Income tax season is well and truly upon us again in Singapore, with around half a million residents already in receipt of their annual bill from IRAS, thanks to the rollout of the Direct Notice of Assessment (D-NoA) scheme, with others seeing their statements later this month.

Ipaymy already launched its 2025 tax payment promotion around a month ago, but CardUp has been a little later to the party this year, now announcing its its own discounted fee deal for 2025 – with a Visa card fee starting at 1.75%.

There’s also the option for selected OCBC cardholders to benefit from a 1.73% income tax payment offer via CardUp this year, driving down the cost per mile to as little as 1.06 cents each.

However, if you’re not in a rush, it may be worth waiting for one more potential offer – from Citi PayAll – which has historically provided even lower fees for tax payments in recent years.

CardUp Income tax offer (Visa)

If you schedule your 2025 income tax payment via CardUp using a Visa or UnionPay card, you’ll be eligible for the following discounted fees:

- 1.75% for a one-time payment, using the VTAX25ONE promo code

Schedule by: 23rd May 2025

Charge by: 26th May 2026 - 1.75% for a recurring payment (GIRO arrangement), using the VTAX25R promo code

Schedule by: 31st August 2025

Charge by: 25th March 2026

Maximum 11 payments (excludes first month)

Full terms and conditions for these promo codes are available here.

Cost per mile (Visa)

Here’s how the cost per mile looks for some popular Visa credit cards issued in Singapore.

Cost per mile

VTAX25ONE

VTAX25R

| Card | Mpd | Cost per mile (1.75% fee) |

Citi ULTIMA Visa Citi ULTIMA Visa |

1.6 | 1.07¢ |

DBS Insignia |

1.6 | 1.07¢ |

UOB Reserve UOB Reserve |

1.6 | 1.07¢ |

DBS Vantage |

1.5 | 1.15¢ |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.23¢ |

SC Visa Infinite SC Visa Infinite |

1.4* | 1.23¢* |

UOB VI Metal |

1.4 | 1.23¢ |

OCBC 90ºN Visa OCBC 90ºN Visa |

1.3 | 1.32¢ |

DBS Altitude Visa DBS Altitude Visa |

1.3 | 1.32¢ |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2 | 1.43¢ |

SC Journey Card SC Journey Card |

1.2 | 1.43¢ |

* For SCVI 1.4 mpd is subject to a minimum spend of S$2,000 in the same statement cycle, otherwise 1 mpd. CardUp payments do count towards the minimum.

Even with one of the widely-held 1.2 mpd cards like the SC Journey Card and Citi PremierMiles Visa options, an effective cost per mile of 1.43 cents is competitive.

For those lucky enough to have 1.6 mpd earning cards, the cost per mile drops to an excellent 1.07 cents.

If you have a large enough tax bill, that could mean earning enough miles for a one-way Singapore Airlines Business Class saver award to Tokyo (52,000 miles) for just S$558.97 in fees!

You can refer to the latest full list of cards awarding points and miles for CardUp payments here.

OCBC Voyage deal is cheaper

You may notice we didn’t include the OCBC Voyage card lineup in the cost per mile table for CardUp’s regular income tax promo code this year.

That’s because CardUp also partners specifically with OCBC, and for the 2025 income tax season is offering a slightly better 1.73% fee option for those using OCBC Voyage and Premier Visa Infinite cards to settle their bill, either as a one-time or recurring payment.

- 1.73% for a one-time or recurring income tax payment, using the OCBCTAX173 promo code

Schedule by: 31st August 2025

Charge by: 25th March 2026

Full terms and conditions for this promo code are available here.

Here’s how the cost per mile looks for these cards.

Cost per mile

OCBCTAX173

| Card | Mpd | Cost per mile (1.73% fee) |

BOS Voyage BOS VoyageOCBC PPC Voyage OCBC Premier Voyage |

1.6 | 1.06¢ |

OCBC Voyage Visa OCBC Voyage Visa |

1.3 | 1.31¢ |

OCBC Premier VI OCBC Premier VI |

1.28 | 1.33¢ |

If you’re new to CardUp – in other words you haven’t yet signed up for an account, or you have an account but have never made a payment using the service – OCBC also has a very competitive one-time 1.55% fee deal for your first payment.

This is valid for any domestic or international one-time payment of up to S$20,000 (Voyage / Premier Visa Infinite) or S$10,000 (90ºN cards), between now and 31st March 2026.

That means you could use this deal to pay your income tax if you wish, even though the promo codes are designed for all payment types. More details about these promotions is available here.

No Mastercard or Amex deals

Unfortunately CardUp is not currently offering any income tax payment deals for those using a Mastercard or American Express card in 2025.

For these cards, look at ipaymy’s 1.99% fee offer instead, with a cost per mile starting at 1.22 cents.

Income tax guide 2025

We’ve updated our comprehensive guide to paying income tax by credit card to include these latest promotions from CardUp, along with other miles-earning options available this year – such as direct bank payment methods and ipaymy deals.

How to pay

The tax payment process using CardUp is relatively straightforward, to pay your income tax bill first log on to your account and press the ‘Create Payment’ button, then select the ‘Taxes’ icon.

After that, select the first option – ‘IRAS – Income Tax’.

You then need to enter your payment amount as per the outstanding tax balance as shown in your IRAS Statement of Account, or the monthly instalment if you’re using that method, plus select (or add) the credit card you wish to use.

Don’t forget to refer to the cost per mile table above, to make sure you’re using the card with the best earn rate for this payment if you have more than one in your wallet!

Next you’ll have to select your tax due date.

Your payment reference number is automatically pulled from the NRIC number registered on your CardUp account. This prevents any erroneous payments to the wrong tax accounts not tied to your own NRIC.

Then it’s the all-important PROMO CODE, where you can enter the VTAX25ONE code or the VTAX25R code, or one of the special OCBC promo codes.

Note that the regular CardUp 2.6% fee shows initially, but once you proceed to the payment stage the discount will be reflected.

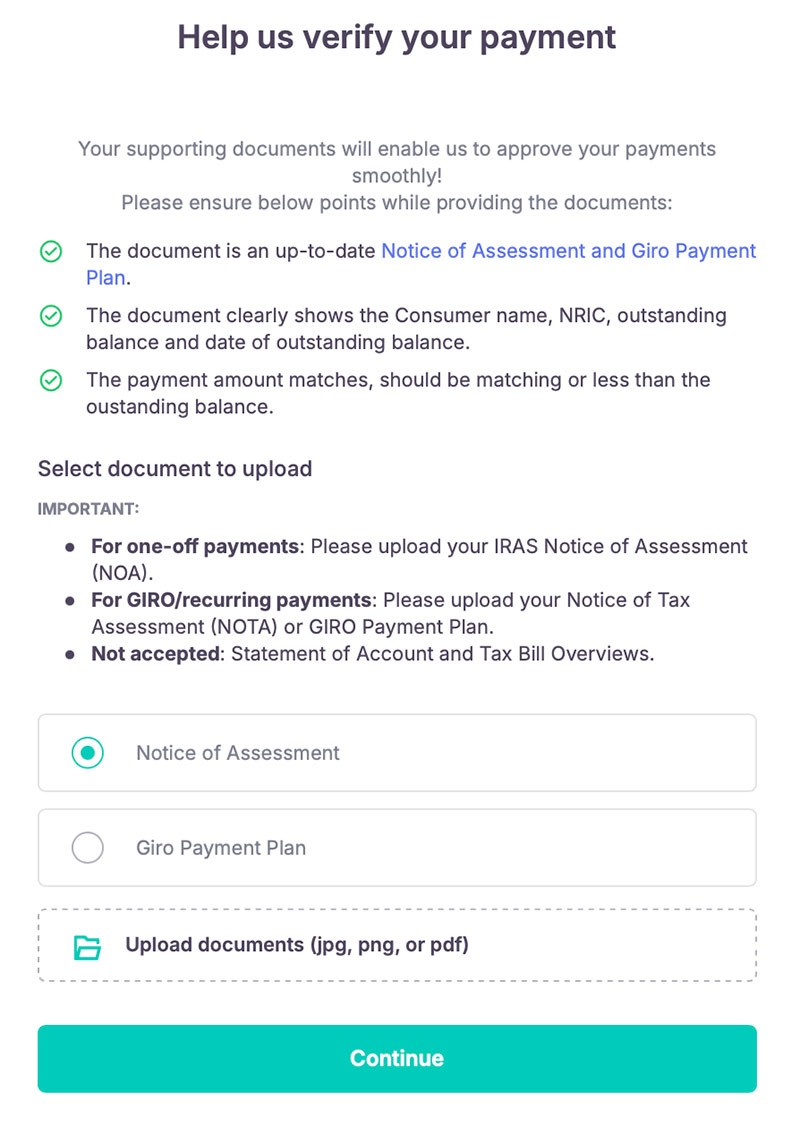

Once you click ‘Continue’, you will be required to upload an up-to-date copy of your NoA or GIRO Payment Plan, showing your Name, NRIC, outstanding balance and date of outstanding balance for CardUp to verify your payment.

You can pay the full outstanding amount, the monthly instalment, or a lower amount, but you cannot overpay your taxes, because this makes IRAS very upset.

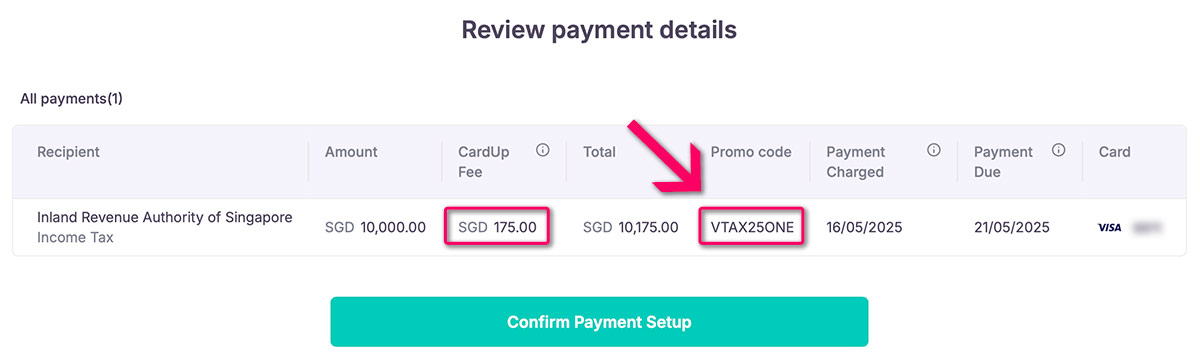

Here’s how it looks for a S$10,000 income tax payment with the VTAX25ONE code applied:

As you can see, the reduced fee of 1.75% (usually 2.6%) then applies. In the above example an income tax payment of S$10,000 now carries a fee of S$175 (1.75%) instead of S$260 (2.6%).

Monthly instalments (GIRO)

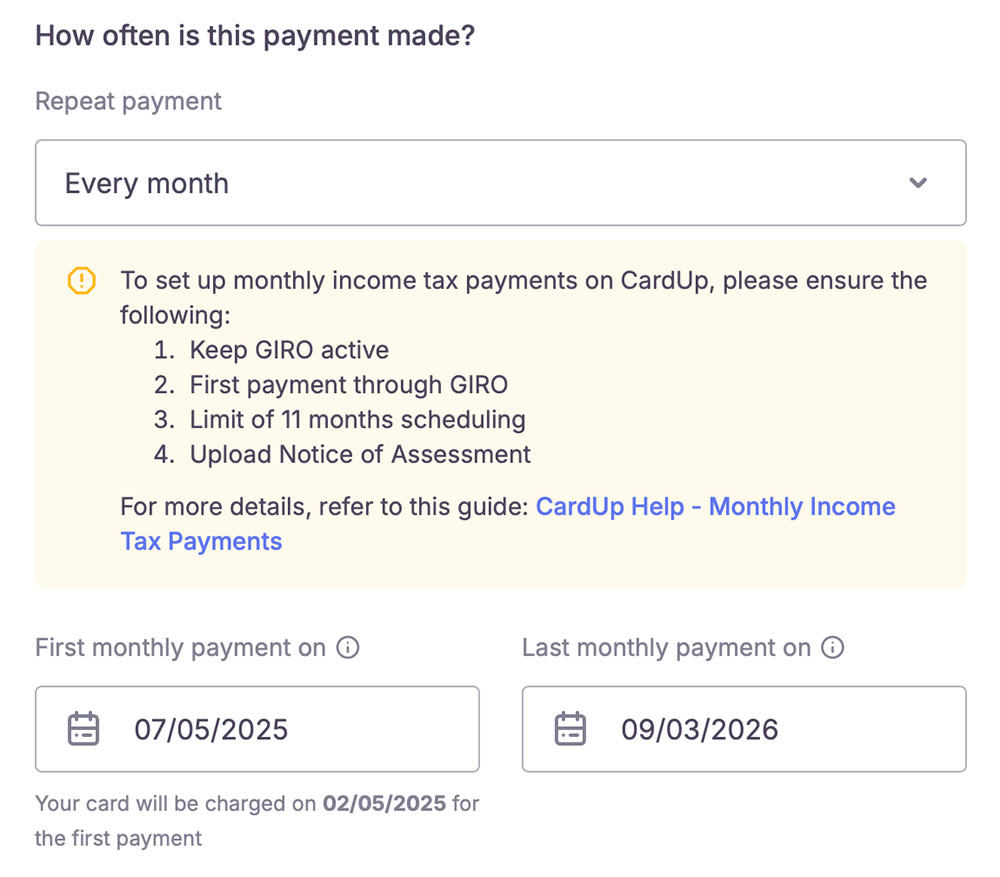

Provided you have a GIRO arrangement set up with IRAS for your income tax payment deductions, you can still use CardUp to settle the amount each month with a Visa card, using the VTAX25R discount code.

One catch this year is that CardUp is requiring you to let IRAS collect the first monthly payment via GIRO directly from your bank account. You can then only use CardUp for the remaining instalments, which means you’re limited to a maximum of 11 miles-earning payments via your credit card.

“You can only set up 11 months of payments on CardUp, not 12. This is because the first payment of each new tax cycle should be deducted through GIRO, as mandated by IRAS. This ensures that your GIRO remains active and valid.”

CardUp

This isn’t a restriction we’ve heard of before, and it’s not being enforced by ipaymy at the time of writing, but this is how it will have to be setup if you use CardUp this year, including the unfortunate loss of miles earning in your first payment month.

CardUp provides full instructions on how to pay your income tax via GIRO here, helping you ensure that the monthly CardUp payment will ‘cancel out’ the GIRO deduction from your bank account, meaning you are only charged once per instalment.

If you set up a recurring payment, you will have to include the first and last dates. Due to the strange new 11-month rule, 7th May 2025 is the earliest start date you can select this year (for June’s GIRO deduction).

Once the promo code is entered, the review stage should look something like this:

Citi cardholders should wait

If you have a Citi card, do hold off settling your income tax bill for now if you can, since a Citi PayAll promotion is likely to launch in the coming days, based on previous patterns.

In recent years, this has included the ability to buy miles for as little as 0.8 cents each for a range of payments, including income tax.

Once the 2025 deal is announced, we’ll then have a full suite of options on the table for you to choose from this year.

Summary

CardUp has launched its 2025 income tax payment promotion, matching the excellent 1.75% fee level seen in recent years for Visa cards, though sadly there’s no repeat of last year’s 1.99% Mastercard deal at this stage.

This also matches ipaymy’s rates for 2025, which were launched in early March, though CardUp does have a superior 1.73% deal for those holding selected OCBC credit cards.

The recurring payment option also has an added complication if you choose CardUp this year – your first monthly payment will have to be direct from your bank account to IRAS, earning no miles at all.

Do note that unless you need to pay quickly, it may still be worth holding off for the Citi PayAll deal to be released before you commit, since offers in recent years have included the ability to generate miles from as little as 0.8 cents each.

Links on Mainly Miles may pay us an affiliate commission.

(Cover Photo: CardUp)