It’s income tax season again, which means your Notice of Assessment from IRAS will soon arrive for taxes on your 2024 earnings. Thankfully there’s a silver lining as usual – the opportunity to pay by credit card and rack up potentially thousands of points or miles in the process.

Card payments platform ipaymy has launched its 2025 income tax payment offer, allowing both new and existing users to pay a competitive fee of 1.75% for these payments using Visa or UnionPay cards, or 1.99% using Mastercard or Amex cards, the same popular rates it has offered during tax seasons over recent years.

A rate of 1.75% represents a 27% discount on the usual 2.4% fee when you use your credit card to pay bills using ipaymy.

The offer

If you use ipaymy to pay your income tax bill between now and 31st August 2025, you’ll be eligible for the discounted fee using the following promo codes:

- TAX2025 (for Singapore Visa or UnionPay cards)

- TAX199 (for Singapore Mastercard or Amex cards)

The offer is subject to the following terms and conditions:

- One-time or recurring payments to IRAS (TAX2025 code)

- One-time payments to IRAS (TAX199 code)

- First charge date is on or before 31st August 2025

- One use per account

There is no upper cap on the tax amount paid under this promotion, however if you have a particularly large tax payment to make, do contact the ipaymy team via support@ipaymy.com, in case they can offer a special concession rate.

The offer is available to both new and existing ipaymy personal account holders. Simply use the relevant promo code at the ‘Payment Details’ stage.

| TAX2025 | 1.75% | |||

| One-time or recurring IRAS income tax payment with a Singapore-issued Visa or UnionPay card | ||||

| TAX199 | 1.99% | |||

| One-time IRAS income tax payment with a Singapore-issued American Express card or Singapore-issued Mastercard | ||||

Cost per mile

Here’s how the cost per mile looks for some popular Visa credit cards issued in Singapore, with the most competitive 1.75% fee in play.

Cost per mile – TAX2025

| Card | Mpd | Cost per mile (1.75% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.07¢ |

DBS Insignia |

1.6 | 1.07¢ |

UOB Reserve UOB Reserve |

1.6 | 1.07¢ |

DBS Vantage |

1.5 | 1.15¢ |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.23¢ |

SC Visa Infinite SC Visa Infinite |

1.4* | 1.23¢* |

UOB VI Metal |

1.4 | 1.23¢ |

OCBC 90ºN Visa OCBC 90ºN Visa |

1.3 | 1.32¢ |

OCBC Voyage Visa OCBC Voyage Visa |

1.3 | 1.32¢ |

DBS Altitude Visa DBS Altitude Visa |

1.3 | 1.32¢ |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2 | 1.43¢ |

SC Journey Card SC Journey Card |

1.2 | 1.43¢ |

* 1.4 mpd subject to a minimum spend of S$2,000 in the same statement cycle, otherwise 1 mpd. ipaymy payments do count towards the minimum.

As you can see even with one of the widely-held 1.2 mpd cards like the SC Journey Card and Citi PremierMiles options, an effective cost per mile of 1.43 cents is competitive.

For those lucky enough to have 1.6 mpd earning cards, the cost per mile drops to an excellent 1.07 cents.

Here’s how the cost per mile looks for some popular American Express credit cards issued in Singapore, starting at 1.50 cents.

Cost per mile – TAX199

| Card | Mpd | Cost per mile (1.99% fee) |

Amex KF PPS Amex KF PPS |

1.3 | 1.50¢ |

Amex KF Solitaire PPS Amex KF Solitaire PPS |

1.3 | 1.50¢ |

DBS Alt Amex DBS Alt Amex |

1.3 | 1.50¢ |

KF Ascend KF Ascend |

1.2 | 1.63¢ |

KF Blue KF Blue |

1.1 | 1.77¢ |

| 0.98 | 1.99¢ | |

| 0.78 | 2.50¢ | |

| 0.69 | 2.83¢ | |

| 0.69 | 2.83¢ |

Here’s how the cost per mile looks for some popular Mastercard credit cards issued in Singapore, starting at 1.22 cents.

Cost per mile – TAX199

| Card | Mpd | Cost per mile (1.99% fee) |

Citi Ultima MC Citi Ultima MC |

1.6 | 1.22¢ |

UOB PRVI MC UOB PRVI MC |

1.4 | 1.39¢ |

Citi Prestige Citi Prestige |

1.3 | 1.50¢ |

OCBC 90°N MC OCBC 90°N MC |

1.3 | 1.50¢ |

| 1.2 | 1.63¢ | |

Citi PM MC Citi PM MC |

1.2 | 1.63¢ |

BOC EM BOC EM |

1.0 | 1.95¢ |

As you can see even with one of the widely-held 1.2 mpd to 1.3 mpd cards like the Citi PremierMiles and OCBC 90°N options, an effective cost per mile of 1.43 to 1.5 cents is a little on the high side.

However, for those lucky enough to have 1.4 mpd or 1.6 mpd earning cards, the cost per mile drops to a far more competitive 1.39 cents or even 1.22 cents.

Note: UOB excludes UNI$ earning on payments with the descriptor “IPAYMY” in its credit card T&Cs, but does not exclude ipaymy as a merchant itself. ipaymy states that UOB cards do still earn miles, and reader reports confirm this. ipaymy is still honouring its points guarantee for payments made with UOB cards.You can refer to the latest full list of cards awarding points and miles for ipaymy transactions here.

Calculation

One of the common questions we are asked regarding ipaymy is why the cost per mile isn’t simply the fee divided by the earn rate (e.g. 1.75% ÷ 1.4 mpd = 1.25 cents per mile).

The reason is that you will earn miles on the fee itself, as well as the due amount when you make a payment through ipaymy, which gives you slightly more miles than you might have expected.

Here’s an example using the DBS Vantage Visa for an income tax payment under this offer:

- S$10,810 payment

- 1.75% fee = S$189

- Fund safeguarding fee = S$1

- ipaymy charges your card S$11,000 (S$10,811 + S$190)

- DBS awards 8,250 DBS Points (= 16,500 miles)

Cost per mile is S$190 ÷ 16,500 miles = 1.15 cents per mile

How to pay

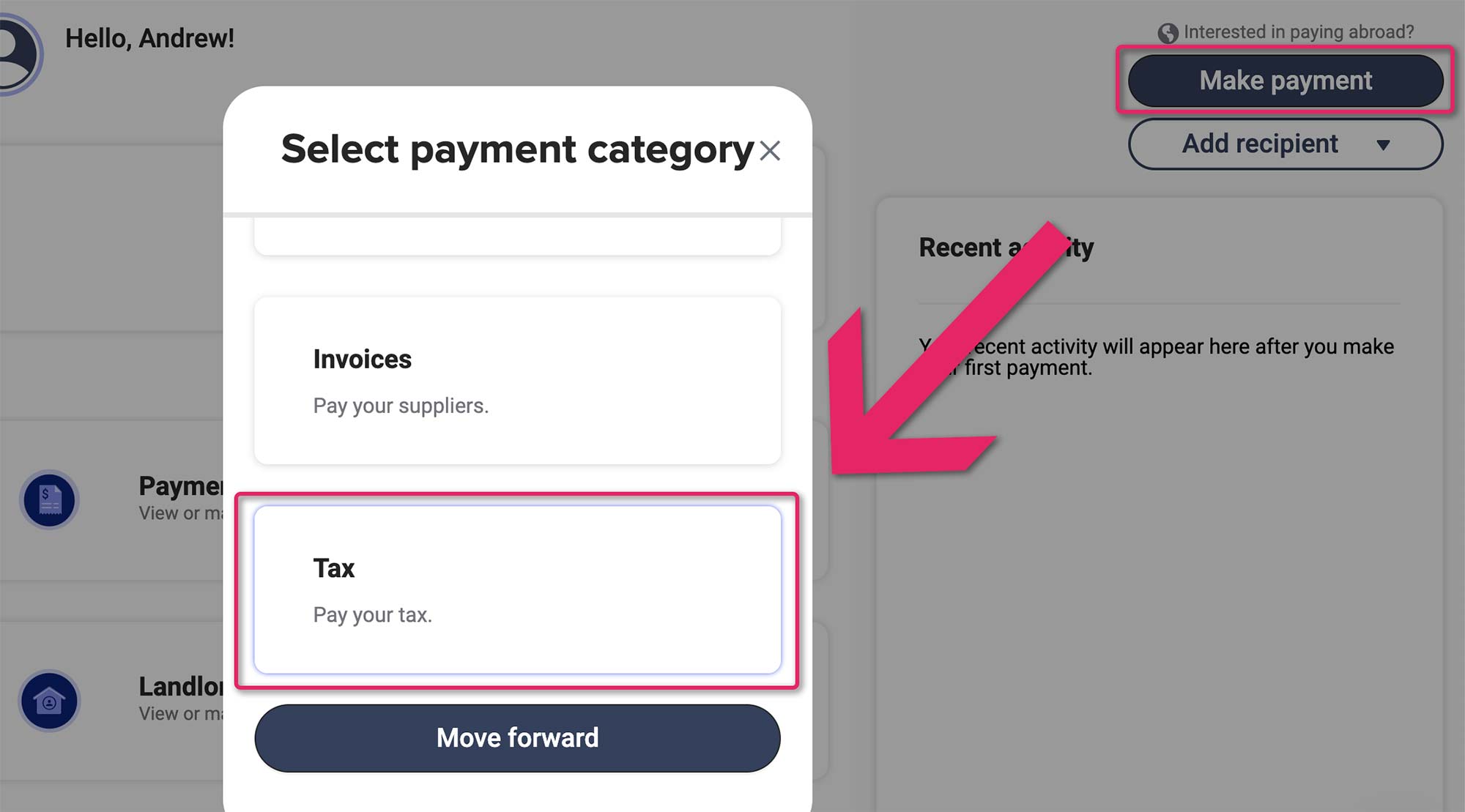

Once you’re logged on to ipaymy you’ll be presented with the ‘Dashboard’ screen. To set up your income tax payment, click ‘Make payment’ in the top right, then select ‘Tax’.

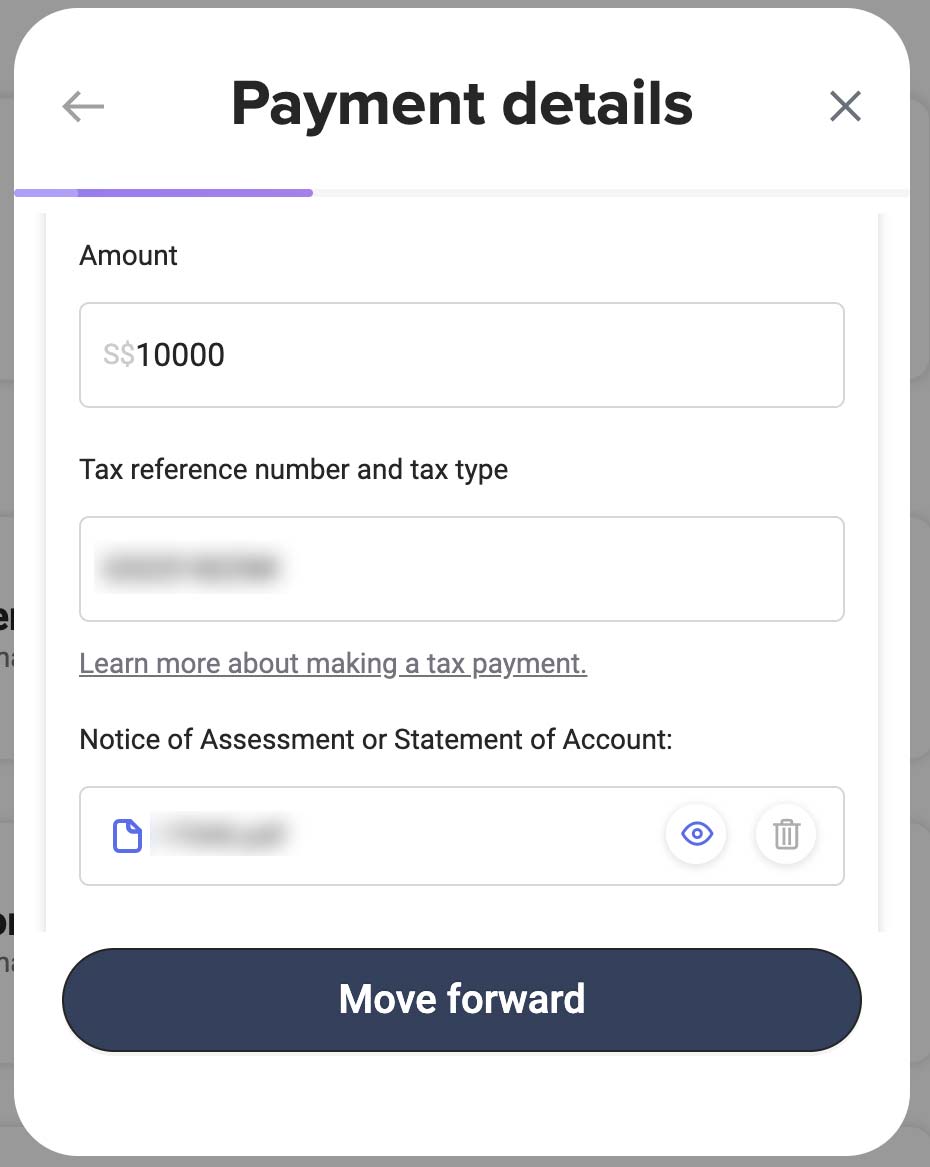

You’ll then be asked to enter the details for your tax bill. These should match your IRAS Notice of Assessment (NoA), which you’ll also have to upload as a PDF or scanned copy.

Tip: You can download a PDF version of your IRAS NoA once it’s published, by logging on to the IRAS myTax Portal using SingPass.

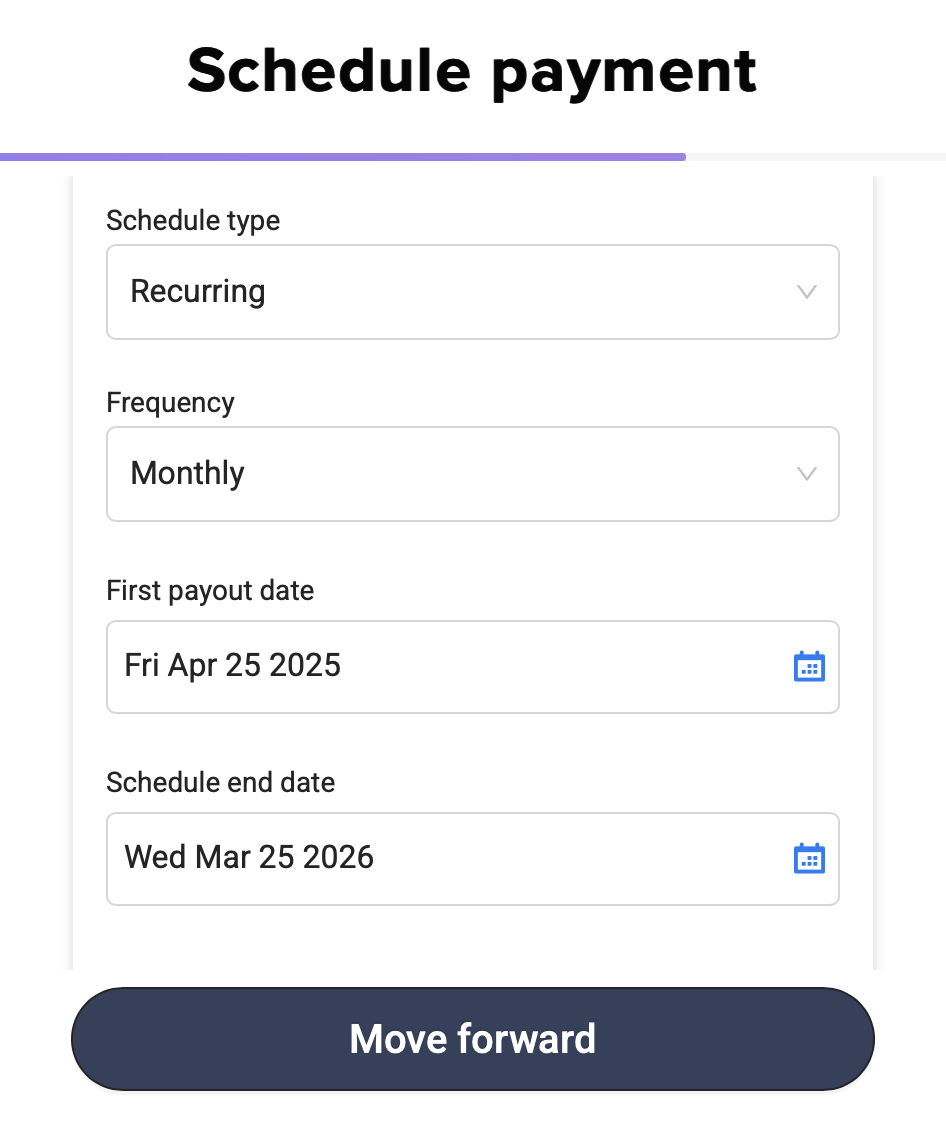

Next you’ll choose your payment date, but bear in mind that your card will be charged the previous working day, as shown on the calendar presentation.

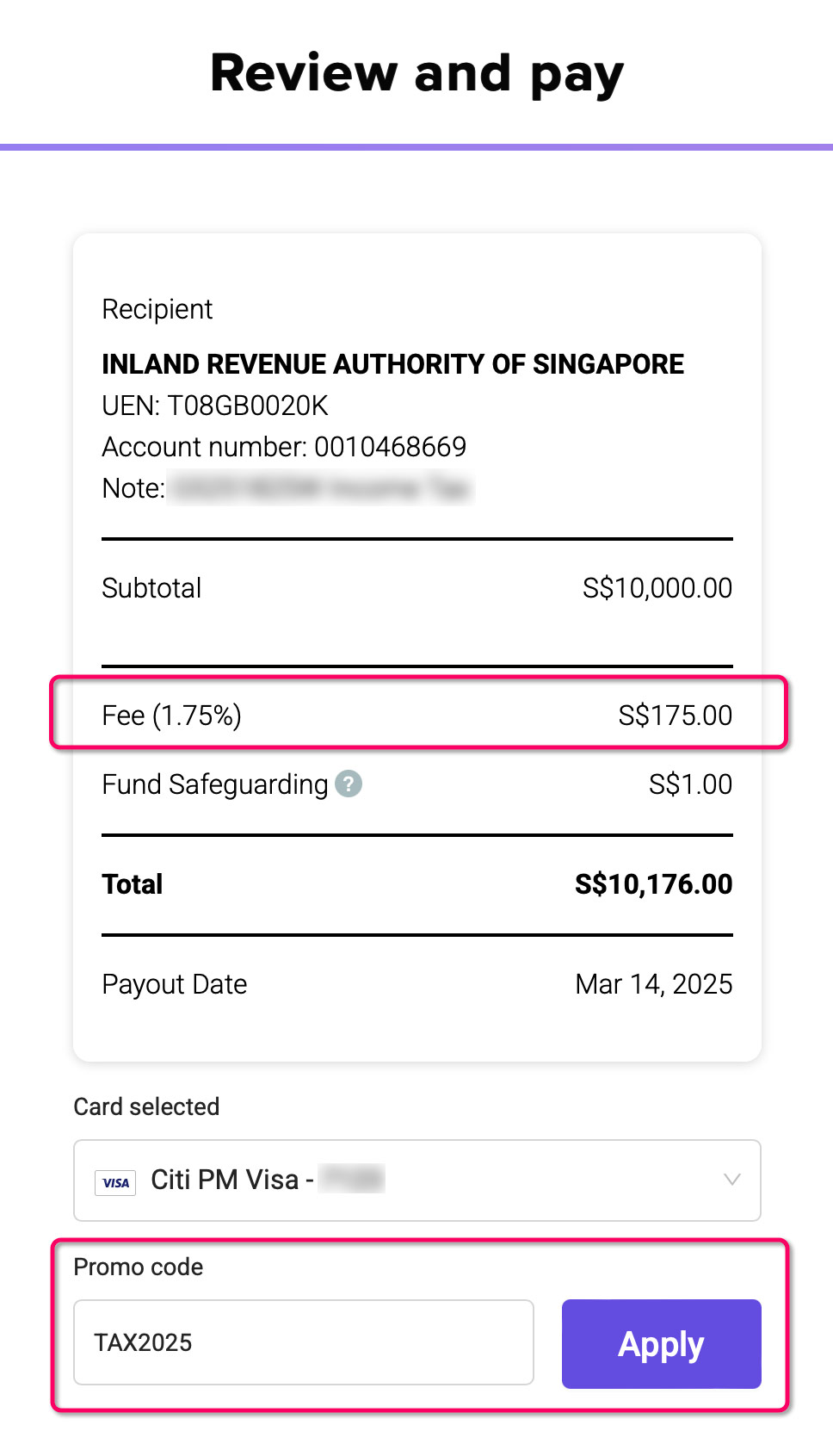

At the Payment Details screen, you’ll select which saved credit card you wish to use, then the regular ipaymy fee of 2.4% will be displayed.

Here’s where you’ll enter the TAX2025 or TAX199 promo code.

Once applied, you will see the fee drop from 2.4% to 1.75% (Visa / UnionPay) or 1.99% (Mastercard / Amex). In the following example, an income tax payment of S$10,000 using a Visa card now carries a fee of S$175 (1.75%) instead of S$240 (2.4%).

Note that ipaymy adds a S$1 surcharge to the fee payable for ‘Fund Safeguarding’, which ensures your funds are protected and held in a segregated safeguarded account. For smaller payments, this does adversely affect the cost per mile.

You can still pay by GIRO

For some time, ipaymy has been supporting monthly payments to IRAS, provided you have a GIRO arrangement set up and you schedule your recurring payments at least five working days prior to the IRAS GIRO debit date each month.

That’s because if you settle the monthly deduction before it falls due, IRAS then won’t take the payment from your bank account that month, because it knows your account is up to date (however, you must keep the GIRO arrangement in place, otherwise IRAS will demand full payment of your outstanding tax).

Good news is you can also use the TAX2025 promo code (for local Visa or UnionPay cards) when setting up these recurring payments to IRAS. When scheduling the payment, simply choose the recurring monthly option and enter the first payment date and the last payment date, in accordance with your GIRO plan.

These payout dates are the dates your payment will reach IRAS each month, but again do ensure they are at least five working days ahead of your regular monthly payment date (which is on the 6th of each month), in order to ‘cancel out’ the GIRO from your bank account to IRAS for that month.

Not received your IRAS NoA yet?

Don’t worry if you haven’t received your bill yet and/or don’t have a ‘Notice of Assessment’ date showing at the online IRAS portal. NOAs are sent out between now and September 2025, so your tax liability may be in a later batch.

Remember these TAX2025 and TAX199 promo codes are valid for payments until the end of August 2025, so you’ll still be able to use it even if your tax statement comes through later.

Citi cardholders should wait

If you have a Citi card, you may want to hold off settling your income tax bill for now if you can, since a Citi PayAll promotion is likely to launch in April 2025, based on previous patterns.

In recent years, this has included the ability to buy miles for as little as 0.8 cents each for payments including income tax, though last year the deal was lousy – at a cost of 1.63 cents per mile, with hoops to jump through.

Other tax types also included

While income tax season is just around the corner, the good thing about these new ipaymy promo codes for IRAS tax payments is that they are also valid for use on other taxes payable in Singapore, not just income tax.

These include:

- Property tax

- Stamp duty

Summary

A competitive rate for income tax payments from ipaymy this year, starting at a 1.75% fee using Visa or UnionPay cards, translating to an excellent cost per mile starting at just 1.07 cents when settling this year’s bill.

Don’t forget to apply the TAX2025 promo code at the review stage to receive the discounted rate, which can also be used when setting up monthly recurring payments to IRAS for those paying by GIRO this year.

For those using a Mastercard or Amex card, promo code TAX199 gives you a 1.99% fee option, which brings the cost per mile down to 1.22 cents in some cases.

Do note that unless you need to pay quickly, it may still be worth holding off for all the deals to be released including from the likes of Citi PayAll and CardUp before you commit, since offers in recent years have included the ability to generate miles from as little as 0.8 cents each.

Links on Mainly Miles may pay us an affiliate commission.

(Cover Photo: Shutterstock)

interested to see if Cardup can match this year

I think they will, once their current 1.8% IRAS tax promo ends on 31st March, or potentially earlier given IPM is first out of the blocks this year.

Isn’t ipaymy an exclusion for the PRVI cards?

This is covered in the article.