Updated: 16th September 2021

It’s that time of year again when the dreaded IRAS income tax Notice of Assessment lands on the doormat (or more likely these days by SMS or email inviting you to log on and download it). As with this time last year, we’ve started getting messages from readers asking what’s the best way to earn miles when paying the 2021 bill.

As always it boils down to analysing the methods to pay your income tax by credit card, though once again this is not a service offered directly by IRAS, even for a fee.

The transaction must usually be arranged through your credit card issuer or a third-party card payments provider, who in turn will charge you a fee for the service, which unfortunately means the miles you accrue are not going to be free.

As with 2020, however, there are a range of valuable options to turn one of the year’s single biggest expenses into thousands of miles at a reasonable cost.

Your options

The options for paying your income tax this year are almost the same as in 2020. You can do so with one of six bank-specific facilities, if you hold one of their eligible miles-earning credit cards, or through the two major card payment providers, CardUp and ipaymy.

| Provider | Fee |

| 2% | |

| 3% | |

| 0.5 – 1.5% | |

| 1.9% | |

| 1.6 – 1.9% | |

| 1.7 – 1.9% | |

| 1.7 – 2.4% | |

| 1.75% |

The options available to you depend on the credit card(s) you hold. Remember your income tax bill is typically payable within a month of your ‘Notice of Assessment’ (NOA) date, unless your NOA states otherwise, so there may still be time to apply for and receive a new credit card with a superior miles earning rate if you wish.

Note that BOC also allows income tax payment through some of its credit cards for a 1% fee, but does not award any points for the transaction, making it of little interest to our readers and not worth including in this article.

CardUp and ipaymy’s 2021 Income Tax offers

This year both CardUp and ipaymy have repeated their 2020 promotional income tax payment rate for those using a Singapore-issued Visa or Mastercard, at a competitive 1.75% fee.

| CUTAX2021 | 1.75% | |||

| One-time IRAS income tax payment or the first payment in a recurring series with a Singapore-issued Visa or Mastercard. | ||||

| TAX2021 | 1.75% | |||

| One-time IRAS income tax payment with a Singapore-issued Visa or Mastercard (can also be used as a one-off monthly GIRO settlement). | ||||

With the same fee for Visa and Mastercard holders, whether you use CardUp or ipaymy for an income tax payment probably depends on which one you have used previously, since you may not want to go to the hassle of opening a new account. We do not recommend one provider over the other, only the cheapest deal.

Additionally, CardUp also supports income tax payment using Singapore-issued American Express cards, with two discount codes available for new and existing customers paying by Amex at 2.2% or 2.4% fee, excluding the following cards (which retain the usual year-round 2.6% fee):

- Amex Corporate card

- Amex SIA Business credit card

- DBS Amex cards

- UOB Amex cards

| AMEXTAX | 2.4% | |||

| One-time IRAS income tax payment of S$1,000+ with selected Singapore-issued American Express cards (existing customers) | ||||

| AMEXNEWTAX | 2.2% | |||

| One-time IRAS income tax payment of S$1,000+ with selected Singapore-issued American Express cards (new customers) | ||||

ipaymy is not currently offering payment using American Express cards.

CardUp’s promotional rates are currently valid for income tax payments scheduled by 31st December 2021, for payment due dates between 1st May 2021 and 5th January 2022 inclusive.

ipaymy’s promotional rate is currently valid for a charge date on or before 31st December 2021.

Both CardUp and ipaymy will also offer concessionary rates for large income tax payments. Email each provider directly for more details if you have a significant tax bill this year:

Best deals for your 2021 income tax payment

Let’s take a look at the cost per mile table, which once again we’ve split into four this year following positive feedback, depending on how good a deal we think you’re getting.

The formula is simply the fee divided by the number of miles you will receive, to generate a cost per mile.

Bear in mind that for both CardUp and ipaymy you will also earn miles on the fee itself, which is accounted for in the calculation. That’s not the case when you use the bank-specific or Citi PayAll payment methods, where the fee element will not earn miles. For example:

Here’s our definitive list of your credit card income tax payment options for 2021. Simply start at the top (lowest cost per mile), and work your way down the table until you find a credit card you hold or wish to use.

Updated 16th September 2021

Excellent cost per mile

You can ‘buy’ miles paying your income tax by credit card from between 0.80 cents and 1.32 cents each this year, an excellent rate for most of us, using the following methods.

| Card | Method | Fee | Mpd | Cost per mile |

| 1.7% (promo) |

1.6 | 1.04¢ | ||

| 1.7% (promo) |

1.6 | 1.04¢ | ||

| 1.75% | 1.6 | 1.07¢ | ||

| 1.75% | 1.6 | 1.07¢ | ||

| 1.75% | 1.6 | 1.07¢ | ||

| 1.75% | 1.6 | 1.07¢ | ||

| 1.6% | 1.4* | 1.14¢* | ||

Step up |

1.5% | 1.25** | 1.20¢** | |

| 1.75% | 1.4 | 1.23¢ | ||

| 1.75% | 1.4 | 1.23¢ | ||

| 1.75% | 1.4 | 1.23¢ | ||

| 1.75% | 1.4* | 1.23¢* | ||

| 1.75% | 1.6 | 1.07¢ | ||

| 0.5% | 0.4 | 1.25¢ | ||

| 1.7% (promo) |

1.3 | 1.29¢ | ||

| 1.75% | 1.3 | 1.32¢ |

* 1.4 mpd earn rate for the SCVI card is subject to a minimum spend of S$2,000 in the same statement cycle as your income tax payment. The income tax payment does count towards the minimum.

** Step up earn rate for HSBC VI is only applicable from year two of card membership onwards, provided you spent at least S$50,000 in the previous year.

Still worth considering

As miles purchase rates fall into the 1.43 – 1.9 cents range (1.9 cents being our upper limit to buy), they may still be worth considering if you are comfortable with these levels and can’t take advantage of the options outlined above.

| Card | Method | Fee | Mpd | Cost per mile |

| 1.7% (promo) |

1.2 | 1.39¢ | ||

| 1.75% | 1.2 | 1.43¢ | ||

| 1.75% | 1.2 | 1.43¢ | ||

| 1.75% | 1.2 | 1.43¢ | ||

| 1.75% | 1.2 | 1.43¢ | ||

| 1.75% | 1.2 | 1.43¢ | ||

| 2% | 1.3 |

1.51¢ | ||

| 1.9% | 1.2 | 1.58¢ | ||

| 2% | 1.2 |

1.63¢ | ||

| 2% | 1.2 |

1.63¢ | ||

| 1.7% | 1.0 | 1.70¢ | ||

| 1.75% | 1.0 | 1.72¢ | ||

| 1.75% | 1.0 | 1.72¢ | ||

| 0.7% | 0.4 | 1.75¢ | ||

| 0.7% | 0.4 | 1.75¢ | ||

| 2.2% | 1.2 | 1.79¢ | ||

| 1.8% | 1.0 | 1.80¢ | ||

| 2.6% | 1.4 | 1.81¢ | ||

| 3% | 1.6 | 1.88¢ | ||

| 1.9% | 1.0 | 1.90¢ | ||

| 1.9% | 1.0 | 1.90¢ | ||

| 1.9% | 1.0 | 1.90¢ |

Probably of no interest

If you still don’t have a credit card payment option in the lists above to settle your income tax bill, it’s probably time to either get one, or call it quits.

The following options all come in above our personal limit to buy miles, and should only be considered if you are 100% comfortable doing so.

| Card | Method | Fee | Mpd | Cost per mile |

| 2.4% | 1.2 | 1.95¢ | ||

| 2.2% | 1.1 | 1.96¢ | ||

| 2.6% | 1.2 | 2.11¢ | ||

| 2.4% | 1.1 | 2.13¢ | ||

| 3% | 1.2 | 2.50¢ | ||

| 3% | 1.2 | 2.50¢ | ||

| 3% | 0.4 | 7.50¢ |

We only included the last card, the DBS WWMC, as an example of a clearly ridiculously expensive option. There are others in this category which we haven’t listed. It serves as a reminder that unfortunately no cards accrue their bonus 4 mpd rate for income tax payments through any means (that would be too easy!).

Two payment ‘methods’

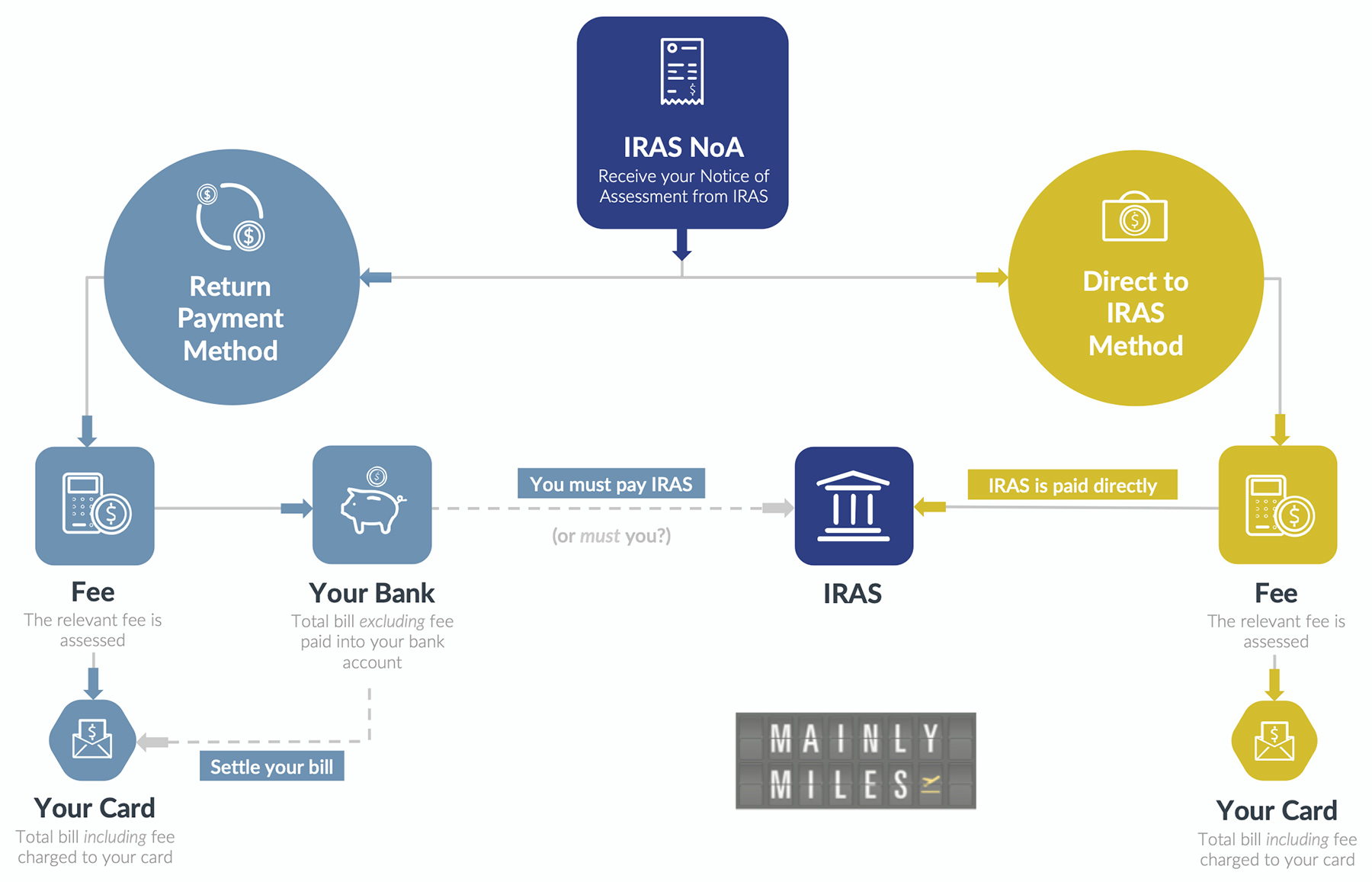

The various card payment providers may seem the same, but in fact there are two distinct ways in which they help you to settle your income tax bill.

First there is the ‘Return Payment Method’, where you produce your NoA to the supplier and they transfer the relevant amount to your bank account while charging your credit card for the same amount plus the processing fee.

Then there is the ‘Direct to IRAS Method’, where the supplier will still charge your card with your NoA balance plus the processing fee, but will settle your income tax account with IRAS directly.

Here’s a summary of which providers do what:

Return Payment Method

|

Direct to IRAS Method

|

* These methods are designed for any payment with any purpose and a copy of your NoA is not required.

What’s the difference, you might ask. The key difference between the ‘Return Payment Method’ and the ‘Direct to IRAS Method’ is:

- The ‘Return Payment Method’ can be completed as many times as you like (once per provider), and also gives you the freedom to pay your tax bill by monthly GIRO if that’s what you prefer. You are responsible for paying IRAS, the intermediary has no knowledge of this.

- The ‘Direct to IRAS Method’ is usually completed once, meaning you normally settle your full tax bill directly, however it can be used to replace your monthly GIRO if you set it up to make sufficient payment around a week before the pre-arranged GIRO debit date each month. The intermediary is responsible for paying IRAS on your behalf.

In other words you can repeat several different ‘Return Payment Methods’, but any option using the ‘Direct to IRAS Method’ is usually only used once via a lump sum payment, or can be used to ‘cancel out’ your monthly GIRO setup with IRAS.

You can ‘churn’ several tax payments

This gives you the opportunity to earn even more miles from your income tax statement by following the ‘Return Payment Methods’ as many times as you think you are getting good value for them.

For example, say I just received an S$11,200 income tax NoA from IRAS, but I hold the following four credit cards:

- HSBC Premier

- OCBC Voyage

- Standard Chartered Visa Infinite (SCVI)

- UOB PRVI Miles Visa

Entering our tables above at the top, I can immediately see I should use the SCVI card through the bank’s own tax payment programme (cost 1.14 cpm).

However if I want to ‘churn’ as many miles as possible, I can do the following (subject to a sufficient credit limit on each card):

- SCVI Income Tax payment through the bank

- HSBC Premier Income Tax payment through the bank

- OCBC Voyage Income Tax payment through the bank

Then finally actually settle my IRAS tax bill with:

- UOB PRVI Miles Visa through ipaymy/CardUp

Now instead of the 15,680 miles I would get from the SCVI bank payment facility (at a cost of 1.14 cpm), I will earn:

- 15,680 miles from SCVI (Fee S$179.20, 1.14 cpm)

- 4,480 miles from HSBC (Fee S$56.00, 1.25 cpm)

- 11,200 miles from OCBC Voyage (Fee S$212.80, 1.9 cpm)

- 15,954 miles from UOB PRVI Miles (Fee S$196.00, 1.23 cpm)

Total: 47,314 miles for a combined fee of S$644 = 1.36 cents per mile.

I’ve just earned enough miles for a Business Class saver award ticket on SIA from Singapore to Tokyo or Seoul for S$644.

Just to put your mind at ease, there is nothing in the terms and conditions for any of the ‘Return Payment Method’ providers that prevents you from doing this, just be careful to only use a ‘Direct to IRAS’ method once (unless using it to offset the monthly GIRO deduction).

Paying income tax by GIRO

As we mentioned above, if you wish to pay your income tax bill by monthly GIRO payment plan with IRAS but still earn miles on your annual bill, you’ll probably be using one of the ‘Return Payment Methods’:

- SCVI Income Tax Payment

- HSBC Tax Payment

- OCBC Income Tax Payment

- UOB PRVI Pay*

- UOB VI Payment Facility*

For example you can use the SCVI Income Tax Payment facility, use the money they give you to settle your credit card statement the following month, then continue with your IRAS GIRO payment plan throughout the year.

If you can take advantage of that option or a similar one, your tax payments will then be spread through the year as usual, but you’ll still have a chunk of miles from the original transaction.

This year both CardUp and ipaymy are also supporting tax payment by monthly GIRO, with their 1.75% promotional fee applicable to your first payment, then a 2.25% fee each month with CardUp or a 1.89% fee with ipaymy for subsequent months.

Check out our detailed article on how it works.

This year there’s a nifty way to use both providers to get the best deal, if you’re organised enough to keep on top of the payments.

It’s also possible to use Citi PayAll to settle your GIRO tax payments (again, be sure to arrange for each payment at least five working days in advance of your GIRO deduction date, then IRAS won’t take it from your bank account).

That means eligible cardholders can take advantage of the Citi 2.5 mpd offer even when paying by GIRO between now and the end of August 2021.

Don’t forget about points flexibility

As we say every year, remember that some cards allow you to earn points that can be converted into several different Frequent Flyer Programmes, other than the relatively generic Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles schemes.

You can see a full breakdown of who transfers where at our dedicated and continually updated page here.

A good example is Citi Miles or ThankYou points, which transfer to:

- SQ KrisFlyer

- CX Asia Miles

- Avios

- Turkish

- EVA Air

- Thai

- MH Enrich

- Qatar Privilige Club

- Qantas

- KLM / Air France

- Etihad

- IHG (Hotels)

That’s a lot of added flexibility.

COVID-19: In the current climate, the future value of your frequent flyer miles is of some concern. Having a wide range of FFPs to transfer your credit card points to in future is therefore potentially a bigger consideration than usual when making your income tax payment choice.Don’t forget about transfer blocks

If your best value income tax payment option is with a bank whose cards you don’t typically use year-round, you may find your accrued miles from an income tax payment aren’t very useful, because they fall short of one of the bank’s transfer ‘block’ sizes to airline miles.

That might then force you to use a card you wouldn’t normally use for additional spending in order to reach the next ‘block’ transfer threshold, so do make sure you’re accruing useful credit card points (and a useful amount) that transfers easily or ties in with your year-round spending anyway.

Summary

No one likes paying their annual income tax bill, but 2021 is proving to be another record-setting year for the widest and most competitive range of options for doing so using your credit card to earn miles in the process.

This year CardUp and ipaymy are back with their 1.75% fee option again, allowing you to buy miles from 1.07 cents each.

Even the relatively accessible UOB PRVI Miles card can be used from as little as 1.23 cents per mile – a fantastic rate when you look back to the offers on the table just a couple of years ago.

Your income tax payment can be one of the biggest single boosts to your miles balance each year, so do take the time to consider the options in our tables above carefully before committing to your payment method (though frankly if you have a participating Citi card, it’s a no-brainer this year!).

As always, the cost per mile (which we have calculated above for almost all cards across all methods) is key to deciding whether this is a good deal for you or not, though there are a few other considerations we’ve highlighted including what range of frequent flyer programmes you’ll be able to transfer into.

What’s your plan for earning miles from your income tax bill this year? Let us know in the comments section below.

(Cover Photo: Shutterstock)

Wow a side-by-side comparison of CardUp and ipaymy what a novelty for a Singapore blog! 🤣