HSBC has launched a new welcome promotion for its Premier Mastercard, now offering up to 106,200 miles through a two-tier reward system. Running from 19th August 2025 to 19th October 2025, this promotion is available both to new cardholders and existing HSBC customers who don’t currently hold this specific card.

As usual, to pick up this card you must be an HSBC Premier customer in Singapore – so sadly it’s not open to everyone. Also, there’s now a smaller bonus of 46,200 miles for those who are not “Premier Qualified” customers – i.e. those without a total HSBC relationship balance of S$200,000+ at the current time.

HSBC Premier Mastercard sign-up bonus

The latest welcome bonus is a purely spend-based reward, for those charging a minimum of S$5,000 to their card from account opening date to the end of the following calendar month.

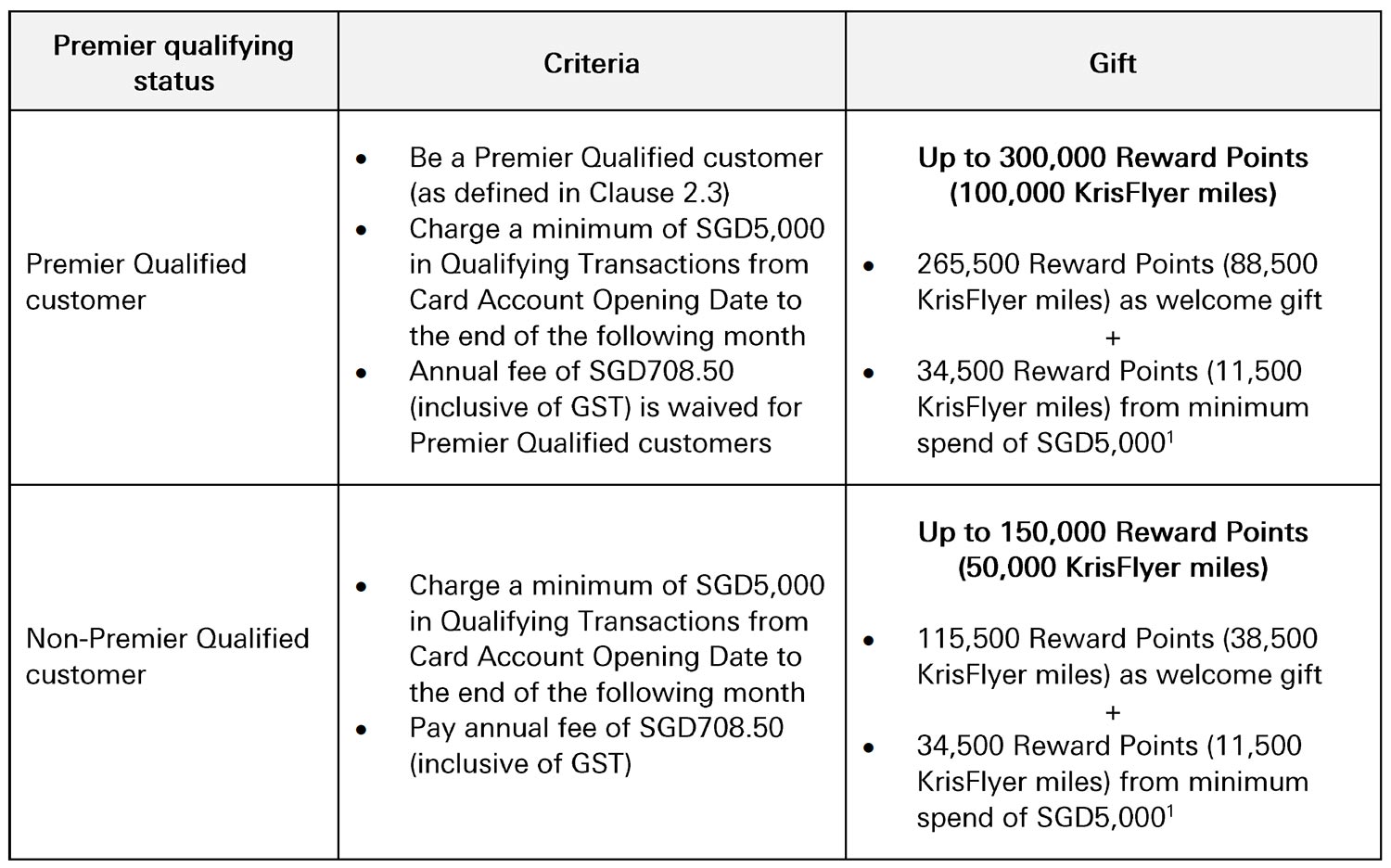

Bonus miles awarded depend on whether you are currently a “Premier Qualified” customer:

- Having a Premier relationship with HSBC; and

- Maintaining a total relationship balance of S$200,000+

If you are a Premier customer whose relationship balance has fallen below the requirement, you will be considered “Non-Premier Qualified” for the purposes of this promotion.

| HSBC Premier Mastercard Sign-Up Bonus |

|

| Customer type | Bonus |

| Premier Qualified (S$5,000+ spend) |

106,200 miles (265,500 HSBC Reward points) Annual Fee waived |

| Non-Premier Qualified (S$5,000+ spend) |

46,200 miles (115,500 HSBC points) Annual fee of S$708.50 payable |

Premier Qualified cardholders who meet the S$5,000+ spending requirement receive 106,200 bonus miles, plus base miles for the spend itself.

HSBC Premier customers in Singapore who are not Premier Qualified receive 46,200 bonus miles, plus base miles for the spend itself.

In the latter case, there’s really no point in applying for this card, since the steep S$708.50 annual fee also applies (1.53 cents per mile cost, if you put no value on the card’s other perks).

Interestingly HSBC advertises the bonus promotion based only on a KrisFlyer miles transfer – but 20% more miles are available for those transferring into the bank’s better-ratio partners like British Airways, Cathay Pacific, Air France and EVA Air.

Key promotion details

- Application period: 19th August 2025 to 19th October 2025

- Approval deadline: 2nd November 2025

- Spend qualification period: 1-2 months from card approval, depending on card account opening date

- Bonus miles fulfilment: Within 120 days of account opening

Eligibility and requirements

Eligible applicants:

- Must be HSBC Premier customers

- Must not currently hold a principal HSBC Premier Mastercard

- Must not have cancelled a principal HSBC Premier Mastercard within the past 12 months prior to approval

Application requirements:

- Consent to receive marketing materials during application

- Pay S$708.50 annual fee (waived for Premier Qualified customers)

This eligibility scope is more generous than typical HSBC promotions, which usually exclude current holders of any principal HSBC credit card.

Spending requirements and timeline

Qualifying spend periods vary by account opening date, as outlined in the following table.

| HSBC Premier Mastercard Spend Periods |

|

| Card Opening Date | Qualifying Spend Period |

| 19 – 31 Aug 2025 | Until 30 Sep 2025 |

| 1 – 30 Sep 2025 | Until 31 Oct 2025 |

| 1 – 31 Oct 2025 | Until 30 Nov 2025 |

| 1 – 2 Nov 2025 | Until 31 Dec 2025 |

This gives you 1 to 2 months to meet the minimum spend, depending on your card approval date.

Qualifying transactions include posted retail purchases, with foreign currency amounts converted at prevailing exchange rates. Standard HSBC exclusions likely apply: government services, insurance premiums, utilities, education, charitable donations, and third-party payment platforms.

HSBC Points transfer options

The welcome bonus points can be transferred to 20 airline and hotel partners, with transfer ratios significantly impacting the effective value:

= Good transfer ratio

= Lousy transfer ratio

HSBC Airline FFP Transfer Partners

| FFP | Transfer Ratio | ||

|

30,000 10,000

35,000

10,000 |

|||

|

35,000 10,000

35,000

10,000 |

|||

|

25,000 10,000

25,000

10,000 |

|||

|

30,000 10,000

30,000

10,000 |

|||

|

35,000 10,000

35,000

10,000 |

|||

|

35,000 10,000

35,000

10,000 |

|||

|

25,000 10,000

25,000

10,000 |

|||

|

25,000 10,000

25,000

10,000 |

|||

|

50,000 10,000

50,000

10,000 |

|||

|

25,000 10,000

25,000

10,000 |

|||

|

35,000 10,000

35,000

10,000 |

|||

|

25,000 10,000

25,000

10,000 |

|||

|

25,000 10,000

25,000

10,000 |

|||

|

25,000 20,000

25,000

20,000 |

|||

|

25,000 10,000

25,000

10,000 |

|||

|

35,000 10,000

35,000

10,000 |

|||

As you can see some of these options fall into our ‘lousy’ category due to their adverse transfer ratios, which effectively reduce the ‘advertised’ miles per dollar earn rate of your card compared to a 2.5:1 partner – like Asia Miles.

HSBC Hotel Transfer Partners

| FFP | Transfer Ratio | ||

|

25,000 5,000

25,000

5,000 |

|||

|

25,000 10,000

25,000

10,000 |

|||

|

25,000 10,000

25,000

10,000 |

|||

|

30,000 10,000

30,000

10,000 |

|||

In all cases the transfer ratios shown in the tables above represent the minimum transfer of HSBC Reward points to loyalty programme miles or points – after that it’s flexible.

Transfer logistics are as follows:

- Processed instantly via HSBC Singapore app (exceptions: Hainan within 5 working days, JAL within 10 working days)

- No transfer fees

- Minimum 10,000 miles / points, then increments of 2 miles / 1 point

- Points pool across all your HSBC cards

Value depends on your chosen partner

For cardholders spending S$5,000 in local currency, total miles earned reach 114,600:

- Sign-up bonus: Up to 106,200 miles

- Base earning: Up to 8,400 miles (at 1.68 mpd)

A recent revamp of the HSBC Premier Mastercard has seen its earn rates improve significantly. However, the effective value depends heavily on transfer partner choice.

You aren’t really getting the card’s ‘full’ earn rates if you transfer to some partners.

Effective mpd rates by FFP partner

| Partner Ratio |

HSBC Premier MC HSBC Premier MC |

||||

| Local Spend |

FCY Spend* |

||||

| 2.5:1 | 1.68 mpd | 2.76 mpd | |||

| 3:1 | 1.4 mpd | 2.3 mpd | |||

| 3.5:1 | 1.2 mpd | 1.97 mpd | |||

| 5:1 | 0.84 mpd | 1.38 mpd | |||

Using the most favourable 25,000:10,000 ratios (e.g. British Airways Avios, Cathay Pacific Asia Miles), the full 106,200 bonus miles value as a Premier Qualified customer is realised.

Less favourable ratios reduce the effective earning accordingly – for KrisFlyer it’s 88,500 bonus miles, for example, if you’re a Premier Qualified customer.

Card overview and benefits

Here’s a quick overview of the HSBC Premier Mastercard, for those not familiar.

| Fast Facts

Annual fee: S$708.50 (waived for Premier Qualified customers) |

| Up to 106,200 miles when you spend APPLY HERE |

* Assuming you transfer points to a 2.5:1 ratio partner

One of the primary perks of the card are its World Elite Mastercard benefits and latest perks improvement, which comprise:

Lounge access: Unlimited Priority Pass visits including up to three supplementary cardholders

Airport transfers: Two quarterly limo transfers with S$12,000 quarterly spend (no min. spend for Premier Elite members

Elite status programmes:

- Hotels: Langham Ruby, Centara Platinum, GHA Titanium, IPrefer Titanium, Millennium Prestige, ONYX Platinum

- Car rental: Avis President’s Club

Additional perks: 3GB annual Flexiroam data, HoteLux Elite Plus membership, complimentary golf, travel insurance, restaurant reservations.

Terms and conditions

Full terms and conditions for this sign-up bonus are available here.

Summary

This latest sign-up promotion for the HSBC Premier Mastercard represents a significant improvement over previous iterations, with up to 106,200 bonus miles for Premier Qualified customers.

The two-tier gift structure then accommodates those who are HSBC Premier customers but don’t currently have Premier Qualified status, with 46,200 bonus miles on offer – though the annual fee is also payable in this case.

It’s also worth noting that KrisFlyer now falls into HSBC’s 3:1 transfer ratio partner list – so the maximum bonus if you’re transferring into that programme is 88,500 miles.

HSBC Premier customers should definitely consider this offer against their spending patterns and preferred loyalty programmes.

The combination of this competitive welcome bonus, recent card earn rate improvements and comprehensive World Elite benefits really make this a decent proposition – while the sign-up bonus is generous, at least if you’re “Premier Qualified”.