After many months of devaluations, tighter spend category restrictions and bonus earn rate cap cuts across several miles-earning credit cards in Singapore, there’s some rare good news for those holding the Citi PremierMiles card, with a welcome improvement in store from mid-September.

That’s because the bank has announced that the card’s earn rate for overseas retail purchases, including online spend made in foreign currency, will be getting a 10% boost.

This improvement elevates the card’s benefits among its peers for this spend category, and surprisingly makes it an even better option than the supposedly-superior Citi Prestige Card, even for those holding over 10 years tenure with the bank.

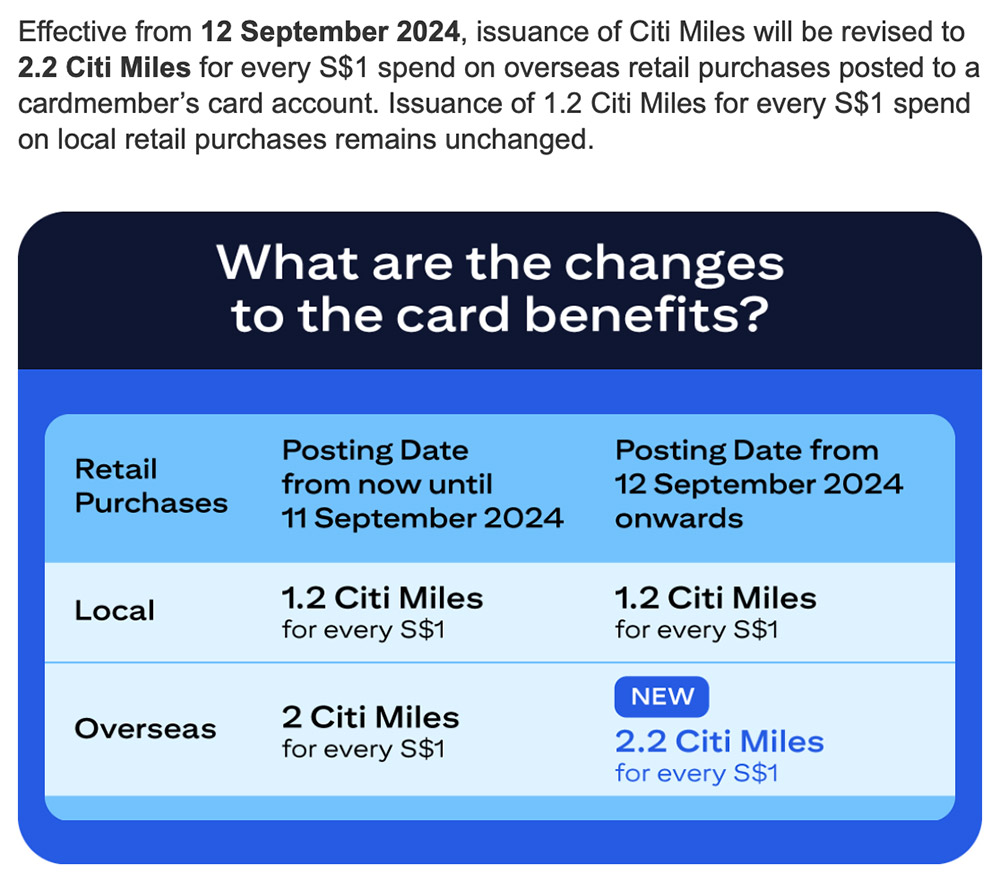

Citi PremierMiles boosting FCY earn rate

Citi has now announced that for retail FCY transactions posted to your card account from 12th September 2024 onwards, a revised earn rate of 2.2 mpd will be effective, instead of the current 2 mpd.

The changes mean that from 12th September the Citi PremierMiles card earns:

- 1.2 mpd for local spend (i.e. transacted in SGD)

2 mpd2.2 mpd for overseas spend (i.e. transacted in FCY)

Citi Miles never expire as long as your card account remains active.

Here’s how the FCY earn rate compares to some other general spend cards with similar income requirements on the market in Singapore.

FCY Earn rates

(general spend cards)

Best to worst

| Card | FCY Spend |

| 2.8 mpd^ | |

| 2.4 mpd | |

| 2.4 mpd | |

(from 12 Sep) |

2.2 mpd |

| 2.2 mpd | |

| 2.1 mpd | |

| 2 mpd | |

(till 11 Sep) |

2 mpd |

| 2 mpd | |

| 2 mpd* | |

| 2 mpd* | |

| 1.2 mpd |

^ Maybank HVS 2.8 mpd earn rate is subject to $800 minimum spend in the same calendar month

* During June and December only, otherwise the local spend rate applies

Unfortunately the card’s local earn rate is not being adjusted, which leaves it lagging somewhat in the SGD general spend stakes against others on the market.

Local Earn rates

(general spend cards)

Best to worst

| Card | Local Spend |

| 1.4 mpd | |

| 1.3 mpd | |

| 1.3 mpd | |

| 1.2 mpd | |

| 1.2 mpd | |

| 1.2 mpd | |

| 1.2 mpd | |

| 1.2 mpd | |

| 1.2 mpd | |

| 1.1 mpd | |

| 1 mpd |

Nonetheless the Citi PremierMiles card can still be a good option especially for smaller transactions, due to its generous rounding policy.

Every eligible transaction you make using the Citi PremierMiles card is rounded down to the nearest Singapore dollar (after conversion from foreign currency, if applicable), before Citi Miles are then assessed, unlike some other cards that use S$5 earn blocks.

Cost per mile reduces

Citi charges a 3.25% FCY fee for transactions made in foreign currency on its credit cards, and thankfully that’s not changing from 12th September 2024.

That will reduce the cost per mile for FCY spend from 1.71 cents currently (at 2 mpd) to 1.56 cents, including a 0.3% ‘spread’ over money changer currency rates, though this doesn’t apply to all banks and all foreign currencies, so is a worst-case scenario.

Cost per mile on FCY transactions

(various general spend cards)

Best to worst

| Card | Fee | Miles per $ |

Cost per mile |

| 2.75% | 2.8^ | 1.22¢^ | |

| 3.5% | 3.0* | 1.22¢* | |

| 3.25% | 2.4 | 1.43¢ | |

| 3.25% | 2.4 | 1.43¢ | |

| 3.0% | 2.2 | 1.45¢ | |

| 2.8% | 2.0 | 1.50¢ | |

(from 12 Sep) |

3.25% | 2.0 | 1.56¢ |

| 3.25% | 2.2 | 1.56¢ | |

| 3.25% | 2.2 | 1.56¢ | |

(Jun & Dec) |

2.95% | 2.0 | 1.57¢ |

| 3.25% | 2.1 | 1.63¢ | |

(till 11 Sep) |

3.25% | 2.0 | 1.71¢ |

| 3.5% | 2.0 | 1.83¢ | |

| 3.25% | 1.2 | 2.86¢ |

* 3 mpd earn rate for the SCVI card is subject to a minimum spend of $2,000 (any currency) in the same statement cycle

^ Maybank HVS 2.8 mpd earn rate is subject to $800 minimum spend in the same calendar month

Despite the improvement, there are still better cards than the Citi PremierMiles for overseas spend, and you should probably be looking at the Maybank Visa Infinite or UOB PRVI Miles for much better rates, not just in cost per mile terms but miles per dollar too.

Citi Prestige cardholders miss out

Interestingly Citi does not appear to be changing the earn rate for its higher-end S$120,000 per year income requirement Prestige Card at the same time as this boost for PremierMiles customers kicks in.

The Citi Prestige card continues to earn:

- 1.3 mpd for local spend (i.e. transacted in SGD)

- 2 mpd for overseas spend (i.e. transacted in FCY)

With the Citi Prestige card, there is also a Relationship Bonus applied to the regular earn rates for longstanding Citi customers, with the following effective earn rates.

| Citi Prestige Relationship Bonus Actual miles earn rates (mpd) |

|||

| 0 – 5 years | 6 – 10 years | > 10 years | |

| Local Spend Citigold / Private Client |

1.36 | 1.38 | 1.42 |

| Overseas Spend Citigold / Private Client |

2.06 | 2.08 | 2.12 |

| Local Spend Regular |

1.32 | 1.34 | 1.36 |

| Overseas Spend Regular |

2.02 | 2.04 | 2.06 |

The strange thing is that even as a Citigold customer holding over 10 years tenure with the bank, your 2.12 mpd overseas earn rate with the Citi Prestige card will still be less than you’ll get using the Citi PremierMiles card from 12th September 2024.

It will be interesting to see whether Citi will retain this strange disparity between these two cards going forward.

Citi Miles are very flexible

One of the best things about Citi Miles (and Citi ThankYou points) in Singapore is the wide range of transfer partners compared with other bank loyalty points.

You can transfer your miles into 10 different frequent flyer programmes and into IHG points.

Here’s the latest list of loyalty programmes you can transfer your Singapore credit card points into, as of 11th August 2024.

Singapore credit card transfer list

to FFP and hotel partners

As you can see from the table above, Citi gives you a wide range of flight redemption options including Oneworld and SkyTeam carriers.

While other banks offer a wide range of partners, those like HSBC and OCBC apply lousy transfer ratios to many of them, compared to a transfer to KrisFlyer. Citi, on the other hand, converts to all FFPs at the same ratio.

For a full list of which credit card loyalty points balances transfer into which frequent flyer programmes or hotel loyalty schemes in Singapore, check out our comprehensive guide here. It also gives examples of some of the alliance and partner airline redemptions you can achieve that you might not have considered before.

30,000 miles sign-up bonus

Citi is currently offering a 30,000 miles sign-up bonus for new-to-bank customers successfully applying for its PremierMiles card between now and the end of October 2024, for making only S$800 spend in the first two months.

This excellent deal is equivalent to buying miles for only 0.65 cents each, based on payment payment of the S$196.20 annual fee. See our article below for full details.

You can also read our recent review of the Citi PremierMiles card, based on its current benefits.

| Citi PremierMiles Card | |||

|

1.2 mpd local |

2.2 mpd FCY |

11 transfer partners |

| READ OUR REVIEW | |||

| Citi PremierMiles Card | ||

|

||

|

1.2 mpd local |

2.2 mpd FCY |

11 transfer partners |

| READ OUR REVIEW | ||

Revised terms and conditions

The revised Citi PremierMiles Cardmember’s Agreement including the latest 2.2 mpd earn rate for FCY transactions is available below:

Citi PM Revised TnCs (fm 12 Sep 2024)

For reference, the current agreement is available here.

Summary

The popular Citi PremierMiles card in Singapore is hiking its FCY earn rate to 2.2 mpd from 12th September 2024, a 10% increase compared to the current 2 mpd.

While the local earn rate of 1.2 mpd is not changing, this elevates the card above competitors like the OCBC 90oN and the Standard Chartered Journey card for overseas spend, to the same level offered by the DBS Altitude cards.

Strangely the Citi Prestige card is getting no rate hike, which will even put those cardholders who are also Citigold customers with over 10 years tenure with the bank at a disadvantage, compared to PremierMiles customers.

(Cover Photo: Shutterstock)