It’s well-known among our readers that the UK imposes some of the highest aviation taxes globally. The Air Passenger Duty (APD) significantly increases the cost of both revenue and award tickets, coming in addition to mandatory airport fees and any applicable carrier surcharges.

This tax already means, for instance, that those redeeming KrisFlyer miles for an SIA flight from London Heathrow to Singapore incur a total cash outlay of GBP 141 (~S$240) in Economy Class, or GBP 251 (~S$428) in Premium Economy, Business Class, First Class, or Suites, on top of their miles outlay, up to 80% of which is APD.

APD is increasing again

When APD was first introduced by the UK Government in 1994, it was set at GBP 5 for European flights and GBP 10 for long-haul flights, the latter being around GBP 25 (S$48) in today’s money.

It’s unlikely many people would be complaining about a tax of that magnitude these days, however APD has substantially increased over the years, and now works on a distance-based banding, with higher rates payable for those travelling in any cabin other than basic Economy Class.

In the last five years alone, APD for long-haul flights in a premium cabin has increased by 17%, but there’s a far quicker and even steeper rise in store, following the UK Government’s latest budget.

APD is set to rise again, with an increase of over 25% for premium cabin travel between now and April 2026. This will drive the cash component of a KrisFlyer redemption on SIA for a premium cabin trip from Heathrow to Singapore to a staggering GBP 305, around S$520, 83% of which will be APD.

While the full schedule of APD rates is rather complex, here’s what it means for those redeeming award flights on Singapore Airlines from the UK to Singapore or to Houston.

| UK Air Passenger Duty Singapore Airlines Routes |

||||

| Period | UK Singapore |

UK Houston |

||

| Y | PY J F |

Y | PY J F |

|

| Now March 2025 |

GBP 92 | GBP 202 | GBP 88 | GBP 194 |

| April 2025 March 2026 |

GBP 94 | GBP 224 | GBP 90 | GBP 216 |

| April 2026 |

GBP 106 | GBP 253 | GBP 102 | GBP 244 |

Y – Economy Class

PY – Premium Economy Class

J – Business Class

F – First Class / Suites

Singapore Airlines is ending its Manchester – Houston service from April 2025, but it already looks as though there’s potential for a new “fifth freedom” route from the UK’s third largest city to be joining the roster.

The UK PSC is in addition

While APD makes up the lion’s share of the taxes payable on an award ticket departing from the UK, it’s not the only fee levied.

Singapore Airlines also adds the UK Passenger Service Charge (PSC) – imposed to cover costs paid to the airport operator for use of the facilities, like terminals, runways, baggage systems and security.

The PSC differs airport-by-airport. As we’ve highlighted previously, it’s highest at London Heathrow, but significantly less at SIA’s other UK ports – London Gatwick and Manchester.

Here’s how total redemption costs will look with APD and PSC included for those redeeming an SIA flight from the UK to Singapore in Premium Economy, Business or First, once the highest rate of APD kicks in for departures from 1st April 2026 onwards.

SIA KrisFlyer Award Taxes & Fees

Premium cabins, ex-UK

April 2026 onwards

| Airport | APD | PSC* | Total |

| London Heathrow | GBP 253 | GBP 51.72 | GBP 304.72 (~S$519) |

| Manchester | GBP 253 | GBP 23.03 | GBP 276.03 (~S$470) |

| London Gatwick |

GBP 253 | GBP 19.77 | GBP 272.77 (~S$465) |

* Assumes current PSC levels are maintained, these can vary each year

As you can see the lowest cash outlay on top of your miles is from London Gatwick, closely followed by Manchester, with London Heathrow the most expensive.

(Photo: MainlyMiles)

A family of four redeeming in Premium Economy Class from London to Singapore will save around S$216 flying from Gatwick instead of Heathrow – worth remembering since the SIA website requires a separate award space search to display Gatwick results.

Who pays APD?

APD applies to all passengers departing from the UK on a ticket that originates in the UK, including the return portion of a round-trip ticket.

- APD is not charged for arriving passengers

- APD is not paid by infants (0 – 23 months old) in any cabin class, since they do not occupy a seat, or by children aged 2 – 15 on the date of the flight, provided they are travelling in Economy Class.

- If a seat is purchased for an infant, they will only by exempt from APD if they are travelling in Economy Class.

- Passengers transiting through the UK on a single ticket are exempt from APD, provided their connection is under 24 hours (e.g. SIN-MAN-IAH is exempt, but if a stopover in MAN is added to the ticket, APD is charged).

- If you pay to upgrade your flight from Economy Class, the higher rate of APD becomes payable, though in reality this is built in to the upgrade cost – you won’t get a second bill.

- If you receive a complimentary upgrade to a higher travel class from Economy Class, the higher rate of APD is not payable.

Singapore Airlines therefore does not charge APD on commercial or award tickets departing the UK for any infants (all cabins), or children aged 2-11 years old (in Economy Class), and will automatically remove the charge for adults aged 12-15 on the travel date (in Economy Class), once their date of birth has been added during the booking process.

APD is not actually a passenger charge

Interestingly, Air Passenger Duty is not actually charged to passengers, like many other aviation and airport taxes are.

Instead it is charged to airlines by HM Revenue and Customs (HMRC), who in turn elect to pass it on to passengers in almost all cases. This includes when redeeming KrisFlyer miles with Singapore Airlines.

For example, on a 100% full Airbus A380 departure from London to Singapore, SIA currently has to ‘write a cheque’ to the UK HMRC for GBP 57,412 (over S$98,000), purely for APD due in relation to the 471 passengers on board.

HMRC does not care whether the airline recovered that money from the passengers directly, or just dug into its own pockets to pay the bill.

(Photo: Heathrow Airport Limited)

While SIA simply builds the APD cost into the total fare for revenue passengers, it’s no surprise the airline is unwilling to cover it, even partially, for those redeeming KrisFlyer miles, so the cash element of APD is added to your booking, and is therefore payable separately.

APD feels like a passenger charge:

- because of the way it is calculated (based on the number of passengers, their travel class, and destination); and

- because of the the way it is implemented in practice (airlines include APD in the ticket price as a separate line item).

Legally, however, APD is charged to the airline or aircraft operator. The operator is responsible for collecting and remitting the duty to the UK Government, as HMRC says, “whether [the passengers] have paid for the flight or not”.

By our estimates, based on 85% load factors purely on its UK – Singapore flights, SIA currently pays around GBP 1.3 million per week to the UK Government for APD, a total that will increase to over GBP 1.6 million by April 2026.

So yes, SIA could let KrisFlyer members off the hook for APD if it wanted to – but that’s not going to happen with bills like these to pay!

Avoiding APD

There aren’t many ways to avoid paying APD when departing from the UK by air, however the charge itself is far lower for Band A (0 – 2,000 miles from London) than it is for destinations like Houston and Singapore.

For example, flying in Economy Class from the UK to most European destinations will currently set you back GBP 13 in APD, a rate that’s increasing only slightly to GBP 15 from 1st April 2026.

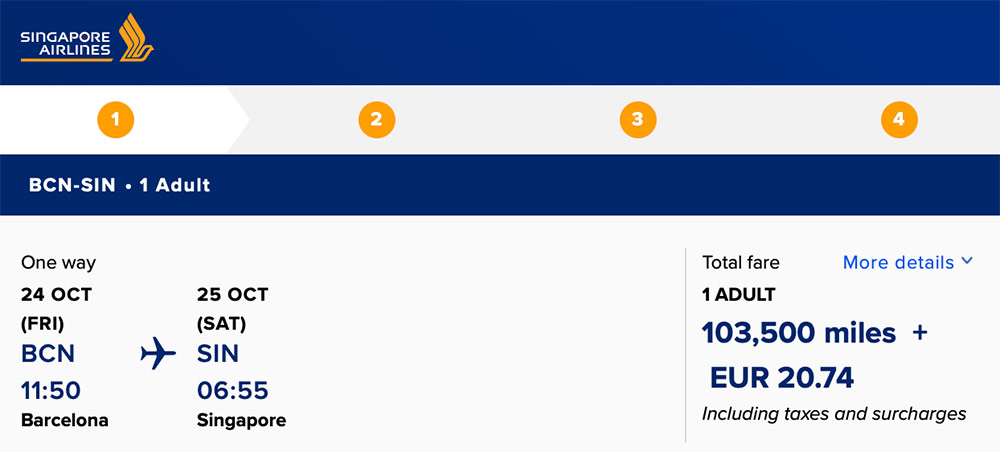

That means it’s relatively cheap in APD terms to ‘escape’ the UK in order to take a long-haul flight to Singapore from a country with low aviation taxes, like Spain.

In other words – fly long-haul in to the UK, but try to fly short-haul out of the UK (or take a train), then long-haul only from a second country with low taxes.

This requires you to book an unprotected connection (two separate tickets), as APD is charged based on the distance band of your final destination, so always allow enough connection time or ideally build in an overnight stop before your second flight.

The strategy also applies when flying with other airlines or redeeming with alternative frequent flyer programmes, like BA or Qatar Airways Avios points.

For example, redeeming Qatar Airways in Business Class from London Heathrow to Singapore via Doha in October 2025 will set you back 75,000 Avios + GBP 446.

Head across to Dublin and take a Qatar Airways flight to Singapore in Business Class via Doha and it’s 75,000 Avios + GBP 179, a saving of around GBP 267 (~S$455) per person!

(Photo: Qatar Airways)

A short flight from London to Dublin costs as little as S$85 with a low-cost airline like Ryanair, including a checked bag, or from S$110 with a full-service airline like British Airways.

A couple redeeming from Dublin instead of London in this example is saving S$910 in total by doing so, but is still S$690 up after taking a British Airways flight to Dublin first, more than enough for a very nice hotel stay and dinner on the Emerald Isle!

Don’t forget your ETA

Another cost for Singaporeans to factor into a UK trip is now the Electronic Travel Authorisation (ETA), required for tourism and business visits from 8th January 2025 onwards.

This requires advance application and payment of a GBP 10 (~S$17) fee per person, including children and infants, for a two-year entry approval. See our article for full details.

While APD does not apply for arriving passengers, this can now be seen as an arrival tax of sorts!

Summary

The UK’s Air Passenger Duty is one of the highest aviation taxes in the world when it comes to long-haul flights, like those connecting the country with Singapore.

The latest hikes will see the taxes and fees on a typical Business Class KrisFlyer award redemption from London Heathrow to Singapore increase from around S$430 today to around S$470 from April 2025, then S$520 from April 2026, a significant hit especially for families.

While the tax is not directly payable by passengers, practically all airlines pass it on to ticket and award redemption costs regardless, so there’s no avoiding it – except by taking a short flight from the UK on your departure to a country with lower taxes, then flying long-haul from there.

That’s a decent strategy to consider if you have time, and can find award space to suit your travel plans.

(Cover Photo: Heathrow Airport Limited)

Absolute madness. The solution to take a short flight to another country is always the one I use.

Crazy UK government. Might have to enter via dinghy. Apparently you get a nice hotel for free.

Ok, doesn’t apply on arrival, only departing.

You can always originate your journey out of the UK from INV, via AMS or LHR. INV has been APD exempt since 1994