Most Mainly Miles readers are already CardUp customers, having signed up for and used the payments platform to settle a range of bills like rental payments, education fees, insurance premiums and general invoices with a credit card to earn miles and points, where this otherwise wouldn’t normally be possible.

However, if you haven’t signed up to CardUp, or you have an account but have yet to make a payment, there are a couple of interesting offers now running that might be enough to pique your interest.

One of these is a 1.3% fee for your first payment of up to S$2,000, which is the equivalent of buying miles at 0.8 cents each with some credit cards, an excellent rate to accrue miles for future flight redemptions.

1.3% fee for new users (Visa)

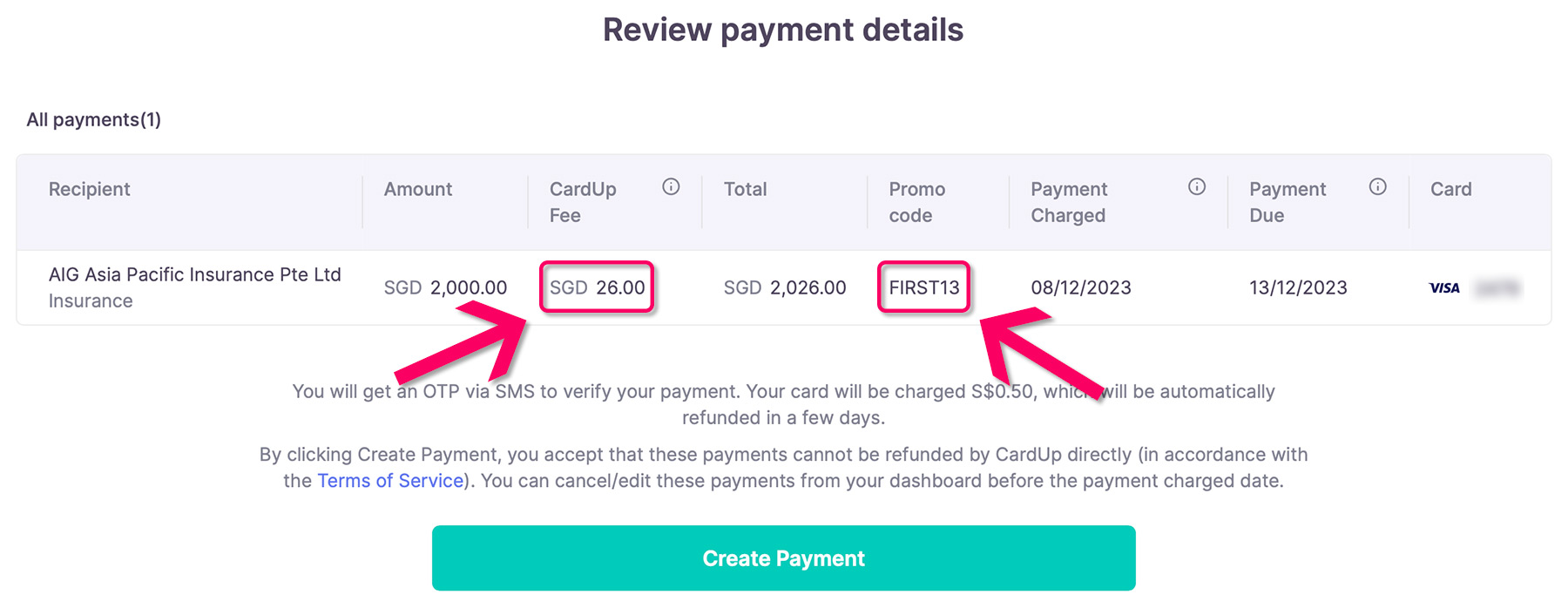

If you schedule a domestic or international CardUp payment using a locally-issued Visa card on or before 26th December 2023, you’ll be entitled to a discounted 1.3% processing fee using promo code FIRST13

You’ll have to schedule the payment at least 3 business days in advance of the payment due date, to allow for processing time.

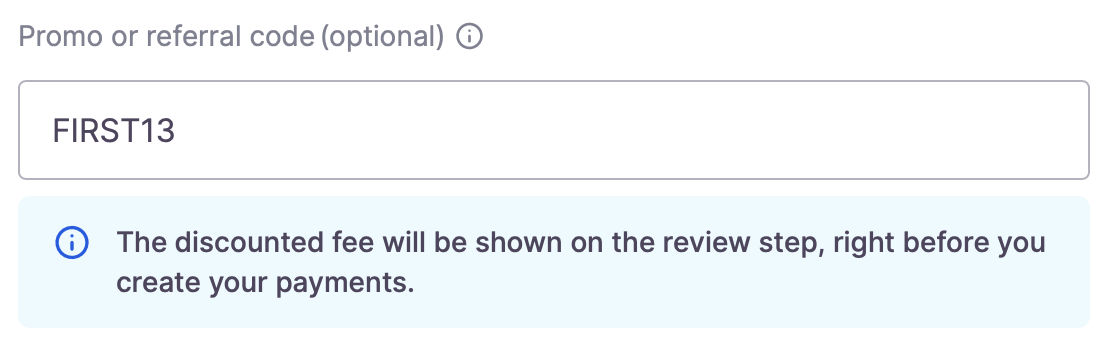

Simply enter the code when setting up your payment in the ‘PROMO CODE’ field:

The reduced fee will then be reflected on the next page, where you review your payment:

This promo code can be applied to a one-time transaction, or can apply to the first payment in a weekly or monthly recurring payment series.

The code is subject to a maximum payment amount of S$2,000, after which CardUp’s regular 2.6% fee applies, so it’s best to keep this one to S$2k payments or below, or at least only exceed that level by a small amount if you can.

However, even for a payment of say S$2,500, 1.3% for the first S$2,000 and 2.6% for the next S$500 is still the equivalent of an overall fee of 1.56%. That would mean buying miles for 0.96 cents each with a 1.6 mpd credit card, definitely worth considering.

The promo code may be redeemed once per user and does not apply:

- with non-Visa credit cards (e.g. Mastercard, UnionPay, American Express) and all credit cards issued outside of Singapore;

- on any additional fees incurred for ‘Next Day’ payments;

- in conjunction with any other promotions, offers or discounts.

Full terms and conditions are available here.

Cost per mile

Here are some cost per mile examples for Singapore-issued credit cards under this promotional deal at the 1.3% rate (first S$2,000):

| Card | Mpd | New User Cost per mile (1.3% fee) |

UOB Reserve UOB Reserve |

1.6 | 0.80¢ |

Citi ULTIMA Citi ULTIMA |

1.6 | 0.80¢ |

DBS Vantage DBS Vantage |

1.5 | 0.86¢ |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 0.92¢ |

Standard Chartered Visa Infinite Standard Chartered Visa Infinite |

1.4* | 0.92¢* |

OCBC Voyage Visa OCBC Voyage Visa |

1.3 | 0.99¢ |

OCBC 90ºN Visa OCBC 90ºN Visa |

1.3 | 0.99¢ |

DBS Altitude Visa DBS Altitude Visa |

1.3 | 0.99¢ |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2 | 1.07¢ |

* 1.4 mpd subject to a minimum spend of S$2,000 in the same statement cycle, otherwise 1 mpd. CardUp payments do count towards the minimum.

Needless to say, all of these are very competitive rates to buy miles.

Summary

CardUp is offering a competitive 1.3% fee on a first payment of up to S$2,000 when using a Visa card as a new user, with this FIRST13 promo code, allowing you to generate miles from as little as 0.8 cents.

You can exceed S$2,000 on your first payment with this code, but ideally do so by as little as possible, since the fee for any amount over this level then doubles to 2.6%.

(Cover Photo: CardUp)