If you’re holding several miles earning credit cards in Singapore, which most of our readers almost certainly are, you’ll probably know that one thing to keep on top of is card points expiry dates, and ensuring you transfer your hard-earned rewards into miles before they vanish from your account.

In Singapore, expiry of your credit card points typically falls into one of two categories:

- Points never expire as long as your card account remains open

- Points expire at the end of a fixed period following the month they were earned (typically, 2 or 3 years)

Citi cards

If you’re holding the Citi PremierMiles, Citi ULTIMA or Citi Prestige cards, there are no concerns here. Any miles or points earned with those three cards are ‘evergreen’ – they won’t expire as long as you keep each card account active.

Other cards with non-expiring miles in Singapore include the DBS Altitude, OCBC Voyage and Standard Chartered Visa Infinite.

One exception in the Citi lineup though, is the Citi Rewards cards.

Like the Citi Prestige card, these earn Citi ThankYou Points, which transfer into a host of frequent flyer programmes at a 2.5 to 1 ratio.

The difference here is that ThankYou Points earned on the Rewards card, which don’t pool with those from the Prestige card and sit in their own separate stash per card account, do expire.

The (strange) Citi Rewards expiry policy

Citi says ThankYou Points earned on its Rewards cards “are valid for a period of 60 months”. That’s five years, which sounds very generous, but it’s not as simple as they make out.

In fact you have to accrue and redeem your points in fixed five-year periods, which Citi calls ‘Points Validity Periods’, and that’s not really the same thing.

During each Points Validity Period, the cardmember will receive Points based on the amount of retail purchases made during that Points Validity Period and the cardmember may use the Points in their account to redeem any Rewards at any time during that Points Validity Period. Points accumulated in any 1 Points Validity Period shall not be carried forward to subsequent Points Validity Period.

Citi Rewards Terms and Conditions

It means your points will not expire at a fixed period after earning, but at the end of a fixed window based on your card opening date.

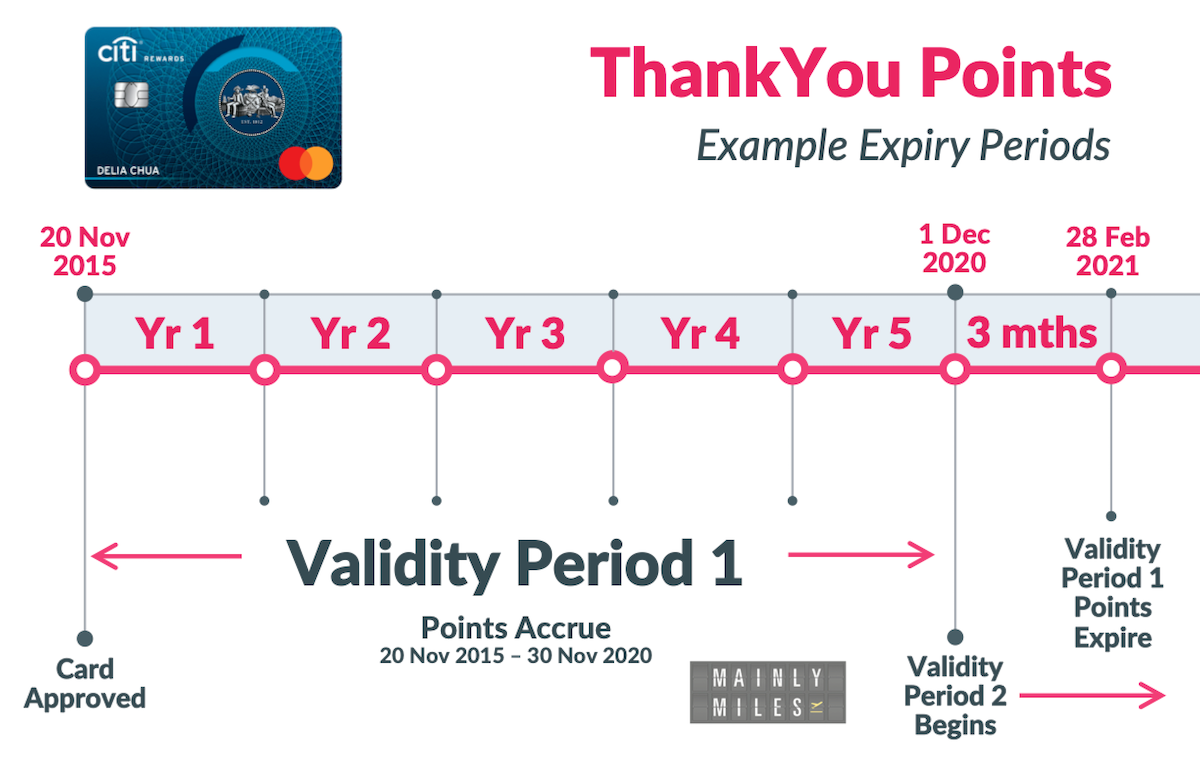

For example, I opened my Citi Rewards Mastercard account on 20th November 2015.

My first 60-month Points Validity Period ended on 30th November 2020. All remaining points accrued on that date will now expire no matter whether I earned them five years ago or in the last week of November 2020!

Citi give you 3 months to use any unredeemed points from that 60-month period before wiping them from your account, meaning I need to transfer mine to miles by 28th February 2021.

In the worst case, that means the points from a purchase I made in November 2020 will disappear from my account on 28th February 2021, if not redeemed (hardly five years!).

Strangely, Citi changed its terms and conditions in September 2018 to say that you only have 1 month after each Points Validity Period to use up your expiring points, but it is still sticking with the old 3 month rule. One to watch out for in case they get round to changing it later!

Any Points which are not used as at the last day of a Points Validity Period shall be available for use for a further 1 month; thereupon such unused Points shall be automatically cancelled and shall not thereafter be available for use by the cardmember nor be reinstated.

Citi Rewards Terms and Conditions

Checking your expiry

Luckily it’s fairly easy to check when the ThankYou Points earned on your Citi Rewards card(s) are expiring. You’ll need to log on to your account via the Citi site using a desktop computer to check this.

Go to Rewards & Offers, select your Citi Rewards card from the list and click Citi ThankYou Rewards, then navigate to My Points Summary.

This will show you your current points balance and the number of points expiring within the next 60 days.

Clicking on the link will reveal the exact date of expiry, in my case 28th February 2021 for these 274,571 points.

That’s 60 months since I opened my card account, plus the 3-month grace period to redeem.

Why aren’t all my points expiring?

You’ll notice that over 7,000 of my Citi ThankYou Points aren’t expiring in February 2021. That’s because points I have accrued on this card since December 2020 are in the new 5-year Points Validity Period, which runs until November 2025 (so those points expire on 28th February 2026).

Effectively my account is in the three-month ‘overlap’ period, where points accrued in the first validity period are still valid (but expiring) and new points are being accrued in a fresh new window.

What most will see

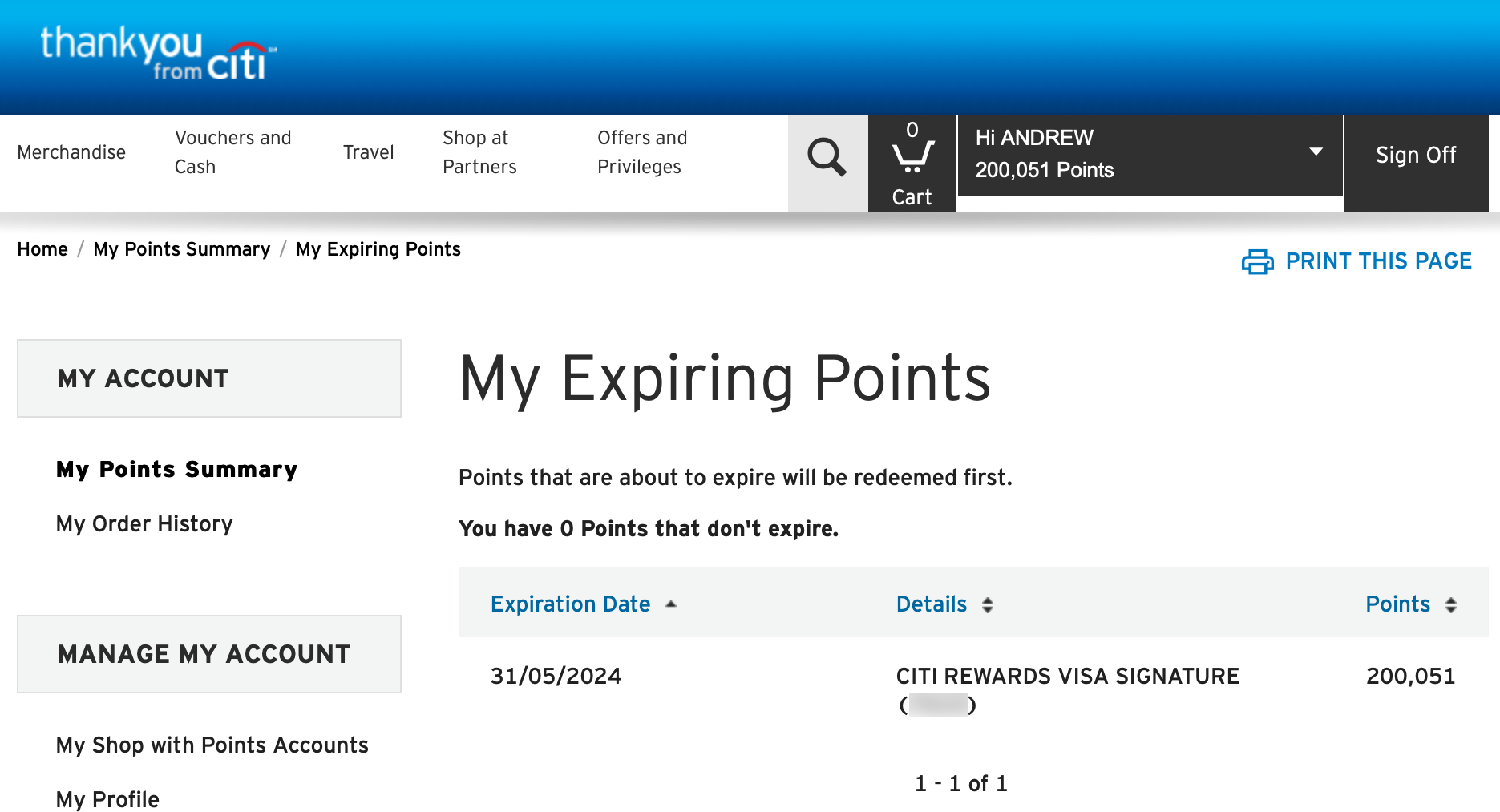

Even if your points aren’t expiring soon, which is likely the case for most of our readers, you can check when they will.

For example, I opened my Citi Rewards Visa card (when it was still possible to get one) in February 2019, so the points accrued on that are not expiring until May 2024.

Redemption blocks can mean orphan points

Around three months before your points expiry date, you need to take a look at your points balance and start making some plans…

Why? Well since Citi moved to 25,000-point transfer thresholds to its partner frequent flyer programmes, there’s a risk of orphan points when you fall short of a rounded redemption block size, with points that will then soon expire. Effectively, you’ll want to make a rounded transfer of your expiring points with as little excess ‘waste’ as possible.

Three months before your expiry, if it looks like you can achieve the next redemption threshold from your total points balance at the time (expiring + non-expiring) then that’s something to aim towards.

An example

Let’s say you have 211,000 Citi ThankYou Points on your Rewards card in January, with your expiry coming up at the end of April. You’ll need to spend S$1,400 in the 10X rewards (4 mpd) spend categories by expiry date to have enough to transfer the next full ‘block’ of 225,000 Points into airline miles.

- If that seems achievable, make sure you achieve it!

- If it doesn’t, you may want to stop spending on the card until you are earning in the next ‘fresh’ 5-year Points Validity Window again.

Remember even if your expiring balance has become ‘locked’ and you are now earning in the new 5-year Points Validity Window for your spend (as with my CRMC account), you can still increase your total points balance to the next redemption threshold then make a transfer before the expiring miles vanish.

In this case you are transferring a mix of expiring and non-expiring points to miles, but that’s irrelevant. Points that are about to expire will be redeemed first, but can be mixed with those not imminently expiring in a larger redemption transaction.

What if you can’t reach a miles redemption threshold?

If you no longer have time or spending plans appropriate to reach a suitable 25,000 points redemption threshold with your Citi card, you may as well cash out the excess points after you’re done transferring the maximum quantity you can to miles.

That’s despite the terrible rate Citi offers for cashing out, equivalent to just 0.57 cents per mile.

For example, say you’ve got 211,000 Citi ThankYou Points from your Rewards card expiring next week. Transferring 200,000 of those into 80,000 airline miles is almost certainly what you’ll be doing with them, but you don’t have enough time to accrue another 14,000 points to reach the next redemption threshold of 225,000.

Technically you could whack a load of spending on your Rewards card overnight, mostly at 0.4 mpd (1 Rewards Point per dollar spent) due to the monthly 10X cap, and make it to the next threshold, but that would not be worth doing!

The 11,000 points you’ll have left over, which would be equivalent to 4,400 miles but sadly can’t be converted in that quantity, can be redeemed at a (terrible) 0.227 cents per point (equivalent to 0.57 cents per mile).

Citi allows this through two methods; Cash Rebate and Pay with Points. Both will give you the same rate, and the easiest way to do this is through the Citi App on your phone.

Cash rebate can be applied in S$10 intervals up to S$50 rebate, so with 11,000 Points left over you could use 8,800 of them for a S$20 rebate as shown below (you can’t achieve a S$30 rebate in this case as 13,200 Points would be required).

That will still leave you with 2,200 Points (11,000 – 8,800) left over, so it’s time to take a look at Citi’s Pay with Points option, which allows you to use your points to offset a transaction made on your card in the last two months.

In my example looking at my CRV card, a S$5 Grab ride earlier this month is the perfect solution, using up all 2,200 excess expiring points.

While they couldn’t realistically be converted to miles at this late stage, in total the 11,000 excess expiring Citi ThankYou Points in this example have at least earned you S$25, so be sure to ‘clear out’ any remaining expiring points this way once you’ve maximised your transfer to frequent flyer miles.

The Citi Lazada card is different

While miles earned on the Citi PremierMiles card or ThankYou Points earned on the Prestige card never expire, as we mentioned above, there’s one other card in Citi’s lineup that works on a different fixed period validity – the Citi Lazada card.

This one is based on the same principle as the Rewards cards, but has a shorter 36 months (3 years) validity window, rather than 60 months (5 years).

This card was first launched in December 2019, so the fixed validity period for miles accrued in the first three years will start to come into play for some users from December 2022. It’s definitely another one to check and keep on top of for similar reasons.

Summary

On the face of it, Citi’s five-year validity for ThankYou Points accrued on the Rewards cards is quite generous, and in many ways it is, but you have to be careful not to get caught out as you approach the end of each rewards period.

Indeed points earned in the last week of your five-year window could expire as little as three months after earning if not redeemed, which seems incredibly unfair but is just the way it is with these cards.

The important thing is not to let your Citi ThankYouPoints expire before you’ve had a chance to convert them to miles.

We recommend setting a calendar alert three months before expiry, which is enough time to also allow you to decide how to ‘optimise’ your card spending to reach one of the 25,000-point redemption thresholds as closely as possible, thereby avoiding orphan points or any need to cash out at a very poor rate.

| Fast Facts

Annual fee: $192.60/yr (first year free) |

(Cover Photo: Shutterstock)

Who is the model for the cover pic?