Here’s our review of the Standard Chartered Visa Infinite X credit card issued in Singapore. It forms part of our series of credit card reviews, which are all summarised on our dedicated Credit Cards page.

Dollar amounts refer to SGD, and ‘miles’ refer to KrisFlyer miles, except where stated. This review was updated on 2nd January 2020.

Key features

Annual fee: $695.50/yr

EIR/APR: 26.9%

Sign-up bonus: 30,000 miles

Local earn rate: 1.2 miles per $1

Overseas earn rate: 2.0 miles per $1

Foreign transaction fee: 3.5%

Minimum Age: 21

Minimum income: $80,000/yr*

* Priority/Private Banking customers: S$30,000/yr (Singaporean/PR) or S$60,000/yr (Foreigner)

Annual fee

One of the more expensive cards on the market – the X card will set you back $695.50 each year (including the first year). Since the annual fee is not optional in year one, we expect this will most likely be the case in subsequent years too.

Sign-up bonus

When it launched, this card had one of the most generous sign-up bonuses ever seen of 100,000 miles. However that has since ended and the ongoing bonus Standard Chartered is offering is:

- 30,000 KrisFlyer miles “Upfront Gift Promotion”: for activating your card within 30 days and paying the annual fee of S$695.50, and provided your card is approved by 31st December 2019.

That’s equivalent to ‘buying’ miles at 2.32 cents each, significantly above our upper limit to buy of 1.9 cents each.

The upfront gift of 30,000 miles will be awarded within 30 days of your X card activation date. For example if your card is activated on 31st January 2020 you’ll see this first bonus in your account by 1st March 2020.

Is there an annual renewal bonus?

Contractually no, but we have both always received 20,000 miles each year for renewing our Standard Chartered Visa Infinite cards.

It will be interesting to see whether any similar carrot is dangled for X card holders to spend another $700 in year two, since as you’ll see there are currently no other benefits that make the card worth keeping at that price.

Earning rates

The X card earns miles at the following rates:

- 1.2 miles per $1 spent locally (i.e. transacted in SGD), and

- 2 miles per $1 spent overseas (i.e. transacted in foreign currency)

These are towards the low end for a card with such a high annual fee, only matching the Citi PremierMiles and DBS Altitude rates – much more accessible cards in terms of income requirement and both fee-free in year one.

You’ll achieve higher earn rates with other widely available cards like the BOC Elite Miles (1.5 mpd locally, 3 mpd overseas) or the UOB PRVI Miles (1.4 mpd locally, 2.4 mpd overseas).

Even the Standard Chartered Visa Infinite boasts a better earn rate of 1.4 mpd locally and 3 mpd overseas, though both those rates require that you spend at least $2,000 per statement cycle on the card.

Are KrisFlyer miles credited directly?

No, in fact rather than being credited miles directly you’ll accrue ‘360o Rewards Points’ for your regular spending on this card. These transfer to KrisFlyer miles at a 2.5:1 ratio.

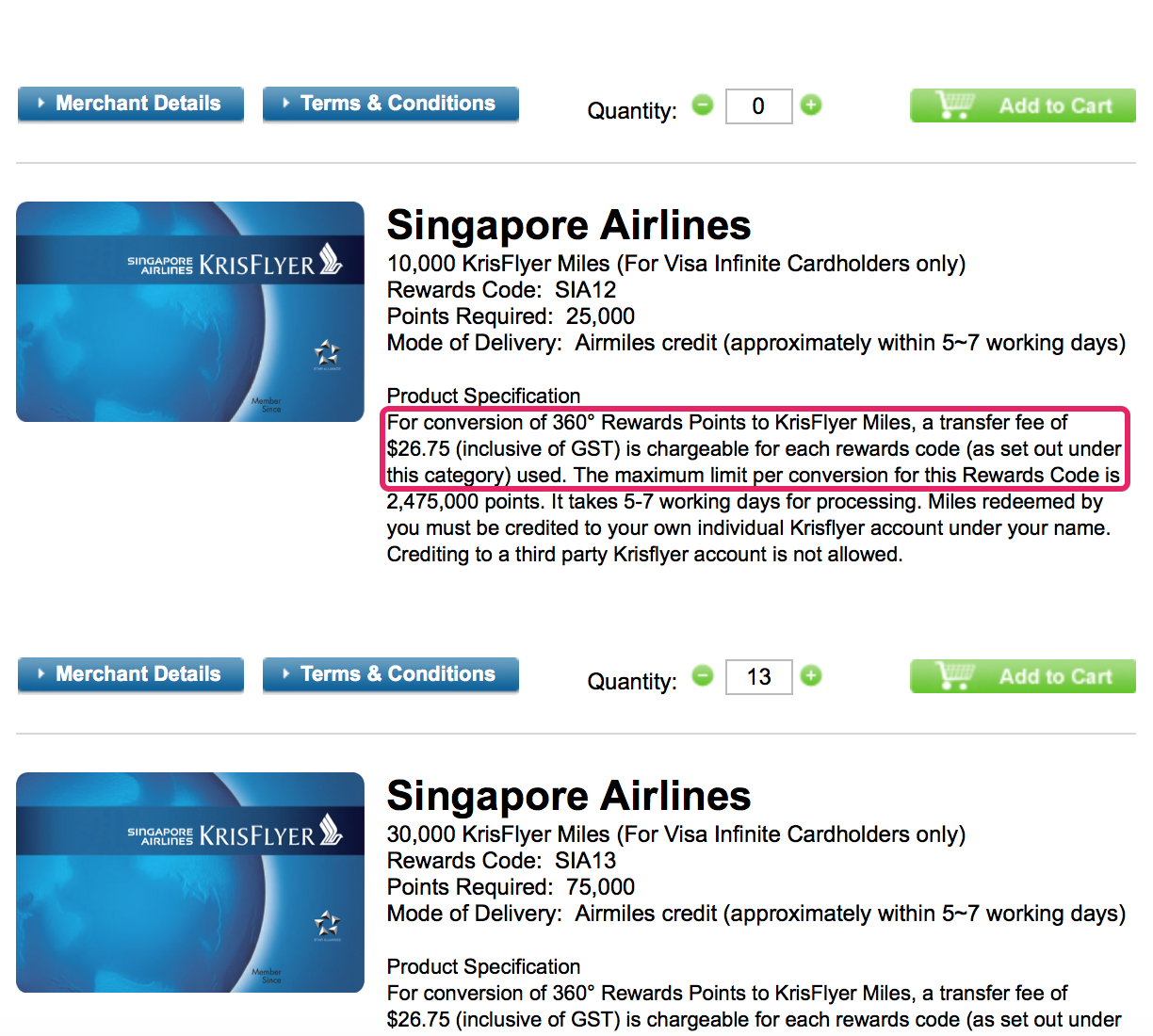

What is the transfer cost to KrisFlyer miles?

It’ll cost you $25+GST (i.e. $26.75) each time you transfer each ‘block’ of your points to KrisFlyer miles.

Is there a minimum transfer amount?

The minimum number of rewards points you can transfer into KrisFlyer is 2,500 (converting to 1,000 KrisFlyer miles). You can structure your points transfer in larger blocks instead, or add multiple smaller blocks but you should be aiming to accrue a decent rewards points balance before transferring as each rewards block code transferred attracts the $26.75 transfer fee.

Reward blocks available are:

- 2,500 points > 1,000 miles

- 25,000 points > 10,000 miles

- 75,000 points > 30,000 miles

- 125,000 points > 50,000 miles

- 250,000 points > 100,000 miles

You can add up to 99 of each ‘rewards block’ per transfer (e.g. 99 x 2,500 points blocks will give you 99,000 KrisFlyer miles).

Since you will attract the $26.75 transfer fee charge for each of the blocks used, it’s better to add multiple numbers of the same block size. For example if you have accrued 325,000 points that should give you 130,000 miles.

Looking at the options you might think you’ll have to transfer 1 x 250,000 points block and 1 x 75,000 points block to do this, but that will result in you being charged the $26.75 fee twice!

The better strategy in this example is to add 13 x 25,000 points blocks. This will mean only being charged the $26.75 fee once, but you’ll still get 130,000 miles credited.

It’s a stupid system, but it’s just the way it works.

Remember the golden rule – if you combine more than one block size (‘rewards code’) in a rewards to points conversion you’ll be charged $26.75 for each one!

How long do miles take to credit to KrisFlyer?

The official line from Standard Chartered is “5 to 7 working days”.

The last four times we converted from Standard Chartered reward points to KrisFlyer, it took:

- Almost exactly a week (5 working days) the first two times (2018).

- 3 working days (early July 2019).

- 2 working days the most recent time (late July 2019).

It does seem like the transfer time has improved lately, but to be safe we would still transfer to KrisFlyer at least a week before needing the miles in your account.

Note that Standard Chartered does not store or remember your KrisFlyer account details, even for subsequent transfers if you’ve moved your points into miles before, so you’ll have to have your account number to hand each time you do it.

Other loyalty schemes

Apart from KrisFlyer, there are 11 other loyalty programmes you can transfer into from the X card.

These don’t all transfer at the same 2.5:1 ratio, in many cases it’s a higher ratio meaning fewer points or miles in your loyalty account, so do beware if you’re going down this route that in many cases you may be losing out.

| X card Airline Partner Conversion | |

| FFP | Conversion Ratio |

| 2.5:1 | |

| 2.5:1 | |

| 2.5:1 | |

| 2.5:1 | |

| 3:1 | |

| 3:1 | |

| 3:1 | |

| 3.5:1 | |

| 3.5:1 | |

| 3.5:1 | |

| X card Hotel Partner Conversion | |

| Loyalty scheme | Conversion Ratio |

| 2.5:1 | |

| 5:1 | |

As you can see in some cases the transfer ratio is double that to KrisFlyer, giving you half as many points / miles in the loyalty scheme for the same number of rewards points transferred.

Do reward points pool with other Standard Chartered cards?

Yes, since November 2019 you can use points from all your Standard Chartered credit cards to redeem for KrisFlyer miles or any of the 11 other partner programs, like Qantas, United or IHG.

Be careful if you’re sitting on a large SCVI points balance

As we mentioned in this article, when redeeming points into KrisFlyer miles the credit card account with the highest points balance is used first.

That means if you have a significant SCVI points balance, it won’t be possible to transfer your X card points to KrisFlyer unless you also deplete the SCVI ones either first or at the same time in one big transfer.

The article linked above goes into full detail but effectively you have three options in this case, assuming you want to protect your SCVI points since they never expire but at the same time empty the X card balance so you can cancel the card:

- Transfer the minimum number of your points to KrisFlyer as necessary to reduce the remaining SCVI points total just below the X card total, then make a separate transfer of all the X card points (now the highest balance) into KrisFlyer. This will involve paying the S$26.75 transfer fee twice, and may significantly reduce your SCVI points balance.

- Transfer your SCVI card points to a nominee, either permanently or temporarily (they can move them back for you, if you are one of their nominees), then redeem your X card points.

How long do miles take to credit to other FFPs?

We don’t have any data points yet on actual transfer times to other FFPs (e.g. Qantas or United). These are likely to differ from programme to programme, so do allow ample time and don’t assume it will be the same as for KrisFlyer miles.

If you have any data points to share for these kinds of transfers, do let us know in the comments section below and we’ll update this section.

Points top up

Standard Chartered also offers the option to top up your points to meet a higher redemption threshold – applicable to KrisFlyer miles only (not the other loyalty schemes). The cost is 0.8 cents per point, which equates to 2 cents per mile (since 2.5 points = 1 mile).

Apart from the relatively high cost (we value KrisFlyer miles at 1.9 cents each), the other consideration with this method is that you must have at least 30% of the desired points transfer total in order to pay to top up (though you likely won’t want to be paying to more than triple your balance at this purchase rate!).

Here’s an example:

In this case you are paying S$141.46 to top up by 17,682 points in order to meet the next redemption threshold. Our full article about this feature explains it in detail.

Points rounding

Local (SGD) transactions are multiplied by 3 reward points down to the cent, and then rounded to the nearest whole number of reward points.

For example:

- $113.58 x 3 = 340.74 reward points, rounds to 341 reward points

- $227.15 x 3 = 681.45 reward points, rounds to 681 reward points

Overseas (non-SGD) transactions are first multiplied by 3 reward points, as though they are local transactions, and then in a separate calculation they are multiplied by a further 2 reward points.

In both cases the total transaction amount when converted to SGD is accounted for, including the cents, then the reward points total is rounded to the nearest whole number of reward points.

For example:

- $69.28 x 3 = 207.84 reward points, rounds to 208 reward points

- $69.28 x 2 = 138.56 reward points, rounds to 139 reward points

- 208 + 139 = 347 reward points credited

That’s subtly different to the total you might expect if the base amount was multiplied by 5 reward points in one go (346 reward points would be the result in that case).

Note that for non-SGD payments you will see these two points totals shown separately for each transaction.

‘Merchant Promo Rewards’ in this case is the foreign currency transaction ‘bonus’ points.

Minimum spend to earn points

A very fair card, $0.17 (SGD) is the minimum transaction amount to earn any reward points (0.17 x 3 = 0.51, which rounds to 1 reward point).

$0.17 is also the minimum transaction amount for a foreign currency transaction to earn any reward points.

That’s because as mentioned above amounts spent overseas don’t actually earn 5 reward points (2 miles per dollar), but instead earn at the local rate (3 rewards points), then are assessed a second time at the additional overseas rate (+2 rewards points).

If you want to be really pedantic, you’ll earn at the local rate for an overseas transaction of $0.17 to $0.24, and you won’t actually trigger the overseas earn rate until your transaction total is $0.25 (when converted to SGD).

Hardly anyone will be making such small transactions on a credit card so it’s not very relevant to most of our readers.

Overall the Standard Chartered credit cards have a very fair rounding system. You’ll earn points right down to the cent, then you’ll ‘win some / lose some’ at the final rounding stage, depending on whether your points total rounds up or down to the nearest whole point.

Do your points expire?

No, as with the SCVI card your 360o Rewards Points never expire while your account remains in good standing, so you can keep your points at the Standard Chartered side as long as you need to before converting to KrisFlyer or another FFP.

Once your miles are in KrisFlyer, they are valid for 3 years from the month of deposit.

Forex fee / cpm overseas

The X card, in common with the Standard Chartered Visa Infinite (SCVI) card, has a hefty 3.5% foreign currency transaction fee.

The big difference though is that the SCVI card awards 3 miles per dollar on overseas purchases, 50% more than the 2 miles per dollar offered using the X card.

That means that instead of being one of the best cards to use for these transactions, like the SCVI card, the X card is probably the worst.

Cost per mile on overseas credit card transactions by card

(Best to worst, August 2019)

| Card | Fee | Miles per $ | Cost per mile |

| 3.0% | 3.0 | 1.06¢ | |

| 3.5% | 3.0 | 1.22¢ | |

| 2.5% | 2.0 | 1.40¢ | |

| 3.0% | 2.3 | 1.39¢ | |

| 2.75% | 2.0 | 1.48¢ | |

| 2.8% | 2.0 | 1.50¢ | |

| 3.25% | 2.4 | 1.43¢ | |

| 3.0% | 2.0 | 1.60¢ | |

| 3.0% | 2.0 | 1.60¢ | |

| 3.5% | 2.0 | 1.83¢ | |

| 3.25% | 1.2 | 2.86¢ |

Cost per mile also accounts for an additional 0.3% ‘spread’ over money changer currency rates, though this doesn’t apply to all banks and all foreign currencies, so is a worst-case scenario.

As you can see you’ll be wanting to direct your foreign currency transactions to a different card if at all possible.

Cashback and travel alternatives

The Standard Chartered X card also offers a cashback alternative allowing you to redeem reward points for 1.2% cashback per $1 spent locally and 2% cashback for every $1 spent in foreign currency.

These are poor rates relative to the value of KrisFlyer miles earned, and unlikely to be of much interest to our readers (unless you value KrisFlyer miles at less than 1 cent each, in which case there are better cashback cards on the market anyway).

There is also the option to receive travel credits at a rate of 250 rewards points to $1, which is similarly poor value versus transfer into KrisFlyer miles.

SC EasyBill

In August 2019 Standard Chartered launched EasyBill, a way for their credit card customers to earn the usual rewards points for outgoings not usually allowing credit card payments, like rental and education expenses.

The X card also participates in the scheme, and a typical administrative fee of 2% is charged (though this can vary according to the terms and conditions). Do bear in mind that certain accounts may not be eligible for the feature at all, at the bank’s discretion.

At a 2% fee, EasyBill allows you to ‘buy’ miles using your Standard Chartered X card for 1.67 cents each when making these payments.

Although that is less than our upper limit to buy of 1.9 cents per mile, there are usually more competitive deals out there through other card payment schemes or companies like CardUp and ipaymy. Be sure to do the calculation on these alternative methods first before committing to EasyBill.

If you also hold the Standard Chartered Visa Infinite card, EasyBill is available from a cost of 1.43 cents per mile due to the higher earning rate.

Check out our article about SC EasyBill for full details.

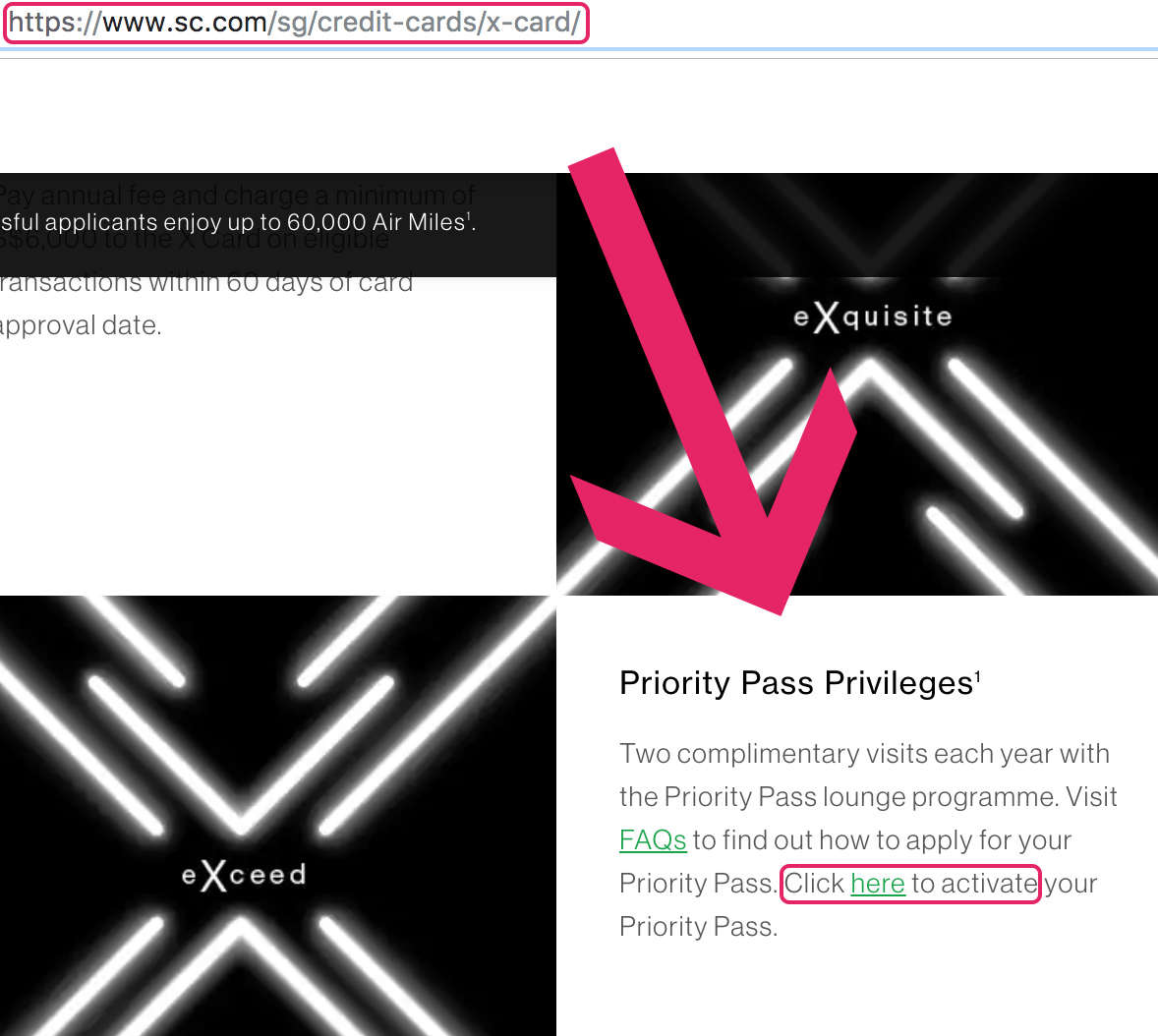

Priority Pass membership

Principal cardholders are entitled to two complimentary Priority Pass lounge visits per membership year.

Membership is not automatic, to enrol you’ll have to send the following SMS to Standard Chartered:

- SMS “SCX [space] PP [space] last 4 digits of X Card” to 77222, for example “SCX PP 1234”

You’ll then receive an SMS response from Standard Chartered within 2 business days confirming your application, though my response was immediate.

Within 14 business days of receiving this message you will be sent a unique code (also by SMS) to activate your Digital Priority Pass.

You then need to visit sc.com/sg/x-card and locate the “Priority Pass Privileges” activation link.

This will then direct you to the Priority Pass website to enter your code then complete your application.

You’ll then be able to access and use your Digital Priority Pass through the Priority Pass app, which also helps you keep track of your outstanding lounge visit entitlement.

Each principal cardholder will be entitled to two free visits in the first year from the date of your priority pass approval to the day before the first anniversary of that approval. In each subsequent year you’ll be entitled to a further two complimentary visits. For example if your Priority Pass is approved on 13th September 2019:

- 13th September 2019 – 12th September 2020: Two visits

- 13th September 2020 – 12th September 2021: Two visits

- 13th September 2021 – 12th September 2022: Two visits

Note that your X card account must remain open and in good standing when the bank checks your X card status shortly before approving each annual Priority Pass renewal. If you have cancelled your X card before your next anniversary year, the membership will not renew.

You can’t carry forward unused Priority Pass visits to the next membership year. You can bring one guest into a Priority Pass lounge with you, however this will use up one of your free access entitlements.

Once your free entitlements are used up, lounge access is at the prevailing rate of US$27 per visit.

Other benefits

Aside from two Priority Pass lounge visits per year, there are very few other perks with the X Card. Most of these are common to all Standard Chartered credit cards, such as:

- Up to 50% off à la carte dining and selected buffets at The Fullerton Hotel Singapore and The Fullerton Bay Hotel Singapore. Terms and conditions apply.

- Exclusive Hotel & Resort Rewards at The St. Regis, Shangri-La Hotels & Resorts and Mandarin Oriental.

- Golf Privileges in Asia Pacific.

Visa Infinite benefits

The SCVI X Card is a Visa Infinite product. That means it automatically comes with a few additional perks including:

- Hertz Car Hire discounts.

- 8% off Hotels.com bookings.

The full list of Visa Infinite benefits can be found here.

Our summary

The Standard Chartered Visa Infinite X card lacks any allure with an expensive sign-up bonus, very average local and overseas earn rate, an uncompetitive foreign currency transaction fee and only a couple of complimentary lounge visits each year on the benefits side.

Similar perks are available using cards with a much lower annual fee.

On the plus side there are a host of new loyalty programs to transfer your points to, however the transfer ratios for many of these will rule them out as an option for most of our readers.

For those who got in at the 100k or 60k sign-up bonus levels, without any significant offer before the second year annual fee is due, we can’t see anyone keeping the X Card into year two. Metal or not, there are simply much better alternatives on the market for general spend.

Our recommendations for credit cards and other similar products on this site do not constitute financial advice.

Are the 20,000 miles for the SCB Visa Infinite card renewal automatic or do you have to call in?

Always been automatic for us so far, never had to call in or threaten to cancel etc.

50,000 reward points = 20,000 miles.

Hi, any insight on whether university fees to NUS/NTU will be included on the $6k éligible spend?

It depends whether they categorise those as ‘Government agencies’. Best to check with Standard Chartered (online chat so you have it in writing is my recommendation!).

Is signing up a new line with any of the 3 telcos considered eligible transactions?