(Updated June 2019)

Introduction

The value of a KrisFlyer mile differs from person to person because it is based on how you typically use them, and just as importantly – what your alternative would be if you couldn’t.

That makes any valuation quite subjective, but having one we can justify to our readers and are prepared to use ourselves, especially when discussing offers where you can take opportunities to ‘buy’ miles throughout the year, is essential.

The spoiler

This is a long article, so let’s cut to the chase for those who want a quick answer.

Value of a KrisFlyer mile

|

||

| Previously (2018) | Now (2019) | |

|

→ |

1.9¢ |

Firstly, don’t get all dismayed and rush to cash out all your miles and abandon the scheme just yet!

Think of this as our ‘upper limit to buy’

There is no ‘single’ valuation for a KrisFlyer mile. As always, and as we will show in this article, you can get much less value for your miles (even ‘negative value’, as we’ve often demonstrated), but used properly you can usually get much more value than 1.9 cents each from them.

- This remains the case.

- This remains our objective (and should be yours too).

We’ll say this again later on, but remember when you’re buying KrisFlyer miles, you’re exchanging something very fluid (cash) for something often very restrictive (saver award availability). It therefore makes little sense to buy miles at your average redemption rate.

Unless you’re making a small top up to achieve a specific redemption, you must build in a comfortable buffer between the cost of buying miles and the value you can achieve from them. That’s what we’re aiming to calculate in this article.

Our analysis

We’re going to repeat our 2017 analysis in this article using the latest KrisFlyer redemption rates, breaking it down under the following sections:

- Part 1: The bare minimum value Singapore Airlines will give you for each of your KrisFlyer miles, when used in the most flexible way – as a cash equivalent.

- Part 2: The theoretical value when redeeming flights on Singapore Airlines, based on your traveller profile and cabin class.

- Part 3: The value we have personally achieved in the last few years, if we assume current redemption rates for all those trips (nearly 1.7 million miles spent at today’s rates).

How much do Singapore Airlines think a KrisFlyer mile is worth?

Just 1 cent (or, more accurately, 1.02 cents). That’s because it’s what they’ll give you off any full fare ticket when you choose to part-pay with miles. While this offers great flexibility, since an award redemption does not have to be available, it doesn’t represent good value, and you should probably never do it.

Take the example of a Singapore to Dubai flight in Business Class.

If you want to offset the cash cost of this flight using some of your KrisFlyer miles, it’s possible as shown.

To cut the price of a one-way business class ticket from Singapore to Dubai by $515.95, for example, would cost you 50,568 KrisFlyer miles. You would still have over $2,500 left to pay. Since a one-way ‘Saver’ redemption in business from Singapore to Dubai is 49,000 miles + S$51.70 in taxes, this is nonsensical.

Of course, you would only go down the part-pay with miles route if a redemption was not available, and you needed to travel. However, Emirates is offering a non-stop business class flight on their A380 on the same route and the same day for S$2,450, less than you’d be paying to fly on Singapore Airlines having already forked out over 50,000 miles for the ‘discount’.

Assuming the Singapore Airlines redemption was not available, and you would be happy with the Emirates option, use of part-pay with miles in this case actually gives them a negative value.

Is it ever useful?

Granted, we picked an obvious ‘waste of miles’ example there. If you have miles expiring which you cannot use as there are no redemptions available, having considered a number of other options we outline here including extending your miles for 6 months, this is a possible way to get at least some value from them.

It is a slightly better rate than you will achieve using your miles on Scoot, for example.

Also, while derisory in value, the discount for part payment with KrisFlyer miles is helpful in one sense. It means if you can ‘buy’ KF miles for less than 1.02 cents each (call it 1 cent or less), you basically cannot lose out (provided you would book and fly with Singapore Airlines in any class, which most of our readers would).

Whether you should part with more than 1 cent per mile when ‘buying’ depends on how you use them, i.e. your own personal valuation. More on that later.

Non-flight redemptions

If you want an even poorer rate for your miles, just head to the KrisShop, where you can buy a wide range of price-inflated items and instead of using cash, redeem your KrisFlyer miles for 0.8 cents each. There’s almost no excuse for this, please never do it.

In the above example KrisShop are selling a MacBook Pro, delivered to your door, but they are giving you just 0.8 cents per mile versus the retail price of the device (S$2,045).

For the same number of miles you could redeem a return suites redemption from Singapore to London, or fly return business class to Sydney twice (and still have miles left over).

Just when we thought it couldn’t get any worse, in July 2018 Singapore Airlines brought us KrisPay. It’s a one-way ticket to using up your KrisFlyer miles as cash at a pathetic 0.67 cents value each at a very limited range of merchants in Singapore, including ‘car beautification’ (that’s a thing?), spas and strip wax joints.

On the plus side, earning through KrisPay came about in March this year, and that is a useful way of topping up your miles at a limited merchant list.

Bottom line here is that whenever you convert your KrisFlyer miles to any form of cash (or pseudo cash) it’s almost always at a terrible rate.

If you think these options might be useful for any expiring KrisFlyer miles, think again. Depending on your geographical location and circumstances, and of course how many of your miles are about to disappear, we came up with up to 12 methods to get something rather than nothing out of them, and at least 9 of them were superior to these two options!

If you’re in this situation do check out the methods that might work for you, before resigning yourself to something like KrisPay.

Part 1

What value we think you can actually achieve

We examined four short to medium-haul trips (Bali, Hong Kong, Da Nang and Beijing) and also four of long-haul trips (Auckland, Zurich, New York and Paris) all originating in Singapore and booked as round-trip saver awards.

We assessed the value of each one on the basis of four different preference / travel behaviour assumptions to determine the cents per mile valuation of the redemption.

- Type A – You would only be willing travel on Singapore Airlines, and would buy a full fare ticket on the same route with SIA, if the redemption was not available.

- Type B – You would only be willing to travel on an alternative cheaper (non-SIA) flight if it was still non-stop, and operated by a full service carrier.

- Type C – You would be willing to travel on an alternative cheaper (non-SIA) flight, with one stop, operated by a full service carrier (for long-haul, the Business Class product would have to be of a similar service standard and seat layout to Singapore Airlines).

- Type D – You would be willing to travel on an alternative cheaper (non-SIA) flight if it was still non-stop, but operated by a low-cost carrier (applicable for short to medium-haul economy class only, including pre-payment for 1 checked bag, a drink and a meal, for fair comparison).

You generally book each short to medium-haul flight 3 months in advance, and the long-haul flights 6 months in advance. You are only willing to book a ‘Saver’ category redemption, otherwise you pay full fare.

Full fare tickets are also assessed outside any holiday periods. If you can redeem during peak periods (when fares are higher, but redemptions will also be harder to come by) you will achieve a higher value than shown because the alternative cash fares will be higher.

If you tend to book one-way redemptions, you will also achieve a higher value than shown because one-way tickets, especially with full-service airlines, tend to cost much more than 50% of a round-trip ticket cost, while the KrisFlyer miles needed are exactly half.

Economy Class

| Bali return (SIN-DPS-SIN) | |||

| Saver Redemption: 15,000 miles + $71.40 | |||

| Type | Cost | Value per mile | Method |

| A | S$376.40 | 2.03¢ | SQ nonstop |

| B | S$302.40 | 1.54¢ | KL nonstop |

| C | S$260.00 | 1.26¢ | MH via KUL |

| D | S$259.00 | 1.25¢ | TR nonstop |

| Hong Kong return (SIN-HKG-SIN) | |||

| Saver Redemption: 30,000 miles + $95.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$535.10 | 1.47¢ | SQ nonstop |

| B | S$355.90 | 0.87¢ | CX nonstop |

| C | S$337.50 | 0.81¢ | MH via KUL |

| D | S$373.10 | 0.93¢ | 3K nonstop |

| Da Nang return (SIN-DAD-SIN) | |||

| Saver Redemption: 25,000 miles + $79.90 | |||

| Type | Cost | Value per mile | Method |

| A | S$427.90 | 1.39¢ | MI nonstop |

| B | n/a | n/a | n/a |

| C | S$316.00 | 0.94¢ | VN via SGN |

| D | S$380.00 | 1.20¢ | 3K nonstop |

| Beijing return (SIN-PEK-SIN) | |||

| Saver Redemption: 40,000 miles + $68.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$593.10 | 1.31¢ | SQ nonstop |

| B | S$523.10 | 1.14¢ | CA nonstop |

| C | S$487.00 | 1.05¢ | MH via KUL |

| D | n/a | n/a | n/a |

| Auckland return (SIN-AKL-SIN) | |||

| Saver Redemption: 56,000 miles + $113.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$1,115.10 | 1.79¢ | SQ nonstop |

| B | S$1,115.10 | 1.79¢ | NZ nonstop |

| C | S$891.10 | 1.39¢ | MH via KUL |

| D | n/a | n/a | n/a |

| Zurich return (SIN-ZRH-SIN) | |||

| Saver Redemption: 76,000 miles + $96.60 | |||

| Type | Cost | Value per mile | Method |

| A | S$1,156.60 | 1.39¢ | SQ nonstop |

| B | S$1,156.60 | 1.39¢ | SQ nonstop* |

| C | S$979.00 | 1.16¢ | CA via PEK |

| D | n/a | n/a | n/a |

* Note: SIA is already the cheapest full fare carrier on this route in Economy Class

| New York return (SIN-NYC-SIN) | |||

| Saver Redemption: 80,000 miles + $145.60 (JFK via FRA) | |||

| Type | Cost | Value per mile | Method |

| A | S$1,497.60 | 1.69¢ | SQ direct |

| B | n/a | n/a | n/a |

| C | S$1,066.60 | 1.15¢ | CI via TPE |

| D | n/a | n/a | n/a |

| Paris return (SIN-CDG-SIN) | |||

| Saver Redemption: 76,000 miles + $131.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$1,226.10 | 1.44¢ | SQ nonstop |

| B | S$1,226.10 | 1.44¢ | SQ nonstop* |

| C | S$876.60 | 0.98¢ | VN via SGN |

| D | n/a | n/a | n/a |

* Note: SIA is already the cheapest full fare carrier on this route in Economy Class

Premium Economy Class

Firstly, a note about Premium Economy redemptionsPremium economy redemptions are not a good way of using KrisFlyer miles, and that’s not just because we don’t like the product (we don’t, by the way), it’s because in miles terms it’s simply too expensive. Singapore Airlines price their Premium Economy redemptions just below Business Class, which is a farce, not only when you look at the difference in product and service, but also when you see the difference in price. Take a flight from Singapore to Paris for example. A round-trip ticket on Singapore Airlines booked six months from now in Premium Economy would set you back S$2,437.40. Business would be $5,942.40, a massive jump in cost of 144% (more than double). However, if you want to book a round-trip saver redemption using KrisFlyer miles for your flight it’s going to set you back 129,000 miles in Premium Economy, and 184,000 miles in Business Class, only a 43% increase. It doesn’t take a rocket scientist to work out that you’re getting a much better deal redeeming in Business than in Premium Economy on this route. The same goes for just about any Singapore Airlines route. |

Bali return (SIN-DPS-SIN)

Cabin not operated on this route

| Hong Kong return (SIN-HKG-SIN) | |||

| Saver Redemption: 49,000 miles + $95.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$1,119.10 | 2.09¢ | SQ nonstop |

| B | S$940.90 | 1.73¢ | CX nonstop |

| C | n/a | n/a | n/a |

| D | n/a | n/a | n/a |

Da Nang return (SIN-DAD-SIN)

Cabin not operated on this route

| Beijing return (SIN-PEK-SIN) | |||

| Saver Redemption: 64,000 miles + $68.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$1,478.60 | 2.20¢ | SQ nonstop |

| B | S$969.60 | 1.41¢ | CA nonstop |

| C | n/a | n/a | n/a |

| D | n/a | n/a | n/a |

| Auckland return (SIN-AKL-SIN) | |||

| Saver Redemption: 94,000 miles + $113.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$2,714.10 | 2.77¢ | SQ nonstop |

| B | S$2,404.10 | 2.44¢ | NZ nonstop |

| C | n/a | n/a | n/a |

| D | n/a | n/a | n/a |

| Zurich return (SIN-ZRH-SIN) | |||

| Saver Redemption: 129,000 miles + $96.60 | |||

| Type | Cost | Value per mile | Method |

| A | S$2,686.60 | 2.01¢ | SQ nonstop |

| B | S$969.60 | 2.01¢ | SQ nonstop* |

| C | n/a | n/a | n/a |

| D | n/a | n/a | n/a |

* Note: SIA is already the cheapest full fare carrier on this route in Premium Economy Class

| New York return (SIN-NYC-SIN) | |||

| Saver Redemption: 146,000 miles + $80.40 | |||

| Type | Cost | Value per mile | Method |

| A | S$1,932.40 | 1.27¢ | SQ nonstop |

| B | n/a | n/a | n/a |

| C | S$1,747.40 | 1.14¢ | BR via TPE |

| D | n/a | n/a | n/a |

| Paris return (SIN-CDG-SIN) | |||

| Saver Redemption: 129,000 miles + $131.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$2,438.00 | 1.79¢ | SQ nonstop |

| B | S$2,189.10 | 1.60¢ | AF nonstop |

| C | S$2,081.10 | 1.51¢ | EY via AUH |

| D | n/a | n/a | n/a |

Business Class

| Bali return (SIN-DPS-SIN) | |||

| Saver Redemption: 38,000 miles + $71.40 | |||

| Type | Cost | Value per mile | Method |

| A | S$1,136.50 | 2.80¢ | SQ nonstop |

| B | S$620.50 | 1.45¢ | KL nonstop |

| C | S$601.00 | 1.39¢ | MH via KUL |

| D | n/a | n/a | n/a |

| Hong Kong return (SIN-HKG-SIN) | |||

| Saver Redemption: 61,000 miles + $107.30 | |||

| Type | Cost | Value per mile | Method |

| A | S$1,887.30 | 2.92¢ | SQ nonstop |

| B | S$1,753.10 | 2.70¢ | CX nonstop |

| C | S$1,054.00 | 1.55¢ | MH via KUL |

| D | n/a | n/a | n/a |

| Da Nang return (SIN-DAD-SIN) | |||

| Saver Redemption: 43,000 miles + $79.90 | |||

| Type | Cost | Value per mile | Method |

| A | S$1,177.90 | 2.55¢ | MI nonstop |

| B | n/a | n/a | n/a |

| C | S$1,098.00 | 2.37¢ | VN via SGN |

| D | n/a | n/a | n/a |

| Beijing return (SIN-PEK-SIN) | |||

| Saver Redemption: 78,000 miles + $68.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$2,735.60 | 3.42¢ | SQ nonstop |

| B | S$2,333.00 | 2.90¢ | CA nonstop |

| C | S$1,444.00 | 1.76¢ | MH via KUL |

| D | n/a | n/a | n/a |

| Auckland return (SIN-AKL-SIN) | |||

| Saver Redemption: 124,000 miles + $113.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$4,802.10 | 3.78¢ | SQ nonstop |

| B | S$4,687.10 | 3.69¢ | NZ nonstop |

| C | S$3,150.00 | 2.45¢ | MH via KUL |

| D | n/a | n/a | n/a |

| Zurich return (SIN-ZRH-SIN) | |||

| Saver Redemption: 184,000 miles + $96.60 | |||

| Type | Cost | Value per mile | Method |

| A | S$5,946.60 | 3.18¢ | SQ nonstop |

| B | S$5,946.60 | 3.18¢ | SQ nonstop* |

| C | S$3,738.00 | 1.98¢ | AY via HEL |

| D | n/a | n/a | n/a |

* Note: SIA is already the cheapest full fare carrier on this route in Business Class

| New York return (SIN-NYC-SIN) | |||

| Saver Redemption: 198,000 miles + $80.40 (EWR nonstop) | |||

| Type | Cost | Value per mile | Method |

| A | S$6,987.40 | 3.49¢ | SQ nonstop |

| B | n/a | n/a | n/a |

| C | S$4,072.30 | 2.02¢ | MU via PVG |

| D | n/a | n/a | n/a |

| Paris return (SIN-CDG-SIN) | |||

| Saver Redemption: 184,000 miles + $193.00 | |||

| Type | Cost | Value per mile | Method |

| A | S$5,943.00 | 3.13¢ | SQ nonstop |

| B | S$5,649.00 | 2.97¢ | AF nonstop |

| C | S$3,848.80 | 1.99¢ | EY via AUH |

| D | n/a | n/a | n/a |

First / Suites Class

|

A note about First / Suites redemptions One of the easiest ways to generate a very high assumed ‘value’ for a KrisFlyer mile, is a redemption into First / Suites. That’s not only because the cost of the ticket is very high, but also that there are very few cheap First Class alternatives with other carriers on most routes. If you manage to secure a return First / Suites saver redemption from Singapore to London two months from now for example, it’s arguably worth S$14,200, as that’s what the ticket would cost. The cheapest alternative on the route, Qantas, is still expensive at S$12,200. The best indirect option is with Etihad at S$11,400. None of these are cheap. The redemption cost with Singapore Airlines is 250,000 miles + S$428.70. It generates a theoretical miles value of 5.51 cents per mile versus the Singapore Airlines fare, 4.71 cents per mile against the Qantas fare, and 4.39 cents per mile against the Etihad fare. All pretty impressive returns. The problem is, the tickets are only worth that if you would be prepared to pay your own cash for them, and the vast majority of people simply would not. The redemption doesn’t therefore translate to a ‘true’ cash saving, as you wouldn’t have been prepared to part with that amount of money for the ticket, had the redemption not been available. First / Suites is therefore more of an ‘experience’ for 99% of people, and will have a different value to each person because their alternative travel plans would all differ in cost. We’ve presented the assumed value here anyway, but take it with a pinch of salt. |

Bali return (SIN-DPS-SIN)

Cabin not operated on this route

Da Nang return (SIN-DAD-SIN)

Cabin not operated on this route

| Hong Kong return (SIN-HKG-SIN) | |||

| Saver Redemption: 81,000 miles + $107.20 | |||

| Type | Cost | Value per mile | Method |

| A | S$4,702.20 | 5.67¢ | SQ nonstop |

| B | S$4,702.20 | 5.67¢ | SQ nonstop* |

| C | n/a | n/a | n/a |

| D | n/a | n/a | n/a |

* Note: SIA is already only carrier operating First Class on this route

| Beijing return (SIN-PEK-SIN) | |||

| Saver Redemption: 106,000 miles + $67.60 | |||

| Type | Cost | Value per mile | Method |

| A | S$6,567.60 | 6.13¢ | SQ nonstop |

| B | n/a | n/a | n/a |

| C | S$5,192.60 | 4.83¢ | KA via ICN* |

| D | n/a | n/a | n/a |

* Note: KA fare is in First Class SIN-ICN but Business Class ICN-PEK, which is a slightly unfair comparison, however since Cathay Pacific stopped offering First Class from Singapore there would be no other way to compare.

| Auckland return (SIN-AKL-SIN) | |||

| Saver Redemption: 170,000 miles + $113.10 | |||

| Type | Cost | Value per mile | Method |

| A | S$10,613.10 | 6.18¢ | SQ nonstop |

| B | n/a | n/a | n/a |

| C | n/a | n/a | n/a |

| D | n/a | n/a | n/a |

| Zurich return (SIN-ZRH-SIN) | |||

| Saver Redemption: 250,000 miles + $96.60 | |||

| Type | Cost | Value per mile | Method |

| A | S$13,746.60 | 5.46¢ | SQ nonstop |

| B | S$11,431.00 | 4.53¢ | LX nonstop |

| C | S$10,074.40 | 3.99¢ | EY via AUH |

| D | n/a | n/a | n/a |

| New York return (SIN-NYC-SIN) | |||

| Saver Redemption: 264,000 miles + $145.60 (JFK via FRA) | |||

| Type | Cost | Value per mile | Method |

| A | S$17,502.60 | 6.57¢ | SQ direct |

| B | n/a | n/a | n/a |

| C | S$12,952.00 | 4.85¢ | BA via LHR |

| D | n/a | n/a | n/a |

| Paris return (SIN-CDG-SIN) | |||

| Saver Redemption: 250,000 miles + $193.00 | |||

| Type | Cost | Value per mile | Method |

| A | S$14,098.00 | 5.56¢ | SQ nonstop |

| B | S$9,611.00 | 3.77¢ | AF nonstop |

| C | S$10.070.80 | 3.95¢ | EY via AUH |

| D | n/a | n/a | n/a |

Summary

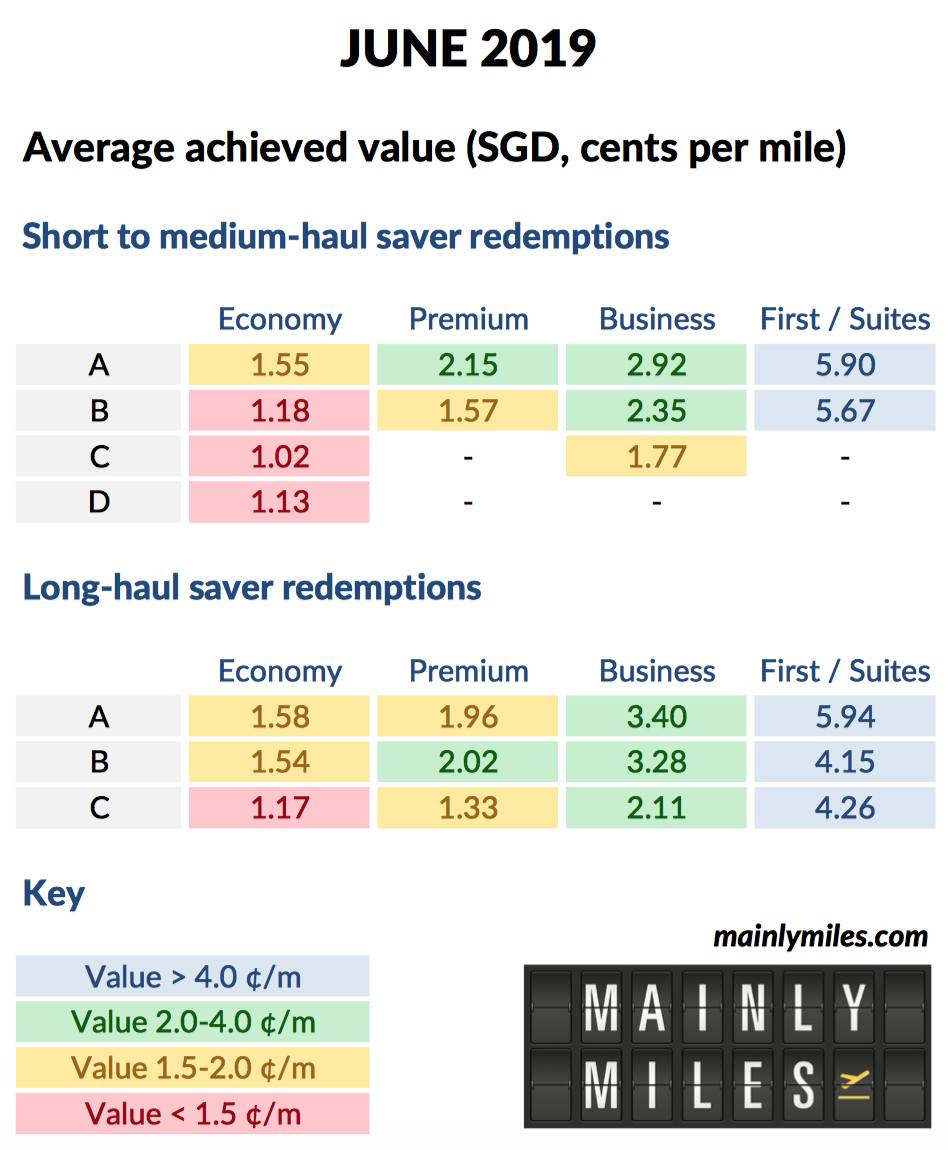

Crunching the numbers, the following table shows the average value per mile, by travel habit assumption. Just to recap on the A-D travel assumption meanings:

- Type A – You would only be willing travel on Singapore Airlines, and would buy a full fare ticket on the same route with SIA, if the redemption was not available.

- Type B – You would only be willing to travel on an alternative cheaper (non-SIA) flight if it was still non-stop, and operated by a full service carrier.

- Type C – You would be willing to travel on an alternative cheaper (non-SIA) flight, with one stop, operated by a full service carrier (for long-haul, the Business Class product would have to be of a similar service standard and seat layout to Singapore Airlines).

- Type D – You would be willing to travel on an alternative cheaper (non-SIA) flight if it was still non-stop, but operated by a low-cost carrier (applicable for short to medium-haul economy class only, including pre-payment for 1 checked bag, a drink and a meal, for fair comparison).

The table speaks for itself – for A and B type travellers, if you stick to premium cabins for your short and medium-haul redemptions, but split your redemptions equally between Economy Class and say Business Class for long-haul trips throughout the year, you will achieve an average of over 2.4 cents per mile. This is particularly true for long-haul travel in the Business Class cabin alone, where closer to 3.3 cents per mile will be the norm.

For C type travellers, who are less fussy about their routing and the particular airline when a redemption isn’t available, you really need to be redeeming in Business Class or First Class to achieve good value from your miles.

Let’s also compare to the same analysis we did in November 2017. Bear in mind though this was using two fewer routes, with cash prices searched at a completely different time of year, so direct comparison is not totally valid.

As you can see things were much better in 2017, though as mentioned it’s not a like-for-like comparison due to the routes analysed and the time of year (we were looking at short and medium-haul prices in February and long-haul prices in May last time round, this time it’s September and December respectively).

What it does show though is that options are getting much tighter if you want to achieve 2 cents per mile for your redemptions.

The Economy Class exceptions

We always talk about not redeeming your KrisFlyer miles for travel in Economy Class, unless you’re happy to get lousy value from them.

There is at least one exception out there on the network though, brought about by an ‘artificial’ lack of competition (a sort of ‘legal cartel’).

Generally a round-trip Economy flight from Singapore to Koh Samui will cost you at least S$480 (with Bangkok Airways, leader of the ‘cartel’ and owner of Koh Samui Airport), and around S$490 with SilkAir (notice the price similarity, ‘choice’ is an illusion here as the two are in joint venture on the route – so it’s a monopoly).

Bangkok Airways artificially imposes a restriction on the size of aircraft allowed to fly scheduled services in and out of Koh Samui Airport to no larger than an A319 (the runway comfortably accommodates A321s), and does not permit low-cost carriers to operate.

These are very high fares for Economy Class, and they can rise even more steeply if you’re looking to make last-minute plans or fly over a weekend (S$855 this weekend with SilkAir), or of course during any Singapore school holiday period!

Economy Class redemptions on SilkAir are 25,000 KrisFlyer miles + S$85 for a return trip.

Even on the cheapest days that’s giving you a value of 1.62 cents per mile, on more expensive dates it’s more like 3.08 cents per mile.

Definitely one worth looking at as an Economy Class redemption, due to the complete lack of non-stop alternatives on the route.

Koh Samui is not the only example, fares to and from Da Nang and Siem Reap can also be expensive on SilkAir, especially for weekend trips. While there are low-cost options on these routes (Jetstar), they too know they can charge high fares during these periods. We have redeemed KrisFlyer miles on SilkAir REP-SIN before for this reason.

Offsetting the earning rate

Full fare (cash) tickets on Singapore Airlines also earn KrisFlyer miles, but award redemptions do not (with the exception of upgrades using miles, but that’s a whole different topic).

It’s something to take into account when assessing the value of a mile, but only when your alternative to redeeming on SIA would be to actually pay for a full fare ticket with SIA. If your alternative cash ticket is with Qatar or Finnair for example, there will be no KrisFlyer miles earned back from these bookings.

Granted you could earn miles in an alternative oneworld or SkyTeam program, but that’s only much use if you can accrue enough over a year or two to effectively use them.

If you booked a cheaper full fare ticket with another Star Alliance airline, you could be earning some KrisFlyer miles for the trip, but that’s getting a bit complicated!

So for example, you want to take a Business Class return trip from Singapore to Frankfurt using your miles. If the award had not been available, and your true alternative would have been to pay a cash fare in Business Class on the same Singapore Airlines flights, then one has to also account for the miles you would earn from booking the full fare cash ticket, when calculating the value of the miles on this trip.

If the Saver award is available both ways, your 184,000 miles are saving you S$6,000 on the usual cash fare, 3.26 cents per mile, which sounds pretty good. But hang on, if you booked the cash fare you would also earn 15,968 miles, so it’s really costing you 199,968 miles to book the redemption. That dilutes the earning rate a little, to 3.00 cents per mile. Still good of course, but not as good.

If you hold KrisFlyer Elite or PPS Club status, the redemption gets a bit worse as you are forfeiting even more miles – you would earn 19,960 miles for the same cash ticket because of your 25% status bonus, so it’s really costing you 203,960 miles to book the redemption, a value of 2.94 cents per mile.

All of this still sounds good, after all approximately 3 cents+ per mile is normally far above what you obtained them for. But what if a ‘Saver’ redemption is not available in either direction, just an ‘Advantage’ redemption? As you’ll now have to fork out 240,000 miles for the trip, the value per mile becomes 2.34 cents for regular KF members, and 2.31 cents for KF Elite Silver and above status members.

Again remember that this all assumes Singapore Airlines is your only airline choice, and you will fly with them regardless, which makes you a very fussy customer – most people will seek a cheaper fare with another airline if they cannot redeem with SIA, and this reduces the ‘value’ of the miles.

Note that in Part 1 of this article, where we looked at the value of miles you can expect to achieve, no allowance has been made to factor in the value of the miles you would earn where the valuation was based a Singapore Airlines full fare ticket as the alternative.

Another consideration: Flexibility

Award tickets on Singapore Airlines are extremely flexible, unlike most cheap Economy Class fares and even some cheaper Business Class tickets, which can still carry costly amendment or cancellation penalties.

Fees for changes to award bookings have increased since we last wrote about the value of a mile, but remain competitive against those charged by other airlines.

For example, on an award booking:

- If you need to change the date of your flight, assuming there are still award seats available on the date you want to change to, that’s US$20 (free for an Advantage redemption, but you don’t want one of those).

- If you need to change the route, cabin class or award type, that’s US$25.

- If you need to refund the ticket completely, and have the miles re-deposited into your account, that’s US$75.

It is not easy to find a cheap revenue ticket with this level of flexibility. It means that, provided you have enough miles, you can lock in redemption tickets as an ‘insurance policy’ for a probable trip as soon as they become available, knowing it is relatively inexpensive to cancel even the day before travel if you’ve changed your plans, find an alternative, or just can’t go.

We do this regularly, taking advantage of the typically good availability just under a year in advance to lock in a business or suites redemption. Usually for us it’s a gamble because we haven’t secured the annual leave for that period yet, but it’s only a US$75 gamble. Granted it does mean doing some advance planning, and it requires a healthy miles balance.

How it could work for you

Let’s say you planned to be in Melbourne for an event 11 months from now, but it was only 50% certain that the event would go ahead, or perhaps that you would be able to secure the annual leave.

In this case you would be mad to part with the S$736.70 it would cost for the cheapest non-refundable, non-changeable return ‘Economy Lite’ fare, as there’s a good chance you’ll never use it and would simply lose the money.

You would have to book an ‘Economy Flexi’ ticket, at S$1,636.70, which allows for cancellation before the first flight departs for a fee of US$100 (about S$136). Notice you’ll still take quite a hit if this doesn’t work out!

The alternative of course, assuming it’s available, is a saver award redemption, which comes with even better flexibility ‘built in’. The cost is 56,000 miles + S$154.20.

As you then sit on your award flight to Melbourne 11 months later, assuming the trip goes ahead, you can’t honestly say the miles you used were only worth 1.04 cents each, against the cheapest economy return fare, because you wouldn’t have been able to book that ticket 11 months ago, since for this trip you needed the flexibility, and couldn’t risk losing $740.

Realistically, you must compare the miles used against the Flexi fare when assessing the value, meaning that your miles in this case achieved 2.65 cents each.

Note that in Part 1 of this article, where we looked at the value of miles you can expect to achieve, comparison for Economy Class fares was all based on the cheapest non-refundable tickets. Generally you will get nothing back if you cancel these, or your plans change, unlike the award redemption, which is flexible.

Part 3

The value we have personally achieved

Between us, we’ve redeemed almost 1.7 million KrisFlyer miles in the last three years or so. It’s a decent sample and we have a spread sheet containing all our awards, with a very fair and conservative methodology to assess the true value of each flight we took.

The result was, we achieved an average value of 3.18 cents per mile.

That’s actually slightly higher than we quoted in November 2017, but has been skewed by the unusually high number of First / Suites Class redemptions we have made since then. The ‘value’ of those is slightly false as we already mentioned earlier in Part 2.

The methodology

This is the really boring but quite important bit. In order to fairly assess the value of our redemptions, we had to honestly look at what our alternative would have been had those redemptions not been available. That means assessing them against the best value, but still realistic full fare cash booking.

We assumed things like:

- We would take a full-service carrier with a similar product on an indirect routing if a KrisFlyer Business Saver redemption on Singapore Airlines was not available. (We actually wouldn’t always be prepared to do this)

- Most people travel on a round-trip itinerary, so the ‘value’ of a one-way trip is judged against half the cost of a return fare, which is almost always less than a one-way fare. (We have only made one return award trip in 3 years using miles, to Cape Town. Otherwise, we like to travel around.)

- Some of the redemptions we have done lately were at the ‘Spontaneous Escapes’ rate (including Bangkok to Singapore in the 2018 RJ seat for part two of our review, costing us just 14,000 KrisFlyer miles each). Despite this we have assessed that we would have taken the flight anyway at the current full rate (21,500 miles).

The summary of the methodology, and the individual award value calculations, are shown in the following PDF document:

![]() Achieved Miles Value Table – June 2019 (PDF, 211KB)

Achieved Miles Value Table – June 2019 (PDF, 211KB)

Summary

We usually redeem in Business Class (22 out of the 32 trips), occasionally in First / Suites (7 trips, though many of those are taken or booked recently) and rarely in Economy Class (3 trips).

When we look at all 32 Singapore Airlines KrisFlyer redemptions against the best available alternative fare and then assume we took all of them at pre-March 2017 redemption rates, March 2017 to January 2019 redemption rates and current redemption rates, including applicable taxes in those respective periods, it shows the following:

Overall we are looking at an 8-9% loss in value if we made all 32 redemptions at today’s rates compared to making all 32 at last year’s rates.

Notice how the (small number of) Economy Class redemptions we took were best value under the previous award chart. That’s because fuel surcharges were eliminated from award tickets in March 2017, and for many cheaper Economy fares that outweighed the increased miles cost.

The Economy Value has dropped in the latest round not because of an increased miles cost (there wasn’t one), but because taxes on those routes have in fact increased. For example it used to be S$34 on top of your miles for an award redemption from Singapore to Bali, now it’s S$50.

Reaching a valuation

We’ve said from the outset that the value of a mile is personal, based on how you use the KrisFlyer program.

On that basis our valuation of a mile is also very personal, largely based on the ways we use KrisFlyer miles as you’ve seen from the previous section.

As we’ve shown in Part 2, very few Economy Class itineraries now provide good value when using your KrisFlyer miles. That’s down to cheap full fare alternatives on most routes, since the miles needed to redeem in Economy Class weren’t changed this year.

We have done a lot of redemptions lately in First Class and Suites on Singapore Airlines, but as we’ve mentioned the valuation here isn’t ‘real’, because like most of our readers we’d hardly ever part with the cash fares charged for this cabin class if a redemption weren’t available. The value in First Class is in the experience, rather than the cost saving.

We’ve therefore focused on our predominant use of the KrisFlyer scheme, saver Business Class redemptions both short and long, to more accurately assess the value we achieve.

Examining our Business Class redemptions in isolation, it looks like this:

- Pre March 2017: 2.84 cents per mile

- Mar 2017 – Jan 2019: 2.63 cents per mile

- Jan 2019 onwards: 2.42 cents per mile

So the value of a mile to us, assuming we made all these redemptions at current rates, is 2.42 cents right? Well yes, but what we’re looking for here as we said before is more of an upper limit to buy.

Remember when you’re buying KrisFlyer miles, you’re exchanging something very fluid (cash) for something often very restrictive (saver award availability). It therefore makes little sense to buy miles at your average redemption rate.

At what rate should you ‘buy’ KrisFlyer miles?

What rate you should set as your ceiling when ‘buying’ KrisFlyer miles depends on how you use them, i.e. your own personal valuation. As we alluded to earlier, buying at anything less than 1 cent per mile is a no-brainer – you basically can’t lose out.

If you use your miles only to redeem into Economy Class, be careful buying at anything over 1.4 cents per mile, as you may not realise a good return when it comes to redemption. Even then, you’ll still have to be careful to check for each trip when it’s better to pay cash rather than miles. Economy redemptions just don’t add up a lot of the time.

If you generally use your miles to redeem into Business Class, you should not lose out buying at 2 cents per mile or less.

Our personal ceiling for ‘buying’ KrisFlyer miles is now 1.9 cents per mile, because we know we can achieve a higher return than that, above 2.4 cents on average. The reason we would not ‘buy’ at a higher rate is that KrisFlyer miles simply do not have the flexibility of cash, and Singapore Airlines can change the workings of the scheme anytime they want.

We can usually secure the redemptions we need, as we either book a long way in advance or travel during off-peak periods, but like anyone we cannot guarantee a redemption will be available, and sometimes we have to fall back on a cash ticket. In this case cash is more useful, and the miles we would have used are simply ‘parked’ for a future trip.

Buying at a ‘known discount’ on their value (again based on our personal valuation, yours will depend how you use them) also protects against a future devaluation of the scheme.

Singapore Airlines has been chipping away at the value of KrisFlyer miles for Business Class awards approximately every 18 months lately, at around the 10% mark each time.

Let’s say they got a bit greedy though and doubled that next time round – a 20% devaluation. Would we still be getting value from our miles, assuming we had bought them all at 2 cents each?

2.42 x 0.8 = 1.936

No is the answer, on that assumption we’d be making a loss.

How do others value KrisFlyer miles?

We’ve seen valuations of a KrisFlyer mile from 0.7 cents to 7.0 cents each (seriously). While it sounds a wild range, in some sense each can be defended (well 7.0 is looking a bit rich now to be honest, but you know what we mean).

In fact very few people seriously attempt to value a KrisFlyer mile, and kudos to them for doing so. As you can see from this article it’s by no means a simple (or even possible) task, and there are a range of approaches you can take.

In the US, One Mile at a Time values KrisFlyer miles at 1.4 US cents each (1.91 Singapore cents at current exchange rates). Of course that nicely matches what we’re now quoting, but bear in mind Ben’s valuation is more suited to US-based travellers using the KrisFlyer program, rather than Singapore-based members.

The Points Guy is a little more pessimistic, attaching a 1.3 US cent valuation on KrisFlyer miles (1.77 Singapore cents). Again it’s for a US audience, and in this case we think that’s on the conservative side if you’re locally based and using miles sensibly (feel free to use it though!).

In Australia Point Hacks goes with a maximum earn threshold (an upper limit to buy) of 1.7 Australian cents for KrisFlyer miles (1.6 Singapore cents), with a target redemption rate of 1.9 Australian cents (1.8 Singapore cents). That’s very conservative in our view, but again it’s targeted at an Australian audience not a Singapore-based member.

Here in Singapore MileLion is quoting 1.7 cents per mile as a KrisFlyer valuation. That’s nice and safe in our book; personally we’d still buy miles slightly above that if we needed them. If a higher proportion of your redemptions are in Economy Class than ours, by all means it’s a safe benchmark.

Conclusion

2 cents was always a ‘nice’ valuation for a KrisFlyer mile. For one thing it made the maths easy! It was probably never exactly right, as we’ve said there’s no ‘correct’ valuation – you can achieve much worse and much better than almost any sensibly quoted figure.

If you still want to use 2cpm – that’s fine. For a ballpark calculation it isn’t far wrong.

We just can’t hold our hand on our heart and say it’s fully defensible anymore, especially if you’re buying miles as many of our readers are, whether that be through credit card sign-up bonuses, conversion of points from the likes of Chope and Grab Rewards, or paying a credit card fee to make an overseas transaction or pay a local bill purely to earn miles in the process.

Of course your own limit for buying miles may never have been 2 cents each (we always shied away from paying that ‘upper limit’ unless we had a compelling reason).

If you always used 1cpm and still want to – that’s fine. Of course there will be very few opportunities for you to buy miles through the year at or below your threshold level in that case, but at least you’ll be comfortable whenever you do.

We’re hanging our hat on 1.9 cents per mile as the highest rate you should be buying at in 2019 because we’re personally comfortable with it, and we believe it to be defensible.

Hopefully this article goes some way to helping you determine what your own personal valuation and cut-off point for ‘buying’ KrisFlyer miles should be.

If you’re just getting started in this game and your objective is the same as ours (amazing First and Business Class redemptions with one of the world’s finest airlines) then we’re happy recommending 1.9 cents as a starting point, until you ‘fine tune’ your valuation.

In summary:

- The value of a KrisFlyer mile is personal. It depends how you usually use them, and what you would do instead if you couldn’t.

- Our analysis is based on ‘Saver’ awards with Singapore Airlines and SilkAir. If you redeem ‘Advantage’ awards, expect to practically halve the value of your miles.

- If you redeem only in Economy Class, you’ll probably achieve 1.2 to 2 cents per mile, but it can be more (in peak periods, but when redemptions are still available), and it can be less (during sales, or when used on routes with inexpensive cash fares).

- If you mix your redemptions between Economy and Business Class, you should achieve at least 1.9 cents per mile on average, especially for long-haul trips.

- If you redeem almost exclusively in Business or First Class, especially on long-haul flights, you should achieve about 2.6 cents per mile, potentially more on some routes.

- If you use your miles for non-flight redemptions, you will achieve pitiful rates at or below 1 cent per mile. Avoid this method at all costs. Even if you have miles expiring, explore the alternatives before settling for some of these poor value options.

- We personally value KrisFlyer miles, conservatively, at 1.9 cents per mile, as we would not ‘buy’ miles above this cost.

- We actually achieve about 2.4 cents per mile when we use them to fly Business Class, based on analysis of over 1 million miles redeemed in that cabin on Singapore Airlines over the last three years (assuming current rates), against some pretty strict valuation criteria.

(Updated June 2019)

Just saw your article. What about upgrading with miles (eg buying a PE and upgrade to Business) instead of getting a full Business redemption ticket as upgrade can be gotten easily on the spot while buying a full redemption ticket has to be waitlisted most of the time. Upgrade will have miles awarded whereas a full redemption ticket has no miles awarded.

Hey Andrew

So how does one accumulate so many KF miles to pay for flights? Unless one has a substantial spending put away on a credit card that earns the points that are converted to miles, which for some will take ages to accumulate. Any tip or tricks will be appreciated.

Sorry but I still cant get my head around when to use points or when to buy ticket . I can buy a ticket for $517 or I can use 20,000 Kris Flyer points and pay $94 which is the best deal ?

Of course using the miles and just pay $94 is the better deal. If you don’t use your miles they are just points, if you don’t spend your monies, they are just papers.

Request for an update to the article to have a sensing of the current value of the miles. Thanks!