It’s income tax time of year again, when your dreaded IRAS income tax Notice of Assessment notification comes through with your liability for last calendar year’s earnings. Like every years, we’ve been getting messages from readers asking what’s the best way to earn miles when paying the 2023 bill.

As always it boils down to analysing the methods to pay your income tax by credit card, though once again this is not a service offered directly by IRAS, even for a fee.

The transaction must usually be arranged through your credit card issuer or a third-party card payments provider, who in turn will charge you a fee for the service, which unfortunately means the miles you accrue are not going to be free.

As with previous years, however, there are a range of valuable options to turn one of the year’s single biggest expenses into thousands of miles at a reasonable cost.

Your options

The options for paying your income tax this year are almost the same as in previous years. You can do so with one of five bank-specific facilities, if you hold one of their eligible miles-earning credit cards, or through the two major card payment providers, CardUp and ipaymy.

| Provider | Fee |

| 2.2% | |

| 3% | |

| 1.9% | |

| 1.9% | |

| 1.7 – 2.1% | |

| 1.75 – 2.25% | |

| 1.75 – 1.99% |

The options available to you depend on the credit card(s) you hold. Remember your income tax bill is typically payable within a month of your ‘Notice of Assessment’ (NOA) date, unless your NOA states otherwise, so there may still be time to apply for and receive a new credit card with a superior miles earning rate if you wish.

In case you’re wondering what happened to the HSBC Income Tax Payment Programme, that was unfortunately discontinued from April 2023.

With the bank also excluding CardUp and ipaymy from rewards earning across its entire product range, that leaves no way to accrue miles for income tax payments with an HSBC credit card in 2023.

CardUp and ipaymy’s 2023 Income Tax offers

This year both CardUp and ipaymy have a promotional income tax payment rate for those using a Singapore-issued Visa card, at a 1.75% fee.

| MMTAX23 | 1.75% | |||

| One-time IRAS income tax payment or all income tax payments in a recurring series with a Singapore-issued Visa. | ||||

| TAX2023 | 1.75% | |||

| One-time IRAS income tax payment or all income tax payments in a recurring series with a Singapore-issued Visa. | ||||

Whether you use CardUp or ipaymy for an income tax payment with a Visa card probably depends on which one you have used previously, since you may not want to go to the hassle of opening a new account. We do not recommend one provider over the other, only the cheapest deal.

However, for a Mastercard payment CardUp has a special offer this year that ipaymy is not matching – the ability to pay your income tax with a 1.99% fee.

| MCTAX23 | 1.99% | |||

| One-time IRAS income tax payment with a Singapore-issued Mastercard. | ||||

On the flip side, ipaymy is offering income tax payment (and indeed any domestic payment) using Singapore-issued American Express cards at a 1.99% fee for existing users, or a 1.90% fee for new users, while CardUp charges a 2.6% fee for Amex payments, with no promo code available this year.

| AMEXNEW | 1.90% | |||

| One-time payment with a Singapore-issued American Express card (new users). | ||||

| AMEXSG | 1.99% | |||

| One-time payment with a Singapore-issued American Express card (existing users). | ||||

The ipaymy existing user offer can be utilised on up to three payments, potentially a way to spread your income tax cost over a few months provided you have a GIRO arrangement set up with IRAS.

CardUp’s promotional rates are currently valid for income tax payments scheduled by 31st August 2023.

ipaymy’s promotional rate for Visa payments is currently valid for a charge date on or before 30th June 2023, while the American Express rate is good until 26th August 2023.

Both CardUp and ipaymy will also offer concessionary rates for large income tax payments. Email each provider directly for more details if you have a significant tax bill this year:

Citi PayAll has the best deal

As with previous years, Citi’s PayAll facility is offering the best income tax payment offer for most of our readers in 2023, with a 2.2% admin fee but 2.2 miles per dollar charged, for an effective cost per mile of just 1 cent each.

Full details of the offer are available in our dedicated article here.

The downside? Bonus miles won’t credit until mid-December 2023, and your combined payments (including income tax) on a single card must be S$8,000 – S$100,000 between 20th April 2023 and 20th August 2023.

If your payments will fall below S$8,000 during this period, you won’t get the bonus 2.2 mpd earn rate, which usually makes other methods like CardUp and ipaymy better for your income tax.

Best deals for your 2023 income tax payment

Let’s take a look at the cost per mile table, which once again we’ve split into three sections this year, depending on how good a deal we think you’re getting.

The formula is simply the fee divided by the number of miles you will receive, to generate a cost per mile.

Bear in mind that for both CardUp and ipaymy you will also earn miles on the fee itself, which is accounted for in the calculation. That’s not the case when you use the bank-specific or Citi PayAll payment methods, where the fee element will not earn miles.

For each card we’ve just listed the cheapest way to buy miles in the table when paying your income tax payment using that card. In many cases there are additional options available as well.

For example, there are three options for settling your income tax bill using the DBS Altitude Amex card this year, if that’s the one you want to use (or the best option you have), as shown below.

| Method | Fee | Mpd | Cost per mile |

|

| 1.9% |

1.2 | 1.55¢ | ||

| 1.99% |

1.2 | 1.63¢ | ||

| 2.5% |

1.5 | 1.67¢ | ||

| 2.5% |

1.2 | 2.11¢ |

As you can see, ipaymy is the cheapest option at 1.55 cents or 1.63 cents per mile, followed by DBS’s own Payment Plan at 1.67 cents per mile, followed by CardUp at 2.11 cents per mile.

There is little point in us cluttering the table with all three options, since we see no reason anyone simply wouldn’t go for the cheapest option here – ipaymy in this case – so that’s the one we list.

Where CardUp or ipaymy are offering a discounted fee for new users, we list those deals separately (as shown above) if they are the cheapest option, then later in the table we show the card again with the cheapest option for all customers (including existing users).

Here’s our definitive list of your credit card income tax payment options for 2023. Simply start at the top (lowest cost per mile), and work your way down the table until you find a credit card you hold or wish to use.

Excellent cost per mile

You can ‘buy’ miles paying your income tax by credit card from between 0.92 cents and 1.39 cents each this year, an excellent rate for most of us, using the following methods.

| Card | Method | Fee | Mpd | Cost per mile |

BOS Voyage BOS VoyageOCBC PPC Voyage OCBC Premier Voyage |

1.5% (promo) |

1.6 | 0.92¢ | |

| 2.2% | 2.2 | 1.00¢ | ||

| 2.2% | 2.2 | 1.00¢ | ||

| 2.2% | 2.2 | 1.00¢ | ||

| 2.2% | 2.2 | 1.00¢ | ||

| 2.2% | 2.2 | 1.00¢ | ||

| 2.2% | 2.2 | 1.00¢ | ||

| 1.75% | 1.6 | 1.07¢ | ||

BOS Voyage BOS VoyageOCBC PPC Voyage OCBC Premier Voyage |

1.75% | 1.6 | 1.07¢ | |

| 1.75% | 1.6 | 1.07¢ | ||

| 1.6% | 1.4* | 1.14¢* | ||

| 1.5% (promo) |

1.3 | 1.14¢ | ||

| 1.5% (promo) |

1.3 | 1.14¢ | ||

| 1.5% (promo) |

1.3 | 1.14¢ | ||

| 1.5% (promo) |

1.28 | 1.15¢ | ||

| 1.75% | 1.5 | 1.15¢ | ||

| 1.75% | 1.4 | 1.23¢ | ||

| 1.75% | 1.4 | 1.23¢ | ||

| 1.75% | 1.3 | 1.32¢ | ||

| 1.75% | 1.3 | 1.32¢ | ||

| 1.75% | 1.28 | 1.34¢ | ||

| 1.99% | 1.4 | 1.39¢ |

* 1.4 mpd earn rate for the SCVI card is subject to a minimum spend of S$2,000 in the same statement cycle as your income tax payment. The income tax payment does count towards the minimum.

Still worth considering

As miles purchase rates fall into the 1.43 – 1.9 cents range, they may still be worth considering if you are comfortable with these levels and can’t take advantage of the options outlined above.

| Card | Method | Fee | Mpd | Cost per mile |

| 1.9% | 1.3 | 1.43¢ | ||

| 1.9% | 1.3 | 1.43¢ | ||

| 1.75% | 1.2 | 1.43¢ | ||

| 1.75% | 1.2 | 1.43¢ | ||

| 1.99% | 1.3 | 1.50¢ | ||

| 1.99% | 1.3 | 1.50¢ | ||

| 1.99% | 1.3 | 1.50¢ | ||

| 1.9% | 1.2 | 1.55¢ | ||

| 1.9% | 1.2 | 1.55¢ | ||

| 1.99% | 1.2 | 1.63¢ | ||

| 1.99% | 1.2 | 1.63¢ | ||

| 1.99% | 1.2 | 1.63¢ | ||

| 1.9% | 1.1 | 1.70¢ | ||

| 1.75% | 1.0 | 1.72¢ | ||

| 1.99% | 1.1 | 1.77¢ | ||

| 2.6% | 1.4 | 1.81¢ | ||

| 1.9% | 0.98 | 1.90¢ | ||

| 1.99% | 1.0 | 1.95¢ | ||

| 1.99% | 0.98 | 1.99¢ |

Probably of no interest

If you still don’t have a credit card payment option in the lists above to settle your income tax bill, it’s probably time to either get one, or call it quits.

The following options all come in above our personal limit to buy miles, and should only be considered if you are 100% comfortable doing so.

| Card | Method | Fee | Mpd | Cost per mile |

| 1.9% | 0.78 | 2.39¢ | ||

| 1.99% | 0.78 | 2.50¢ | ||

| 1.9% | 0.69 | 2.70¢ | ||

| 1.9% | 0.69 | 2.70¢ | ||

| 1.99% | 0.69 | 2.83¢ | ||

| 2.25% | 0.69 | 2.83¢ |

Remember that unfortunately no cards accrue their bonus 4 mpd / 6 mpd rate for income tax payments through any means, like the DBS WWMC and HSBC Revolution (that would be too easy!).

The Citi Rewards Card is one option in this category, earning an uncapped 2.2 mpd when used via Citi PayAll this year, but steer clear of using the others.

Two payment ‘methods’

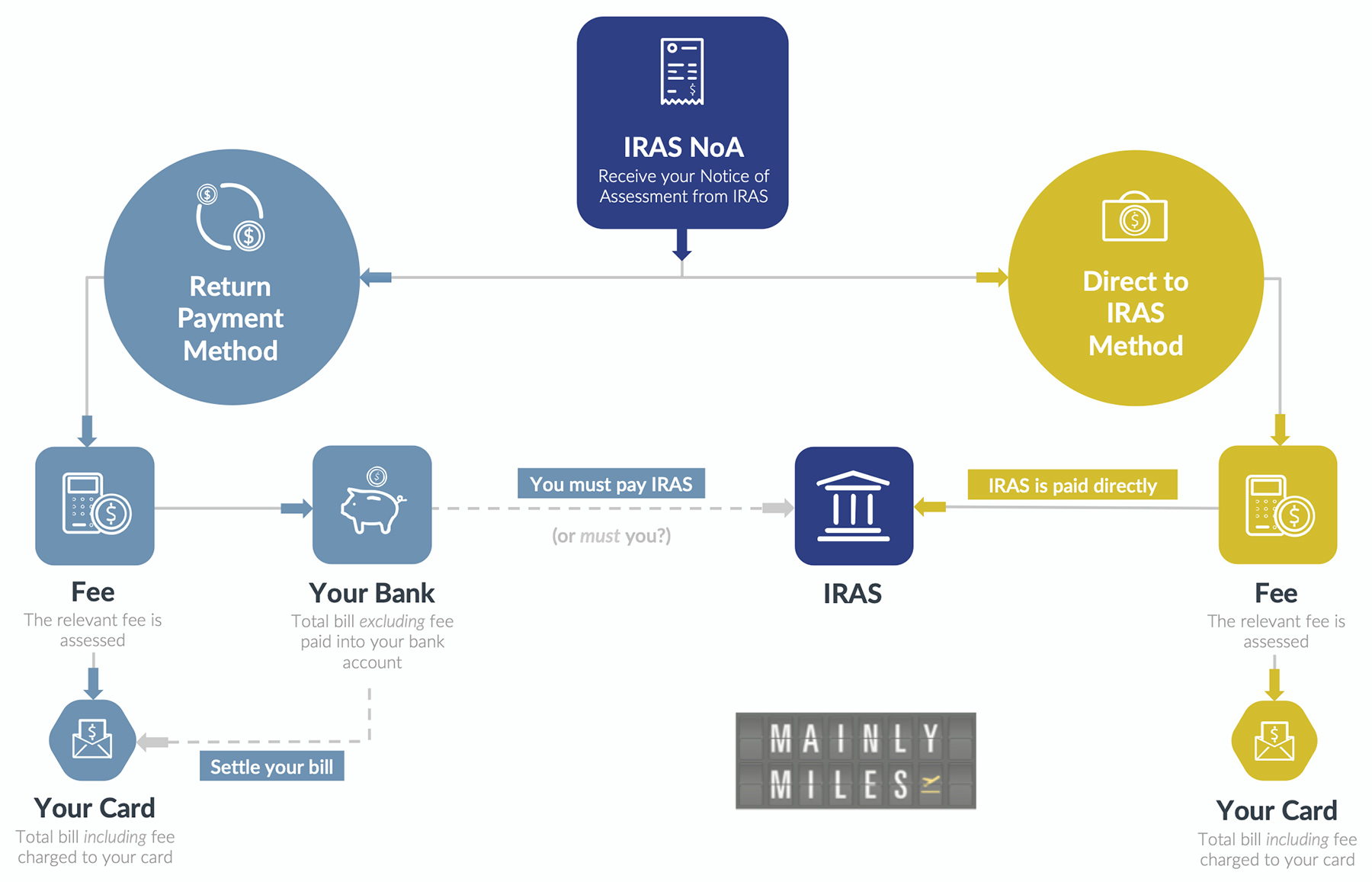

The various card payment providers may seem the same, but in fact there are two distinct ways in which they help you to settle your income tax bill.

First there is the ‘Return Payment Method’, where you produce your NoA to the supplier and they transfer the relevant amount to your bank account while charging your credit card for the same amount plus the processing fee.

Then there is the ‘Direct to IRAS Method’, where the supplier will still charge your card with your NoA balance plus the processing fee, but will settle your income tax account with IRAS directly.

Here’s a summary of which providers do what:

Return Payment Method

|

Direct to IRAS Method

|

* These methods are designed for any payment with any purpose and a copy of your NoA is not required.

What’s the difference, you might ask. The key difference between the ‘Return Payment Method’ and the ‘Direct to IRAS Method’ is:

- The ‘Return Payment Method’ can be completed as many times as you like (once per provider), and also gives you the freedom to pay your tax bill by monthly GIRO if that’s what you prefer. You are responsible for paying IRAS, the intermediary has no knowledge of this.

- The ‘Direct to IRAS Method’ is usually completed once, meaning you normally settle your full tax bill directly, however it can be used to replace your monthly GIRO if you set it up to make sufficient payment around a week before the pre-arranged GIRO debit date each month. The intermediary is responsible for paying IRAS on your behalf.

In other words you can repeat several different ‘Return Payment Methods’, but any option using the ‘Direct to IRAS Method’ is usually only used once via a lump sum payment, or can be used to ‘cancel out’ your monthly GIRO setup with IRAS.

You can ‘churn’ several tax payments

This gives you the opportunity to earn even more miles from your income tax statement by following the ‘Return Payment Methods’ as many times as you think you are getting good value for them.

For example, say I just received a S$11,500 income tax NoA from IRAS, but I hold the following three credit cards:

- Citi PremierMiles Visa

- Standard Chartered Visa Infinite

- OCBC Voyage

Entering our tables above at the top, I can immediately see I should use the Citi PremierMiles card through the Citi PayAll programme (cost 1 cent per mile).

However if I want to ‘churn’ as many miles as possible, I can do the following (subject to a sufficient credit limit on each card):

- SCVI Income Tax payment through the bank

- OCBC Voyage Income Tax payment through the bank

Then finally actually settle my IRAS tax bill with:

- Citi PremierMiles Visa using Citi PayAll

Now instead of the 25,300 miles I would get from Citi PayAll (at a cost of 1 cpm), I will earn:

- 16,100 miles from SCVI (Fee S$184.00, 1.14 cpm)

- 11,500 miles from OCBC Voyage (Fee S$218.50, 1.9 cpm)

- 25,300 miles from Citi PayAll (Fee S$253.00, 1 cpm)

Total: 52,900 miles for a combined fee of S$655.50 = 1.24 cents per mile.

I’ve just earned enough miles for a Business Class saver award ticket on SIA from Singapore to Tokyo, Osaka or Seoul for S$656.

Just to put your mind at ease, there is nothing in the terms and conditions for any of the ‘Return Payment Method’ providers that prevents you from doing this, just be careful to only use a ‘Direct to IRAS’ method once (unless using it to offset the monthly GIRO deduction).

Paying income tax by GIRO

As we mentioned above, if you wish to pay your income tax bill by monthly GIRO payment plan with IRAS but still earn miles on your annual bill, you’ll probably be using one of the ‘Return Payment Methods’:

- SCVI Income Tax Payment

- OCBC Income Tax Payment

- UOB Payment Facility

For example you can use the SCVI Income Tax Payment facility, use the money they give you to settle your credit card statement the following month, then continue with your IRAS GIRO payment plan throughout the year.

If you can take advantage of that option or a similar one, your tax payments will then be spread through the year as usual, but you’ll still have a chunk of miles from the original transaction.

Both CardUp and ipaymy also support tax payment by monthly GIRO.

Here’s how it works for CardUp, and here’s how it works for ipaymy.

It’s also possible to use Citi PayAll to settle your GIRO tax payments (again, be sure to arrange for each payment at least five working days in advance of your GIRO deduction date, then IRAS won’t take it from your bank account).

That means eligible cardholders can take advantage of the Citi 2.2 mpd offer even when paying by GIRO between now and 20th August 2023 (beware – the cost per mile will go up after that, so try to settle the whole balance by then).

Don’t forget about points flexibility

As we say every year, remember that some cards allow you to earn points that can be converted into several different Frequent Flyer Programmes, other than the relatively generic Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles schemes.

You can see a full breakdown of who transfers where at our dedicated and continually updated page here.

A good example is Citi Miles or ThankYou points, which transfer to:

- SQ KrisFlyer

- CX Asia Miles

- BA Avios

- Turkish

- EVA Air

- Thai

- Qatar Avios

- Qantas

- KLM / Air France

- Etihad

- IHG (Hotels)

That’s a lot of added flexibility, so do consider this when making your decision.

Don’t forget about transfer blocks

If your best value income tax payment option is with a bank whose cards you don’t typically use year-round, you may find your accrued miles from an income tax payment aren’t very useful, because they fall short of one of the bank’s transfer ‘block’ sizes to airline miles.

That might then force you to use a card you wouldn’t normally use for additional spending in order to reach the next ‘block’ transfer threshold, so do make sure you’re accruing useful credit card points (and a useful amount) that transfers easily or ties in with your year-round spending anyway.

Summary

No one likes paying their annual income tax bill, but 2023 is proving to be another great year for a competitive range of options for doing so using your credit card to earn miles in the process.

This year CardUp and ipaymy are back with their 1.75% fee option again, allowing you to buy miles from 1.07 cents each.

Even the relatively accessible UOB PRVI Miles Visa card can be used from as little as 1.23 cents per mile – a fantastic rate when you look back to the limited offers on the table just a few years back.

Citi PayAll still rules the roost though, with an almost unbeatable 1 cent per mile cost, provided your bill is between S$8,000 and S$100,000.

Your income tax payment can be one of the biggest single boosts to your miles balance each year, so do take the time to consider the options in our tables above carefully before committing to your payment method (though frankly if you have a participating Citi card, it’s a no-brainer this year!).

As always, the cost per mile (which we have calculated above for almost all cards across all methods) is key to deciding whether this is a good deal for you or not, though there are a few other considerations we’ve highlighted including what range of frequent flyer programmes you’ll be able to transfer into.

What’s your plan for earning miles from your income tax bill this year? Let us know in the comments section below.

Links on Mainly Miles may pay us an affiliate commission.

(Cover Photo: Shutterstock)

Are there any indirect facilities left that can be split over 12 months?

Don’t quite understand the churn method. Can you elaborate