EXPIRED This article relates to an offer or promotion which has now expired.

If you hold the Citi Prestige Mastercard in Singapore you may have received an email over the last few days inviting you to take part in a bonus miles offer, with up to 61,000 additional miles awarded if you have a (not insignificant) S$30,000 to spend between now and the end of the year.

If S$30k sounds a bit rich, there’s an alternative deal for half as many miles if you manage to spend S$15,000 in the same period.

There’s only one snag. You’ll have to pay a fee for the bonus miles, so they’re not “free”. That doesn’t mean it can’t work out as a good deal for you, but it certainly won’t be for everyone.

Who is eligible?

To be eligible you must have received an invitation directly from Citi by SMS or email. The promotion does seem to be widely offered as we have both been targeted, despite only occasionally using our Citi Prestige cards these days for the fourth night free benefit.

Assuming you have been invited, you must also enrol for the promotion by sending an SMS to Citi as follows, and receiving the automated acknowledgement.

Eddie enrolled for the offer today and the acknowledgement from Citi was instant.

The offer

If you successfully enrol and then spend S$30,000 between now and 31st December 2019 on your Citi Prestige card, you’ll be awarded 152,500 Citi ThankYou bonus points (equivalent to 61,000 miles in a range of frequent flyer programs), but you’ll also be charged a “programme fee” of S$700 for the privilege.

That’s equivalent to ‘buying’ miles at 1.15 cents each, certainly well below our upper limit to buy of 1.9 cents per mile.

You’ll continue to earn your regular 1.3 miles per dollar on local transactions and 2 miles per dollar on overseas spend, in addition to the bonus miles.

Citi is doing its usual trickery by advertising a 100,000 miles offer, lumping the two miles totals together to make the deal look even better. In fact you would earn 39,000 of those miles anyway for spending S$30,000 on the card without any such promotion running.

Here’s how Citi sells it:

The true bonus, which is what you’re paying the fee for in this case, is therefore 61,000 miles.

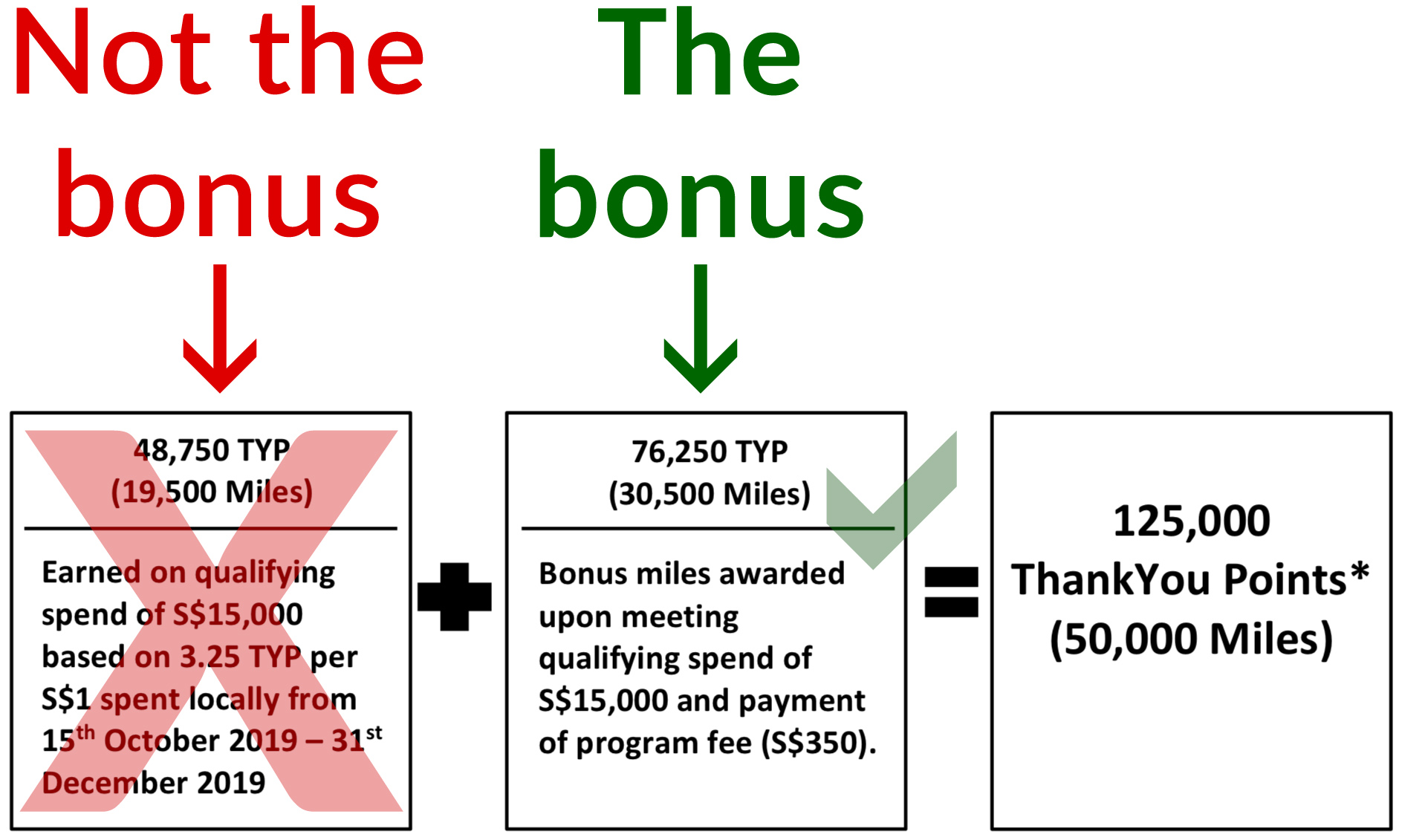

If S$30,000 sounds a lot to spend in just over two months (and it is!), there is an offer for a reduced spend of S$15,000 over the same period. In this case you’ll earn a bonus of 30,500 miles bonus, for a “programme fee” of S$350.

The lower bonus looks like this:

Full terms and conditions for these offers are available at the Citi website here.

There’s no need to pick an offer

You can’t actually choose one of the two offers, provided you register successfully you’ll receive one of the following bonus levels based on your spend:

- Spend <S$15,000: no bonus miles, no fee charged

- Spend S$15,000 – S$29,999: 30,500 bonus miles, S$350 fee charged

- Spend S$30,000+: 61,000 bonus miles, S$700 fee charged

Excluded transactions

Your S$30,000 (or S$15,000) spend includes eligible retail transactions charged in Singapore dollars, or its equivalent in foreign currency.

Exclusion categories are as follows:

- Equal Payment Plan (EPP) purchases

- Refunded / disputed / unauthorised or fraudulent retail purchases

- Quick Cash / Ready Credit PayLite and other instalment loans

- PayLite / FlexiBill / cash advance / quasi-cash transactions / balance transfers / annual card membership fees / interest / goods and services taxes

- Bill payments made using the Eligible Card as a source of funds

- Late payment fees

- Any other form of service / miscellaneous fees

Citi PayAll is included, but not CardUp or ipaymy

We asked Citi whether transactions made using its PayAll service were included in the eligible spend for this offer, and they confirmed to us that PayAll does indeed count.

![]()

That means you can potentially channel a large amount of this spend requirement on rental payments, tax payments, education and other bills.

Most private landlords in Singapore will also accept rent payments in advance if you wish to overpay, for example you could arrange to pay two or three months’ rent upfront using PayAll if it helps you meet the spend threshold.

Do note that other credit card payment methods like CardUp and ipaymy are not eligible for the minimum spend under this offer. Citi advised us that they regard these as third-party bill payment facilities (see exclusions above).

Opportunity cost

Depending which credit card you are currently using for general spend in Singapore, there may be an ‘opportunity cost’ associated with taking part in this promotion.

For example we both use the BOC Elite Miles card for general spend, earning 1.5 miles per dollar locally and 3 miles per dollar overseas. Assuming we had S$30,000 of local spend to make during the rest of 2019 we would be taking a hit of 0.2 miles per dollar by diverting this spend to the Citi Prestige card (6,000 miles).

This reduces the true bonus for us from 61,000 miles to 55,000 miles. With a cost of S$700 still charged, that makes it $700/55,000 = 1.27 cents per mile in our case.

That becomes a bit worse if we suppose some of the transactions are made in foreign currency. Let’s say S$10,000 of our S$30,000 spend is in currencies other than SGD, earning 2 miles per dollar with Citi Prestige, with the remaining S$20,000 in SGD at 1.3 miles per dollar.

For the foreign currency transactions we’re losing out on 1 mile per dollar compared with using our BOC Elite Miles card (1 x 10,000 = 10,000 miles), plus still falling short of 0.2 miles per dollar on the local spend (0.2 x 20,000 = 4,000 miles).

That reduces our true effective bonus by 14,000 miles (from 61,000 miles to 47,000 miles). With a cost of S$700 still charged, we’re now looking at 1.49 cents per mile ($700/47,000), which is starting to look like a much less attractive deal given the sheer volume of spending required.

Those are just a couple of examples, so do check your own personal cost per mile calculation, based on the rates you would be diverting your spend away from.

Citi ThankYou Points are very flexible

Citi has one of the widest range of frequent flyer programmes for you to transfer your points into, including British Airways, Etihad Guest, Turkish Airlines and Qantas, making these very flexible points to accrue.

Citi ThankYou Points earned on the Citi Prestige card never expire while they remain in your Citi rewards account.

See our full review of the Citi Prestige card for more details, including a full list of transfer partners.

| Citi Prestige Mastercard | ||

|

Sign-up Bonus: | 25,000 miles |

| Annual Fee: | S$535.00 | |

| Cost per mile: | 2.14¢ | |

| Min Spend: | None | |

| Min Income: | S$120,000/yr | |

| Citi ThankYou Points credit to the following programmes: | ||

|

||

They also transfer to your preferred frequent flyer programme quickly compared to some other cards. In our experience of transferring Citi Miles or ThankYou Points to KrisFlyer, Avios and Asia Miles they usually credit at the loyalty program side within 24 hours, with a maximum wait of 2 days.

That certainly can’t be said for Bank of China, where KrisFlyer transfers seem to take anywhere from 1 week to 1 month (our most recent transfer took 3 weeks, so things aren’t improving!).

These factors do give Citi ThankYou Points the edge over some other bank loyalty currencies.

Summary

1.15 cents is a good rate to get your hands on KrisFlyer miles, which are worth at least 65% more than that in our book. Indeed we achieve approximately 2.4 cents per mile in value when we redeem.

Bear in mind that if taking part in this promotion means diverting some of your general spend away from higher earning cards, the cost per mile does increase slightly.

The inclusion of transactions made through Citi’s PayAll facility adds a very useful method to meet the high spend threshold between now and the end of 2019.

Citi ThankYou Points accrued on the Prestige card also have the benefit of transferring into 11 different frequent flyer programmes and never expire while your card account remains in good standing, so these can also be quite flexible.

Additionally, they tend to transfer into frequent flyer miles (well, KrisFlyer, Asia Miles and Avios at least in our experience) in just one to two days, giving you a good chance to jump on an available redemption regardless of which frequent flyer currency you need to use.

Awesome analysis with the opportunity costs part, Andrew… 👏🏻👏🏻

Thanks. Hope it makes sense!

This card should come with year long priority pass? How does it compare to the stan chart x card going at 60,000 miles for much lesser spend? It seems the spending hurdle/ miles per cent is more worthy?

For Citipay, would you know if it must be new arrangements set up and charged during the promo period? Or would previous arrangements set up before the promo period but charged during the promo period count? Thanks!!

Any payment made from 15th October 2019 to 31st December will be eligible, provided you have successfully registered for the offer. It doesn’t matter if there are previously registered or recurring payments.

Thanks Andrew!

I’ve been constantly paying over $7k/month for the past months but haven’t received that promotion… 🙁

If you try to enrol for it by SMS what does it say?

It worked!!! Thanks for the advice!!!