Updated: 9th April 2025

It’s income tax season once again in Singapore, a fact I was starkly reminded of back on the evening of 15th March when I received an SMS from gov.sg informing me that my 2025 tax bill – officially known as the Notice of Assessment (NoA) – was ready for review, based on earnings from the 2024 calendar year.

About half a million of us are in this boat in 2025, thanks to the enhanced Direct Notice of Assessment (D-NoA) scheme, meaning our NoAs are arriving about a month earlier than usual.

Close to 500,000 taxpayers on the NFS will benefit from the Direct Notice of Assessment (D-NOA) initiative and receive their tax bills earlier from mid-March 2025. This year, the D-NOA has also been expanded to self-employed persons for the first time.

IRAS

For everyone else, NoAs should arrive from around the end of April, so don’t feel too left out if you’re still waiting!

The good news? You can still earn miles when settling your bill in 2025, just like you’ve been able to in previous years, so with NoAs already being generated it’s a good time for us to refresh our full guide to turning one of the year’s single biggest expenses into thousands of miles, at a reasonable cost.

Your options

The Inland Revenue Authority of Singapore (IRAS) does not accept income tax payments via credit card directly. Instead, payments can be made either through your credit card issuing bank’s own scheme, or a third-party card payments provider – and these are the options we’re evaluating here.

Unfortunately, these services all come with a fee attached, meaning any miles earned from paying your income tax this year won’t be truly free.

That said, many options come in at a competitive cost per mile, starting at just 0.95 cents each in 2025.

The income tax payment options this year remain largely unchanged from previous years. You can pay via one of five bank-specific facilities if you have an eligible miles-earning credit card, or through the two major card payment providers, CardUp and ipaymy.

Here’s how the list looks, with the associated fee for each provider.

| Singapore Income Tax Payment 2025 Options |

|

| Provider | Fee |

| 2.6% | |

| 2.5% | |

| 1.9% | |

| 1.9% | |

| 1.6% – 1.8% | |

| 1.5% – 2.6% | |

| 1.75% – 1.99% | |

Bear in mind that a lower fee doesn’t always mean cheaper miles.

The fee percentage alone doesn’t actually determine the cost per mile – you also need to factor in the applicable earn rate.

For example, UOB’s Payment Facility charges a 1.8% fee for PRVI Miles cardholders, but earns 1 mile per S$1, resulting in a cost of 1.8 cents per mile. The Standard Chartered Income Tax Payment Facility, on the other hand, has a higher 1.9% fee, but with the Beyond card’s 1.5 mpd earn rate, the cost per mile is actually much lower at 1.27 cents.

The options available to you depend on the credit card(s) you hold. Remember your income tax bill is typically payable within a month or two of your ‘Notice of Assessment’ (NOA) date, unless your NOA states otherwise, so there may still be time to apply for and receive a new credit card with a superior miles earning rate if you wish.

In case you’re wondering what happened to the HSBC Income Tax Payment Programme, that was unfortunately discontinued back in April 2023.

With the bank also excluding CardUp and ipaymy from rewards earning across its entire product range, that leaves no way to accrue miles for income tax payments with an HSBC credit card in 2025.

CardUp and ipaymy’s 2025 Income Tax offers

This year both CardUp and ipaymy have a promotional rates for tax payments using Singapore-issued Visa cards, at competitive fees ranging from 1.55% to 1.99%.

| Card Payment Providers 2025 Tax Promotions |

||||

| Provider | ||||

| 1.75% | 1.99% | 1.99% | 1.75 – 1.99% | |

| Expires: 31st August 2025 | ||||

| 1.75% | 1.55 – 1.67% | 2.6% (no promo) |

1.55 – 1.73% | |

| Promos expire: 31st August 2025 | ||||

ipaymy’s tax payment deal was launched first, in early March, while CardUp’s offer came a little later at the end of March. Both effectively run until the end of August 2025.

Here’s the current list of tax promo codes from ipaymy and CardUp (click to expand):

Choosing between ipaymy and CardUp for your income tax payment could simply come down to which provider you’ve used before, since you may not want to go to the hassle of opening a new account. We don’t favour one company over the other – only the cheapest deal.

Both CardUp and ipaymy will usually also offer concessionary rates for large income tax payments. If you have a significant tax bill this year, email each provider directly for more details, with rates as low as 1.7% reportedly offered in previous tax seasons.

Citi PayAll hasn’t shown its cards yet

In recent years, Citi’s PayAll facility has offered the best income tax payment offer for many of our readers, with effective cost per mile rates ranging from just 0.8 cents to 1 cent.

That sadly changed last year, when the bank increased its fee from 2.2% to 2.6% and reduced the earn rate to 2 mpd. This resulted in a 1.3 cent cost per mile for tax payments – but crucially only if you also spent at least S$5,000 on non-tax payments at a higher cost of 1.63 cents per mile, in order to qualify for the convoluted offer.

That put many people off, ourselves included, but let’s wait and see what the bank has up its sleeve for 2025.

A new Citi PayAll deal should come through in April, so stay tuned.

Best deals for your 2025 income tax payment

Let’s take a look at the cost per mile table, which once again we’ve split into three sections this year, depending on how good a deal we think you’re getting.

The formula is simply the fee divided by the number of miles you will receive, to generate a cost per mile.

Keep in mind that with ipaymy and CardUp, you’ll also earn miles on the fee itself, which is factored into the calculation. However, this doesn’t apply to bank-specific or Citi PayAll payments, where the fee element won’t earn miles.

For each card, we’ve listed the cheapest way to buy miles when paying your income tax. However, there are often additional options available.

For example, if you’re using the DBS Altitude Amex card – or if it’s your best available option – there are currently three ways to settle your tax bill this year, as shown below.

| Method | Fee | Mpd | Cost per mile |

|

| 1.99% |

1.3 | 1.50¢ | ||

| 2.5% |

1.5 | 1.67¢ | ||

| 2.6% |

1.3 | 1.95¢ |

As you can see, ipaymy is the cheapest option at 1.50 cents per mile, followed by DBS’s own Payment Plan at 1.67 cents per mile, followed by CardUp at 1.95 cents per mile.

There’s no need to clutter the full analysis table with all three options when the cheapest one – ipaymy in this case – is the clear choice, so that’s the only one we’ve listed.

When card payment providers offer discounted fees for new users or banks extend special rates to premier customers, we list those deals separately if they’re the lowest available. Later in the table, we include the same card again with the best rate applicable to all customers, including existing users and standard banking clients.

Here’s our definitive list of your credit card income tax payment options for 2025. Simply start at the top (lowest cost per mile), and work your way down the table until you find a credit card you hold, or wish to use.

Excellent cost per mile

0.95 – 1.39 cpm

You can ‘buy’ miles paying your income tax by credit card from between 0.95 cents and 1.39 cents each this year, an excellent rate for most of us, using the following methods.

| Card | Method | Fee | Mpd | Cost per mile |

BOS Voyage BOS VoyageOCBC PPC Voyage OCBC Premier Voyage |

OCBC155 |

1.55% |

1.6 | 0.95¢ |

| 1.9% | 2.0 | 0.95¢ | ||

BOS Voyage BOS VoyageOCBC PPC Voyage OCBC Premier Voyage |

1.73% | 1.6 | 1.06¢ | |

VTAX25R |

1.75% | 1.6 | 1.07¢ | |

VTAX25R |

1.75% | 1.6 | 1.07¢ | |

VTAX25R |

1.75% | 1.6 | 1.07¢ | |

VTAX25R |

1.75% | 1.5 | 1.15¢ | |

OCBC90N155 |

1.55% |

1.3 | 1.17¢ | |

OCBC90N155 |

1.55% |

1.3 | 1.17¢ | |

OCBC155 |

1.55% |

1.3 | 1.17¢ | |

OCBC155 |

1.55% |

1.28 | 1.19¢ | |

| 1.99% |

1.6 | 1.22¢ | ||

VTAX25R |

1.75% | 1.4* | 1.23¢* | |

VTAX25R |

1.75% | 1.4 | 1.23¢ | |

VTAX25R |

1.75% | 1.4 | 1.23¢ | |

| 1.9% | 1.5 | 1.27¢ | ||

| 1.73% | 1.3 | 1.31¢ | ||

VTAX25R |

1.75% | 1.3 | 1.32¢ | |

VTAX25R |

1.75% | 1.3 | 1.32¢ | |

| 1.73% | 1.28 | 1.33¢ | ||

| 1.99% | 1.4 | 1.39¢ |

* 1.4 mpd earn rate for the SCVI card is subject to a minimum spend of S$2,000 in the same statement cycle as your income tax payment. The income tax payment does count towards the minimum.

Still worth considering

1.43 – 1.81 cpm

As miles purchase rates fall into the 1.43 – 1.81 cents range, they may still be worth considering if you are comfortable with these levels and can’t take advantage of the options outlined above.

| Card | Method | Fee | Mpd | Cost per mile |

VTAX25R |

1.75% | 1.2 | 1.43¢ | |

VTAX25R |

1.75% | 1.2 | 1.43¢ | |

VTAX25R |

1.75% | 1.2 | 1.43¢ | |

| 1.99% | 1.3 | 1.50¢ | ||

| 1.99% | 1.3 | 1.50¢ | ||

| 1.99% | 1.3 | 1.50¢ | ||

| 1.99% | 1.3 | 1.50¢ | ||

| 1.99% | 1.3 | 1.50¢ | ||

| 1.99% | 1.2 | 1.63¢ | ||

| 1.99% | 1.2 | 1.63¢ | ||

| 1.99% | 1.2 | 1.63¢ | ||

VTAX25R |

1.75% | 1.0 | 1.72¢ | |

| 1.99% | 1.1 | 1.77¢ | ||

| 2.6% | 1.4 | 1.81¢ |

Probably of no interest

1.95+ cpm

If you still don’t have a credit card payment option in the lists above to settle your income tax bill, it’s probably time to either get one, or call it quits.

The following options all come in above our personal limit to buy miles, and should only be considered if you are 100% comfortable doing so.

| Card | Method | Fee | Mpd | Cost per mile |

| 1.99% | 1.0 | 1.95¢ | ||

| 1.99% | 0.98 | 1.99¢ | ||

| 1.99% | 0.78 | 2.50¢ | ||

| 1.99% | 0.69 | 2.83¢ | ||

| 1.99% | 0.69 | 2.83¢ |

Remember, no cards offer their enhanced 4 mpd bonus rate for income tax payments, including the DBS WWMC and Citi Rewards cards – if only it were that easy!

Doesn’t UOB exclude ipaymy transactions?

UOB excludes UNI$ earning on payments with the descriptor “IPAYMY” in its credit card terms and conditions, but does not exclude ipaymy as a merchant itself.

ipaymy states that UOB cards do still earn miles, and reader reports confirm this. The exception is the UOB PRVI Miles Amex card, which does not earn UNI$ for ipaymy spend.

ipaymy is still honouring its points guarantee for payments made with UOB cards included on the provider’s full list of cards awarding points and miles for ipaymy transactions – which you can check here.

Two payment ‘methods’

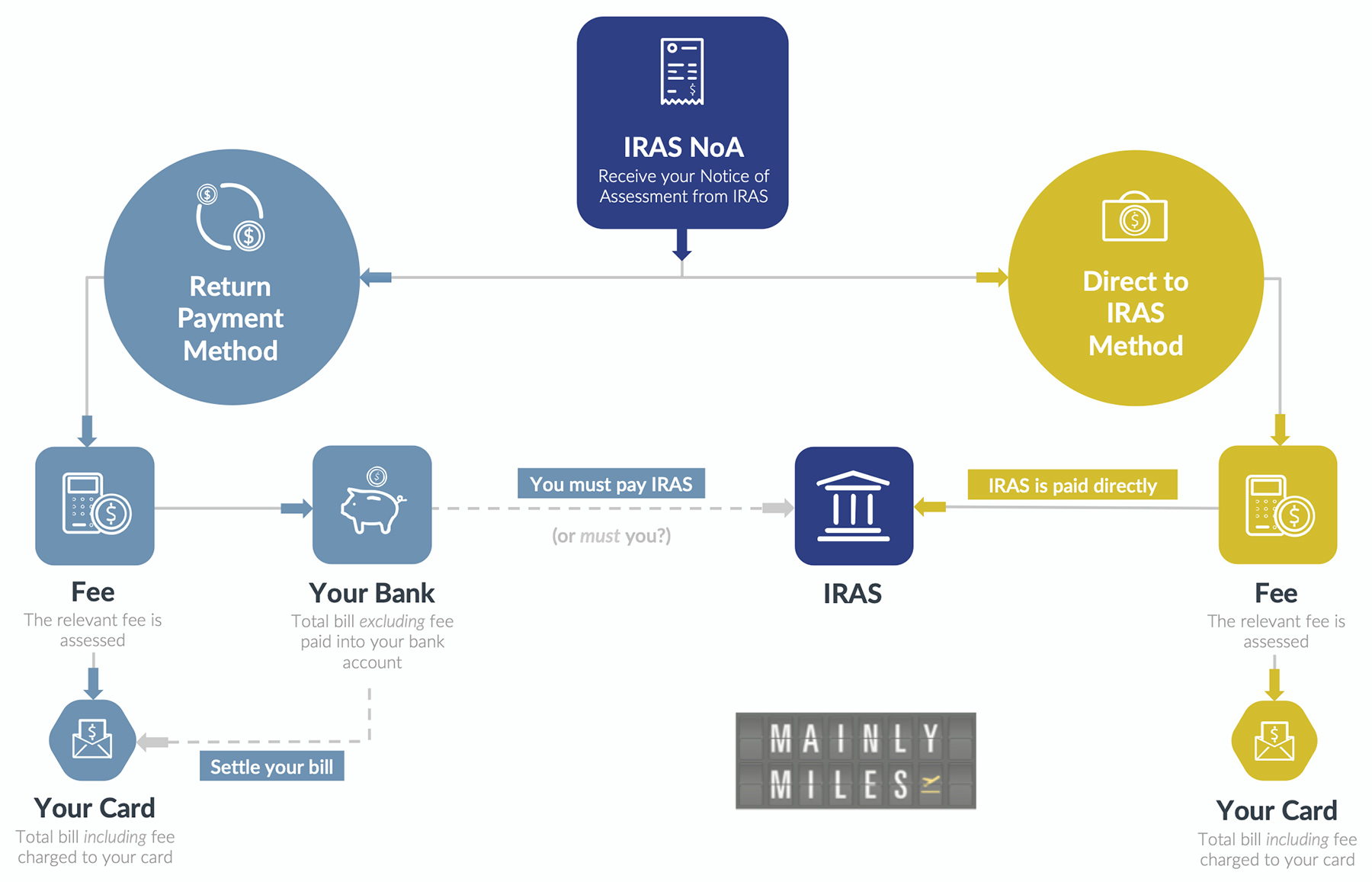

The various card payment providers may seem the same, but in fact there are two distinct ways in which they help you to settle your income tax bill.

First there is the ‘Return Payment Method’, where you produce your NoA to the supplier and they transfer the relevant amount to your bank account while charging your credit card for the same amount, plus the relevant processing fee.

Then there is the ‘Direct to IRAS Method’, where the supplier will still charge your card with your NoA balance plus the processing fee, but will settle your income tax account with IRAS directly.

Here’s a summary of which providers do what:

Return Payment Method

|

Direct to IRAS Method

|

* This method is designed for any payment with any purpose – a copy of your NoA is not required

What’s the difference, you might ask. The key difference between the ‘Return Payment Method’ and the ‘Direct to IRAS Method’ is:

- The ‘Return Payment Method’ can be completed as many times as you like (well, once per provider anyway), and also gives you the freedom to pay your tax bill by monthly GIRO, if that’s what you prefer.

You are responsible for paying IRAS, the intermediary has no knowledge of this. - The ‘Direct to IRAS Method’ is normally completed once, meaning you settle your full tax bill directly, however it can also be used to replace your monthly GIRO if you set it up to make sufficient payment around a week before the pre-arranged GIRO debit date each month.

The intermediary is responsible for paying IRAS on your behalf.

In other words you can repeat several different ‘Return Payment Methods’, but any option using the ‘Direct to IRAS Method’ is usually only used once via a lump sum payment, or can be used on a monthly basis to ‘cancel out’ your regular GIRO deduction with IRAS.

You can ‘churn’ several tax payments

This strategy lets you maximise your miles from your income tax bill by repeatedly using the ‘Return Payment Methods’ – as long as the value makes sense for you.

For example, suppose I just received a S$13,500 income tax NoA from IRAS, but I hold the following three credit cards:

- DBS Vantage

- Standard Chartered Visa Infinite

- OCBC Voyage

Looking at the tables above, from top downwards, it’s clear that the best option for settling my IRAS tax bill this year is using the DBS Vantage card via ipaymy, with the miles costing me just 1.15 cents each.

However if I want to ‘churn’ as many miles as possible, I can do the following (subject to a sufficient credit limit on each card):

- SCVI Income Tax payment through the bank

- OCBC Voyage Income Tax payment through the bank

Then finally actually settle my IRAS tax bill with:

- DBS Vantage using ipaymy

Now instead of the 20,250 miles (S$13,500 x 1.5 mpd) I would get from ipaymy – at a cost of 1.15 cpm – I will actually earn:

- 18,900 miles from SCVI (Fee S$256.50, 1.36 cpm)

- 13,500 miles from OCBC Voyage (Fee S$256.50, 1.9 cpm)

- 20,250 miles from ipaymy (Fee S$236.25, 1.15 cpm)

Total: 52,650 miles for a combined fee of S$749.25 = 1.42 cents per mile.

I’ve just earned enough miles for a Business Class saver award ticket on SIA from Singapore to Japan or South Korea (52,000 miles one-way) for less than S$750.

(Photo: MainlyMiles)

Just to put your mind at ease, there is nothing in the terms and conditions for any of the ‘Return Payment Method’ providers that prevents you from doing this, just be careful to only use a ‘Direct to IRAS’ method once (unless you’re using it to offset the monthly GIRO deduction).

Paying income tax by GIRO

As we mentioned above, if you wish to pay your income tax bill by monthly GIRO payment plan with IRAS but still earn miles on your annual bill, you’ll probably be using one of the ‘Return Payment Methods’:

- Standard Chartered Income Tax Payment

- OCBC Income Tax Payment

- UOB Payment Facility

For example you can use the Standard Chartered Income Tax Payment facility, use the money they give you to settle your credit card statement the following month, then continue with your IRAS GIRO payment plan throughout the year.

If you can take advantage of that option or a similar one, your tax payments will then be spread through the year as usual, but you’ll still have a chunk of miles from the original transaction.

However, both CardUp and ipaymy also support tax payment by monthly GIRO.

Here’s how it works for CardUp, and here’s how it works for ipaymy.

It’s also possible to use Citi PayAll to settle your GIRO tax payments. Again, be sure to arrange for each payment at least five working days in advance of your GIRO deduction date, to ensure that IRAS won’t take the regular deduction from your bank account.

Don’t forget about points flexibility

As we mention every tax season, don’t forget that some cards let you earn points that can be converted into multiple Frequent Flyer Programmes – not just the usual Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles schemes.

You can see a full breakdown of “who transfers where” at our dedicated and continually updated page here.

A good example is Citi Miles or Citi ThankYou points, which currently transfer to:

- SQ KrisFlyer

- CX Asia Miles

- BA Avios

- Turkish

- EVA Air

- Thai

- Qatar Avios

- Qantas

- KLM / Air France

- Etihad

- IHG (Hotels)

That’s a lot of added flexibility, so do consider this when making your decision.

Don’t forget about transfer blocks

If your best value income tax payment option is with a bank whose cards you don’t typically use year-round, you may find your accrued miles from an income tax payment aren’t very useful, because they fall short of one of the bank’s transfer ‘block’ sizes to airline miles.

This could leave you needing to use a less optimal card for additional spending just to reach the next transfer block – potentially at an inferior earn rate. To avoid this, ensure you’re accumulating credit card points that are both valuable and transferable in practical amounts, ideally aligning with your regular spend cards.

Summary

No one really enjoys paying their income tax bill, but 2025 is shaping up to offer another solid range of credit card options allowing you to earn miles while doing so.

This year, some NoAs – like mine – arrived unusually early. ipaymy was first to launch a promotion, offering a 1.75% fee for Visa payments and 1.99% for Mastercard and Amex. CardUp followed with a similar Visa deal and preferential rates for OCBC cardholders, though unfortunately, no offers were extended to Mastercard or Amex users.

Citi PayAll is also likely to roll out an offer – hopefully something better than last year’s somewhat complex and underwhelming deal.

(Photo: Finnair)

Your income tax payment can be one of the biggest single boosts to your miles balance each year, so do take the time to consider the options in our tables above carefully before committing to your payment method.

As always, the cost per mile – calculated above for nearly all cards and payment methods – is crucial in determining whether a deal is worthwhile. However, other factors also matter, such as the range of frequent flyer programs you can transfer into, and avoiding ‘orphan’ miles in banks you don’t normally accrue points with.

We’ll be keeping the analysis up to date as new deals come through in the weeks ahead, so do check back regularly for the latest options.

Links on Mainly Miles may pay us an affiliate commission.

(Cover Photo: IRAS)

Thanks for the highly detailed article Andrew. Do you know if the chocolate card will be a viable option for earning 2mpd for the first 1k per month of income tax payments (paired with Cardup or ipaymy)?

hi, building on this ques, would it be possible to pay the first $1k of the bill using Cardup and then pay the remainder via bank transfer/giro? Not too sure if that’s possible under the direct to IRAS method.

Great article thank you. Would you be able to expand on this section further (You can ‘churn’ several tax payments)