It’s that time of year again – income tax season is approaching in Singapore, which means your Notice of Assessment for earnings in 2023 is likely to be arriving soon, if it hasn’t done already. For most of our readers, that means turning attention to the best way to accrue miles when settling the bill.

This year CardUp is one of the first payment providers to launch its discounted fee offer for this often significant annual expense, allowing you to earn a large stash of points or miles towards future travel in the process.

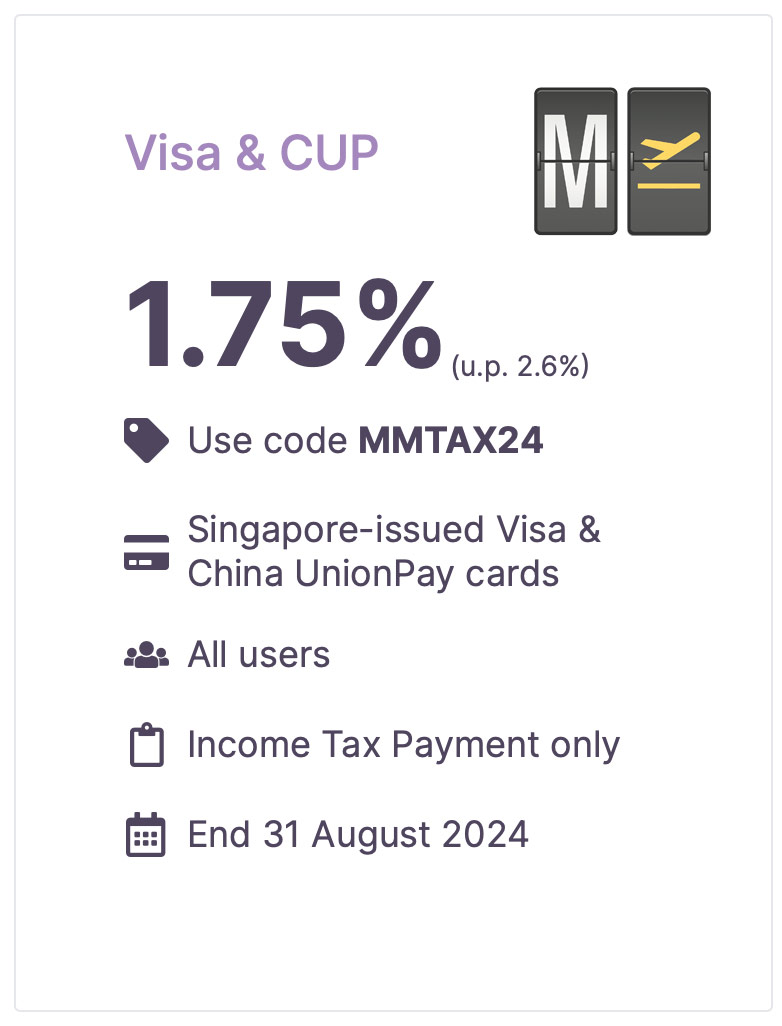

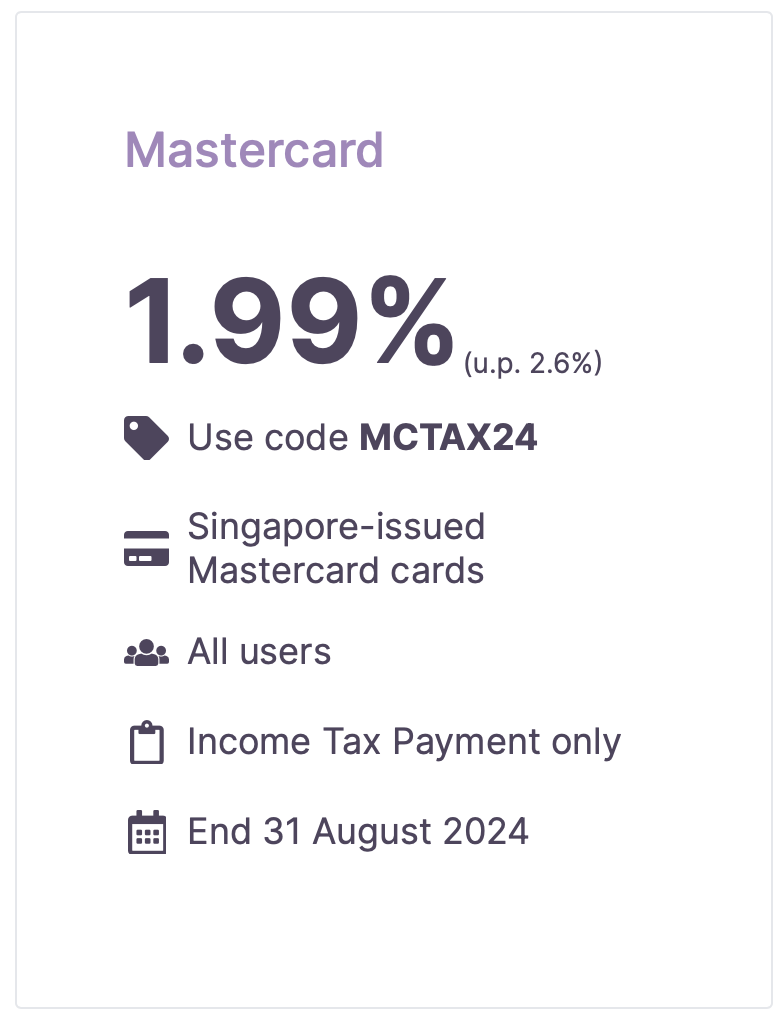

A discounted rate of 1.75% is now available for both new and existing customers using a Singapore-issued Visa card for a tax payment, or 1.99% for a Singapore-issued Mastercard.

The Visa code is valid for one-off (lump sum) or a full series of recurring (GIRO) income tax payments, while for Mastercard users its a one-time deal.

That’s up to a 33% discount on the provider’s usual 2.6% fee when you use your credit card to settle these kind of payments, but it may still be worth holding off for likely deals from Citi PayAll and ipaymy if you don’t need to commit just yet, since even cheaper options have been available in recent years.

Income tax offer

If you schedule an income tax payment using CardUp between now and 31st August 2024, with a due date on or before 25th March 2025, you’ll be eligible for the following discounted fees:

- 1.75% with a Visa card, using the MMTAX24 promo code

- 1.99% with a Mastercard, using the MCTAX24 promo code

These codes are subject to the following terms and conditions:

- Valid on all income tax payments scheduled on or before 31st August 2024, 6pm (SGT). The payment due date must be on or before 25th March 2025. Payments must be scheduled at least 3 business days in advance of the due date to allow for processing time.

- You must enter the Promo Code MMTAX24 or MCTAX24 during the “Schedule payment” process when setting up payment details. The 1.75% / 1.99% CardUp fee for the eligible payments will be reflected before you confirm and submit payment.

- Each promo code may only be redeemed once per customer.

- New and existing customers are eligible.

- There is no upper cap on the tax amount paid under this promotion.

| MMTAX24 | 1.75% | |||

| One-time IRAS income tax payment or all income tax payments in a recurring series with a Singapore-issued Visa card or China Unionpay card. | ||||

Full terms and conditions for the Visa offer can be found here.

| MCTAX24 | 1.99% | |||

| One-time IRAS income tax payment with a Singapore-issued Mastercard. | ||||

Full terms and conditions for the Mastercard offer can be found here.

Cost per mile (Visa)

Here’s how the all-important cost per mile looks for some popular Visa credit cards issued in Singapore.

Cost per mile – MMTAX24

| Card | Mpd | Cost per mile (1.75% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.07¢ |

DBS Insignia |

1.6 | 1.07¢ |

UOB Reserve UOB Reserve |

1.6 | 1.07¢ |

DBS Vantage |

1.5 | 1.15¢ |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.23¢ |

SC Visa Infinite SC Visa Infinite |

1.4* | 1.23¢* |

UOB VI Metal |

1.4 | 1.23¢ |

OCBC 90ºN Visa OCBC 90ºN Visa |

1.3 | 1.32¢ |

OCBC Voyage Visa OCBC Voyage Visa |

1.3 | 1.32¢ |

DBS Altitude Visa DBS Altitude Visa |

1.3 | 1.32¢ |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2 | 1.43¢ |

SC Journey Card SC Journey Card |

1.2 | 1.43¢ |

* For SCVI 1.4 mpd is subject to a minimum spend of S$2,000 in the same statement cycle, otherwise 1 mpd. CardUp payments do count towards the minimum.

Even with one of the widely-held 1.2 mpd cards like the SC Journey Card and Citi PremierMiles Visa options, an effective cost per mile of 1.43 cents is competitive.

For those lucky enough to have 1.6 mpd earning cards, the cost per mile drops to an excellent 1.07 cents.

For those with a large enough tax bill, that could mean earning enough miles for a one-way Singapore Airlines Business Class saver award to Tokyo (52,000 miles) for just S$558.97 in fees!

Cost per mile (Mastercard)

Here’s how the cost per mile looks for some popular miles-earning Mastercard credit cards issued in Singapore.

Cost per mile – MCTAX24

| Card | Mpd | Cost per mile (1.99% fee) |

UOB PRVI Miles MC UOB PRVI Miles MC |

1.4 | 1.39¢ |

Citi Prestige Citi Prestige |

1.3 | 1.50¢ |

OCBC 90ºN MC OCBC 90ºN MC |

1.3 | 1.50¢ |

Citi PremierMiles MC Citi PremierMiles MC |

1.2 | 1.63¢ |

HSBC T1 HSBC T1 |

1.2 | 1.63¢ |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.63¢ |

BOC Elite Miles BOC Elite Miles |

1.0 | 1.95¢ |

If you have a 1.3 or 1.4 mpd Mastercard, the cost per mile of 1.5 cents or less may be worth considering, but unfortunately for the more widely-held 1.2 mpd cards like the KrisFlyer UOB credit card a cost per mile of 1.63 cents isn’t so attractive.

You almost certainly won’t want to be using the BOC Elite Miles card at a cost per mile of 1.95 cents!

You can refer to the latest full list of cards awarding points and miles for CardUp payments here.

How to pay

The process is straightforward, to pay your income tax bill first log on to your account and press the ‘Create Payment’ button, then select the ‘Taxes’ icon.

After that, select the first option – ‘IRAS – Income Tax’.

You then need to enter your payment amount as per the outstanding tax balance as shown in your IRAS Statement of Account, or the monthly instalment if you’re using that method, plus select (or add) the Visa card you wish to use.

Don’t forget to refer to the cost per mile table above, to make sure you’re using the Visa card with the best earn rate for this payment if you have more than one in your wallet!

Next you’ll have to select your tax due date.

Your payment reference number is automatically pulled from the NRIC number registered on your CardUp account. This prevents any erroneous payments to the wrong tax accounts not tied to your own NRIC.

Then it’s the all-important PROMO CODE, where you can enter the MMTAX24 code or the MCTAX24 code.

Note that the regular CardUp 2.6% fee shows initially, but once you proceed to the payment stage the discount will be reflected.

Once you click ‘Continue’, you will be required to upload an up-to-date copy of your Statement of Account, showing your Name, NRIC, Outstanding balance and date of outstanding balance for CardUp to verify your payment.

You can pay the full outstanding amount, the monthly instalment, or a lower amount, but you cannot overpay your taxes because this makes IRAS very upset.

Here’s how it looks for a S$10,000 income tax payment with the MMTAX24 code applied:

As you can see, the reduced fee of 1.75% (usually 2.6%) then applies. In the above example an income tax payment of S$10,000 now carries a fee of S$175 (1.75%) instead of S$260 (2.6%).

Monthly instalments (GIRO)

Provided you have a GIRO arrangement set up with IRAS for your income tax payment deductions, you can still use CardUp to settle the amount each month using the MMTAX24 discount code.

CardUp provides full instructions on how to do this in advance here, to ensure that the CardUp payment will ‘cancel out’ the GIRO deduction from your bank account each month, ensuring you are only charged once per instalment.

If you set up a recurring payment, you will have to include the first and last dates, then using the promo code the review stage should look like this:

Yet to receive your IRAS NoA?

Don’t worry if you haven’t received your bill yet and/or don’t have a ‘Notice of Assessment’ date showing at the online IRAS portal. NOAs are sent out between now and September 2024, so your tax liability may be in a later ‘batch’.

If your bill payment becomes due after late August 2024, we are hopeful that CardUp may extend its offer or provide an alternative deal, but as always we’ll keep you updated.

We’re also awaiting income tax season deals from ipaymy and Citi PayAll, which may provide even more competitive income tax payment options, so it could be a good idea to hold off anyway if you can, since those should be announced soon.

Citi cardholders should wait

If you have a Citi card, do hold off settling your income tax bill for now if you can, since a Citi PayAll promotion is likely to launch in April 2024, based on previous patterns.

In previous years, this has included the ability to buy miles for as little as 0.8 cents each for payments including income tax.

Summary

CardUp is first out of the blocks again this year with its 2024 income tax payment promotion, matching the excellent 1.75% fee level seen in recent years for Visa cards, with a repeat of last year’s 1.99% Mastercard deal too, allowing you to generate a large sum of miles when settling this bill for a competitive cost in most cases.

Do note that unless you need to pay quickly, it may still be worth holding off for all the deals to be released including from the likes of ipaymy and Citi PayAll before you commit, since offers in recent years have included the ability to generate miles from as little as 0.8 cents each.

Links on Mainly Miles may pay us an affiliate commission.

(Cover Photo: CardUp)

Hi Andrew, do they usually do Amex offers as well? Worth waiting for that? Need to meet minimum spend for the KFEG 12.5k offer. Thanks!

There have been AMEX deals in the past, so hopefully there will be something in store this year too. Stay tuned!