It’s that time of year again when the Notice of Assessment from IRAS arrives, outlining your income tax owed from earnings in 2023, though as always there’s some light at the end of the tunnel – the option to pay by credit card and earn potentially thousands of points or miles in the process.

Card payments platform ipaymy has launched its 2024 income tax payment offer, allowing both new and existing users to pay a competitive fee of 1.75% for these payments, the same popular rate it has offered during tax seasons over recent years.

A rate of 1.75% represents a 22% discount on the usual 2.25% fee when you use your credit card to pay bills using ipaymy.

The offer

If you use ipaymy to pay your income tax bill between now and 31st August 2024, you’ll be eligible for the discounted fee using the TAX2024 promo code.

TAX2024

The offer is subject to the following terms and conditions:

- One-time or recurring payments to IRAS

- Charge date is on or before 31st August 2024

- One use per account

- Valid for any Singapore-issued Visa card

There is no upper cap on the tax amount paid under this promotion, however if you have a particularly large tax payment to make, do contact the ipaymy team via support@ipaymy.com for a special concession rate.

The offer is available to both new and existing ipaymy personal account holders. Simply use the promo code TAX2024 at the ‘Payment Details’ stage.

| TAX2024 | 1.75% | |||

| One-time or recurring IRAS income tax payment with a Singapore-issued Visa card | ||||

Cost per mile

Here’s how the all-important cost per mile looks for some popular Visa credit cards issued in Singapore.

You can refer to the latest full list of cards awarding points and miles for ipaymy transactions here.

Cost per mile – TAX2024

| Card | Mpd | Cost per mile (1.75% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.07¢ |

DBS Insignia |

1.6 | 1.07¢ |

UOB Reserve UOB Reserve |

1.6 | 1.07¢ |

DBS Vantage |

1.5 | 1.15¢ |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.23¢ |

SC Visa Infinite SC Visa Infinite |

1.4* | 1.23¢* |

UOB VI Metal |

1.4 | 1.23¢ |

OCBC 90ºN Visa OCBC 90ºN Visa |

1.3 | 1.32¢ |

OCBC Voyage Visa OCBC Voyage Visa |

1.3 | 1.32¢ |

DBS Altitude Visa DBS Altitude Visa |

1.3 | 1.32¢ |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2 | 1.43¢ |

SC Journey Card SC Journey Card |

1.2 | 1.43¢ |

* 1.4 mpd subject to a minimum spend of S$2,000 in the same statement cycle, otherwise 1 mpd. ipaymy payments do count towards the minimum.

As you can see even with one of the widely-held 1.2 mpd cards like the SC Journey Card and Citi PremierMiles options, an effective cost per mile of 1.43 cents is competitive.

For those lucky enough to have 1.6 mpd earning cards, the cost per mile drops to an excellent 1.07 cents.

Note: UOB excludes UNI$ earning on payments with the descriptor “IPAYMY” in its credit card T&Cs, but does not exclude ipaymy as a merchant itself. ipaymy states that UOB cards do still earn miles, and reader reports confirm this. ipaymy is still honouring its points guarantee for payments made with UOB cards.Calculation

One of the common questions we are asked regarding ipaymy is why the cost per mile isn’t simply the fee divided by the earn rate (e.g. 1.75% ÷ 1.4 mpd = 1.25 cents per mile).

The reason is that you will earn miles on the fee itself as well as the due amount when you make a payment through ipaymy, which gives you slightly more miles than you might have expected.

Here’s an example using the DBS Vantage Visa for an income tax payment under this offer:

- S$10,810 payment

- 1.75% fee = S$189

- Fund safeguarding fee = S$1

- ipaymy charges your card S$11,000 (S$10,811 + S$190)

- DBS awards 8,250 DBS Points (= 16,500 miles)

Cost per mile is S$190 ÷ 16,500 miles = 1.15 cents per mile

How to pay

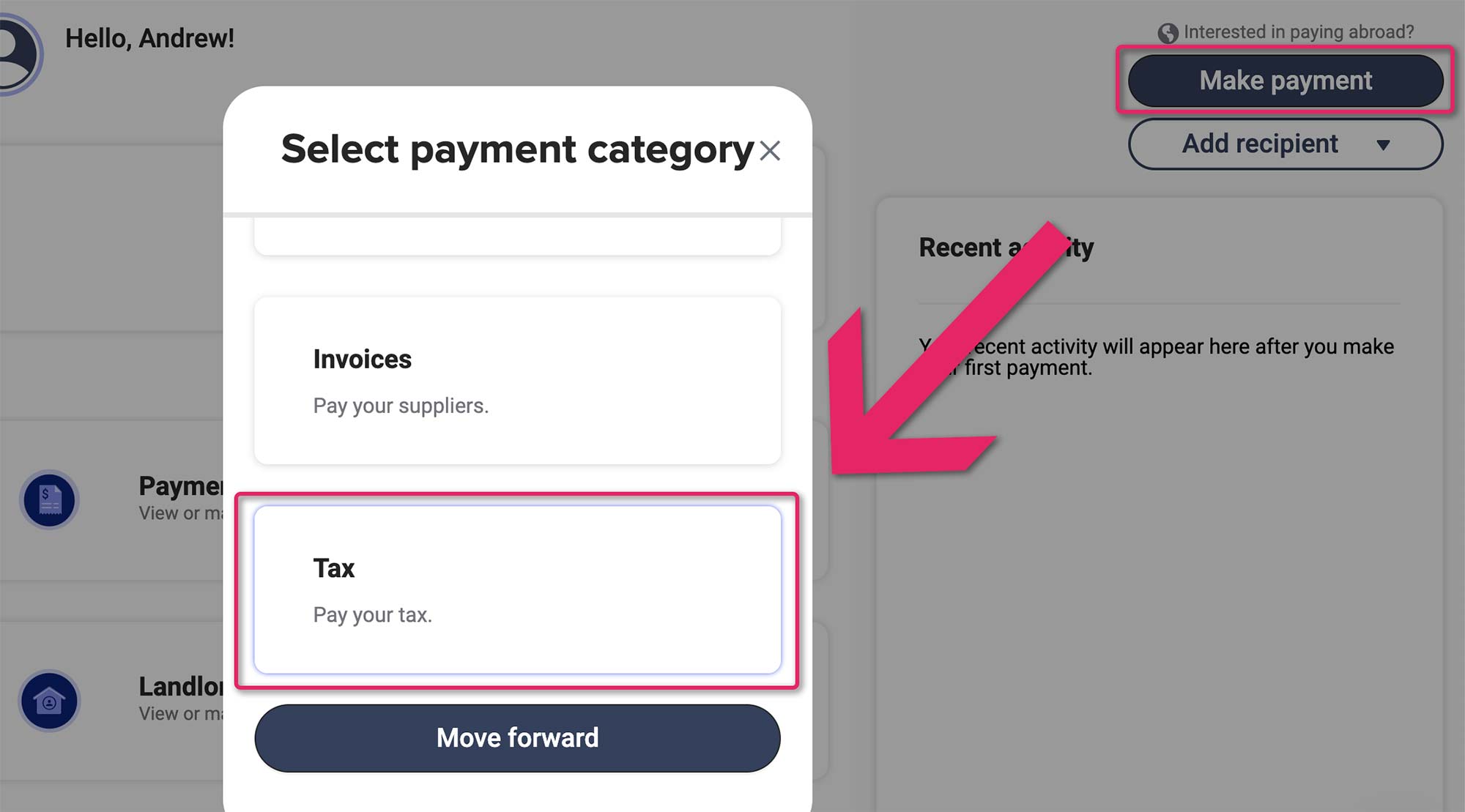

Once you’re logged on to ipaymy you’ll be presented with the ‘Dashboard’ screen. To set up your income tax payment, click ‘Make payment’ in the top right, then select ‘Tax’.

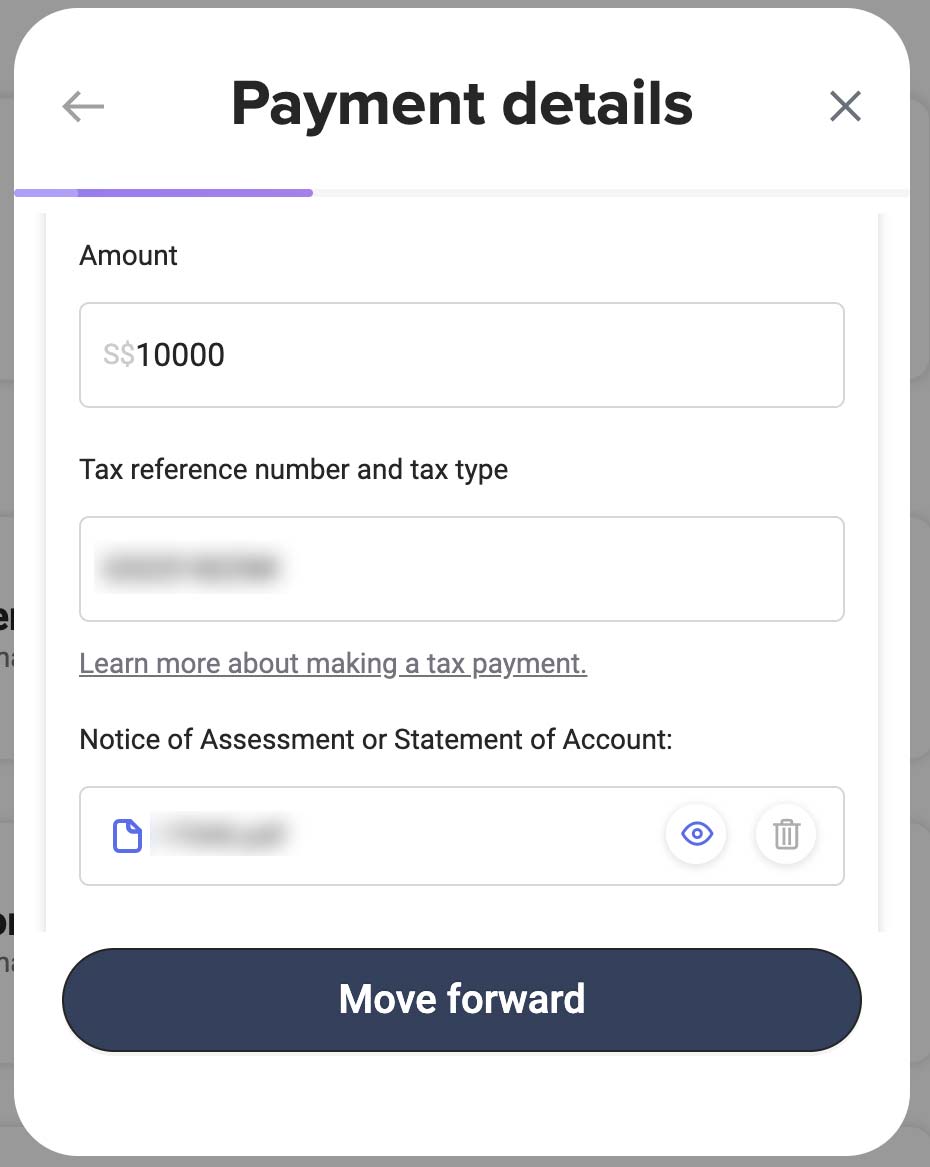

You’ll then be asked to enter the details for your tax bill. These should match your IRAS Notice of Assessment (NoA), which you’ll also have to upload as a PDF or scanned copy.

Tip: You can download a PDF version of your IRAS NoA once it’s published, by logging on to the IRAS myTax Portal using SingPass.

Next you’ll choose your payment date, but bear in mind that your card will be charged a few days earlier as shown on the calendar presentation.

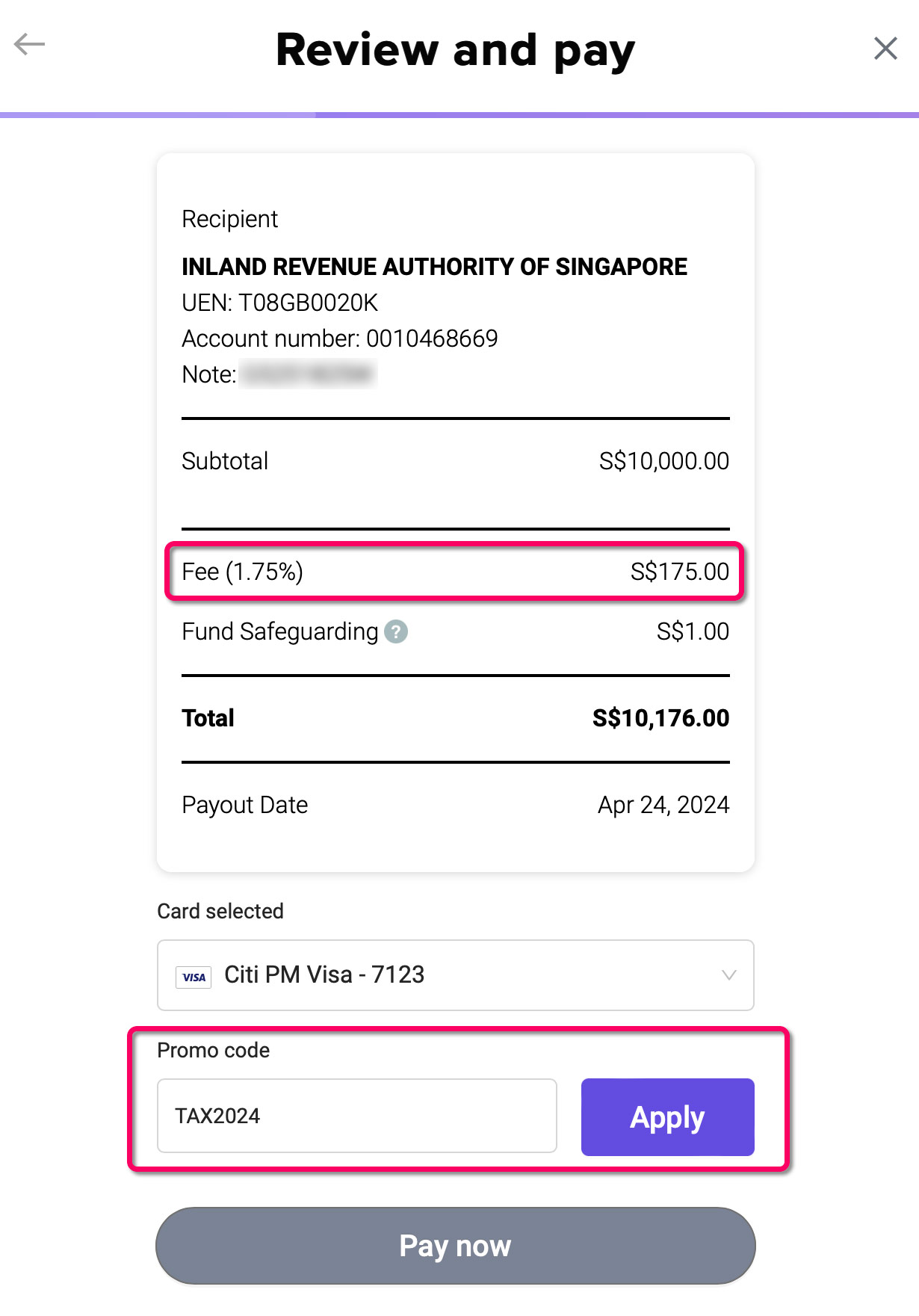

At the Payment Details screen, you’ll select which saved credit card you wish to use, then the regular ipaymy fee of 2.25% will be displayed.

Here’s where you’ll enter the TAX2024 promo code.

Once applied, you will see the fee drop from 2.25% to 1.75%. In this example an income tax payment of S$10,000 now carries a fee of S$175 (1.75%) instead of S$225 (2.25%).

Note that ipaymy now adds a S$1 surcharge to the fee payable for ‘Fund Safeguarding’, which ensures your funds are protected and held in a segregated safeguarded account. For smaller payments, this does adversely affect the cost per mile.

You can still pay by GIRO

For some time, ipaymy has been supporting monthly payments to IRAS, provided you have a GIRO arrangement set up and you schedule your recurring payments at least five working days prior to the IRAS GIRO debit date each month.

That’s because if you settle the monthly deduction before it falls due, IRAS then won’t take the payment from your bank account that month, because it knows your account is up to date (however, you must keep the GIRO arrangement in place, otherwise IRAS will demand full payment of your outstanding tax).

Good news is you can also use the TAX2024 promo code when setting up these recurring payments to IRAS. When scheduling the payment, simply choose the recurring monthly option and enter the first payment date and the last payment date, in accordance with your GIRO plan.

These payout dates are the dates your payment will reach IRAS each month, but again do ensure they are at least five working days ahead of your regular monthly payment date (which is on the 6th of each month), in order to ‘cancel out’ the GIRO from your bank account to IRAS for that month.

AMEX payments for 2.25% fee

ipaymy is not currently offering a tax payment promotion for those using American Express cards, but with a year-round 2.25% fee for these payments it does offer the lowest fee in the market when using these cards.

Here are some cost per mile examples for selected Singapore-issued American Express credit cards when using ipaymy.

Cost per mile – AMEX Cards

| Card | Mpd | Cost per mile (2.25% fee) |

Amex KF PPS Amex KF PPS |

1.3 | 1.69¢ |

Amex KF Solitaire PPS Amex KF Solitaire PPS |

1.3 | 1.69¢ |

DBS Altitude AMEX DBS Altitude AMEX |

1.3 | 1.69¢ |

KF Ascend KF Ascend |

1.2 | 1.83¢ |

KF Blue KF Blue |

1.1 | 2.00¢ |

Amex Centurion Amex Centurion |

0.98 | 2.25¢ |

Amex Platinum Charge Amex Platinum Charge |

0.78 | 2.82¢ |

Amex Platinum CC Amex Platinum CC |

0.69 | 3.19¢ |

Amex Platinum Reserve Amex Platinum Reserve |

0.69 | 3.19¢ |

Readers should also note that ipaymy charges its usual 2.25% fee for Mastercard income tax payments, but that CardUp has a 1.99% fee deal for those cards, which comes in cheaper.

Other ipaymy offers

We recently wrote about ipaymy’s 1.99% fee offer for a one-time payment in April 2024 using a Visa card, which is a nice deal assuming you have an expense other than income tax to pay this month.

Other offers include:

- Recurring rental payments at 1.79% fee with a Visa or UnionPay card

- Other recurring payments at 1.85% fee with a Visa or UnionPay card

- All other payments at 2.25% fee with a Visa, Mastercard, American Express or UnionPay card

Not received your IRAS NoA yet?

Don’t worry if you haven’t received your bill yet and/or don’t have a ‘Notice of Assessment’ date showing at the online IRAS portal. NOAs are sent out between now and September 2024, so your tax liability may be in a later batch.

Remember this TAX2024 promo code is valid for payments until the end of August 2024, so you’ll still be able to use it even if your tax statement comes through later.

Citi cardholders should wait

If you have a Citi card, do hold off settling your income tax bill for now if you can, since a Citi PayAll promotion is likely to launch in April 2024, based on previous patterns.

In recent years, this has included the ability to buy miles for as little as 0.8 cents each for payments including income tax.

Summary

A competitive rate for income tax payments from ipaymy this year, with a 1.75% fee using Visa or cards, translating to an excellent cost per mile starting at just 1.07 cents when settling this year’s bill.

Don’t forget to apply the TAX2024 promo code at the review stage to receive the discounted rate, which can also be used when setting up monthly recurring payments to IRAS for those paying by GIRO this year.

Do note that unless you need to pay quickly, it may still be worth holding off for all the deals to be released including from the likes of Citi PayAll before you commit, since offers in recent years have included the ability to generate miles from as little as 0.8 cents each.

Links on Mainly Miles may pay us an affiliate commission.

(Cover Photo: Shutterstock)

If the payment is setup before Aug 24 but recurring payment goes on beyond Aug is the charges still 1.75%