Citi’s ‘PayAll’ facility is back with another of its promotional offers for eligible cardholders over the next few months, allowing you to settle a range of bills or invoices with your Citi credit card and ‘buy’ miles from 1.31 cents each, though this is less generous than recent deals.

This time, instead of boosting miles earn rates, Citi is cutting its usual 2.6% PayAll fee, but the 0.5% rebate will only hit your card by mid-May 2026.

Nonetheless, these promotions can still make sense for expenses where the merchant or service provider does not necessarily accept credit cards as a payment method, and like similar offers before it this latest one covers all payment types.

Citi has a range of options for its PayAll programme, including tax, insurance, charity and transport payments, not to mention payments to friends or family members for ‘services rendered’, given that the bank doesn’t request evidence of your payment.

0.5% fee rebate offer

Between 18th November 2025 and 28th February 2026, Citi is offering eligible cardholders the option to earn 0.5% fee rebate on for up to S$150,000 spend using PayAll.

Your minimum aggregate total spend using the service during the period (regardless of the number of transactions) must be at least S$6,000 on a single eligible card, to trigger the reduced fee on all S$1 – S$150,000 processed, again on a single eligible card.

Note that Citi advertises this deal as “up to 0.6% cash rebate”, but that’s not realistic for most of our readers who will benefit only from 0.5% back, as we’ll cover later.

Eligible cards are:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Rewards Card

Offer details

With one of the eligible Citi cards, you’ll pay 2.1% on PayAll transactions instead of the usual 2.6%, as long as your total spend on a single card exceeds S$6,000 between now and 28th February 2026.

There’s no need to set up recurring payments or meet a minimum / maximum number of transactions. Provided you hit S$6,000+ total spend across multiple payments on a single card – you’re included.

The upper limit for fee rebate is a generous S$150,000 spend per customer.

The reduced fee and the new cost per mile are as follows for the miles-earning eligible cards in the promotion:

| Card | Earn rate Fee |

Cost per mile |

Citi ULTIMA Citi ULTIMA |

1.6 mpd 2.1% |

1.31¢ |

Citi Prestige Citi PrestigeAPPLY |

1.3 mpd 2.1% |

1.62¢ |

Citi PremierMiles Citi PremierMilesAPPLY |

1.2 mpd 2.1% |

1.75¢ |

Citi Rewards Citi RewardsAPPLY |

0.4 mpd 2.1% |

5.25¢ |

Note that to qualify for the promotion, your Citi PayAll Payment set-up date(s) must fall within the promotion period of 18th November 2025 to 28th February 2026. The successful charge date must be on or before 5th March 2026.

If you set up any payments recently that haven’t been processed yet, but which will fall in the promotion window, you’ll need to cancel them and set them up again for the amount to qualify towards the minimum spend, and for the 2.1% fee deal.

Full terms and conditions for this promotion, which includes some payment illustrations, can be found here.

If you’re planning to be a big spender on PayAll during this promotion and you hold more than one Citi card (for example the PremierMiles and a Citi Rewards card), do also note that the S$150,000 total transaction limit is per customer, not per card, so unfortunately you can’t double your cap.

You can set up PayAll payments via the Citi Mobile App, by clicking the ‘Payments’ icon.

Do note that the reduced fee will not reflect at the confirmation stage, since the 0.5% rebate for that will come in later than the base points (and remains subject to the minimum aggregate spend condition).

Is it a good deal?

This could be a good way to settle large expenses at a cost per mile of 1.31 cents with the Citi ULTIMA card or 1.62 cents with the Prestige card, though it’s a bit more marginal for the PremierMiles product which earns only 1.2 mpd locally, and it’s definitely a bad deal for the Citi Rewards card (0.4 mpd)!

However, do be aware this doesn’t always beat rates offered by card payment providers like CardUp and ipaymy.

For example, if you have a DBS Vantage card earning 1.5 mpd you can pay bills, taxes or other invoices via CardUp at a cost per mile of 1.47 cents, at a 2.25% fee (promo code GET225) – better than using the Citi Prestige card under this PayAll offer.

Those with a Citi ULTIMA card can get an even better rate of 1.38 cents per mile with CardUp, a slightly higher purchase cost than this PayAll deal but without the need to wait up to six months for any fee rebate.

In a 2023 offer, PayAll was offering a 1.8 mpd earn rate for these cards, which combined with its lower 2.2% fee meant buying miles at a much more competitive 1.22 cents each.

This time round it’s potentially a more marginal proposition.

Just use one card during this promotion

Remember only PayAll spend on a single card counts for fee rebate earning during this promotion.

For example, if you make S$10,000 of PayAll payments using your Citi PremierMiles card and S$9,000 of PayAll payments using your Citi Prestige card during the promotion, only the card with the most accumulated spend will benefit from the 2.1% fee, in this case the PremierMiles card, despite the minimum spend having been met on both cards.

It’s therefore important to choose (and stick to) a single card for PayAll payments from now until the end of February 2026, if you’re participating in this promotion.

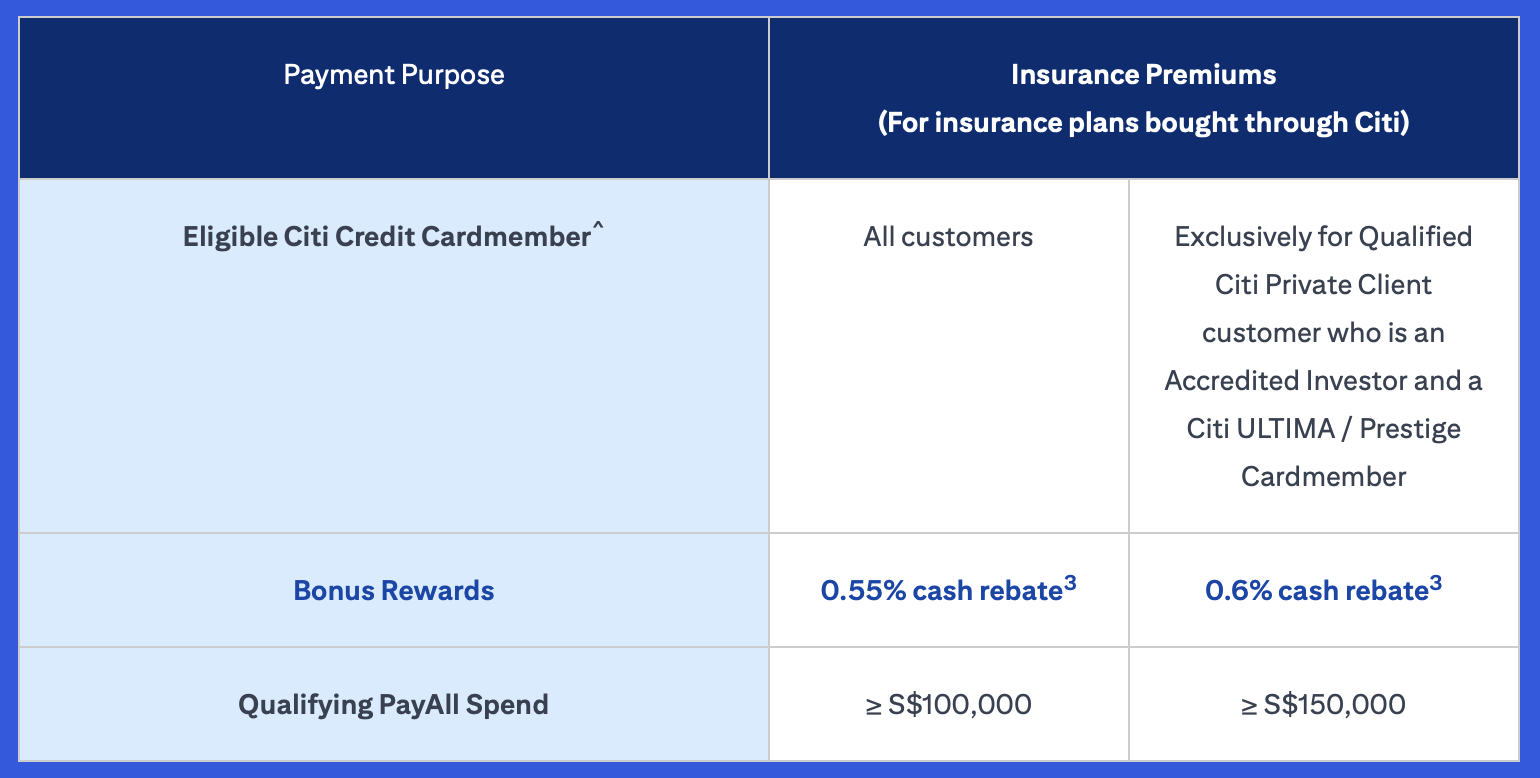

The “enhanced” 0.55% and 0.6% rebate on Citi insurance

Citi is also offering higher bonus rebates of 0.55% or 0.6% on payments as part of this PayAll deal for its own insurance plans.

However, these deals come with very high minimum spend requirements – for example, at least S$100,000 in fee-paid PayAll transactions to qualify for the 0.55% tier, or S$150,000 plus Citigold Private Client and Accredited Investor status for the 0.6% tier.

The fee rebate limit increases to S$400,000 under these deals, but for most of our readers the spend thresholds are simply too high to be practical.

Buying Citi’s own insurance policies if you spend less than S$100,000 during this deal, or any other provider’s insurance payments via PayAll, will instead earn the standard 0.5% rebate, which is the focus of this article.

When is the fee rebate credited?

Initially you’ll pay the regular full 2.6% fee for Citi PayAll payments made during the promotion period.

The 0.5% fee rebate will be credited to your card account within 12 weeks from the end of the promotion period, which is by 23rd May 2026.

That’s a heck of a long wait for the cashback – over six months from now – and as usual is the major downside of Citi PayAll promotions.

Citi Miles / TYP are very flexible

One of the best things about Citi Miles (and Citi ThankYou points like you earn with the Prestige or Rewards card) in Singapore is the wide range of transfer partners compared with other bank loyalty points.

You can transfer your miles into 10 different frequent flyer programmes and on the hotel side into IHG points.

Here’s how Citi compares to other banks in Singapore.

Singapore credit card transfer list

to FFP and hotel partners

Our comprehensive guide also gives examples of some of the alliance and partner airline redemptions you can achieve that you might not have considered before.

As you can see from the table above, Citi gives you a wide range of flight redemption options including Oneworld and SkyTeam carriers.

(Photo: Qatar Airways)

We’ve personally transferred Citi Miles into British Airways Avios (for good value intra-Asia Cathay Pacific redemptions) and Asia Miles (for the Qatar Airways Qsuite to Europe), but Turkish Airlines and the Qatar Privilege Club are also great options.

Summary

If you’re a Citi customer with one of the eligible cards for this promotion, then you may wish to consider this PayAll deal between now and the end of February 2026 if you have sufficient spend to make, including the likes of a large tax or insurance bill.

Unfortunately 1.31 cents per mile isn’t as attractive as 2023’s offer, but it’s still a competitive rate to buy miles, the promotion mechanics are relatively simple, and the upper cap at S$150,000 is generous.

Nonetheless you may achieve a lower cost per mile with the likes of CardUp and ipaymy, depending on which cards you hold – even with some Citi cards.

Unfortunately a minimum spend of S$6,000 applies to trigger this PayAll fee rebate, but if you have enough aggregate payments to make over the next few months that may be achievable. Just remember to use a single card for all PayAll transactions, and be patient – the rebate may not credit to your card account until May next year!

(Cover Photo: Shutterstock)