It’s fair to say that a ‘cheap’ holiday to the Maldives is virtually unheard of. The archipelago’s 1,200 islands, renowned for their luxury, are home to five-star resorts that command premium prices, attracting affluent tourists from around the globe seeking exclusive escapes, including many of our readers based in Singapore.

One way to mitigate the cost a little is to redeem your KrisFlyer miles for a trip on Singapore Airlines, but as we reported back in late 2021, the Maldives started getting wise to a new revenue source – high air passenger taxation.

That saw the taxes and fees payable on Business Class and First Class tickets departing from the Maldives hiked by 140% and 260% respectively, but there’s now more bad news to report.

Maldives departure tax hiked again

The Maldives essentially charges two taxes to departing passengers, based on travel class, irrespective of your final destination, with tourists departing internationally from Velana International Airport (MLE) paying:

- An Airport Service Charge, replaced by the Departure Tax in 2022

- An Airport Development Fee

These fees were fixed at US$25 each (i.e. US$50 in total) for all passengers prior to 2022, but were then increased, becoming dependent on your travel class.

Now the fees have been hiked again, effective for tickets issued from 1st December 2024 onwards, as shown below.

Maldives (MLE) total departure taxes

| Travel Class | Until 31 Dec 2021 |

1 Jan 2022 to 30 Nov 204 |

From 1 Dec 2024 |

| Economy | US$50 | US$60 20% |

US$100 67% |

| Business | US$50 | US$120 140% |

US$240 100% |

| First | US$50 | US$180 260% |

US$480 167% |

Overall, with these two tax increases, Economy Class passengers now pay twice as much as they did in 2021, while Business Class passengers face nearly a fivefold rise.

First Class passengers – though this doesn’t apply to Singapore Airlines on this route but is available on carriers like Emirates – are now paying practically 10 times the taxes they paid in 2021.

The charges are collected by the airline, meaning any Singapore Airlines award including travel out of Malé ticketed on or after 1st December 2024 now has the new higher cash component added (since KrisFlyer miles cannot be used to offset government and airport taxes and fees).

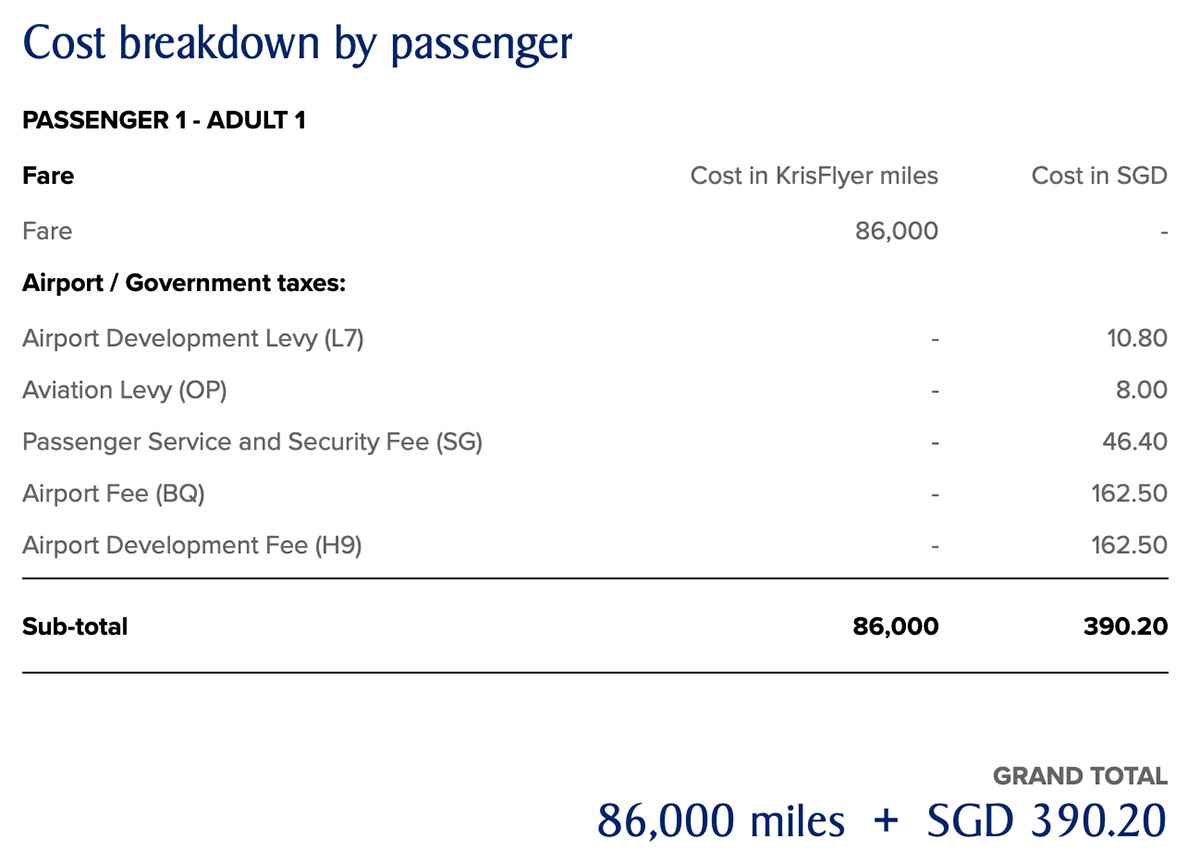

Here’s an example for a round-trip Business Class redemption from Singapore to Malé booked before 1st December 2024, compared to one booked after this date.

Before 1st December 2024

From 1st December 2024

This unfortunate development follows the United Kingdom’s recent announcement of a 25% increase in its already steep Air Passenger Duty (APD) for departing passengers over the next 16 months.

By April 2026, this hike will raise the total taxes and fees payable – on top of your KrisFlyer miles – to an eye-watering S$520 for premium cabin award tickets from London Heathrow to Singapore.

Singapore is not immune from high aviation taxes either, with total charges for departing passengers at Changi Airport set to rise by over 20% in the coming years.

Citizens pay lower taxes in Economy Class

If you are a Maldivian citizen, lower taxes apply to you when booking cash tickets or redeeming on international flights from Malé in the Economy Class cabin.

Singapore Airlines does not automatically apply this discount for you, so you will initially have to pay the full fare and taxes, then apply for a refund.

The Maldives continues to waive departure taxes for children aged under two years.

It could be worse

If you think the increased charges for redeeming flights from the Maldives to Singapore are steep, spare a thought for those booking awards on airlines with hefty fuel surcharges.

For example, redeeming a Business Class ticket on British Airways from London to the Maldives and back using Avios points now costs over S$1,600 per passenger in taxes and fees alone!

That’s a triple whammy of the UK’s exorbitant Air Passenger Duty, British Airways’ hefty fuel surcharges, and the latest high Maldives departure taxes.

SIA’s Maldives flights

Before the COVID-19 pandemic, Singapore Airlines and its regional subsidiary SilkAir operated 16 weekly flights to and from Malé – seven on Boeing 787-10s and nine on Boeing 737-800s.

Frequencies now stand at twice daily, a slight drop to 14 per week. However, both of these flights use 303-seat Airbus A350 Medium Haul aircraft, resulting in a more than 10% increase in seat capacity on this route compared to December 2019.

Here’s how the schedule looks for the current season through to late March 2025.

Singapore ⇄ Malé

Now till 29th March 2025

| Days | |||||||||

| M | T | W | T | F | S | S | |||

| SQ432 A350 MH |

|||||||||

| SIN 09:55 |

MLE 11:45 |

||||||||

| SQ438 A350 MH |

|||||||||

| SIN 20:40 |

MLE 22:15 |

||||||||

| SQ431 A350 MH |

|||||||||

| MLE 12:55 |

SIN 20:45 |

||||||||

| SQ437 A350 MH |

|||||||||

| MLE 23:40 |

SIN 07:15* |

||||||||

* Next day

For the northern summer season between April and October 2025, some minor timing changes apply, but twice-daily Airbus A350 Medium Haul service continues.

Singapore ⇄ Malé

30th March 2025 – 25th October 2025

| Days | |||||||||

| M | T | W | T | F | S | S | |||

| SQ432 A350 MH |

|||||||||

| SIN 10:05 |

MLE 11:55 |

||||||||

| SQ438 A350 MH |

|||||||||

| SIN 20:45 |

MLE 22:10 |

||||||||

| SQ431 A350 MH |

|||||||||

| MLE 13:05 |

SIN 21:00 |

||||||||

| SQ437 A350 MH |

|||||||||

| MLE 23:25 |

SIN 07:05* |

||||||||

* Next day

Taxes by travel class

The Maldives is not the only country on the SIA network to differentiate its departure taxes based on your travel class.

Here are the others we know of.

- 🇫🇷 France: The “Air Passenger Solidarity Tax” is 10 times higher for Business Class and First Class passengers (e.g. CDG-SIN S$89.40), than for those flying Economy and Premium Economy (e.g. CDG-SIN S$10.70).

- 🇭🇰 Hong Kong: The “Hong Kong Airport Construction Fee” is set at a higher rate for Business Class and First Class passengers (e.g. HKG-SIN S$27.90), than for Economy and Premium Economy (e.g. HKG-SIN S$15.70).

- 🇬🇧 United Kingdom: A higher rate of “Air Passenger Duty” applies in any cabin other than basic Economy Class (i.e. Premium Economy and up).

Summary

Departure taxes from Malé to Singapore and other international destinations have increased significantly over the last three years, from a flat US$50 per person to at least US$100 in Economy Class and up to US$380 per person in First Class.

That comes as the Departure Tax and Airport Development Fee have risen sharply for the second time, effective from 1st December 2024, especially for premium cabins.

Economy passengers now pay twice as much as in 2021, Business Class passengers face a nearly fivefold increase, and First Class travellers suffer a tenfold rise compared to pre-2022 rates.

Singapore Airlines travellers redeeming KrisFlyer miles for flights from Malé now see these higher taxes added to their tickets, and in Business Class that increases the total cash outlay to S$390 for a round-trip award.

The hikes are sadly part of a broader trend of rising passenger taxes worldwide, including the UK’s Air Passenger Duty, and fees levied here in Singapore too.

(Cover Photo: Shutterstock)

Hat-tip to OMAAT

Fly in business. Fly out economy. And spend less miles on the return too.

What is this “economy” you speak of? 😂

Slight typo, biz class passagers face a nearly fivefold increase but the article mentions fourfold

Thanks you’re right – corrected.