), 4829, 6536, 6537, 6538 (Money Transfer) and 6050, 6051 (cryptocurrency/Quasi Cash);

(p) Credit Card Funds Transfers to the X Card, cash advances from the X Card, purchases via NETS and ongoing instalment payments;

(q) Any fees and charges (including but not limited to annual fees, service fees, interest charges, cheque processing fees, administrative fees, cash advance fees, finance charges and/or late payment charges and other miscellaneous fees and charges) charged to the X Card;

(r) Any amount charged to the X Card during the Promotion Period that is subsequently cancelled, voided or reversed;

(s) Any charges incurred by the X Card but not submitted or posted to the X Card during the X Card Sign Up Promotion Period;

(t) Any fraudulent transaction; and

(u) Balance owing on the X Card account from other months.

Note especially that CardUp, ipaymy and RentHero transactions are specifically excluded, which will make reaching the minimum spend more difficult for some.

This does not prevent CardUp, ipaymy and RentHero transactions from earning miles with this card at the usual 1.2 mpd local earn rate, they will simply not be taken into account for the S$6,000 minimum spend in the first 60 days to trigger the 70,000 miles bonus.

Earning rates

The sign-up bonus is the main draw for this card, because the regular earn rates are quite paltry.

- Local Spend: 1.2 miles per S$1 (3.0 Rewards Points)

- Foreign Currency Spend: 2.0 miles per S$1 (5.0 Rewards Points)

These are basically Citi PremierMiles / DBS Altitude rates, and certainly not the best in the market.

Even Standard Chartered’s own Visa Infinite card earns 1.4 miles for local spend and 3.0 for overseas, provided you transact at least S$2,000 per statement cycle.

After the first S$6,000 spend you’ll certainly want to be shifting to a better general spending card like the BOC Elite Miles for 1.5 mpd locally and 3.0 mpd overseas, earning you 25% and 50% more miles respectively in those categories than this card.

Are you taking a hit?

To use this card for S$6,000 of spend in two months – almost certainly yes.

Personally we are using the BOC Elite Miles card for general spend in Singapore. Since that earns 1.5 miles per dollar on local spend, moving our transactions to this card is losing us 0.3 miles per dollar x 6,000 = 1,800 miles.

That’s quite inconsequential given the bonus on offer here.

It reduces our ‘effective bonus’ from 100,000 miles to 98,200 miles, but that still brings in the cost per mile taking account of the annual fee at 0.71 cents each.

Even if you managed to channel S$6,000 of spend through credit cards at 4 miles per dollar rates, which you could manage in two months with a DBS Woman’s World card and two Citi Rewards cards (Visa and Mastercard), it’s still worth taking the hit for this many bonus miles.

In that case you’re looking at a ‘hit’ of 16,800 miles (2.8 x 6,000). That reduces your ‘effective bonus’ from 100,000 miles to 83,200 miles, but that still brings in the cost per mile taking account of the annual fee at 0.84 cents each.

If the best you have in your wallet is a Citi PremierMiles, AMEX Ascend or DBS Altitude card for example, you’re not taking a hit here as these all earn 1.2 miles per dollar for local spend. You should be doing better than that though, even in the general spend category.

Our advice?

If you meet the income requirements and have at least S$6,000 spend to make in the next two months, this is a no-brainer – it’s definitely worth it.

At the same time don’t underestimate the minimum spend. S$6,000 is a large amount to commit to for many people over just 60 days, and with the likes of CardUp and ipaymy specifically excluded among many other categories Standard Chartered do mean ‘retail transactions’ here when they say it.

It really isn’t worth it if you fall short – don’t stretch yourself financially.

Cashback and travel alternatives

The Standard Chartered X card is also offering a cashback alternative allowing you to redeem points for 1.2% cashback per S$1 spent locally and 2% cashback for every S$1 spent in foreign currency.

These are poor rates relative to the value of KrisFlyer miles earned, and unlikely to be of much interest to our readers (unless you value KrisFlyer miles at less than 1 cent each, in which case there are better cashback cards on the market anyway).

There is also the option to receive travel credits at a rate of 250 rewards points to S$1, which is similarly poor value versus transfer into KrisFlyer miles.

Which FFPs

Standard Chartered 360o Rewards Points, which is what you’ll actually be earning here, usually only convert into Singapore Airlines KrisFlyer miles on the Frequent Flyer Programme side.

That’s quite restrictive with almost all banks in Singapore allowing transfers at least into Asia Miles as well as KrisFlyer.

With the X card though Standard Chartered is offering SC EasyRewards, which allows transfer into:

| Airline Transfer Partners | |

| Airline | FFP |

| Singapore Airlines | |

| Air France / KLM | |

| Emirates | |

| Etihad | |

| EVA Air | |

| Lufthansa | |

| Qantas | |

| Qatar | |

| United | |

In addition to two hotel loyalty schemes:

- Accor

- IHG

Some interesting options there. At this stage it’s not clear exactly how the conversion rates are structured, so we’ll update this with our full review in due course. The usual transfer fee and turnaround time is quoted.

Note: We now know the transfer ratios from reward points to loyalty points with these programs (and Malaysia Enrich is in addition to those listed). See our article for more details.

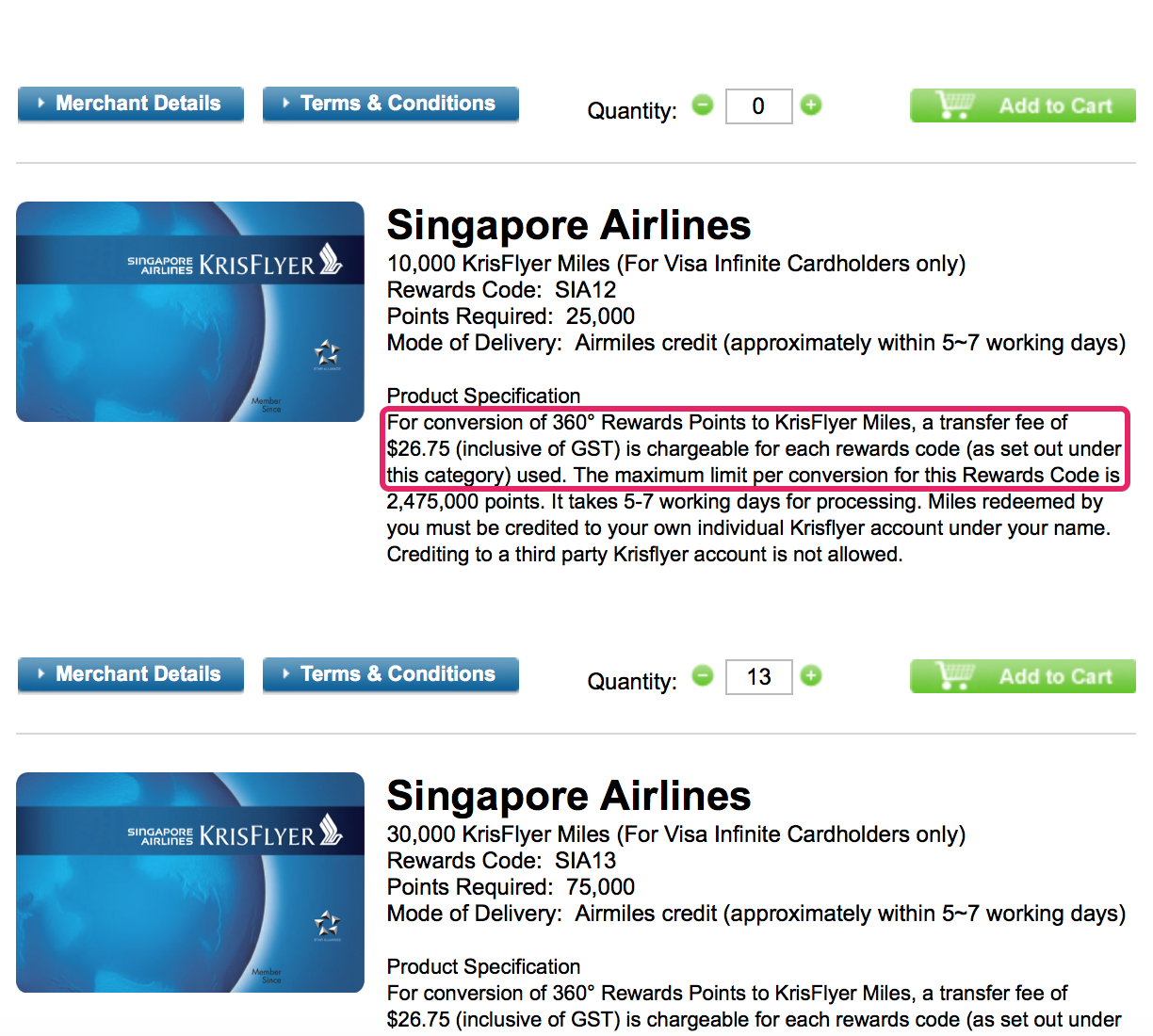

Reward points conversion

The minimum number of rewards points you can transfer into KrisFlyer is 2,500 (converting to 1,000 KrisFlyer miles). You can structure your points transfers in larger blocks instead, or add multiple smaller blocks but you should be aiming to accrue a decent rewards points balance before transferring as each rewards block code transferred attracts the $26.75 transfer fee.

Reward blocks available are:

- 2,500 points > 1,000 miles

- 25,000 points > 10,000 miles

- 75,000 points > 30,000 miles

- 125,000 points > 50,000 miles

- 250,000 points > 100,000 miles

You can add up to 99 of each ‘rewards block’ per transfer (e.g. 99 x 2,500 points blocks will give you 99,000 KrisFlyer miles).

Since you will attract the S$26.75 transfer fee charge for each of the blocks used, it’s better to add multiple numbers of the same block size. For example if you have accrued 325,000 points that should give you 130,000 miles.

Looking at the options you might think you’ll have to transfer 1 x 250,000 points block and 1 x 75,000 points block to do this, but that will result in you being charged the S$26.75 fee twice!

The better strategy in this example is to add 13 x 25,000 points blocks. This will mean only being charged the S$26.75 fee once, but you’ll still get 130,000 miles credited.

It’s a stupid system, but it’s just the way it works.

But hang on, how to convert the sign-up bonus?

There’s a bit of a conundrum if you want to exactly hit the required S$6k spend, let’s say in local currency, and then transfer your points to KrisFlyer miles. With 107,200 miles (268,000 rewards points), you’ll have to pay the fee twice to get them all.

- 1 x 250,000 points > 100,000 miles block (fee S$26.75)

- 7 x 2,500 points > 1,000 miles (fee S$26.75)

That’s because you’ve used two different transfer ‘blocks’ and you will now have to pay for each of them.

You can see where we’re going with this – you can only extract miles in 1,000-mile denominations if you have up to 99,000 miles (247,500 reward points) to transfer.

Once you have over 250,000 rewards points (100,000 miles) you are stuck with 10,000-mile transfer blocks for a single transfer fee, using the 25,000 points > 10,000 miles ‘blocks’.

You’ll therefore need 275,000 rewards points to make a 110,000-mile transfer (11 of the second-smallest transfer blocks) to only pay the transfer fee once. Confused yet?

If your objective is to spend the minimum possible on this card, take the miles then ditch it (which should be your objective), it’s actually better to channel some of the S$6k spend in foreign currency to make sure you reach a nice 10,000-mile transfer block at the end of the process.

S$2,500 local (at 1.2 mpd) and S$3,500 in foreign currency (at 2.0 mpd) should do it perfectly.

Edit: as ksp210 in the comments section mentioned, this may actually be sub-optimal depending on your alternative general spend card, since the foreign currency earn rate is quite poor and comes with a high FCY fee. Here’s the better method suggested:

“I like your optimal spend to minimize conversion fee analysis, but I disagree with your conclusion. What you’ve missed out is the opportunity cost of using the X-card over the BOC EM card, which as you correctly point out, is the best general earner in the market.

If you spend $2500 locally and $3500 abroad on the X-card instead of the BOC EM card, you’re missing out on [$2,500 x (1.5 – 1.2)] + [$3,500 x (3 – 2)] = 4,250 miles. In addition, SCB’s FCY conversion fee is 0.5 cents higher, so another $17.50 out of your pocket (or a whopping 65% of the $26.75 you’re trying to save).

My suggestion: spend $8,334 locally for the 10,000 miles, losing out on only 2,500 miles. No pressure to spend the additional $2,334 within the first 60 days, but do remember to do it before you’re charged the 2nd annual fee.“

How long do miles take to credit to KrisFlyer?

The official line from Standard Chartered is “5-7 working days”. The last three times I converted from my SCVI card, which uses the same process as this card, it took exactly a week the first two times, then about 3 working days the final time.

Not a great turnaround, there are faster cards out there when it comes to miles conversion and it won’t help you ‘jump’ on an available redemption, but it’s manageable if you’re organised.

Do your points expire?

No, as with the SCVI card your 360o Rewards Points never expire while your account remains in good standing, so you can keep your points at the Standard Chartered side as long as you need to before converting to KrisFlyer.

Once your miles are in KrisFlyer, they are valid for 3 years from the month of deposit.

Can you combine points with other Standard Chartered cards?

Unfortunately not, if you have a Standard Chartered Visa Infinite card for example and a good stash of rewards points in that account, it would be logical for any points accrued on this card to combine into a single 360o rewards account with that one.

That’s not what happens and each card account is treated separately, so you’ll be hit with the transfer fee twice if you transfer from SCVI to KrisFlyer and SCVIX to KrisFlyer, for example.

Edit: One of our readers pointed out that 360o rewards transfers to KrisFlyer from the Visa Infinite and Priority Visa Infinite card were able to be combined in a single online transaction, on a ‘pooled’ first-on-first-out basis, so that may also be the case with this card.

What can 100,000 KrisFlyer miles get you?

Singapore to New York in Business Class is the standout redemption, which comes in at 99,000 miles one-way per person, with Singapore to Los Angeles at 95,000 miles or to Europe at 92,000 miles other great options, also both in Business Class.

Here’s a more extensive list with some one-way options:

| Route | Pax | Class | Miles (one-way) |

| Singapore to New York | 1 | Business | 99,000 |

| Singapore to Cape Town | 2 | Business | 98,000 |

| Singapore to Bali | 5 | Business | 95,000 |

| Singapore to Los Angeles | 1 | Business | 95,000 |

| Singapore to Tokyo | 2 | Business | 94,000 |

| Singapore to Paris | 1 | Business | 92,000 |

| Tokyo to Los Angeles | 1 | Business | 92,000 |

| Singapore to Hong Kong | 3 | Business | 91,500 |

| Hong Kong to San Francisco | 1 | Business | 89,000 |

| Frankfurt to New York | 1 | Suites | 86,000 |

| Singapore to Bangkok | 4 | Business | 86,000 |

| Singapore to Auckland | 1 | First / Suites | 85,000 |

| Singapore to Sydney | 3 | Economy | 84,000 |

| Singapore to Hong Kong | 2 | First / Suites | 81,000 |

Some impressive example routings there on a one-way basis, but there are some round-trip redemptions you can also access for example a return Business Class from Singapore to Cape Town, Johannesburg or Dubai for 98,000 miles, impressive.

In Suites you can fly from Frankfurt to New York for 86,000 miles and still have 14,000 miles of your sign-up bonus left to spend.

How it compares

You probably don’t need us to tell you at this stage that there’s nothing else like this on the market currently in terms of a sign-up bonus.

We’ve updated our Top Credit Card Sign-up Bonuses page with the details anyway.

Priority Banking Sign-Up Promotion

If you’re a new to bank customer you may also be interested to earn up to 150,000 additional miles when you take out an X card and also place a minimum of S$200,000 fresh funds in a Priority Banking account, as follows:

- S$200,000 – S$299,999 – 30,000 miles

- S$300,000 – S$799,999 – 100,000 miles

- S$800,000+ – 150,000 miles

Full terms and conditions are available here.

Terms and conditions

Speaking of terms and conditions, the small print for the X card and the launch promotion itself is fairly lengthy, so in case we’ve missed anything here (a full review is coming soon to iron out the creases), please do read them carefully:

Can you just ‘ditch’ the card?

Absolutely, but only once you’ve successfully transferred the bonus miles to KrisFlyer (or another FFP). The terms and conditions permit the bank to recover the sign-up bonus if you cancel within 6 months of the sign-up promotion. But the sign-up bonus is not any number of KrisFlyer miles, it only relates to 360o Rewards Points.

Once you have transferred your rewards points to KrisFlyer and they are credited to your account there is nothing Standard Chartered can do about that (for one thing, they do not manage the KrisFlyer programme nor have access to it or authority over it, for another you might already have redeemed the miles and completed your travel).

The exact same term applies to the SCVI card 35,000 miles sign-up bonus, which is similarly unenforceable once the KrisFlyer transfer is completed.

This condition is a ploy to convince you to keep the card so eventually forget you had it, then get charged the year 2 annual fee. Don’t fall into the trap, once your miles are in KrisFlyer – cancel.

If you want to play it super-safe, diarise the 6 month period or at least cancel before the next annual fee is due.

Other perks

There almost no other perks with the Standard Chartered X Card, we’ll cover this in our detailed review in the coming days, but suffice to say there’s nothing too exciting here, with the main benefit being:

- 2 x Priority Pass visits per membership year (principal cardholders only)

That’s no better than the Citi PremierMiles card offers, and well short of the (cheaper!) Standard Chartered Visa Infinite (which gives you 6 free visits per year).

Other perks include:

- Exclusive Hotel & Resort Rewards at The St. Regis, Shangri-La Hotels & Resorts and Mandarin Oriental

- Golf Privileges in Asia Pacific

Visa Infinite benefits

The SCVI X Card is a Visa Infinite product. That means it automatically comes with a few additional perks including:

- Hertz Car Hire discounts

- 8% off Hotels.com bookings

- Hilton Honors Gold status with 2 stays or 4 nights (ends 31st July 2019, but may well be extended)

The full list of Visa Infinite benefits can be found here.

Summary

An amazing sign-up bonus, but otherwise a wholly disappointing credit card. That’s especially true for a Visa Infinite product with such a high annual fee – it’s just shockingly light on benefits and doesn’t have a competitive earn rate for a card in this category.

If this card is designed for ‘millennials’, then Standard Chartered obviously think we are:

- Easily hooked and will jump on a good deal (we are, and we will); and

- Stupid enough to then keep the card long-term (we aren’t, and we won’t).

Remember Joon, the Air France spinoff and the first airline to target ‘millennials’? Well it seems no one understood, and it was sent on it’s way in under 18 months. We see a lot of parallels with this card. It can’t survive long-term in its current form.

It’s like Standard Chartered has stripped out all the good things this card could have, just to provide a generous sign-up bonus.

We wouldn’t recommend for anyone to hold onto the X card once they’ve transferred their 100,000+ miles into KrisFlyer – it’s simply a poor general earner with little in the way of useful add-on perks. Aside from that, it’s not one you can exactly ‘sock drawer’ with a (presumably) non-negotiable S$700 annual fee!

No limo rides, no bonus spend categories, no club access, no free parking, no complimentary hotel stays, no bells, no whistles. Just two lousy Priority Pass visits a year. For S$700.

Be that as it may, sign-up offers as generous as this one don’t come around very often in Singapore and if you meet the S$80k income requirement it’s a deal to snap up without question, for a significantly large chunk of miles at a competitive rate.

You aren’t compelled to renew the card this time next year, and nor should you unless the terms have significantly changed or we’ve missed a fundamental perk.

You can fly Business Class from Singapore to New York with these bonus miles, or Business Class to Bali five times, and for S$695.50 neither of those examples are to be sniffed at.

After that for serious miles earners, it’s one to ditch sadly.

If you joined the waitlist you should be progressively invited to apply from today, but in any event you can already apply anyway via the product landing page.

We’ll update this article if required as more information comes to light, but look out for our full review of this card in the coming days, where we’ll break down some of the smaller details.

| Update 31st July 2019: The sign-up bonus has now been reduced to 60,000 miles for new applications between 1st August 2019 and 30th September 2019. See our article for details. |

(Cover Image: Singapore Airlines)

I’m not sure if it is specific to this X card but I was able to combine the redemption for both SCB Visa Infinite and SCB Priority Visa Infinite. The redemption was done based on the miles that earned first ie it deducted some from VI account and then the rest from PVI. So although different accounts redemption was effectively one account.

Thanks for the info that’s interesting. Did you have to call SC to do this?

Nope. In fact I called them to ask why it wasn’t deducting from the PVI account and they replied cos they deduct based on First In First Out basis. And yes my subsequent redemptions were that way

To clarify the account, I was redeeming from my PVI account but it was deducting from my VI account hence I called to ask why – that’s how I knew they said it is FIFO

Ok thanks I added a note and will clarify it later since I now have both SCVI and X cards in my account.

Great write up thanks!

Income requirement on SC site says 80k then 60k for foreigners (?) then when I hit apply and click requirements it says 30k/60k. Which is it?

We have no idea! When you further click ‘Key Product Features’ in the application requirements section before you apply it turns out to be a dead link. Another example – the ‘fees and charges’ link on the X Card landing page leads to a document which doesn’t include any details about the X Card.

Standard Chartered are all over the place with this launch.

Not to mention that the T&C document, whose title is ‘Corporate Letterhead’, quotes the annual fee incorrectly at term 41 as S$696.50!

$30,000 is for private priority banking customers

can anyone advise if purchasing NTUC vouchers count towards the 6k min spend?

In theory it’s not excluded but I’d use vouchers as a last resort. They may come back later and say ineligible.

But I was wondering too how they might be able to tell.. Does NTUC have multiple MCC Codes?

I don’t think they have any way to tell as they wouldn’t use a different MCC for voucher sales.

Just wanted to echo Andrew here. I called SC. They do not make a distinction as long as it falls in the right code

I like your optimal spend to minimize conversion fee analysis, but I disagree with your conclusion. What you’ve missed out is the opportunity cost of using the X-card over the BOC EM card, which as you correctly point out, is the best general earner in the market.

If you spend $2500 locally and $3500 abroad on the X-card instead of the BOC EM card, you’re missing out on [$2,500 x (1.5 – 1.2)] + [$3,500 x (3 – 2)] = 4,250 miles. In addition, SCB’s FCY conversion fee is 0.5 cents higher, so another $17.50 out of your pocket (or a whopping 65% of the $26.75 you’re trying to save).

My suggestion: spend $8,334 locally for the 10,000 miles, losing out on only 2,500 miles. No pressure to spend the additional $2,334 within the first 60 days, but do remember to do it before you’re charged the 2nd annual fee.

First world problems, I know…..

But it’s 100,000 miles, not 10,000

I was referring to Andrew’s observation midway in his writeup that due to SCB’s limitations, you can’t convert points to 107,000 miles (which is what you’d end up with if you spent $6,000 locally) without paying the conversion fees twice. Andrew suggests that we collect a little more points to convert to 110,000 miles, which can be done with just one conversion fee. To achieve this, i.e. to collect 10,000 additional miles instead of 7,000 additional miles, he suggests diverting $3,500 of the $6,000 to foreign currency spend.

My argument is that it is more cost efficient to spend $8,334 locally than to spend $2,500 locally and $3,500 abroad (as he suggests) to get the 10,000 miles. My argument assumes that the additional spend is diverted from the BOC EM card, as it is based on the opportunity cost of not spending the same amount on the BOC card.

I see what you mean now. Got it, my bad

Bravo, love your analysis and yes I absolutely hadn’t considered that fully. I was focussed on trying to get to the transfer ‘block’ within the minimum spend, which you have correctly identified would actually cost you more than simply ‘overspending’, provided you have a good alternative card like BOC.

Thanks and I’ll make an update to the article to reflect this (as not many people read the comments section).

so cardup ipaymy cannot earn points on x card

You will earn points as usual at 1.2 mpd rate with CardUp / ipaymy / RentHero transactions, they simply won’t be included in the 6k minimum spend to trigger the 70k mile bonus. Will clarify in article.

The income requirements are really typo and they have corrected in in their website.

Also, want to ask your advice is it ok if I just sign up for the 30K annual fee bonus without targettng the 6K spending? Is it worth it? As I just pay my annual fee (sorta like just buying the miles)

Thanks!

Thanks for that Ben, I’ve updated the income requirements in the article.

You can pay the annual fee and then just take the 30,000 miles if you wish, but that is costing you 2.32 cents per mile which is a bit steep, especially given how few other benefits this card has.

If you qualify for the SCVI card you can get 35,000 miles sign-up bonus with no minimum spend for a S$588.50 annual fee which is much better value at 1.68 cents per mile. The benefits are also better – 6 Priority Pass visits for one thing.

Mpd on the 100k miles is the wrong analysis. Mpd should only be used when there is no lost cost. In this case, you are paying a non recoverable fee of $695 so cpm is the more appropriate metric (the cpm excluding the miles regularly earned from spend ie the 1.2mpd earn).

Otherwise I can say that paying citi/dbs annual fee of $192.60, get 10k miles that is almost 52 mpd. Wowow

Any word on the transfer ratios to other currencys like UA LH? And assuming its the same 100,000 to any of them which is the one you’d go for?

We have a new article on this now with the answers, sadly it is not the same transfer ratio to all the programs and we would probably suggest sticking with KrisFlyer!

Can use to pay NUS/NTU school fees ? Is it eligible towards the $6,000 spend ?

Hi Andrew,

Ref “If you want to play it super-safe, diarise the 6 month period or at least cancel before the next annual fee is due.”

So it means we will pay the first year’s fees, then are free to cancel it anytime before year 2 fees are up right? In the worst case if one forgets to cancel, when year 2 fees, one can still ask to cancel the card and not pay the year 2 fees since such card annual fees are pay upfront and not for past year right? Thanks for advising.

Yes correct. In our experience with other cards when we have forgotten to cancel and been charged another annual fee for the next year, they have always refunded that fee and cancelled the card when we contacted them, so this one should be no different.

It’s best to cancel before the second fee is charged though.

Hi Andrew,

I don’t see KrisFlyer as a transfer partner in their FAQ, just all the other arlines and hotels you list above. Hope I’ve got this wrong!

Hi Min Yu, able to share where u find this info? Thanks.

https://www.sc.com/sg/credit-cards/x-card/

Scroll to FAQ at the bottom, then click on Read More, Who are the participating Partner Airlines and Hotels…

wont it be possible to call up and ask for 108 blocks of 2500 point to be converted to miles instead? that will only require one payment of 26.75.

We have tried that before with the SCVI and the answer was no.

Prepare to be stuck with 10k blocks above 100,000 miles!

Hi.. tks for the write up..

Got a quick qns when it say eligible retail transactions does it mean we need to physical use the card at the cashier in order to count into the 6000 spend?

Or we can use it online purchase like Amazon, lazada, shopee, qoo10, tao bao, aliexpress and etc.

How about supermarket like giant and cold storage?

TIA

Online spend is fine, provided it falls outside the exclusion categories.

When they say “retail transactions” what they sort of mean is “genuine shopping”. You don’t have to be physically present.

Very detailed and great write up. Especially liked the part on converting the points. As they say, the devil is always in the details! Thanks again!

Thanks!

sorry I’m confused.. why are you recommending spending $3500 in the form of foreign currency to avoid an additional $27 conversion fee?

Don’t you take a 3.5% foreign transaction fee hit? (= $122.5) seems counterproductive. LOL

Yes you’re right, it was a simplistic way to avoid a second transfer fee without considering the extra cost (you need to be at 10,000 mile blocks to KrisFlyer at >99k miles, or pay twice to keep 1k blocks).

Will update this today. See comments above about a better strategy by ‘overspending’ on local transactions.

Will payment to Private hospital qualify for the $6000 retail spending?