Back in early April, card payment provider ipaymy launched its 1.75% fee option for income tax payments using Visa cards, and now there’s a new deal with a discounted rate when you use either an American Express card or a Mastercard for the same purpose, with a slightly higher but still competitive 1.99% fee on offer.

This is currently the cheapest way to buy miles for your 2024 income tax payment using an American Express card, starting at 1.5 cents per mile.

The offer is available to both new and existing ipaymy personal account holders. Simply use the promo code TAX199 at the ‘Payment Details’ stage.

| TAX199 | 1.99% | |||

| One-time IRAS income tax payment with a Singapore-issued American Express card or Singapore-issued Mastercard | ||||

There is no upper cap for this promotion code, but it can only be applied once per user, for a one-time income tax payment setup. The code is valid until 31st August 2024.

How it works

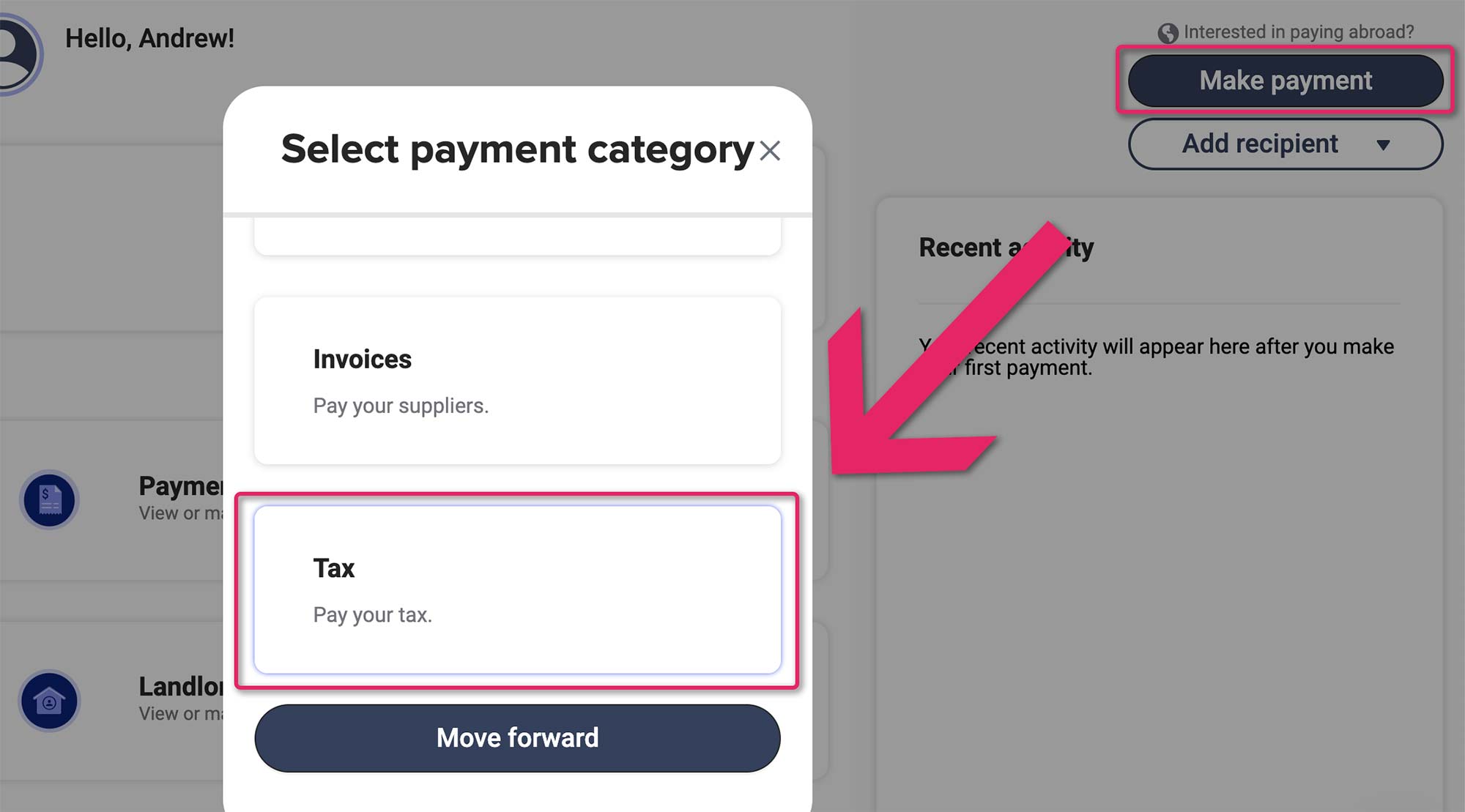

Once you’re logged on to ipaymy you’ll be presented with the ‘Dashboard’ screen. To set up your income tax payment, click ‘Make payment’ in the top right, then select ‘Tax’.

You’ll then be asked to enter the details for your tax bill. These should match your IRAS Notice of Assessment (NoA), which you’ll also have to upload as a PDF or scanned copy.

Tip: You can download a PDF version of your IRAS NoA once it’s published, by logging on to the IRAS myTax Portal using SingPass.

After providing details of your payment including the payment date, you’ll select which credit card you wish to use, then the regular ipaymy fee of 2.25% will be displayed.

Here’s where you’ll enter the TAX199 promo code.

Once applied, you will see the fee drop from 2.25% to 1.99%, provided you have selected a Singapore-issued American Express card or Mastercard. In this example an income tax payment of S$10,000 now carries a fee of S$199 (1.99%) instead of S$225 (2.25%).

Note that ipaymy adds a S$1 surcharge to the fee payable for ‘Fund Safeguarding’, which ensures your funds are protected and held in a segregated safeguarded account. For smaller payments, this does adversely affect the cost per mile.

Cost per mile

Here’s how the all-important cost per mile looks for some popular American Express credit cards issued in Singapore, starting at 1.50 cents.

Cost per mile – TAX199

| Card | Mpd | Cost per mile (1.99% fee) |

Amex KF PPS Amex KF PPS |

1.3 | 1.50¢ |

Amex KF Solitaire PPS Amex KF Solitaire PPS |

1.3 | 1.50¢ |

DBS Alt Amex DBS Alt Amex |

1.3 | 1.50¢ |

KF Ascend KF Ascend |

1.2 | 1.63¢ |

KF Blue KF Blue |

1.1 | 1.77¢ |

| 0.98 | 1.99¢ | |

| 0.78 | 2.50¢ | |

| 0.69 | 2.83¢ | |

| 0.69 | 2.83¢ |

Here’s how the all-important cost per mile looks for some popular Mastercard credit cards issued in Singapore, starting at 1.22 cents.

Cost per mile – TAX199

| Card | Mpd | Cost per mile (1.99% fee) |

Citi Ultima MC Citi Ultima MC |

1.6 | 1.22¢ |

UOB PRVI MC UOB PRVI MC |

1.4 | 1.39¢ |

Citi Prestige Citi Prestige |

1.3 | 1.50¢ |

OCBC 90°N MC OCBC 90°N MC |

1.3 | 1.50¢ |

| 1.2 | 1.63¢ | |

Citi PM MC Citi PM MC |

1.2 | 1.63¢ |

BOC EM BOC EM |

1.0 | 1.95¢ |

You can refer to the latest full list of cards awarding points and miles for ipaymy transactions here.

As you can see even with one of the widely-held 1.2 mpd to 1.3 mpd cards like the Citi PremierMiles and OCBC 90°N options, an effective cost per mile of 1.43 to 1.5 cents is a little on the high side.

However, for those lucky enough to have 1.4 mpd or 1.6 mpd earning cards, the cost per mile drops to a far more competitive 1.39 cents or even 1.22 cents.

Note: UOB excludes UNI$ earning on payments with the descriptor “IPAYMY” in its credit card T&Cs, but does not exclude ipaymy as a merchant itself. ipaymy states that UOB cards do still earn miles, and reader reports confirm this. ipaymy is still honouring its points guarantee for payments made with UOB cards.Ongoing 1.75% fee for Visa income tax payments

If you have a Singapore-issued Visa card, don’t forget that you can also benefit from ipaymy’s 1.75% fee offer for income tax payments, using promo code TAX2024 at the ‘Payment Details’ stage.

| TAX2024 | 1.75% | |||

| One-time or recurring IRAS income tax payment with a Singapore-issued Visa card | ||||

This promo code is valid for one-time payments and scheduled recurring income tax payments, until 31st August 2024.

See our full analysis here for the details, including cost per mile breakdown for a variety of cards, starting at 1.07 cents each.

Citi PayAll

If you have a Citi miles-earning card in Singapore, the bank is offering income tax payments with a cost per mile of 1.3 cents this year, but in order to unlock that rate you’ll be stuck buying a stash of miles at 1.63 cents each in non-tax payments (S$5,000+).

This format makes the PayAll promotion a lot less attractive and a lot less flexible this year.

Indeed Citi ULTIMA cardholders can buy miles at a lower cost through ipaymy this year – 1.22 cents each via this Mastercard deal or 1.07 cents each through ipaymy’s Visa deal, with CardUp also matching these levels.

Summary

ipaymy is offering income tax payments using American Express or Mastercard credit cards with a 1.99% fee this year, for those making a one-time lump sum payment to IRAS.

This is currently the lowest cost per mile when using American Express cards to settle this payment, from 1.50 cents each, while on the Mastercard side rates as low as 1.22 cents per mile are possible.

This offer runs alongside ipaymy’s 1.75% deal for income tax payments with a Visa card this year, a promotion that also allows recurring payments, not to mention CardUp’s similar promos for Visa and Mastercard tax payments.

(Cover Photo: Alex Knight)

No compelling reason to use ipaymy