Kris+ is offering a bonus conversion promotion from 12th November 2025 to 26th February 2026, allowing you to earn 8% more KrisPay miles when transferring Citi ThankYou Points or Citi Miles from your credit card. These miles can then be instantly transferred to your KrisFlyer account.

This promotion brings the transfer ratio closer to the standard Citi-to-KrisFlyer miles ones – however the key advantage is that transfers made this way are instant, fee-free, and allow for smaller transfer blocks. That said, previous 15% and 10% bonus via Kris+ offers were even better value.

Normally to transfer from Citi to KrisFlyer at the standard ratios you’ll wait around 24-48 hours for the transfer to be completed, and pay a S$27.25 fee when transferring from each separate card account you hold with the bank, since unfortunately Citi points don’t pool with one another.

The minimum transfer requirement from your Citi Miles or ThankYou Points balance to Kris+ is also lower – just 4,000 Citi Miles or 10,000 ThankYou Points, compared to the usual 10,000 Miles or 25,000 Points for direct transfers.

That means you can transfer a more precise quantity, or potentially clear out ‘orphan’ miles from a Citi card account you no longer use, without taking too much of a hit on the ratio.

Citi to KrisPay transfers

Citi transfers to Kris+ first became available in late October 2021, but as with other bank partners they usually come at a 15% poorer rate than you’d get converting to miles via the bank method, as shown below.

| Transfer Ratio

Citi Miles KrisPay miles 4,000 : 3,400 |

| Transfer Ratio

Citi Thank You Points KrisPay miles 10,000 : 3,400 |

Transfers should be conducted in 4,000 Citi Miles or 10,000 City TYP blocks thereafter (e.g. 4k Citi Miles, then 8k Citi Miles, then 12k Citi Miles, etc…), otherwise the net transfer amount will not increase until each new threshold is reached.

Bonus offer

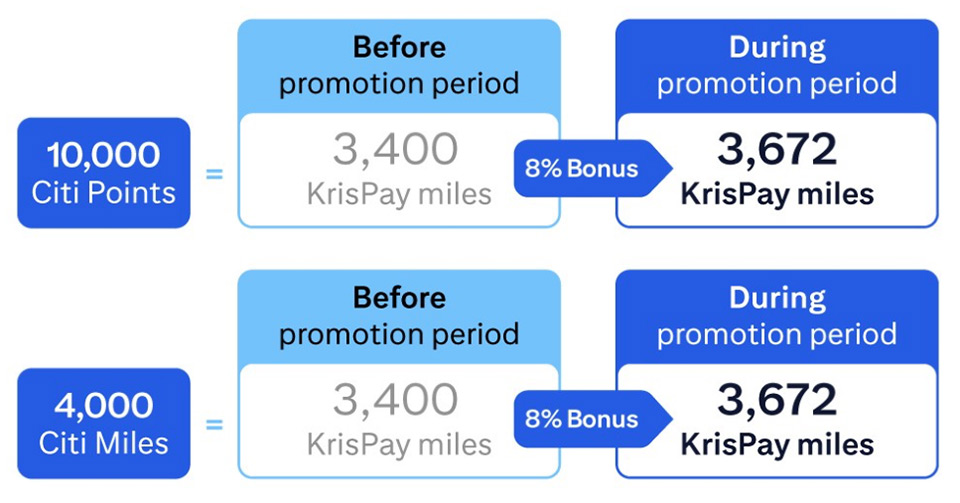

Between 12th November 2025 and 26th February 2026, you will get an 8% bonus on Citi to KrisPay transfers.

| Transfer Ratio (8% Bonus Offer) Citi Miles KrisPay miles 4,000 : 3,672 |

| Transfer Ratio (8% Bonus Offer) Citi Thank You Points KrisPay miles 10,000 : 3,672 |

This offer unfortunately isn’t as good as some other Citi – Kris+ transfer deals, with a 15% bonus offered back in April 2022 and 10% in October 2022. However, it does match last year’s 8% deal.

Here’s how Kris+ outlines the latest offer.

Unfortunately, an 8% bonus on a transfer that already incurs a 15% disadvantage only brings you back to 91.8% of the original value. This means the bonus doesn’t fully offset the 15% reduction inherent in Citi-to-Kris+ transfers year-round, compared to direct transfers.

Overall the net transfer ratio is still 8.2% below the standard Citi to KrisFlyer conversion rate, but for smaller transfers that may be largely inconsequential, as we’ll show below.

It may still be worth considering

Despite a small sacrifice of miles compared to a direct bank-to-KrisFlyer transfer, remember that converting via Kris+ is fee-free and instant, which adds some potential benefits worth considering for some readers with small conversions to make.

For example, if you have 10,000 Citi Miles accrued on your PremierMiles card, these would transfer to KrisFlyer at a 1:1 ratio meaning 10,000 KrisFlyer miles credited, with a S$27.25 fee for the process.

Let’s say you also have 25,000 Citi ThankYou Points accrued on your Prestige card, which would transfer to KrisFlyer at a 2.5:1 ratio for 10,000 KrisFlyer miles, but also attracting another S$27.25 fee when you transfer.

In total you’ll net 20,000 KrisFlyer miles with these two transfers, at a cost of S$54.50.

Under this Kris+ offer, you can immediately transfer all those Citi Miles and ThankYouPoints at no cost into Kris+, then immediately across to your KrisFlyer account, at a slightly poorer ratio but remember – with no fee whatsoever:

- 10,000 Citi Miles = 9,180 KrisPay / KrisFlyer miles

- 25,000 Citi TYP = 9,180 KrisPay / KrisFlyer miles

In total you’ll then have credited 18,360 KrisFlyer miles into your account, instantly and for free, rather than the 20,000 miles you would have accrued within 24-48 hours for a S$54.50 fee.

Sure, you are short by 3,280 miles by following the process via the Kris+ app, but personally we would rather save the S$54.50 fee in this case, unless you value KrisFlyer miles at 3 cents each.

Obviously the value reduces as your transfer becomes larger – once you’re transferring the equivalent of around 20,000 KrisFlyer miles for each S$27.25 Citi fee, it’s probably then worth following the direct bank to KrisFlyer transfer process, for the normal (full) transfer ratio.

However, if you need to make smaller transfers, we would recommend considering this promotion.

Orphan miles

If you no longer accrue Citi Miles or Citi TYP for one of the cards you hold with the bank, but have a small balance (less than 10,000 Citi Miles or less than 25,000 Citi TYP) remaining in your rewards account, which you won’t be adding to in future, you may as well cash out into KrisFlyer via the Kris+ app to recover something useful from the balance.

You’ll need at least 4,000 Citi Miles or 10,000 Citi TYP in your individual card account to make this work, and under this promotion you’re no longer even taking such a significant hit compared to the usual direct transfer ratio for a transfer that size.

Remember to still transfer in 4k Citi Miles or 10k Citi TYP block sizes (e.g. 4k Citi Miles, or 8k Citi Miles), otherwise you are wasting points for an intermediate transfer because the KrisPay transfer will not update until a new ‘block’ threshold is reached.

How to transfer

The process for transferring Citi TYP or Miles into KrisPay miles is as follows.

Simply tap ‘Wallet’ on the Kris+ app homepage, then ‘Transfer’.

You’ll then see the Citi ThankYou Rewards option (if you don’t, you may need to update to the latest version of the app).

Click on ‘Citi ThankYou Rewards’ and you will be redirected to log in to your Citi Rewards account on your mobile device to then proceed with a Citi Rewards to Kris+ transfer.

Be careful

There are two main catches to remember when transferring bank miles to KrisFlyer this way.

Firstly you’ll have to move any miles or points transferred from Citi to KrisPay into KrisFlyer miles within 21 days, otherwise they are stuck in KrisPay forever (value 1 cent per mile, expiry just six months).

The second is just as important, you cannot use any of the KrisPay miles you have earned from your Citi transfer for any Kris+ purchase, no matter how small, as that automatically renders that entire transfer stuck in Kris+ until expiry.

The golden rule therefore is to transfer in to Kris+, then transfer straight out to KrisFlyer. Even with a 21-day window available, don’t even wait – you may forget later.

Wait till February 2026 to transfer

All Citi Miles and most Citi ThankYou Points do not expire while they are at the bank side, but as soon as you transfer to KrisFlyer the three-year validity clock starts ticking.

If you’re going to participate in this promotion and you make a transfer in November 2025, for example, the KrisFlyer miles credited will expire on 30th November 2028, but if you’re super-savvy and do it from 1st-26th February next year instead, you’ll get till 29th February 2029 to use them.

It may seem of little relevance now, but this might just be a big help to you in three years’ time (unless you literally need the miles this month).

Summary

Kris+ is running its transfer bonus offer from Citi credit card points again, though with a repeat of last year’s 8% bonus (unlike the better 15% in April 2022, and even 10% in October 2022).

Nonetheless there are still some readers who will be able to make use of this deal for smaller, instant and fee-free transfers they need to make soon.

Even though you still take an 8.2% hit on the transfer usual ratios for making a direct conversion, you’ll potentially benefit from the following advantages during this offer:

- Transfers are instant (as opposed to 24-48 hours)

- Transfers are free (as opposed to S$27.25 from each card account), outweighing the poorer ratio for smaller conversions

- Minimum transfer quantities are reduced, for smaller top-ups to instantly achieve a redemption threshold if necessary

- You may be able to extract orphan points from unused Citi cards at almost the ‘normal’ bank-to-KrisFlyer conversion rate

If you’re taking advantage of the offer, remember to do so in February 2026 if you can, rather than in November or December 2025, or even in January 2026, to give yourself an extra one or two months of miles validity at the KrisFlyer side.

(Cover Photo: Cam Morin)