Here’s our review of the Standard Chartered Visa Infinite card issued in Singapore. It forms part of our series of credit card reviews, which are all summarised on our dedicated Credit Cards page.

Dollar amounts refer to SGD, and ‘miles’ refer to KrisFlyer miles, except where stated. This review was updated on 21st August 2025.

| SC Visa Infinite | |||

|

50,000 welcome miles |

3 mpd FCY spend |

6 lounge visits |

| APPLY HERE | |||

| SC Visa Infinite | ||

|

||

|

50,000 welcome miles |

3 mpd FCY spend |

6 lounge visits |

| APPLY HERE | ||

Mainly Miles Says

A competitive uncapped 3 mpd earn rate for foreign spend is now one of the few benefits the Standard Chartered Visa Infinite card offers over others, and even that now has close competition.

With the previously excellent income tax payment deal also devalued, it’s hard to see this product’s appeal over competitors in the high income category.

| Pros | Cons |

|

|

Eligibility

- Minimum Age: 21

- Minimum Income: $150,000/yr

The Standard Chartered Visa Infinite card has a $150,000 per year income requirement for all applicants, except for Priority / Private Banking customers, who have a reduced income threshold of:

- Singapore Citizens / PRs: $30,000/yr

- Employment Pass Holders: $60,000/yr

Annual Fees & Interest Rates

- Annual Fee (principal): $599.50

- Annual Fee (supplementary): Free (up to five cards)

The annual fee for the Standard Chartered Visa Infinite card is $599.50. The annual fee is not waivable.

Up to five supplementary cards can be added to your account for free.

Other fees and interest rates for the Standard Chartered Visa Infinite card include:

- EIR: 27.9%

- Interest-free period: At least 22 days

- Minimum payment: 1% (capped at $50)

- Late payment fee: $100

- Cash advance fee: 8% (min. $15)

- Overlimit fee: $40

Sign-up bonus

The Standard Chartered Visa Infinite card currently has a sign-up bonus of 50,000 miles when signing up and paying the non-waivable first year annual fee, then spending S$2,000 within the first 60 days of card approval.

- 25,000 miles (62,500 Rewards Points) upon payment of the S$599.50 annual fee, and

- 25,000 miles (62,500 Rewards Points) with a minimum eligible spend of S$2,000 within the first 60 days of card approval

Both new and existing Standard Chartered credit card holders are eligible for the bonus.

Even if you don’t place any value on the card’s other perks, payment of the annual fee with this spend profile allows you to generate 50,000 miles for 1.2 cents each.

Renewal bonus

There is no official bonus for renewing your SCVI card when paying the annual fee from year two onwards, however we have always been awarded 20,000 miles on renewal automatically without asking.

You may or may not receive the same bonus, so don’t bank on it, but there’s certainly no harm in asking whether any retention miles will be awarded come renewal time.

Regular earn rates

By default, the Standard Chartered Visa Infinite card earns:

- 1 mpd for local spend (i.e. transacted in SGD), and

- 1 mpd for overseas spend (i.e. transacted in foreign currency).

The earn rates are dismal, though big spenders have a far better path to maximise rewards.

Bonus earn rates

Provided you spend at least $2,000 in any statement cycle (note – not calendar month), you’ll be entitled to an additional 0.4 miles per $1 spent locally and an additional 2 miles per $1 spent overseas, for all the spending you made (not just on the amount over and above $2,000).

That means, provided you hit the $2,000 minimum spend each statement cycle on this card, the earning rate is actually:

- 1.4 mpd for local spend (i.e. transacted in SGD), and

- 3 mpd for overseas spend (i.e. transacted in foreign currency).

Note that you are initially awarded 1 mpd on all spending with this card, then once the monthly statement is published the extra miles (+0.4 locally or +2 overseas) are then added, provided the $2,000 spending criteria was met in the same statement cycle.

Beware of DCC

Since this card earns a generous bonus rate for foreign transactions when you spend more than $2,000 per month, here’s the usual reminder on DCC.

A note about Dynamic Currency Conversion (DCC)

Beware of the ‘Dynamic Currency Conversion’ (DCC) offer scam you’ll often experience overseas when paying with your credit card. It’s very common when settling your overseas hotel bill, for example, to be offered to pay in SGD instead of local currency. This is a terrible idea, because:

- you’ll suffer financially, even after the credit card foreign exchange fee is accounted for. If you remember the SGD amount you were offered to pay, then pay in local currency instead, once the transaction appears on your credit card statement you’ll generally find they were scamming you, you’d have paid at least 2% more using DCC.

- you will earn credit card miles at the local spend rate if you accept DCC, because the transaction will take place in SGD, not the local (foreign) currency.

In other words, you’ll pay more, and lose miles. Always insist on paying in the local currency of the country you are in.

Eligible transactions

The following spend categories won’t earn any miles with this card, under Standard Chartered’s exclusion list for Rewards Points issuance:

- Charitable and Religious Organisations

- Education

- Gambling

- Government Services

- EZ-Link top-ups

- Insurance Premiums

- Parking lots

This is not an exhaustive list – you can view the full list of excluded transactions at the card Terms and Conditions document (pages 3, 4 and 5).

Are KrisFlyer miles credited directly?

No, in fact rather than being credited miles directly you’ll accrue ‘360° Rewards Points’ both for your sign-up bonus and your regular spending on this card.

These transfer to KrisFlyer miles at a 2.5:1 ratio (so the sign-up bonus is actually 125,000 Rewards Points, for example, which you can then redeem for 50,000 miles).

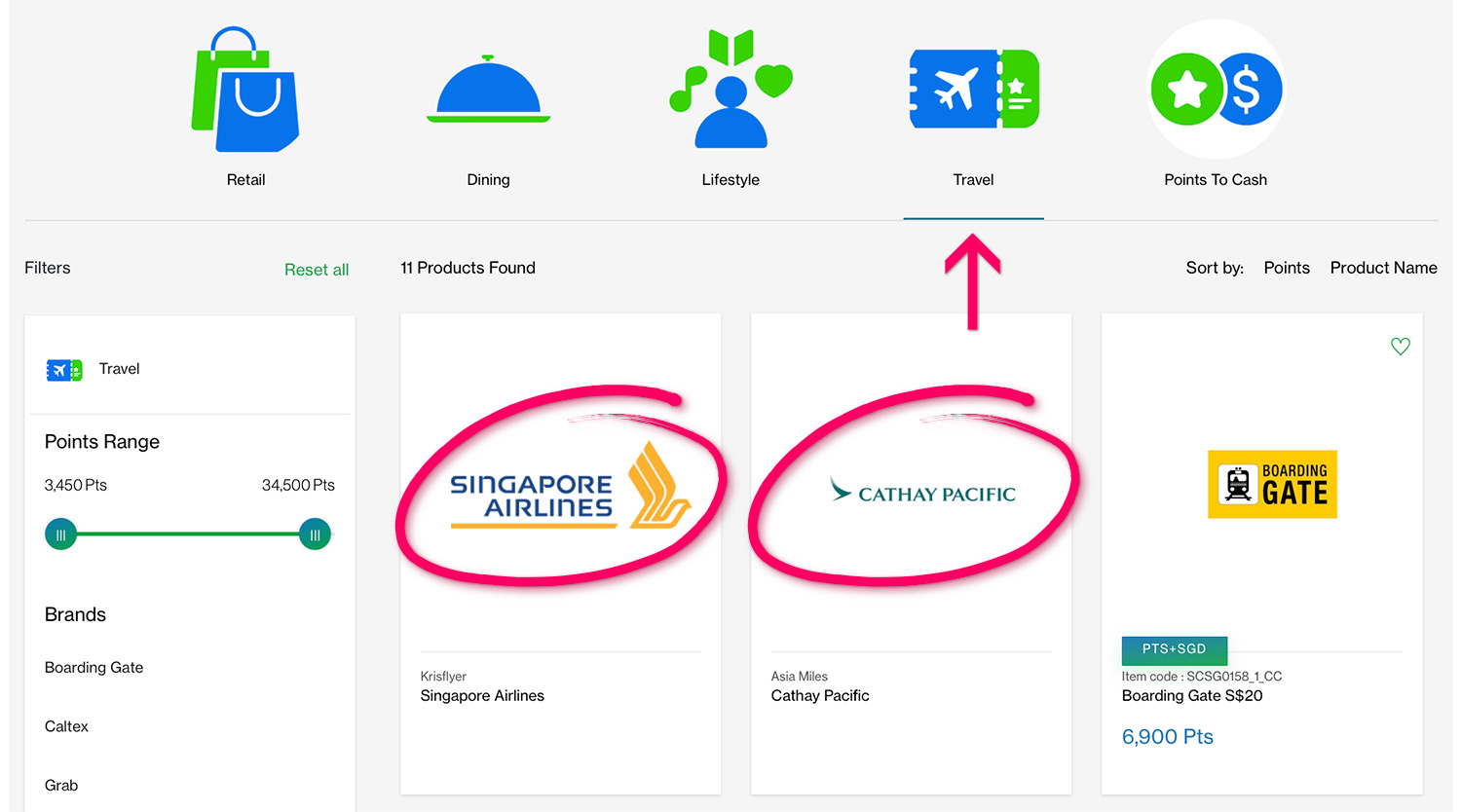

Which loyalty schemes can I transfer into?

Standard Chartered used to boast 10 loyalty programme transfer partners, including KrisFlyer, but in March 2024 nine of those were unceremoniously axed.

The good news is that Singapore Airlines KrisFlyer remains, and that Cathay Pacific Asia Miles was also added to the fold, leaving two popular transfer partners covering both Star Alliance and Oneworld award options.

| Standard Chartered 360° Transfer Partners |

|

| FFP | Conversion Ratio Points : Miles |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

To make a transfer to either of these programmes, log on to your account at the 360° Rewards Redemption Platform, and select your transfer option under the “Travel” category.

Alternatively, KrisFlyer and Asia Miles transfers from your Standard Chartered points are available by logging on to your credit card account via the desktop site, then under ‘Card Details’ by clicking ‘Redeem Rewards Now’.

↥ Is there a minimum transfer amount?

A minimum transfer quantity of 25,000 Rewards Points (into 10,000 miles) applies for transfers to both the KrisFlyer and Asia Miles programmes, with same-sized transfer blocks thereafter (e.g. 50,000 points into 20,000 miles, etc…).

What is the transfer cost to miles?

You’ll pay a fee of $27.25 for each points to miles transfer to either KrisFlyer or Asia Miles, regardless of how many ‘blocks’ you are converting.

When do points credit?

Base 360° Rewards Points at the 1 mpd earn rate (2.5 Rewards Points per $1 spent locally or overseas) should reflect in your account once the transaction posts, which takes anywhere between one and three days.

If you meet the $2,000 total spend in the same statement month, the remaining bonus Rewards Points, equivalent to an additional 0.4 mpd locally and an additional 2 mpd for FCY transactions, will be credited to you rewards account within five days of the end of your statement cycle.

Do be aware that if you are making a purchase to achieve a short-term top-up (to the next miles redemption threshold, for example), you may need to wait until the end of the statement cycle to actually see the full Rewards Points reflected.

Do 360° Rewards Points expire?

No, your 360o Rewards Points never expire while your account remains in good standing, so you can keep your points at the Standard Chartered side as long as you need to, before converting to KrisFlyer.

Once your miles are in KrisFlyer, they are valid for three years from the month of deposit.

(Photo: MainlyMiles)

If you transfer into Asia Miles they will never expire, under the scheme’s latest policy since January 2020 that provided you earn or redeem at least 1 Asia mile every 18 months, all your miles will remain intact.

A transfer from credit card points resets the clock for all your miles, but you can also achieve this with a simple transfer of NTUC LinkPoints to Asia Miles, if necessary, or simply make a 100 miles carbon offset donation.

360° Rewards Points pool with some cards

If you are holding other Standard Chartered Visa Infinite cards, or the Standard Chartered Journey Card, your 360° Rewards Points pool for the purposes of redemption into the KrisFlyer and Asia Miles programme.

However, if you have points accrued with another Standard Chartered card, like the Smart Credit Card, these remain separate and will not combine with “Visa Infinite + Journey” ones for redemption purposes.

How long do miles take to credit to KrisFlyer?

Standard Chartered quotes “up to 5 working days” for successful crediting of miles into the KrisFlyer or Asia Miles programmes, following your transfer request.

In reality, we usually see miles credited to KrisFlyer within around three days of the request.

That’s still quite a long time if you need the miles to lock in an available redemption, or for short-term travel, with some other banks transferring points instantly, or in just one or two days.

Points rounding

Standard Chartered has a generous rounding policy for transactions made on its credit cards.

At the basic earn rate of 1 mpd with the SCVI card, your transaction will be multiplied by 2.5, then rounded (up or down) to the nearest whole number.

For example:

- Transaction $6.60

- 6.60 x 2.5 = 16.5

- Rounds to 17 Rewards Points accrued

17 Rewards Points is equivalent to 6.8 miles, so in this example you’re getting 1.03 mpd (6.8 miles / $6.60).

Provided you spend at least $2,000 in the same statement month, the additional Reward Points accrued for bonus miles earning follow the same policy.

- Additional 1.0x Reward Points for local spend (rounded to nearest whole point)

- Additional 5.0x Reward Points for FCY spend (rounded to nearest whole point)

For that same transaction in FCY, during a statement month in which you exceed the $2,000+ total spend threshold, Reward Points are therefore accrued as follows:

- Transaction $6.60

- 6.60 x 2.5 = 16.5

- Rounds to 17 Rewards Points accrued

- 6.60 x 5.0 = 33.0

- Rounds to 33 Rewards Points bonus

- Total Rewards Points 17+33 = 50

50 Rewards Points is equivalent to 20 miles, so in this example you’re getting 3.03 mpd (20 miles / $6.60).

↥ Minimum spend to earn points

With Standard Chartered having one of the fairest rounding policies for Rewards Points among banks in Singapore, the minimum spend to earn points (and therefore miles) is also extremely low.

- < $2,000 total spend per statement month: $0.20

- > $2,000 total spend per statement month: $0.20 (local) / $0.10 (FCY)

That’s really competitive in the market, with an increasing number of cards now only offering points for transactions of at least $5, including OCBC, UOB and Maybank.

FCY fee / cpm overseas

Despite its generous 3 mpd earn rate for FCY spend, the Standard Chartered Visa Infinite card has a 3.5% foreign currency transaction fee, the highest on the market in Singapore.

In cost per miles terms at 1.22 cents each, that puts it on a par with the Maybank Horizon Visa Signature Card, which earns 2.8 mpd on FCY spend, subject to a minimum of $800 monthly spend in any category.

That’s a much lower spend requirement than the SCVI’s $2,000 threshold.

Nonetheless, both cards sit at the top of the cost per mile table for overseas general spend, as outlined below.

Cost per mile on overseas transactions (general spend cards)

(Best to worst, August 2024)

| Card | Fee | Mpd | Cost per mile |

| 3.5% | 3.0* | 1.22¢* | |

| 3.25% | 2.8** | 1.22¢ | |

| 3.25% | 2.4 | 1.43¢ | |

| 3.0% | 2.2 | 1.45¢ | |

| 3.25% | 2.2 | 1.56¢ | |

| 3.25% | 2.2 | 1.56¢ | |

| 3.25% | 2.2 | 1.56¢ | |

(Jun & Dec) |

2.95% | 2.0 | 1.57¢ |

OCBC 90oN OCBC 90oN |

3.25% | 2.1 | 1.63¢ |

| 3.25% | 2.0 | 1.71¢ | |

| 3.25% | 2.0 | 1.71¢ | |

| 3.5% | 2.0 | 1.83¢ | |

| 3.25% | 1.2 | 2.86¢ |

* 3 mpd earn rate for the SCVI card is subject to a minimum spend of $2,000 (any currency) in the same statement cycle.

** 2.8 mpd earn rate for the Maybank HVS card is subject to a minimum spend of $800 (any currency) in the same calendar month.

Cost per mile also accounts for an additional 0.3% ‘spread’ over money changer currency rates, though this doesn’t apply to all banks and all foreign currencies, so is a worst-case scenario.

If you’re holding a specialised 4 mpd card, like the DBS WWMC, you will of course be able to achieve much better cost per mile for transactions in foreign currency, provided you are spending within the card’s eligible categories and monthly spend cap.

What else can 360° Rewards Points be used for?

There are a variety of rewards other than airline miles you can redeem your Standard Chartered 360° Rewards Points for, though as usual they all represent much poorer value.

We know that 2.5 360° Rewards Points can be converted into 1 KrisFlyer mile, which we value at 1.9 cents each, so that’s approximately 0.76 cents value per 360° Rewards Point when used this way.

Other transfer options are largely for shopping and retail vouchers, for example a $50 TANGS voucher will set you back 17,250 360° Rewards Points.

The same number of points should be getting you 6,900 KrisFlyer miles (or Asia Miles), worth about $130. You should not be using your 360° Rewards Points for anything other than KrisFlyer miles or Asia Miles transfers, in our opinion.

However, some of these alternative redemption options can be useful ways to ‘cash out’ of the scheme, for example prior to cancelling the card, if you fall below the 25,000 points (10,000 miles) redemption threshold needed for KrisFlyer or Asia Miles transfers.

Lounge access

The Standard Chartered Visa Infinite card comes with a Priority Pass membership including six complimentary lounge visits per card membership year.

Each accompanying guest counts as one visit, so for example if you always access a Priority Pass lounge with one guest you’ll only get three visits per year, since that will then exhaust all six visits.

After that, each visit is charged at US$35.

After you receive and activate your SCVI card, you’ll need to register for your complimentary Priority Pass. The process to do so is outlined here.

Over 1,500 lounges are included in the programme, including all the usual third-party options at Singapore Changi Airport, and you can search the full lounge list here.

(Photo: MainlyMiles)

Unfortunately the SCVI card doesn’t compare generously with other products in this high income category when it comes to the lounge access benefit, with some cards offering unlimited access packages.

Check out our full rundown of Singapore credit cards with lounge access benefits to see the better options available.

Income Tax payment facility

For many years the Standard Chartered Visa Infinite card has had one jewel in its crown for miles-earners in Singapore.

That’s been the ability to pay your annual income tax bill using your card and accrue the usual 1.4 mpd earn rate in the process.

While this facility is also available for any credit card through the likes of CardUp and ipaymy, the processing fee using the Standard Chartered method was 1.6%, compared to 1.75% under those options, so it was therefore a much better deal to use the SCVI, with a cost per mile of just 1.14 cents.

Unfortunately from March 2024 Standard Chartered hiked this fee to 1.9%, increasing the cost per mile to 1.36 cents each.

That’s still competitive, but the cost per mile is only 1.23 cents via CardUp or ipaymy this year, with their 1.75% fee repeated for 2025.

The good thing about the Standard Chartered facility is that you can still use it to generate miles for 1.36 cents, a competitive rate, then actually use one of the other providers to settle your bill with IRAS (via ipaymy on monthly GIRO, for example).

That’s because Standard Chartered does not actually pay IRAS directly, instead you simply send them your Notice of Assessment along with your bank account details using the online system, and they then transfer the balance you owe to IRAS to your personal bank account.

Actually settling the bill is up to you.

A full FAQs document for the Income Tax payment facility is available here.

SC EasyBill

In August 2019 Standard Chartered launched EasyBill, a way for their credit card customers to earn the usual rewards points for outgoings not usually allowing credit card payments, like rental and education expenses.

An administrative fee of 1.9% is charged, which means EasyBill allows you to ‘buy’ miles using your Standard Chartered Visa Infinite card from 1.36 cents each when making these payments.

Other benefits

In the past, the SCVI card had a range of attractive benefits including a complimentary 4 hour yacht hire when you spent $75,000 within a year, 15% cashback on all Grab rides globally capped at $30 per month, and up to 25% Caltex fuel savings.

Sadly the current list is a lot thinner than it was, with all of the aforementioned perks whittled away over the years.

Here are the additional current benefits with the Standard Chartered Visa Infinite card which will be of most interest to our readers:

- Complimentary travel insurance coverage of up to $1,000,000 when you charge your full fare to your card before you go abroad. Terms here.

- The Good Life privileges, including dining, travel and shopping discounts.

- Visa’s Luxury Hotel Collection, as a Visa Infinite cardholder. This includes automatic room upgrade where available, complimentary breakfast and a US$25 food and beverage credit.

Terms and conditions

Here are links to the full terms and conditions applicable to the Standard Chartered Visa Infinite card and the 360° Rewards programme.

SCVI T&C

SC 360° Rewards Programme T&C

Our Summary

The Standard Chartered Visa Infinite card used to come with some nice benefits and perks, but over the years most of these have been eroded or axed, making it increasingly difficult to justify an annual fee of $600.

The 50,000 miles welcome bonus is one aspect that’s valuable, worth more the annual fee itself if used wisely, but after that any renewal bonus miles are not guaranteed from year two onwards.

With lounge visits pegged at a paltry six per year, the Income Tax payment facility recently devalued, and no airport limo or immigration perks, there’s really very little left in this card’s arsenal, aside from a competitive 3 mpd earn rate for overseas spend.

The problem there, like the 1.4 mpd local rate, is that you’ll need to make sure you push a hefty $2,000+ per statement month through the card, in order to qualify.

Furthermore, the recently-enhanced Maybank Horizon Visa Signature card‘s uncapped 2.8 mpd for FCY spend requires only $800 of total transactions each month, and comes in at the same cost per mile as this card, thanks to its lower fees.

With only two FFP partners to its name since March 2024, this is one card we just can’t see the logic of signing up for in Singapore, except for “buying” a stash of miles from the outset, then ditching it after year one.

| Our Rating | ||||||||||||||||||||

| 2 / 5 among high income general spend cards |

||||||||||||||||||||

|

Standard Chartered Visa Infinite |

||||||||||||||||||||

How we rate credit cards

|

||||||||||||||||||||

Links on Mainly Miles may pay us an affiliate commission.

(Cover Photo: Shutterstock)