If you’ve ever needed to top up your Asia Miles balance at short notice to lock in an award redemption, you’ll know the frustration all too well. You have the credit card points sitting there, ready to go, but the transfer often takes days – and by the time your miles arrive, if you’re unlucky, the seats have vanished into the ether.

Well, here’s some good news: Citi Miles and Citi ThankYou Points to Asia Miles transfers are now instant in Singapore.

The slow world of miles transfers

Transfers to Asia Miles are available from most major bank and credit card loyalty programmes in Singapore (Bank of China is the notable exception), but here’s the thing – these transfers were never instant.

That is until HSBC launched instant transfers to all 21 of its loyalty partners across its Singapore credit cards back in May 2024. The bank deserves credit for this move, and with no transfer fee to boot. The only exceptions were three more obscure programmes that most of our readers don’t bother with anyway.

OCBC also offers instant transfers to its non-KrisFlyer programmes, but in many cases like Cathay Asia Miles and British Airways Avios points, the conversion ratio is lousy and not worth considering – for Asia Miles you take a 27.5% haircut on your stash versus a (non-instant) KrisFlyer transfer.

For everyone else, the waiting game has continued.

DBS, for example, takes about a week to move your DBS Points across to Asia Miles. UOB? Bank on 3 days as a minimum. Citi was always one of the quicker options at 1 to 2 business days, even before HSBC and OCBC went instant, but “quick” is still not the same as “instant”.

The tip-off from a reader

Earlier this month, one of our readers got in touch to report that their Citi points to Asia Miles transfer had been absolutely instant. I was surprised to hear this but surmised it could be a one-off lucky event – perhaps they’d caught the ‘system’ at just the right moment?

In our recent experience in late 2025, a couple of days was the norm. Still, I made a mental note to test this myself at an appropriate time.

That time came sooner than expected.

Testing the theory – a BA Business Class redemption

Recently, we made a (perhaps stupidly late) decision to head to Australia and visit family there during the Chinese New Year break. And when I say late – we only decided this week!

We’ve already got an Economy cash outbound ticket from Singapore locked in, but I’ve been searching for a good return option.

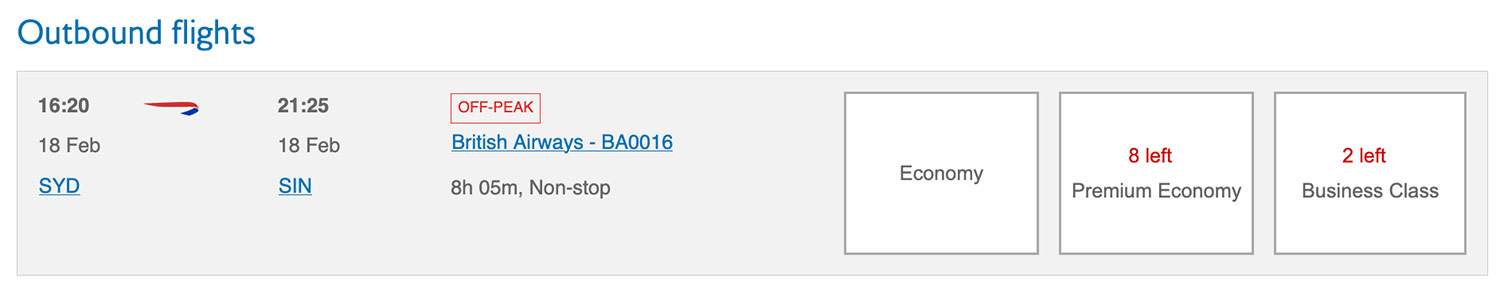

Surprisingly, I saw that British Airways had Club Suite Business Class availability for two passengers right at the end of the CNY period on its daily Sydney to Singapore “fifth freedom” flight (the plane continues to London, but passengers don’t have to).

I decided we needed to jump on this right away, as a comfortable way to get home using miles.

Now let’s be honest, BA’s surcharges are high.

We’re looking at S$320 each in taxes and fees on top of the miles outlay. But this is a rare Business Class award during a peak travel period, so I wasn’t about to let it slip away.

Avios wasn’t the answer

Here’s where it gets interesting from a miles perspective.

Following the recent British Airways Avios devaluation, BA, Qatar Airways and Finnair programmes now all charge 88,000 Avios for this one-way Business Class flight on BA from Sydney to Singapore (up 10% from 80,000 Avios).

Asia Miles, however, still has this route in its 63,000 miles partner redemption zone – a far more palatable option, even though there’s no escaping those carrier surcharges.

For comparison, Singapore Airlines wants 72,000 KrisFlyer miles for a Saver Business redemption on this route, but that’s academic anyway – on the day we’re flying back only Access rates are available on some SQ flights, at a painful 129,500 KrisFlyer miles each.

With the BA option using Asia Miles, we’re looking at 126,000 miles for both of us. That’s a happy redemption in my book, even with the fees to stomach, for a peak period Business Class award on an 8-hour flight.

It’s also in BA’s new(ish) Club Suite Business Class – which I recently tried out on a work trip from Houston to London, and was pleasantly surprised by.

The problem – not enough Asia Miles

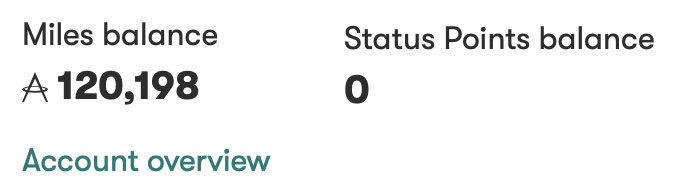

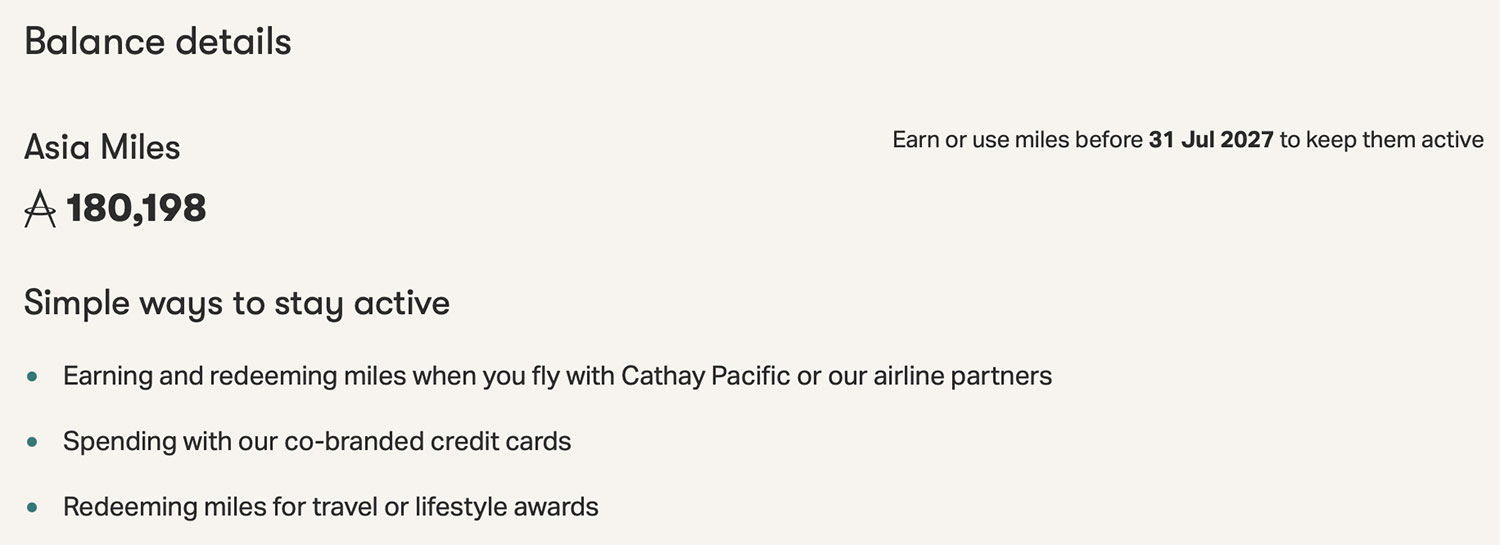

There was just one snag. Eddie currently has a rather insignificant Asia Miles balance, and mine sat at 120,198 miles – not the 126,000 needed to lock in this award for us both.

Cathay Pacific was happy to sell me the additional miles needed for the booking (up to 50% of the required amount can be purchased), but the rate is eye-watering. For the extra 6,000 miles I needed to make this work instantly, the damage would be US$180 (around S$228).

That works out to a horrifying 3.8 Singapore cents per mile. Outrageous, except for a very small amount in an emergency – perhaps.

Then I remembered what our reader had reported just a few weeks ago – Citi to Asia Miles transfers are apparently now instant. Or at least, one transfer was – for him.

The test – Citi ThankYou Points

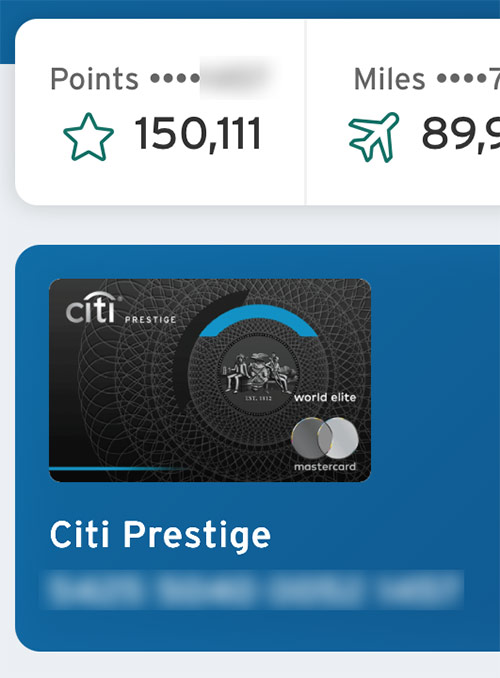

Luckily, I’m now in the market to cash out Citi ThankYou Points from my Prestige card, since I’m cancelling it soon. With 150,111 points sitting in the account, that works out as a nice 60,000-mile block to move into a frequent flyer programme – albeit with a S$27.25 transfer fee.

I had originally intended to move these across to KrisFlyer in early February (giving me three-year validity to the end of February 2029) prior to card cancellation, but I decided – what the hell? Let’s move them into Asia Miles instead, which then fixes this redemption, and also tests the theory.

Is it really instant now?

The result – instant!

Well, the title of this article means you won’t be too surprised at the answer, but I was genuinely impressed – our reader was right.

Just seconds after completing the transfer via the Citi app, I refreshed my Asia Miles account screen and voilà, the miles were there. 180,198 miles now sat in my account.

This wasn’t an ‘office hours’ transfer either – it was initiated after 11pm Singapore Time.

Even the latest transactions page on my Asia Miles account makes no bones about it. Against the 60,000 miles credit, it proudly proclaims: “CB SINGAPORE INSTANT”.

Why does this matter?

For me, it meant I could lock in this Business Class award redemption right away, without worrying that one or both seats might disappear during the usual transfer window. And of course, I avoided that expensive S$228 alternative of “buying” the very pricey small Asia Miles shortfall.

But for many readers, there’s another great benefit here: extending your miles expiry at short notice.

Unlike KrisFlyer’s fixed three-year expiry from the month of earning, Asia Miles operates on an activity-based expiry system. Any earning or redemption activity, no matter how small, resets your entire balance for another 18 months.

If you have no activity on your account for 18 months though, there’s a problem – you lose the lot.

Now, we would never recommend deliberately allowing your Asia Miles account to get uncomfortably close to this 18-month limit (assuming you actually want to use your remaining Asia Miles balance in future).

But if you find yourself very close to expiry, a transfer from Citi is now a great way to recharge your entire stash for a fresh 18 months – right up to expiry day itself, if you’ve let it come to that.

The wider point – this should be normal in 2026

It’s kind of silly that for frequent flyer programme transfers, where the name on the destination account matches that of your bank’s own records, we’re still waiting days and weeks in some cases for points transfers to complete.

All the more galling when we’re often paying S$25 to S$31 a pop for the privilege. The cost banks actually incur for these transfers is likely minuscule in comparison.

So let’s celebrate this small win. Yes, HSBC deserves credit for instant transfers almost across the board since 2024, and with no fee to boot.

OCBC also needs a mention here – instant transfers yes, but not for its popular KrisFlyer option and many other useful partners have diluted transfer ratios – especially Asia Miles where you take a whopping 27.5% haircut compared to KrisFlyer (why would you?).

Other banks in Singapore are still quite happy with slow transfers and hefty “junk” fees for conversion that bear little resemblance to their actual costs (UOB recently increased its own fee!).

Good for Citi here, getting this working instantly for Asia Miles at least. For Citi’s other partners, and for other banks, let’s see some similar progress… please!

Summary

Citi to Asia Miles transfers in Singapore are now instant, and thanks to an initial reader heads-up and some imminent travel plans on our side, it’s now tested and confirmed.

Whether you’re chasing a rare award seat or need to extend your Asia Miles balance expiry at the last minute, this development removes a genuine pain point – for a popular bank and a popular FFP.

The S$27.25 fee still stings when HSBC does it for free, but instant beats waiting. Now if only DBS, UOB and the others would take note – it’s 2026 not 1996.

(Cover Photo: David Syphers)

Congrats on the win. I’m just curious why you are cancelling the Prestige card. Because I’m also on the verge of doing so.

I did it on 31st Dec quite last min to qualify for promotion, and didn’t know Citibank took ages but I transferred and it was almost instant.

tried today and it was immediate too, great!

Good to hear!